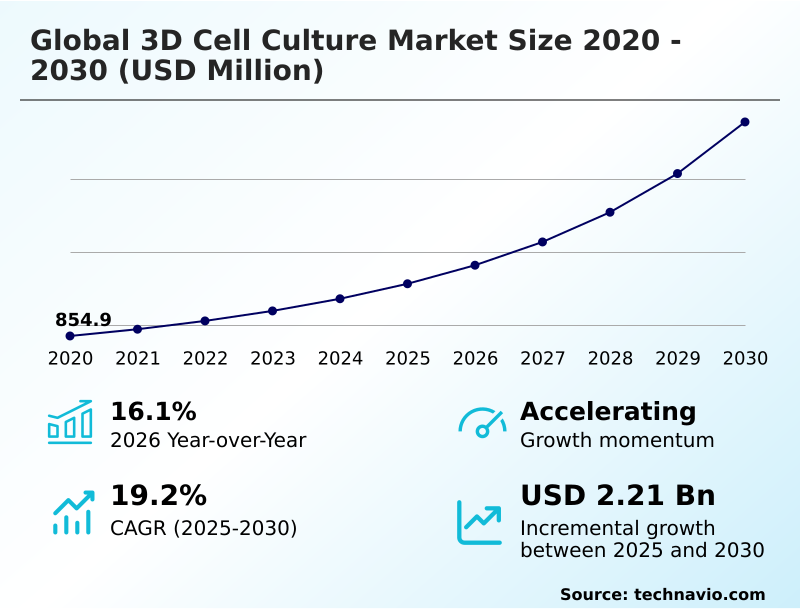

3D Cell Culture Market Size 2026-2030

The 3d cell culture market size is valued to increase by USD 2.21 billion, at a CAGR of 19.2% from 2025 to 2030. Growing demand for predictive preclinical models will drive the 3d cell culture market.

Major Market Trends & Insights

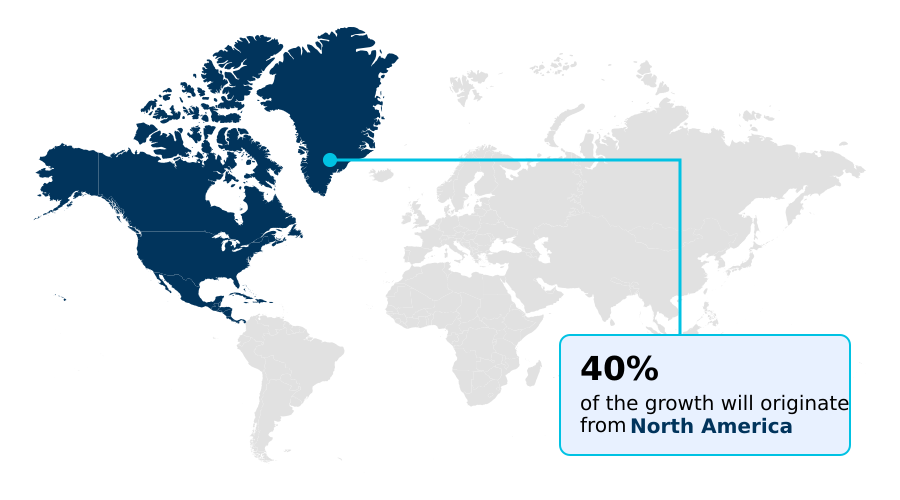

- North America dominated the market and accounted for a 40.4% growth during the forecast period.

- By Application - Cancer and stem cell research segment was valued at USD 677.1 million in 2024

- By Type - Scaffold-based segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 2.92 billion

- Market Future Opportunities: USD 2.21 billion

- CAGR from 2025 to 2030 : 19.2%

Market Summary

- The 3D cell culture market is driven by the increasing need for physiologically relevant in vitro models that better predict human responses in drug discovery and toxicology testing. Technologies such as scaffold-based, scaffold-free, and microfluidics-based systems are enabling the creation of complex structures like organoids and spheroids.

