Agricultural Harvester Market Size 2024-2028

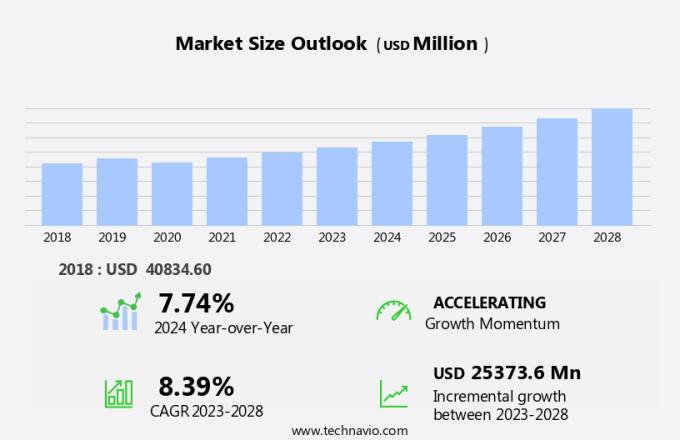

The agricultural harvester market size is forecast to increase by USD 25.37 billion at a CAGR of 8.39% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the farm labor shortage In the agriculture sector, leading farmers to invest in automated harvesting solutions. Another trend gaining popularity is the use of self-propelled forage harvesters equipped with 3D cameras, enhancing productivity and efficiency. However, the high initial and operating costs remain a challenge for market growth. Farmers must weigh the benefits against the investment required to adopt these advanced technologies. The market analysis report provides an in-depth examination of these factors and more, offering valuable insights for stakeholders In the agricultural industry.

What will be the Size of the Agricultural Harvester Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to the increasing demand for mechanized farming solutions in response to labor scarcity and the need for increased yield and product quality. Farmers in both developed and developing economies are turning to agricultural machinery, such as harvesters, to enhance their productivity and competitiveness. Harvesters, including combine harvesters, play a crucial role In the farming process by efficiently reaping grains like wheat and storing them in large grain tanks. The market is driven by factors such as process speed, product quality, and the size of grain tanks. New Holland Fiat and other leading agricultural equipment manufacturers continue to innovate, offering farmers mechanical means to streamline their operations and improve their yields.

- The trend toward farm mechanization is expected to continue, as farmers seek to mitigate labor challenges and maximize their returns.

How is this Agricultural Harvester Industry segmented and which is the largest segment?

The agricultural harvester industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Combine harvesters

- Forage harvesters

- Type

- Four-wheel drive harvesters

- Two-wheel drive harvesters

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Product Insights

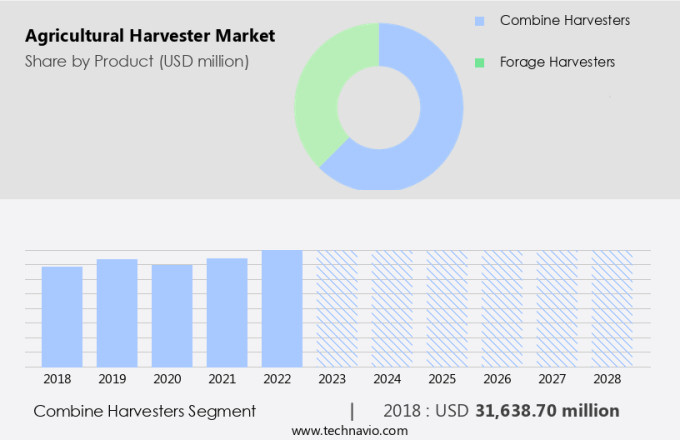

- The combine harvesters segment is estimated to witness significant growth during the forecast period.

Combine harvesters are essential machinery in modern agriculture, integrating harvesting, threshing, and winnowing into a single process. Major manufacturers, including AGCO Corp. (AGCO), Deere, and CLAAS KGaA mbH (CLAAS), dominate The market. Self-propelled combine harvesters, one of the product types, offer advantages such as minimal grain breakage, higher grain cleanliness, and better maneuverability in challenging soil conditions. These harvesters feature an extra-capacity diesel tank and an engine that performs both propulsion and harvesting functions. The market's total import value has been growing due to government initiatives promoting farm mechanization programs and the increasing demand for labor resources. Classified into self-propelled, track-mounted, and tractor-mounted types, self-propelled harvesters' popularity stems from their efficiency and versatility.

