Artificial Intelligence In Telemedicine Market Size 2025-2029

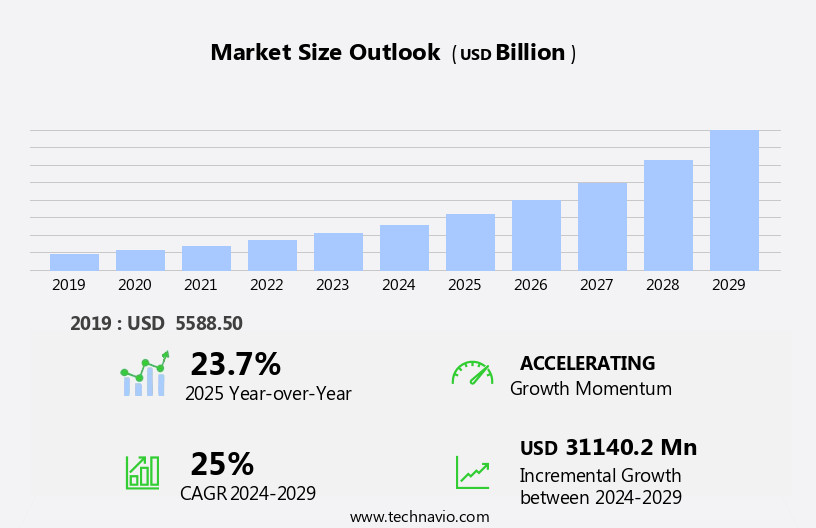

The artificial intelligence in telemedicine market size is forecast to increase by USD 31.14 billion at a CAGR of 25% between 2024 and 2029.

- The Artificial Intelligence (AI) in telemedicine market is witnessing substantial growth, driven by the increasing demand for remote healthcare services and the need for efficient, scalable solutions among healthcare providers. AI integration enhances telemedicine platforms by enabling more accurate diagnostics, personalized treatment recommendations, and improved clinical decision-making, all of which are critical for healthcare organizations aiming to optimize patient outcomes and operational efficiency. The market is further supported by continuous innovation and the launch of advanced AI in telemedicine powered solutions tailored for virtual care environments. However, data privacy and security remain significant concerns, as the digital transmission and storage of sensitive patient information expose healthcare systems to potential breaches and regulatory risks

- With the increasing use of telemedicine and AI, sensitive patient data is being transmitted and stored digitally, making data security a major concern. Ensuring the confidentiality and protection of patient data is crucial for the growth and success of AI in Telemedicine market players. Companies must invest in robust security measures and adhere to regulatory standards to mitigate these risks and build trust with their customers.

What will be the Size of the Artificial Intelligence In Telemedicine Market during the forecast period?

- The artificial intelligence (AI) in telemedicine market continues to evolve, with healthcare providers increasingly integrating AI-driven solutions into their virtual care offerings. Telemedicine infrastructure is enhanced through AI-powered virtual assistants, enabling seamless patient engagement and clinical decision support. Personalized medicine benefits from data integration and predictive analytics, while AI-driven diagnostics and machine learning algorithms advance medical imaging analysis. Insurance companies leverage AI for streamlined claims processing and risk assessment. Telehealth platforms incorporate AI for mental health support, virtual care, and emergency medicine. High-speed internet access and cloud computing facilitate remote patient monitoring and real-time data analysis.

- Wearable sensors and remote patient monitoring systems collect vast amounts of data, which is analyzed using AI for predictive analytics and clinical decision support. Regulatory compliance is ensured through AI-driven systems, while deep learning and computer vision are applied to drug discovery and specialty care. Natural language processing and video conferencing improve patient education and communication. AI-driven systems also support remote surgery and chronic disease management. Data privacy and big data analytics are essential considerations in the evolving AI telemedicine landscape.

How is this Artificial Intelligence In Telemedicine Industry segmented?