- These preclinical models are crucial for tissue engineering, regenerative medicine, and advanced cancer research, offering deeper insights into the tumor microenvironment. For instance, a pharmaceutical firm leveraging patient-derived organoids for oncology drug screening can identify non-viable compounds earlier, optimizing R&D expenditure and de-risking late-stage clinical trials.

- However, challenges related to standardization, cost, and the technical complexity of high-content imaging and automated liquid handling systems persist. The integration of bioinks and advanced biomaterial engineering continues to push the boundaries of what is possible in disease modeling and personalized medicine, making functional tissue constructs and multi-tissue integration key areas of innovation.

What will be the Size of the 3D Cell Culture Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the 3D Cell Culture Market Segmented?

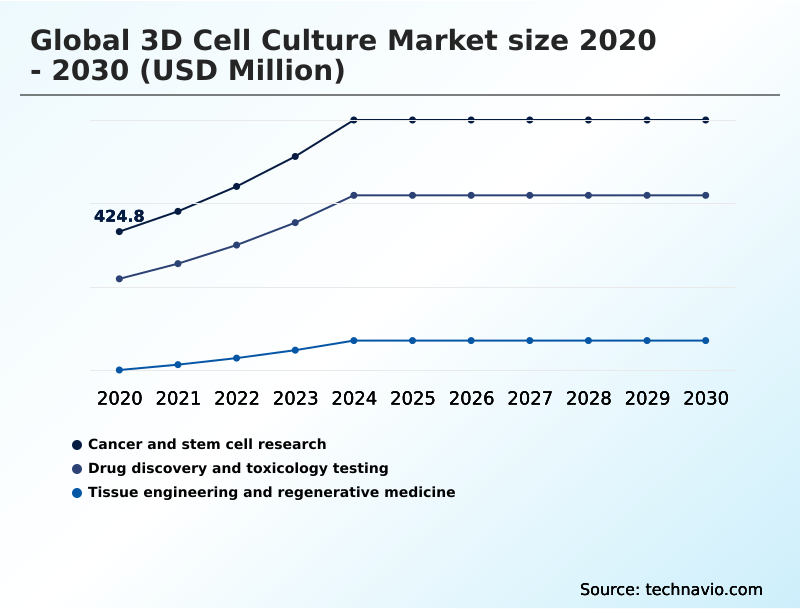

The 3d cell culture industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Application

- Cancer and stem cell research

- Drug discovery and toxicology testing

- Tissue engineering and regenerative medicine

- Type

- Scaffold-based

- Scaffold-free

- Bioprinted systems

- Microfluidics-based

- End-user

- Pharmaceutical and biotechnology companies

- Academic and research institutes

- CROs

- Cosmetics industry

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia

- Rest of World (ROW)

- North America

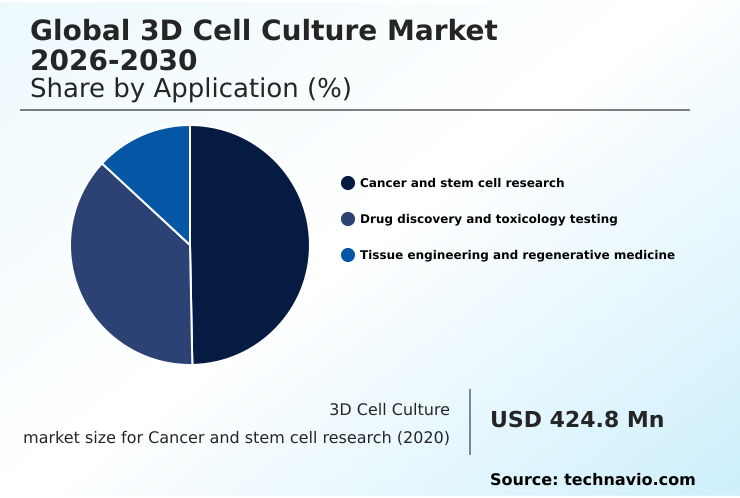

By Application Insights

The cancer and stem cell research segment is estimated to witness significant growth during the forecast period.