Get a glance at the Agricultural Harvester Industry report of share of various segments Request Free Sample

The Combine harvesters segment was valued at USD 31.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

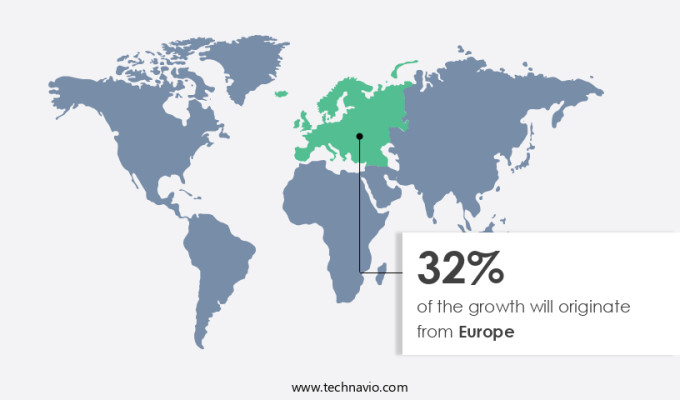

- Europe is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European the market is experiencing significant growth due to the shrinking farm workforce and government initiatives promoting mechanization. With a scarcity of laborers, self-propelled forage harvesters have become increasingly popular. These harvesters, produced by leading manufacturers such as Harvest Automation, Trimble, and Sampo-Rosenlew, ensure efficient handling of crops, reducing harvesting losses and minimizing dependency on labor. Major European markets include the UK, Germany, Spain, France, and Italy. The adoption of advanced technologies in agricultural machinery, including harvesters, is a key trend driving market growth. At agricultural shows like Agritechnica, farmers can explore the latest harvester models and innovations. Effective wheat sowing and paddy field harvesting are crucial for high-quality forage and silage production, making the use of modern harvesters indispensable.

Market Dynamics

Our agricultural harvester market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Agricultural Harvester Industry?

Farm labor shortage in agriculture sector is the key driver of the market.

- The market is experiencing significant growth due to the increasing labor scarcity In the farming industry, particularly in developing economies such as India and the US. Farmers In these countries are turning to agricultural machinery, including harvesters, to increase yield and productivity. According to the US Department of Agriculture, California, which accounts for over 14.3% of the country's total agricultural value, is facing a severe labor shortage. In response, the Government of India and various farm mechanization programs are offering subsidies to encourage farmers to adopt mechanized farming methods. The integration of electronic sensing and cloud-based processing technologies in harvesters is further enhancing process speed, product quality, and precision planting.

- The market for agricultural harvesters is expected to continue growing as farmers seek mechanical means to address labor shortages and reduce farm labor costs. Key players in this sector include New Holland Fiat, Massey Ferguson, Trimble, Sampo-Rosenlew, and others. Harvesters used for cereals and grains, such as wheat and paddy, are in high demand for threshing, reaping, winnowing, and other harvesting processes. The Agriculture Department, in collaboration with the Agriculture Infra Fund, is working to reduce manufacturing costs and promote the adoption of farm equipment. The agricultural machinery market is expected to continue expanding as farmers seek to improve yield and quality while addressing labor shortages and reducing costs.

What are the market trends shaping the Agricultural Harvester Industry?

Growth in popularity of self-propelled forage harvesters with 3D cameras is the upcoming market trend.

- In the agricultural sector, the demand for harvesting machinery, such as self-propelled forage harvesters, is on the rise due to labor scarcity and the need for increased yield and productivity in developing economies. Farmers are turning to mechanical means, like harvesters, to mitigate labor resources constraints and enhance process speed and product quality. Leading agricultural machinery manufacturers are responding to this trend by developing tailored features that cater to the unique needs of farmers. For instance, Deere's 9000 Series self-propelled forage harvesters come equipped with advanced technologies like electronic sensing and cloud-based processing, which streamline operations and reduce the workload on operators.