The artificial intelligence in telemedicine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Hardware

- Services

- End-user

- Pharmaceutical companies

- Hospitals

- Research institutes

- Others

- Technology Specificity

- Machine Learning

- Natural Language Processing

- Computer Vision

- Deep Learning

- Application

- Diagnostics

- Remote Monitoring

- Virtual Assistants

- Drug Discovery

- Deployment Type

- Cloud-Based

- On-Premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- South Korea

- Rest of World (ROW)

- North America

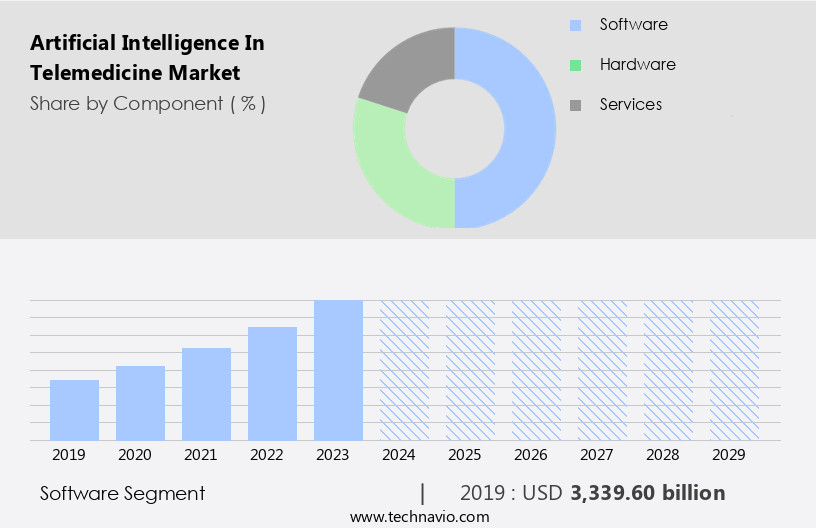

By Component Insights

The software segment is estimated to witness significant growth during the forecast period.

The artificial intelligence (AI) market in telemedicine is experiencing significant growth, with the software segment playing a pivotal role. This segment encompasses diagnostic platforms, virtual assistants, clinical decision support systems, and data analytics tools, all of which leverage machine learning (ML), natural language processing (NLP), and other advanced AI techniques. AI-driven diagnostic software utilizes sophisticated algorithms to analyze medical data, including medical images, electronic health records (EHR), and genetic information, enabling healthcare providers to make more accurate diagnoses and offer evidence-based treatment recommendations. Virtual assistants, powered by AI, enhance patient engagement and streamline workflows, while predictive analytics tools help identify potential health risks and optimize resource allocation.

Telehealth platforms integrate AI to offer personalized medicine, remote patient monitoring, and wearable sensors, allowing for more effective chronic disease management. In mental health, AI-powered virtual care offers immersive, harmonious therapy sessions. AI also plays a crucial role in emergency medicine, medical imaging analysis, drug discovery, specialty care, and regulatory compliance. Cloud computing and high-speed internet access facilitate seamless data integration and access, ensuring efficient clinical decision support. AI's impact extends to primary care, regulatory compliance, and remote surgery, with data privacy and big data analytics ensuring patient data security and improving overall healthcare outcomes.

The Software segment was valued at USD 3.34 billion in 2019 and showed a gradual increase during the forecast period.