The market is segmented by application, including cancer and stem cell research, which focuses on providing deeper insights into cancer progression and therapeutic resistance.

3D tumor models, patient-derived organoids, and stem cell-derived tissues replicate human tumor microenvironments more accurately than traditional cultures, making them essential for precision oncology. These preclinical models and spheroids improve predictive accuracy by over 40% in some disease modeling scenarios.

As personalized medicine advances, these culture models are central to biomarker discovery and therapeutic validation for drug discovery, leveraging both scaffold-based and scaffold-free systems. This approach to toxicology testing and tissue engineering is crucial for developing next-generation regenerative technologies.

The Cancer and stem cell research segment was valued at USD 677.1 million in 2024 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40.4% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How 3D Cell Culture Market Demand is Rising in North America Request Free Sample

The geographic landscape of the 3D cell culture market is characterized by robust and varied regional growth. North America, a mature market, shows consistent expansion driven by strong pharmaceutical investment and advanced research infrastructure, with a growth rate of 19.2%.

In contrast, Asia is emerging as the fastest-growing region, with a projected expansion of 20.4%, fueled by increasing government funding in biomedical science and a rapidly expanding biopharmaceutical sector.

Europe maintains significant momentum with an 18.6% growth rate, supported by stringent regulations promoting alternatives to animal testing and a focus on microphysiological systems.

These regional disparities highlight diverse market drivers, from technological adoption in the US to policy-driven incentives in Europe and infrastructure development in Asia. The integration of high-content imaging, bioinks, and growth factors is a common thread advancing capabilities worldwide.

Market Dynamics

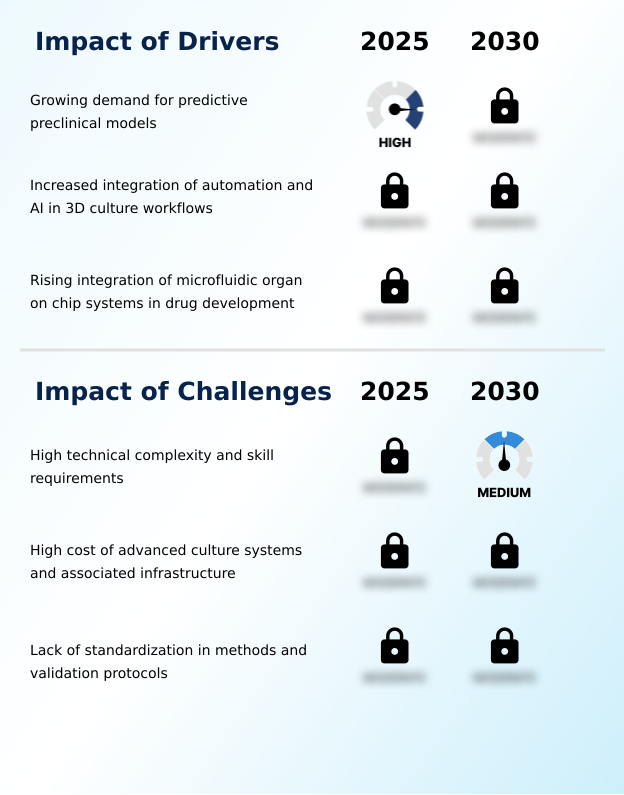

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The strategic implementation of advanced technologies is reshaping the 3D cell culture landscape, with a clear focus on enhancing efficiency and predictive power. Automating 3D cell culture workflows is no longer a niche capability but a core requirement for achieving the scale needed in modern drug discovery.