- Features such as Active Fill Control, which optimizes truck filling, enable operators to focus on other aspects of the harvesting process, ensuring maximum efficiency and throughput. The total import value of agricultural machinery, including combine harvesters, has been increasing steadily in recent years. Governments, such as the Government of India, have initiated farm mechanization programs and subsidies to encourage the adoption of mechanized farming equipment. As a result, the market for agricultural machinery is expected to grow significantly In the coming years. Manufacturers like New Holland Fiat, Trimble, Sampo-Rosenlew, and Massey Ferguson are investing in research and development to create harvesters that cater to the specific requirements of farmers.

- These machines are designed to improve process speed, product quality, and precision, allowing farmers to maximize their yields and minimize their labor costs. Wheeled extractors, powered by diesel engines and boasting high horsepower, are becoming increasingly popular In the agricultural sector. These machines are used for tasks such as threshing, reaping, winnowing, and processing cereals and grains, including wheat and paddy. Agriculture departments and infrastructure funds are also investing in manufacturing costs to make these machines more accessible to farmers. Despite the benefits of farm mechanization, labor shortages and farm labor costs remain a challenge for farmers. As a result, the demand for self-propelled forage harvesters and other agricultural machinery is expected to continue growing, as they offer a more efficient and cost-effective solution to labor-intensive farming practices.

- In conclusion, the market is witnessing significant growth due to the increasing demand for labor-saving machinery, the need for higher yields and product quality, and government initiatives to promote farm mechanization. Leading manufacturers are responding to these trends by developing advanced, efficient, and cost-effective harvesters that cater to the unique needs of farmers, enabling them to maximize their yields and minimize their labor costs.

What challenges does Agricultural Harvester Industry face during the growth?

High initial and operating costs is a key challenge affecting the industry growth.

- The market is witnessing growth due to the increasing labor scarcity in farming industries, particularly in developing economies. Farmers are turning to agricultural machinery, such as harvesters, to increase yield and productivity. However, the high initial cost of these machines is a significant barrier to entry for many farmers. For instance, a new combine harvester from CNH Industrial's CASE IH brand In the US can cost between USD400,000 and USD500,000. Proper operation of agricultural harvesters is crucial to minimize operating expenses. For example, improper use of sugarcane harvesters can damage their rotating shafts, gears, chains, and belts, leading to increased maintenance costs.

- These machines are equipped with sharp knives that operate at high speeds, requiring specialized knowledge and care. Some models even include built-in knife sharpeners, which necessitate the use of shields for maintenance. Governments and agriculture departments in various countries are implementing farm mechanization programs to subsidize the adoption of agricultural machinery, including harvesters. Farmers can benefit from tailored features like precision planting, harvest automation, and electronic sensing, which improve process speed, product quality, and yield. Manufacturers like New Holland Fiat, Trimble, Sampo-Rosenlew, and Massey Ferguson offer a range of harvesters with varying horsepower and specifications to cater to different farming needs.

- Despite the benefits, labor resources remain a significant consideration for farmers when deciding to invest in agricultural harvesters. The Agriculture Infra Fund and other initiatives aim to reduce labor shortage and farm labor costs. Wheeled extractors, diesel engines, and other farm equipment are alternative options for smaller-scale farmers or those with limited budgets. Agriculture machinery manufacturers are continually innovating to address these challenges, introducing more affordable and efficient harvesters to the market. The total import value of agricultural machinery, including harvesters, has been increasing steadily in recent years. Major agricultural shows like Agritechnica provide a platform for manufacturers to showcase their latest offerings, such as wheat sowing machines, paddy field harvesters, threshing machines, reaping machines, winnowing machines, and cereal and grain harvesters.

