Allyl Chloride Market Size 2024-2028

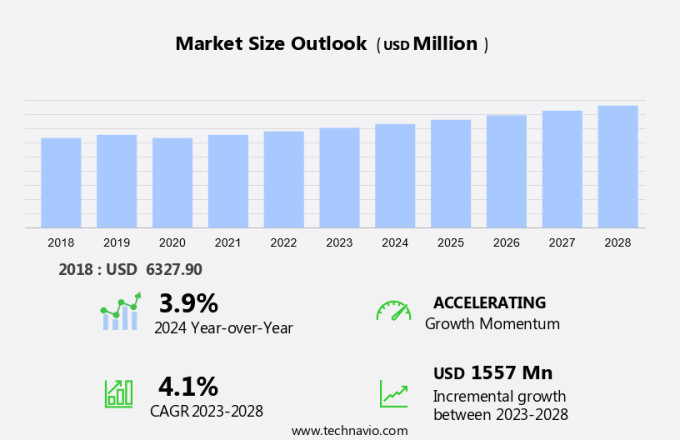

The allyl chloride market size is forecast to increase by USD 1.56 billion at a CAGR of 4.1% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing utilization of allyl chloride derivatives in various industries. In the electrical and electronics sector, allyl chloride is used to produce epoxy resins, which are essential for manufacturing electronic components. The aerospace and marine industries also use allyl chloride derivatives, such as allyl sulfonates and glycidyl ethers, for manufacturing fuel additives and antifouling agents, respectively. Furthermore, the rise of epichlorohydrin-based resins in the water treatment industry is driving market growth. However, stringent environmental laws and regulations are posing challenges to the market, as allyl chloride production involves the release of hazardous by-products. Bio-based alternatives, such as bio-based epichlorohydrin and allyl amines, are being explored to mitigate these environmental concerns. Overall, the allyl chloride market is witnessing growth due to its wide application base in industries like electrical and electronics, aerospace, marine, and water treatment chemicals. However, the market is facing challenges due to stringent environmental regulations and the need for an eco-friendly alternative

What will be the Size of the Market During the Forecast Period?

-

Allyl chloride is a vital chemical compound used extensively as an intermediate in numerous industries. This colorless, pungent, and insoluble liquid plays a significant role in the production of various chemicals and materials. In the chemical industries, allyl chloride is utilized in the synthesis of several derivatives, including epichlorohydrin. Epichlorohydrin is a crucial intermediate in the manufacturing of polymers, resins, and plastic materials. These materials find extensive applications in various sectors, such as the pharmaceutical field, pesticides, adhesives, and coatings. The pharmaceutical industry relies on allyl chloride for the production of generic medicines. It is also used in the synthesis of epichlorohydrin, which is a key ingredient in the production of bio-based epichlorohydrin. This compound is further utilized in the production of epoxy resins, synthetic glycerine, and textiles. Allyl chloride is also a vital intermediate in the electrical and electronics industry. It is used in the production of epoxy resins, which are essential in the manufacturing of printed circuit boards and insulators. These epoxy resins are known for their excellent electrical insulation properties. In the aerospace and marine industries, allyl chloride is used in the production of various materials. For instance, it is used in the manufacturing of transparent liquid epoxy resins, which are used in the coating of aircraft and boats for protective purposes.

-

Allyl chloride is used in the construction industry as a plasticizer and emulsifier. It is also used in the production of chlorinated polyvinyl chloride (PVC) and polyvinyl acetate (PVA) resins, which are widely used in the construction industry for various applications. Allyl chloride is produced through the chlorination of allyl alcohol using phosphorous chloride or hypochlorous acid. The production process involves the reaction of allyl alcohol with chlorine in the presence of a catalyst. Propylene is a common feedstock used in the production of allyl alcohol. In conclusion, allyl chloride is a versatile chemical intermediate that plays a crucial role in various industries. Its derivatives, such as epichlorohydrin, are used in the production of polymers, resins, plastic materials, and epoxy resins, which find extensive applications in various sectors, including pharmaceuticals, electrical and electronics, aerospace, marine, construction, and textiles.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Epichlorohydrin

- Chelating agents

- Allylic ether resins

- Allylic esters

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

- The epichlorohydrin segment is estimated to witness significant growth during the forecast period.