- This automation is particularly critical for leveraging organoid models for cancer drug screening, where high-throughput capabilities can reduce manual error rates by a factor of five compared to traditional methods, allowing for more compounds to be evaluated.

- Concurrently, advancements in microfluidics in organ-on-chip systems are central to the progress of 3D cell culture for personalized medicine, enabling the creation of patient-specific models that mimic human physiological responses with unprecedented accuracy. These systems provide dynamic environments essential for studying complex diseases.

- Furthermore, the evolution of bioprinting for regenerative medicine applications is opening new frontiers in creating functional tissues for therapeutic use, building upon the foundational principles of controlled cellular organization and biomaterial engineering.

What are the key market drivers leading to the rise in the adoption of 3D Cell Culture Industry?

- The growing demand for predictive preclinical models that offer higher physiological relevance is a key driver for market expansion.

- Market growth is fundamentally driven by the demand for more predictive and human-relevant preclinical data, with the market expanding at a rate nearly 20% higher than previous averages.

- The rising integration of microfluidic organ-on-chip systems, which enable dynamic cell culture and multi-tissue integration, is a significant factor. These platforms allow researchers to simulate human biological responses with greater fidelity, improving translational accuracy in drug development.

- The industry's shift toward physiologically relevant models is also supported by regulatory incentives to reduce animal testing.

- Innovations in growth factors and air-liquid interface techniques are further enhancing the complexity and functionality of in vitro models, making them indispensable for modern research.

What are the market trends shaping the 3D Cell Culture Industry?

- The advancement of automation and AI-enabled 3D culture workflows is a significant market trend. This development enhances scalability, reproducibility, and data analysis in preclinical research.

- Key trends are centered on increasing the physiological relevance and throughput of experimental models. The expansion of organoid-based personalized medicine, driven by advances in biomaterial engineering and stem cell research, is a primary focus. Automation and AI are transforming workflows, with next-generation platforms cutting consumable costs four-fold and reducing in-lab labor by half compared to legacy systems.

- This allows for more complex phenotypic screening and high-throughput screening of compounds. The development of advanced biofabrication techniques and biocompatible polymers is enhancing the creation of functional tissue constructs.

- These innovations in disease modeling and personalized medicine are leading to improved assay reproducibility and more reliable preclinical validation, which are critical for accelerating therapeutic development and ensuring cell viability in long-term studies.

What challenges does the 3D Cell Culture Industry face during its growth?

- High technical complexity and the need for specialized skill sets present a significant challenge, potentially limiting widespread adoption and affecting industry growth.

- Despite strong growth drivers, the market faces significant challenges related to technical complexity, cost, and standardization. The operation of advanced 3D culture systems requires specialized expertise, creating a skills gap that can slow adoption.

- Furthermore, the high cost of bioreactors, microfluidic chips, and specialized reagents can be prohibitive, with advanced systems representing an investment up to 10 times greater than traditional 2D culture setups. A lack of standardized protocols for mechanistic studies and cell-cell interactions hinders the ability to compare data across different laboratories, affecting result reproducibility.

- Addressing these issues is crucial for unlocking the full potential of human-relevant models and ensuring broader market penetration and acceptance.

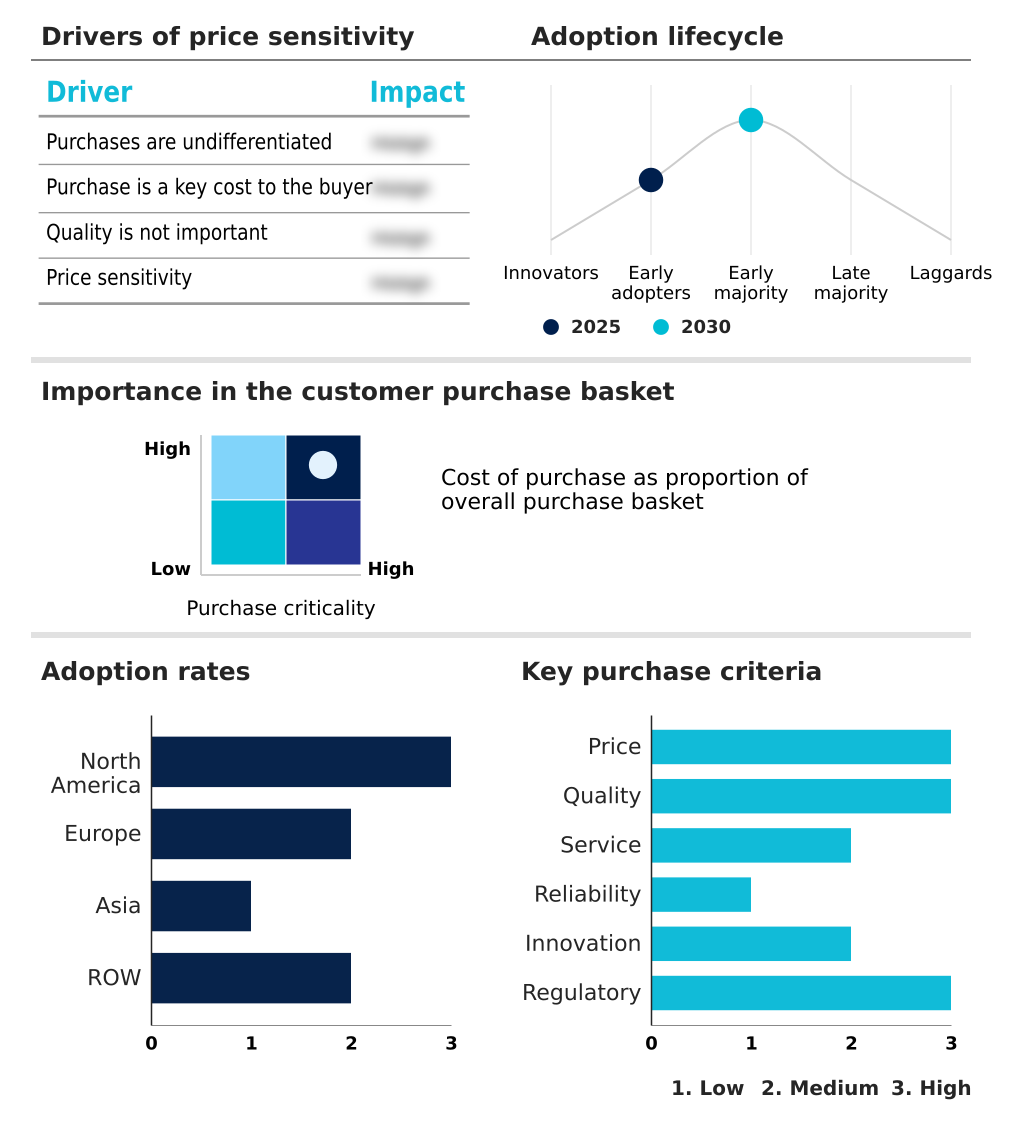

Exclusive Technavio Analysis on Customer Landscape

The 3d cell culture market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 3d cell culture market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of 3D Cell Culture Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, 3d cell culture market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3D Biotek LLC - Analyzes advanced microphysiological systems, including single and multi-organ platforms, for enhanced preclinical research and development.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Biotek LLC

- BICO Group AB

- CN Bio Innovations Ltd.

- Corning Inc.

- Elveflow

- Greiner Bio One International GmbH

- Hamilton Co.

- InSphero AG

- Lonza Group Ltd.

- Merck KGaA

- MIMETAS BV

- PromoCell GmbH

- REPROCELL Inc.

- Revvity Inc.

- Synthecon Inc.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 3d cell culture market

- In August, 2025, Shanghai Biochip Co Ltd. announced its first automated and intelligent in vitro organoid production system, CellXpress AI, marking a significant step toward automation and standardization in organoid technology.