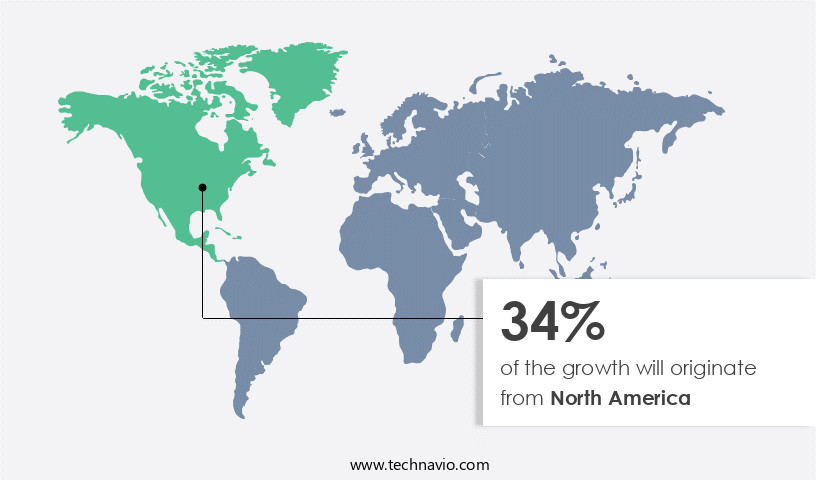

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the global telemedicine market, North America is a major contributor to the artificial intelligence sector, fueled by high adoption rates and technological innovations. According to recent research, 30.1% of adults in the region utilized telemedicine services in 2022, underscoring the increasing trust and dependence on digital health solutions. Canada, in particular, stands out as a pioneer in telemedicine, driven by the need to deliver healthcare in remote locations and the advancement of telecommunications technologies. The Canadian telehealth industry experiences significant growth, expanding at an average annual rate of 35%. Canadian companies, such as Tech4Life in Milton, Ontario, are making waves internationally with their groundbreaking AI-driven telemedicine solutions, including virtual assistants, predictive analytics, and clinical decision support.

These advancements are revolutionizing various aspects of healthcare, from mental health and virtual care to emergency medicine, medical imaging analysis, and chronic disease management. Machine learning algorithms and natural language processing are enhancing patient engagement and enabling personalized medicine, while cloud computing and high-speed internet access ensure seamless data integration and real-time clinical decision support. Insurance companies are also embracing telemedicine, making it an essential component of their offerings. The market's evolution is further characterized by regulatory compliance, data privacy, and big data analytics, which are critical to ensuring the security and effectiveness of AI-powered diagnostics, remote patient monitoring, and remote surgery. The integration of computer vision and deep learning is paving the way for advanced drug discovery and specialty care, ultimately transforming the healthcare landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Artificial Intelligence Market in Telemedicine advances with AI-powered telemedicine platforms and machine learning for remote diagnostics. AI in telehealth market trends highlight deep learning for patient monitoring and AI-driven virtual health assistants. Natural language processing in telemedicine enhances AI for chronic disease management, while predictive analytics for telehealth improves outcomes. AI telemedicine for rural healthcare and cloud-based AI telemedicine solutions ensure accessibility, per telemedicine AI market forecast. AI for medical imaging analysis and real-time AI patient monitoring drive precision, supported by AI telemedicine cybersecurity solutions. AI in telehospital services, automated AI triage systems, and AI for telehealth data privacy optimize care. AI-powered remote consultations, AI telemedicine for mental health, scalable AI telemedicine platforms, and AI for personalized telehealth fuel growth, transforming healthcare delivery through 2029.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence In Telemedicine Industry?

- The surge in demand for telemedicine services is the primary market driver, as more patients seek convenient and accessible healthcare solutions from the comfort of their homes.

- Artificial Intelligence (AI) is revolutionizing telemedicine by enhancing healthcare accessibility and outcomes, particularly in underserved areas. The lack of medical facilities and professionals in these regions poses significant challenges to delivering quality healthcare. AI in telemedicine bridges this gap by enabling remote consultations, continuous patient monitoring, and timely interventions through virtual assistants and AI-powered diagnostics. The integration of predictive analytics and data integration further personalizes treatment plans and improves overall efficiency. The COVID-19 pandemic has accelerated the adoption of telehealth services due to the necessity for social distancing and minimizing in-person interactions.

- This shift has highlighted the convenience and effectiveness of telemedicine, establishing a long-term demand for AI-enhanced telemedicine infrastructure. Insurance companies are increasingly recognizing the value of telemedicine and AI-powered diagnostics, further driving market growth. By leveraging AI, telemedicine infrastructure can offer more immersive, harmonious, and efficient healthcare services, ultimately improving patient care and satisfaction.

What are the market trends shaping the Artificial Intelligence In Telemedicine Industry?