Epichlorohydrin is a crucial epoxide compound, characterized by its colorless liquid form and pungent odor. Manufactured through the reaction of allyl chloride, chlorine, and water, it is primarily employed in various industries for the production of epoxy resins, epichlorohydrin elastomers, water treatment chemicals, surfactants, and paper resins. Allyl chloride, a precursor to epichlorohydrin, is derived from the chlorination of propylene. Epichlorohydrin exhibits moderate solubility in water and is miscible in polar solvents, making it an essential ingredient in the synthesis of epoxy resins. These resins find extensive applications in industries such as construction, automotive, aerospace, electronics, and marine, where they serve as adhesives, coatings, and composite materials.

Furthermore, epichlorohydrin is also utilized in the production of bio-based epichlorohydrin, allyl amines, allyl sulfonates, glycidyl ethers, and water treatment chemicals. In summary, epichlorohydrin, a chlorine-containing epoxy compound, is indispensable in various industries due to its versatile applications in the production of epoxy resins, water treatment chemicals, and other essential industrial chemicals. Its production involves the reaction of allyl chloride, derived from propylene, with chlorine and water. The resulting compound is used in numerous industries, including construction, automotive, aerospace, electronics, marine, and water treatment, to manufacture a range of products.

Get a glance at the market report of share of various segments Request Free Sample

The epichlorohydrin segment was valued at USD 2.89 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 72% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Allyl chloride is a significant chemical compound with various applications in textiles, epoxy resins, pharmaceuticals, and electronic-grade epoxy resins. In 2023, APAC emerged as the leading region in the production and consumption of allyl chloride. The primary reason for this dominance is the high demand for allyl chloride-based products, particularly in China. Allyl chloride is a crucial ingredient in the production of epichlorohydrin, which is extensively used in the manufacturing of epoxy resins and other chemicals. The demand for epichlorohydrin is on the rise in countries like India, China, South Korea, Taiwan, and others in APAC. This growth can be attributed to the increasing demand for epichlorohydrin in paints and coatings applications.

Furthermore, the construction industry's expansion in India, Taiwan, and South Korea has led to a significant increase in the consumption of epichlorohydrin. Allyl chloride is a transparent liquid used in chlorination processes. It is produced by reacting allyl alcohol with phosphorous chloride. Although insoluble in water, it is soluble in organic solvents such as ethanol, acetone, and benzene. The versatility of allyl chloride makes it an essential ingredient in various industries. In summary, APAC is the largest producer and consumer of allyl chloride due to the high demand for allyl chloride-based products, particularly in China. The demand for epichlorohydrin, a key product of allyl chloride, is on the rise in various applications, including paints and coatings and the construction industry, driving the growth of the market in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Allyl Chloride Market ?

Increasing use of allyl chloride derivatives in several applications is the key driver of the market.

- Allyl chloride is a significant chemical intermediate, primarily used in the production of various chemicals. This compound is insoluble in water but soluble in organic solvents. The primary consumer of allyl chloride is the epichlorohydrin industry, which manufactures epichlorohydrin through its reaction with hydrochloric acid. Additionally, allyl chloride finds extensive usage in the production of allyl derivatives, such as allyl alcohol, allylamine, allyl isothiocyanates, and allyl silane. Furthermore, allyl chloride acts as an alkylating agent in the synthesis of various chemical compounds, including pharmaceuticals and pesticides. The expanding plastic industry worldwide is another significant factor fueling the demand for allyl chloride.

- Allyl chloride is also employed as a raw material in the production of surfactants, flame retardants, water treatment chemicals, and allylic esters. Despite being toxic and flammable, allyl chloride's demand remains strong due to its wide range of applications. However, the potential risks associated with its production and use necessitate stringent safety measures and regulations.

What are the market trends shaping the Allyl Chloride Market?

The rise of epichlorohydrin-based resins in water treatment industry is the upcoming trend in the market.