- In March, 2025, More, a German life science startup, raised around $2.6 million in seed funding to accelerate the commercialization of its lab platform, which automates the planning, culture, and analysis of complex 3D cell culture models.

- In February, 2025, Queen Mary University of London opened one of Europe's largest organ-on-chip facilities, the Centre for Predictive in vitro Models (CPM), to advance the development of complex in vitro models and reduce reliance on animal testing.

- In January, 2025, MIMETAS launched OrganoPlate UniFlow (UF), the first commercially available unidirectional, gravity-driven pumpless flow system designed to simplify operations while enhancing model accuracy for drug discovery and disease research.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 3D Cell Culture Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 299 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 19.2% |

| Market growth 2026-2030 | USD 2206.3 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 16.1% |

| Key countries | US, Canada, Mexico, Germany, UK, France, Italy, Spain, The Netherlands, China, Japan, South Korea, India, Indonesia, Thailand, Brazil, Saudi Arabia, UAE, Turkey, Argentina, Colombia, South Africa and Israel |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The 3D cell culture market is defined by a convergence of advanced biological and engineering disciplines aimed at creating more predictive preclinical models. Key technologies including scaffold-based and scaffold-free systems, bioprinted systems, and microfluidics-based platforms are fundamental to this shift.

- The use of organoids and spheroids is becoming standard in drug discovery, toxicology testing, and cancer research, allowing for sophisticated analysis of the tumor microenvironment and therapeutic efficacy. For boardroom consideration, investing in automated liquid handling and high-content imaging platforms is a strategic imperative that can de-risk pharmaceutical pipelines by reducing preclinical timelines by up to 25%.

- Innovations in tissue engineering and regenerative medicine are facilitated by advanced bioinks and extracellular matrix compositions, enabling the development of patient-derived organoids for personalized medicine. The integration of these technologies into microphysiological systems is setting a new benchmark for in vitro modeling and stem cell research.

What are the Key Data Covered in this 3D Cell Culture Market Research and Growth Report?

-

What is the expected growth of the 3D Cell Culture Market between 2026 and 2030?

-

USD 2.21 billion, at a CAGR of 19.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Cancer and stem cell research, Drug discovery and toxicology testing, and Tissue engineering and regenerative medicine), Type (Scaffold-based, Scaffold-free, Bioprinted systems, and Microfluidics-based), End-user (Pharmaceutical and biotechnology companies, Academic and research institutes, CROs, and Cosmetics industry) and Geography (North America, Europe, Asia, Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growing demand for predictive preclinical models, High technical complexity and skill requirements

-

-

Who are the major players in the 3D Cell Culture Market?

-

3D Biotek LLC, BICO Group AB, CN Bio Innovations Ltd., Corning Inc., Elveflow, Greiner Bio One International GmbH, Hamilton Co., InSphero AG, Lonza Group Ltd., Merck KGaA, MIMETAS BV, PromoCell GmbH, REPROCELL Inc., Revvity Inc., Synthecon Inc., Tecan Trading AG and Thermo Fisher Scientific Inc.

-

Market Research Insights

- Market dynamics are shaped by the pursuit of higher translational accuracy in preclinical research, with organizations achieving up to a 40% improvement in predictive outcomes using advanced systems. North America accounts for over 40% of the incremental growth, while Asia demonstrates the fastest expansion, with a rate nearly 10% higher than other regions.

- The adoption of physiologically relevant models and high-throughput screening methods is critical, as is ensuring assay reproducibility for reliable disease modeling. Innovations in microfluidics-based platforms and dynamic cell culture techniques are enabling more complex cell-cell interactions, which is essential for developing effective personalized medicine strategies and accelerating preclinical validation timelines across the industry.

We can help! Our analysts can customize this 3d cell culture market research report to meet your requirements.