- These machines can process a vast quantity of crops in a short time, making them essential for large-scale farming operations. In conclusion, the market is experiencing growth due to the labor scarcity and the need for increased yield and productivity in farming industries. However, the high initial cost and the need for specialized knowledge to operate these machines remain significant challenges. Governments and agriculture departments are implementing programs to subsidize the adoption of agricultural machinery, and manufacturers are continually innovating to address these challenges. The future of agricultural harvesters looks promising, with advancements in technology and a growing demand for mechanization in farming industries.

Exclusive Customer Landscape

The agricultural harvester market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural harvester market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural harvester market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AGCO Corp. - Our company provides advanced combine harvesters engineered for efficient rice, corn, wheat, and other crop harvesting In the field. These harvesters integrate the functions of reaping, threshing, and winnowing into a single operation, enhancing productivity and reducing post-harvest losses. Our commitment to innovation and quality ensures that our harvesters meet the highest industry standards, making us a trusted partner for agricultural producers In the US.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Bernard KRONE Holding SE and Co. KG

- Bucher Industries AG

- CHANGFA

- Changzhou Dongfeng Agricultural Machinery Group Co. Ltd.

- China National Machinery Industry Corp. Ltd.

- CLAAS KGaA mBH

- CNH Industrial NV

- Daedong Corp.

- Deere and Co.

- HORSCH Maschinen GmbH

- ISEKI and Co. Ltd.

- J C Bamford Excavators Ltd.

- Kubota Corp.

- Mahindra and Mahindra Ltd.

- SDF SpA

- Sonalika International Tractors Ltd.

- Tractors and Farm Equipment Ltd.

- Weichei Lovol Heavy Industry Co. Ltd.

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as farmers in developing economies seek to increase yield and productivity on their lands. This trend is driven by the increasing scarcity of labor resources and the need for mechanical means to address the challenges of farming in an efficient and effective manner. Agricultural machinery, including harvesters, plays a crucial role in this process. Harvesters are essential tools for farmers, enabling them to reap, thresh, and winnow crops such as cereals and grains with ease. The adoption of harvesters has been particularly prominent In the cultivation of wheat and paddy fields. The integration of electronic sensing and cloud-based processing technologies into harvesters has further enhanced their capabilities.

These advanced features allow farmers to optimize process speed and product quality, ensuring that they get the most out of their crops. Precision planting and harvest automation are also gaining popularity, as they help farmers to minimize waste and improve the overall efficiency of their operations. The total import value of agricultural machinery, including harvesters, has been on the rise in recent years. This trend is expected to continue as farmers in developing economies invest in mechanization to address labor scarcity and reduce farm labor costs. Governments In these regions have also been implementing farm mechanization programs and providing subsidies to encourage the adoption of agricultural machinery.

For instance, the Government of India has launched several initiatives to promote the use of farm equipment and reduce reliance on manual labor. Manufacturers of agricultural machinery, including New Holland Fiat and Massey Ferguson, have responded to this demand by offering tailored features and improving the quality of their harvesters. For example, combine harvesters now come with higher horsepower diesel engines, greater process speed, and advanced sensing technologies to ensure optimal crop yield and quality. Despite these advancements, the manufacturing costs of agricultural machinery, including harvesters, remain a concern for many farmers in developing economies. However, as the demand for these machines continues to grow, competition among manufacturers is expected to increase, leading to price reductions and greater affordability for farmers.

In conclusion, the market is experiencing robust growth as farmers in developing economies seek to increase yield and productivity through mechanization. The adoption of advanced technologies and government initiatives are driving this trend, and manufacturers are responding by offering more efficient and cost-effective solutions. The future of agriculture In these regions looks bright, as farmers continue to embrace mechanical means to address labor scarcity and improve their overall operations.

|

Agricultural Harvester Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.39% |

|

Market growth 2024-2028 |

USD 25373.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.74 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Agricultural Harvester Market Research and Growth Report?

- CAGR of the Agricultural Harvester industry during the forecast period

- Detailed information on factors that will drive the Agricultural Harvester growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the agricultural harvester market growth of industry companies

We can help! Our analysts can customize this agricultural harvester market research report to meet your requirements.