- The trend in the market involves frequent new launches from companies. This professional and knowledgeable observation underlines the importance of staying informed about industry developments.

- The artificial intelligence (AI) market in telemedicine is experiencing substantial growth due to innovative product launches by companies. One such recent example is the introduction of Wound AI on October 23, 2024, by Vantiq, Telemedicine Solutions, and NTT DATA. This clinical decision support platform, presented at the HLTH Conference 2024, is revolutionizing wound-care treatment. Leveraging real-time, GenAI-powered recommendations, Wound AI aims to enhance patient outcomes, minimize wound-related complications, and boost operational efficiency. The platform seamlessly integrates with Electronic Health Records (EHR) and employs a federated AI model to safeguard data privacy. Wound AI provides precise wound classification, personalized treatment recommendations, and real-time quality checks, all backed by NTT DATA's Smart Management Platform for sophisticated analytics.

- In telehealth, AI applications such as machine learning algorithms, virtual care, mental health, patient engagement, clinical decision support, medical imaging analysis, and wearable sensors are transforming healthcare delivery and operational efficiency. By offering advanced capabilities, these technologies are enabling healthcare providers to make more informed decisions, improve patient care, and optimize resources.

What challenges does the Artificial Intelligence In Telemedicine Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as organizations must balance the need to collect and use data to drive innovation and business growth with the imperative to protect sensitive information from unauthorized access, use, or disclosure.

- Artificial Intelligence (AI) is revolutionizing telemedicine by enabling remote patient monitoring, video conferencing, and natural language processing for effective patient education. Cloud computing facilitates the storage and accessibility of vast amounts of medical data, enabling AI algorithms to analyze patient data and provide accurate diagnoses and treatment recommendations. In emergency medicine, AI can assist doctors in making critical decisions by analyzing vital signs and symptoms in real-time. However, the increasing use of digital health solutions presents significant challenges, particularly in ensuring data privacy and security. According to the U.S. Department of Health and Human Services, there were over 700 healthcare data breaches reported in 2022, exposing millions of records, including sensitive patient information.

- These breaches underscore the importance of implementing robust security measures to protect patient data and prevent severe consequences such as identity theft, financial loss, and compromised patient trust. High-speed internet access and drug discovery are also areas where AI is making a significant impact in telemedicine. Overall, the integration of AI in telemedicine offers numerous benefits, but it is crucial to address the challenges associated with data privacy and security.

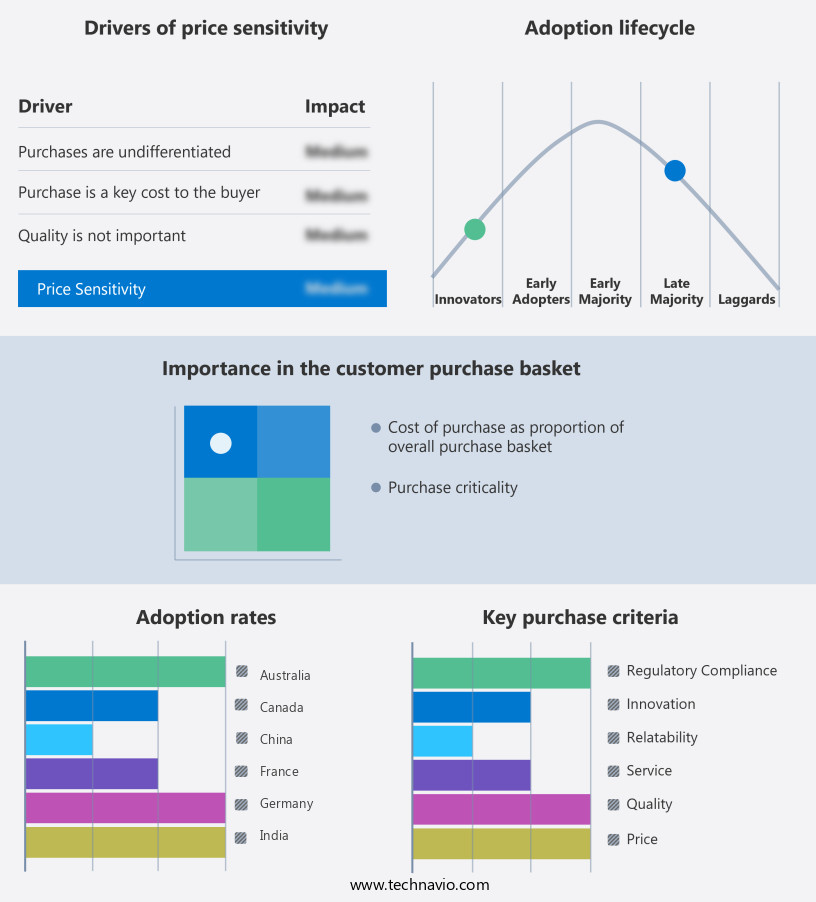

Exclusive Customer Landscape

The artificial intelligence in telemedicine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence in telemedicine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence in telemedicine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- IBM

- Microsoft

- Amazon Web Services

- NVIDIA

- Philips

- Siemens Healthineers

- GE Healthcare

- Aidoc

- Zebra Medical Vision

- Medtronic

- Teladoc Health

- Amwell

- Butterfly Network

- AliveCor

- Enlitic

- Sensely

- Viz.ai

- Qure.ai

- Icometrix

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence In Telemedicine Market

- In March 2023, Google's healthcare subsidiary, Google Health, announced the integration of Google's AI-powered chatbot, "Google Me," with Google Meet for telemedicine consultations (Google, 2023). This development aims to streamline the patient consultation process by enabling automated appointment scheduling, symptom assessment, and prescription management.

- In July 2022, IBM Watson Health and Teladoc Health entered into a strategic partnership to integrate IBM Watson's AI capabilities into Teladoc's telehealth platform (IBM, 2022). This collaboration aims to enhance Teladoc's virtual care offerings by providing AI-driven diagnostic tools and personalized treatment recommendations.

- In January 2022, Microsoft announced the FDA clearance of its AI-powered telemedicine platform, Microsoft Azure AI, for remote patient monitoring and diagnosis (Microsoft, 2022). This approval marks a significant milestone in the adoption of AI in telemedicine, enabling remote diagnosis and treatment of various conditions using AI algorithms.

- In October 2021, Babylon Health secured a USD200 million investment led by Kinnevik and Alphabet's investment arm, GV, to expand its AI-powered digital health services (Babylon, 2021). This funding round will support the company's growth in new markets and the development of advanced AI capabilities for personalized healthcare solutions.

Research Analyst Overview

The artificial intelligence (AI) in telemedicine market is experiencing significant growth, driven by advancements in patient portal technology and the increasing importance of patient consent and medical data security. Health data management is becoming more sophisticated, with AI applications like image segmentation and explainable AI playing crucial roles in precision medicine. However, concerns over AI bias and data encryption remain, necessitating ongoing efforts to ensure patient privacy and trust. Telemedicine apps and virtual consultations are transforming healthcare accessibility, enabling remote monitoring devices to collect and transmit data for disease prediction and patient adherence. AI-driven drug development and genomic sequencing are revolutionizing treatment plans, while AI-assisted diagnosis and medical device integration offer new possibilities for virtual hospital care.

Telemedicine adoption continues to expand, with virtual consultations and AI-enabled medical imaging becoming essential tools for healthcare providers. Despite these advancements, ethical considerations and telemedicine reimbursement remain challenges to widespread adoption. Object detection and biomarker identification are other AI applications contributing to the market's growth, offering opportunities for innovation and improved patient outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence In Telemedicine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25% |

|

Market growth 2025-2029 |

USD 31140.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

23.7 |

|

Key countries |

US, China, Germany, Canada, UK, India, Australia, France, South Korea, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence In Telemedicine Market Research and Growth Report?

- CAGR of the Artificial Intelligence In Telemedicine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence in telemedicine market growth of industry companies

We can help! Our analysts can customize this artificial intelligence in telemedicine market research report to meet your requirements.