- Allyl chloride is a significant chemical intermediate with diverse applications in various industries, including the pharmaceutical field and chemical industries. In the pharmaceutical sector, it is used as a building block in the synthesis of various drugs and generic medicines. Moreover, in the chemical industry, allyl chloride is employed in the production of polymers, resins, and plastic materials. Its utility extends to the manufacturing of pesticides, adhesives, and epoxy resins. Epoxy resins, in particular, have gained popularity due to their non-toxic nature and excellent properties, such as high strength, durability, and resistance to heat and chemicals. These resins are extensively used in the production of drinking water supplies, as they do not contain harmful agents that could potentially affect human health.

- Epoxy resin coatings on pipes and containers prevent the accumulation of epichlorohydrin residues, ensuring the water remains clean and safe for consumption. The increasing demand for epoxy resins and their applications in various industries is anticipated to fuel the growth of the market. According to recent market research, the market for allyl chloride is projected to witness steady growth during the forecast period due to the rising demand for epoxy resins and their derivatives.

What challenges does Allyl Chloride Market face during the growth?

Stringent environmental laws and regulations associated with allyl chloride is a key challenge affecting the market growth.

- Allyl chloride is a significant industrial chemical with various applications in diverse industries, including Chelating Agents, Detergents, Dyestuffs, Flavorings, Metal brighteners, Urethanes, Oil and Gas, and Paints and Coatings. However, the production and utilization of allyl chloride and its derived chemicals, such as epichlorohydrin, are subject to stringent government regulations due to their potential harmful effects on humans and the environment. The manufacturing process of allyl chloride releases harmful gases, contributing to pollution. Propylene, a primary raw material for allyl chloride production, can be hazardous to human health and biodiversity when it comes into contact with water.

- Exposure to propylene can result in severe eye, skin, and respiratory irritation, burns, blistering, and skin rash. Moreover, it can negatively impact the central nervous system, causing symptoms like excitement, headache, dizziness, incoordination, narcosis, drunkenness, vomiting, collapse, and coma. Given these health and environmental concerns, it is crucial for manufacturers to adhere to regulatory guidelines and implement safety measures during the production and handling of allyl chloride and its related chemicals.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Enterprises

- BOCSCI Inc.

- Chemical Corp. Pvt. Ltd.

- China Petrochemical Corp.

- Daiso Chemical Co. Ltd.

- DuPont de Nemours Inc.

- INOVYN Europe Ltd.

- Kashima Chemical Co. Ltd.

- Leo Chemo Plast Pvt. Ltd.

- Mitsubishi Chemical Corp.

- Olin Corp.

- OSAKA SODA CO. Ltd.

- SIELC Technologies

- Solvay SA

- Sumitomo Chemical Co. Ltd.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Allyl chloride is a valuable chemical intermediate with a wide range of applications in various industries. It is extensively used in the chemical industry for the production of epichlorohydrin, which is further utilized in the manufacturing of epoxy resins, polymers, resins, plastic materials, pesticides, adhesives, and generic medicines. In the pharmaceutical field, allyl chloride derivatives find use in the synthesis of allylamine-based drugs. The chemical also finds applications in the electrical and electronics, aerospace, marine, construction, and textile industries. Epoxy resins, produced using allyl chloride, are used as binders in the production of electronic-grade epoxy resins, transparent liquid adhesives, and coatings. Allyl chloride is also used as an alkylating agent in the synthesis of glycidyl ether, a key ingredient in the production of epoxy resins.

Moreover, allyl chloride is used in the production of bio-based epichlorohydrin, a sustainable alternative to the conventionally produced epichlorohydrin. Allyl chloride polymers are used as plasticizers, emulsifiers, and flame retardants in various applications. The chemical is also used in water treatment chemicals, allyl sulfonates, and chelating agents, among others. Despite its widespread use, allyl chloride is a toxic and flammable substance that requires careful handling. It reacts with water to produce hypochlorous acid, which can cause water pollution. Allylic esters, produced from allyl chloride, find use as surfactants, detergents, dyestuffs, flavorings, metal brighteners, urethanes, and oil and gas applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2024-2028 |

USD 1.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch