Battery Management IC Market Size 2025-2029

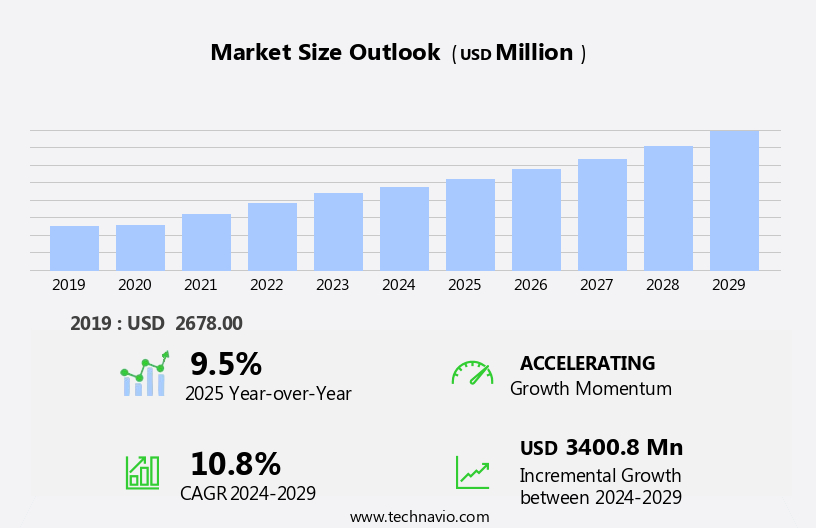

The battery management ic market size is forecast to increase by USD 3.4 billion at a CAGR of 10.8% between 2024 and 2029.

- The Battery Management IC (BMSIC) market is experiencing significant growth, driven primarily by the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). The global EV market is projected to reach a staggering size by 2027, with BMSICs playing a crucial role in managing the complex battery systems of these vehicles. Additionally, the emergence of advanced technologies such as AI and ML algorithms in battery management is further fueling market growth. However, the market also faces challenges, with power efficiency and heat dissipation being major concerns. These issues can significantly impact the performance and lifespan of BMSICs.

- Companies in the BMSIC market must address these challenges effectively to capitalize on the opportunities presented by the growing EV and HEV markets. By focusing on developing more efficient and heat-resistant BMSICs, companies can differentiate themselves and gain a competitive edge. Overall, the BMSIC market's strategic landscape is dynamic, with both opportunities and challenges shaping its future trajectory. Companies seeking to succeed in this market must stay abreast of the latest trends and technologies while addressing the challenges presented by power efficiency and heat dissipation.

What will be the Size of the Battery Management IC Market during the forecast period?

- The Battery Management IC (BMS IC) market continues to evolve, driven by the diverse applications across various sectors. From power tools and electric vehicles to fuel cells and renewable energy systems, the demand for efficient and safe battery management solutions is on the rise. BMS ICs play a crucial role in monitoring and managing the state of charge (SoC) and state of health (SoH) of batteries, ensuring optimal performance and longevity. In the realm of consumer electronics, wearable devices, and hybrid electric vehicles, BMS ICs enable energy density and power density optimization. Meanwhile, in the industrial sector, BMS ICs are integral to grid-scale energy storage and renewable energy systems, providing voltage and temperature monitoring, current monitoring, and cell balancing.

- Furthermore, the integration of IoT connectivity and machine learning algorithms in BMS ICs enhances battery diagnostics, fault detection, and communication capabilities. In the realm of safety, BMS ICs offer overcharge protection, short circuit protection, and overdischarge protection, ensuring fire safety and battery life cycle management. Battery cell selection, battery pack design, and thermal management are other critical aspects of the BMS IC market, with continuous advancements in anode and cathode materials, charge and discharge rates, and battery software optimization. The ongoing unfolding of market activities reveals evolving patterns in the battery management landscape, with a focus on improving battery efficiency, energy density, and power density.

How is this Battery Management IC Industry segmented?

The battery management ic industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Fuel gauge IC

- Battery charger IC

- Authentication IC

- End-user

- Consumer products and communications

- Automotive

- Industrial

- Others

- Battery Type

- Lithium-Ion

- Lead acid

- Nickel metal hydride

- Lithium-polymer

- Type

- Monolithic BMS ICs

- Modular BMS ICs

- Discrete BMS Solutions

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

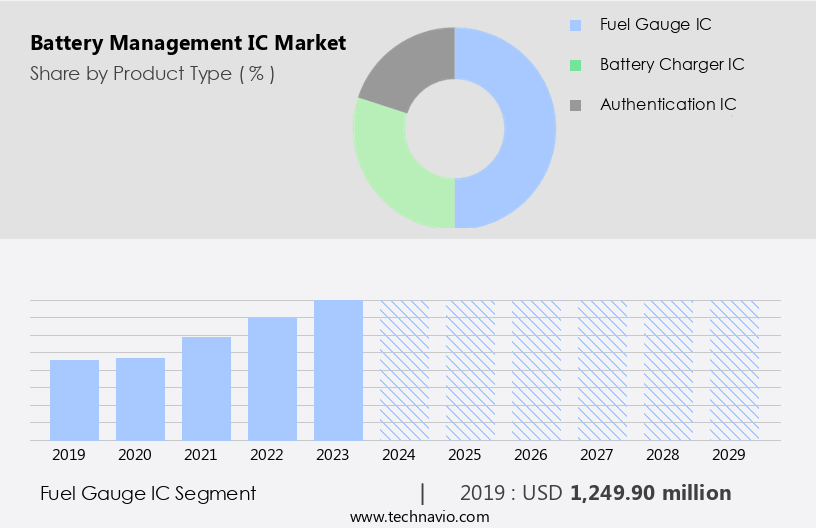

The fuel gauge ic segment is estimated to witness significant growth during the forecast period.

The battery management system market encompasses various technologies and applications, including fuel gauge ICs for battery pack management and monitoring in electric and hybrid vehicles, renewable energy storage systems, and consumer electronics. Fuel gauge ICs play a crucial role in ensuring battery efficiency and safety by accurately monitoring state of charge (SoC) and state of health (SoH) in real-time. This data is essential for optimizing battery usage, enhancing system reliability, and preventing overcharging or overdischarging. The increasing adoption of electric and hybrid vehicles, renewable energy sources, and IoT devices is driving the demand for advanced battery management systems.

These systems enable precise monitoring and control of battery packs, optimizing energy usage and extending battery life. Additionally, the integration of artificial intelligence, machine learning, and cloud connectivity in battery management systems facilitates predictive maintenance, fault diagnosis, and battery degradation analysis. Battery management systems are also critical in ensuring the safety and reliability of fuel cells, which are increasingly being used in various industries, including transportation and power generation. These systems provide real-time monitoring and control of fuel cell performance, ensuring optimal operation and minimizing the risk of safety issues. Furthermore, the development of advanced battery chemistries, such as lithium-ion batteries, and the optimization of cell balancing, current monitoring, and thermal management techniques are essential in enhancing battery performance and extending their life cycle.

The integration of advanced communication interfaces, such as I2C, SPI, CAN, and Lin bus, enables seamless communication between battery management systems and other components in the system. In conclusion, the battery management system market is witnessing significant growth due to the increasing adoption of electric and hybrid vehicles, renewable energy sources, and IoT devices. The integration of advanced technologies, such as artificial intelligence, machine learning, and cloud connectivity, is enabling the development of more efficient, reliable, and safe battery management systems. The market is expected to continue growing as the demand for advanced energy storage solutions increases across various industries.

The Fuel gauge IC segment was valued at USD 1.25 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

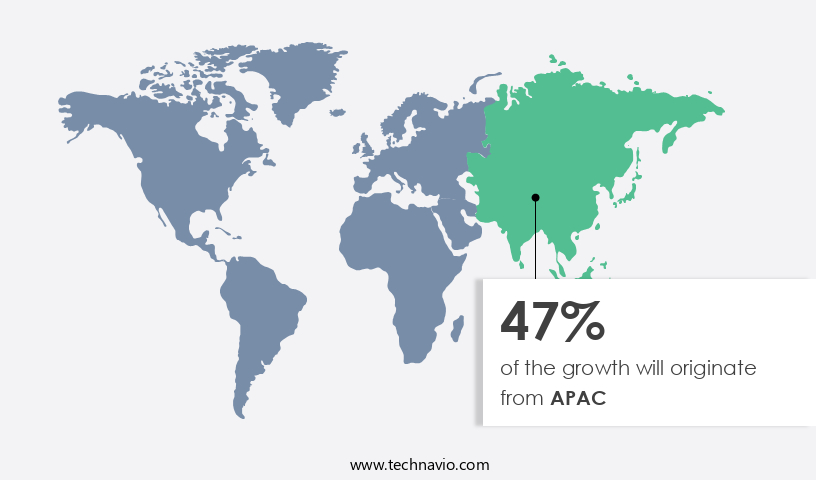

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic technology landscape of APAC, the adoption of electric vehicles (EVs) is surging, fueled by government incentives, ecological consciousness, and technological advancements. Central to the success of EVs is the efficient management of their battery systems. Battery Management ICs (BMS ICs) play a pivotal role in ensuring safe charging, discharging, and overall battery management in EV battery packs. Moreover, the increasing deployment of renewable energy sources, such as solar and wind power, in countries like China and India, necessitates the development of energy storage solutions. BMS ICs are indispensable for managing and optimizing the performance of these energy storage systems, including the lithium-ion batteries used for grid-scale energy storage.

The APAC region is also home to some of the world's largest consumer electronics markets, including China, Japan, and South Korea. Wearable devices, power tools, and other consumer electronics rely on efficient battery management to extend usage time and ensure safety. BMS ICs enable real-time monitoring of battery state of charge, temperature, and other critical parameters, ensuring optimal performance and longevity. Battery aging, degradation, and safety are critical concerns in the battery industry. BMS ICs employ advanced algorithms and machine learning techniques to monitor battery health, predict failures, and provide fault diagnosis. They also offer features like overcharge protection, short circuit protection, and voltage monitoring to ensure battery safety.

Battery management systems (BMS) are increasingly integrating with the Internet of Things (IoT) to enable remote monitoring and management. Cloud connectivity and battery communication enable real-time data analysis and predictive maintenance, enhancing the overall efficiency and reliability of energy storage systems. Battery manufacturers are investing in R&D to improve battery performance, energy density, and power density. Advancements in cell chemistry, anode and cathode materials, and discharge and charge rates are driving innovation in the battery industry. BMS ICs are essential in optimizing the performance of these advanced batteries, ensuring they operate at peak efficiency and longevity. Battery testing and calibration are crucial for ensuring battery performance and safety.

BMS ICs offer advanced battery diagnostics and communication interfaces like I2C, SPI, CAN, and LIN bus, enabling seamless integration with battery testing equipment and software. In conclusion, the APAC region's growing focus on renewable energy, electric vehicles, and consumer electronics is driving the demand for efficient and reliable battery management solutions. BMS ICs are essential components in this evolving landscape, enabling the optimization and management of battery performance, safety, and longevity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Battery Management Integrated Circuit (IC) market grows with battery management IC for EVs and smart BMS IC for lithium-ion. Battery IC market trends 2025 highlight BMS IC for renewable energy and battery management IC APAC dominance. High-efficiency BMS ICs power battery IC for consumer electronics, while automotive BMS IC solutions ensure safety. Battery IC supply chain supports eco-friendly battery IC designs, and BMS IC for energy storage drives sustainability. The battery management IC forecast emphasizes precision BMS IC for EVs and battery IC manufacturing trends. IoT-enabled battery ICs and BMS IC for industrial applications enhance efficiency, while battery IC for 5G devices meets tech demands. Sustainable BMS IC solutions and advanced BMS IC for safety fuel battery IC market growth

What are the key market drivers leading to the rise in the adoption of Battery Management IC Industry?

- The increasing prevalence of electric vehicles (EVs) and hybrid electric vehicles (HEVs) serves as the primary market catalyst. Battery management systems are essential components in electric vehicles (EVs) and hybrid electric vehicles (HEVs), powering their electric drivetrains with sophisticated battery systems. These battery systems consist of numerous interconnected battery cells, necessitating advanced battery management integrated circuits (ICs) for monitoring, controlling, and optimizing their performance, safety, and longevity. The increasing adoption of EVs and HEVs fuels the demand for advanced battery management ICs. These ICs ensure proper cell balancing, state-of-charge estimation, thermal management, and fault detection, enabling the complex battery systems to function efficiently. Battery management ICs employ features like charge rate management, battery protection, overcharge protection, short circuit protection, voltage monitoring, and i2c interface to optimize battery performance and safety.

- Furthermore, energy density, battery calibration, and cell chemistry are crucial factors influencing the development of battery management ICs. Cloud connectivity is a recent trend in battery management systems, enabling real-time monitoring and remote diagnostics. This technology enhances the overall performance and longevity of the battery systems in EVs and HEVs. Lithium-ion batteries are the most common type of batteries used in EVs and HEVs, necessitating specialized battery management ICs for their unique requirements. As the market for EVs and HEVs continues to grow, the demand for advanced battery management ICs will persist, driving innovation and technological advancements in this field.

What are the market trends shaping the Battery Management IC Industry?

- The emergence of artificial intelligence (AI) and machine learning (ML) algorithms in battery management is an emerging market trend. These advanced technologies are increasingly being adopted to optimize battery performance, improve energy efficiency, and enhance overall system functionality.

- Battery Management ICs (Integrated Circuits) equipped with advanced Artificial Intelligence (AI) and Machine Learning (ML) capabilities are revolutionizing the management of batteries in various applications, including consumer electronics and renewable energy sectors. These ICs can analyze vast amounts of battery performance data to predict battery health and the remaining useful life of batteries, enabling early detection of degradation and potential failure modes. By dynamically adjusting charging parameters based on real-time battery conditions, usage patterns, and environmental factors, these ICs optimize energy efficiency, minimize charging times, and extend battery lifespan while ensuring safe operation. ML algorithms enable these ICs to learn from battery performance data continuously, optimizing charging profiles to meet specific application requirements.

- Temperature monitoring, current monitoring, cell balancing, fault diagnosis, and State of Charge (SOC) estimation are essential functions of battery management ICs, which are further enhanced by AI and ML capabilities. In wind energy applications, for instance, these ICs can optimize battery usage based on wind turbine performance data, ensuring maximum energy production and minimal downtime. Moreover, AI-based battery management ICs can diagnose faults and recommend corrective actions, reducing maintenance costs and downtime. By continuously monitoring battery health and performance, these ICs can provide valuable insights into battery behavior, helping to improve overall system efficiency and reliability. With the increasing demand for longer battery life, higher power density, and safer battery operation, AI-powered battery management ICs are becoming an essential component in various applications, from consumer electronics to renewable energy systems.

What challenges does the Battery Management IC Industry face during its growth?

- The optimization of power efficiency and heat dissipation in battery management integrated circuits (ICs) represents a significant challenge that can hinder the growth of the industry. These issues, which are crucial for enhancing the performance and longevity of battery-powered devices, necessitate continuous research and development in IC design and manufacturing.

- Battery management ICs play a crucial role in various high-power density applications, including electric and hybrid vehicles (EVs/HEVs), grid-scale energy storage systems for renewable energy, and industrial equipment. In these applications, high current and power levels can generate substantial heat within the ICs, negatively impacting their efficiency and reliability. Moreover, voltage drops and power losses across internal circuitry, interconnections, and external components such as current sensing resistors and power switches contribute to energy inefficiency and heat generation, particularly in high-current applications. Battery management ICs perform essential functions, including Soh estimation, overdischarge protection, battery cell selection, and thermal management, to ensure optimal battery pack design and safety.

- Additionally, they offer IoT integration and battery testing capabilities to enhance system performance and longevity. In the context of solar energy and renewable energy storage, battery management ICs facilitate the integration of these systems into the grid, ensuring fire safety and efficient energy conversion.

Exclusive Customer Landscape

The battery management ic market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the battery management ic market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, battery management ic market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices - The company specializes in advanced battery management integrated circuits, including the AiT A4004 model. This IC boasts a high level of integration for effective battery management. By utilizing state-of-the-art technology, it optimizes battery performance, ensuring efficient energy usage and prolonging battery life. The circuitry includes features such as cell balancing, temperature monitoring, and state-of-charge detection. With a focus on innovation and quality, the company's battery management solutions cater to various industries and applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices

- Texas Instruments

- STMicroelectronics

- NXP Semiconductors

- Infineon Technologies

- ON Semiconductor

- Microchip Technology

- Maxim Integrated

- Renesas Electronics

- Silicon Labs

- Qualcomm

- Broadcom

- Marvell Technology

- MediaTek

- Dialog Semiconductor

- Cirrus Logic

- Semtech

- Monolithic Power Systems

- ROHM Semiconductor

- Allegro MicroSystems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Battery Management IC Market

- In February 2024, Texas Instruments (TI) introduced the BQ35x95x family of high-performance, integrated battery management solutions, designed to support electric vehicles (EVs) and grid energy storage systems (ESS) with enhanced safety features and improved system efficiency . This expansion of TI's battery management IC (BMC) offerings highlights the growing demand for advanced energy storage solutions.

- In August 2025, Infineon Technologies AG and Volkswagen Group signed a strategic collaboration agreement to develop and produce BMCs for EVs, aiming to improve battery system performance, safety, and charging speed.This partnership underscores the importance of close collaborations between semiconductor companies and automotive manufacturers to address the increasing demand for electric vehicles.

- In November 2024, Dialog Semiconductor announced the acquisition of Adesto Technologies, a leading provider of energy harvesting and energy storage solutions, for approximately USD400 million. This acquisition positions Dialog Semiconductor to expand its portfolio and strengthen its presence in the energy storage market, particularly in the Internet of Things (IoT) and industrial sectors.

- In January 2025, the European Union unveiled its Battery Alliance initiative, aiming to create a European battery industry value chain, from raw material mining to battery recycling, to reduce the EU's dependence on imports and promote sustainable battery production. This initiative represents a significant regulatory push towards a more self-sufficient and eco-friendly battery industry, which is expected to boost demand for BMCs in Europe.

Research Analyst Overview

The battery market is experiencing significant growth, driven by advancements in battery research and innovation. Battery pack validation, modeling, and simulation play crucial roles in ensuring the reliability and safety of high-voltage batteries used in various applications. Fast charging and wireless charging technologies are gaining popularity, pushing the industry to prioritize battery optimization and cost reduction. Battery certification and regulations are essential for ensuring safety standards in battery pack assembly and testing. Multi-cell batteries and series-parallel configurations require stringent validation to meet performance and durability requirements. Battery second life and recycling are becoming increasingly important as the industry focuses on reducing waste and minimizing environmental impact.

Battery lifecycle management and optimization are key areas of development to maximize battery performance and extend its life. The battery industry encompasses a wide range of applications, from low-voltage batteries in consumer electronics to high-voltage batteries in electric vehicles and renewable energy storage systems. Battery cost remains a significant challenge, and ongoing research aims to improve battery efficiency and reduce manufacturing costs. Battery trends include the development of new materials and technologies, such as solid-state batteries and advanced battery chemistries, to address the growing demand for higher energy density and longer battery life. Battery safety standards and regulations continue to evolve to ensure the safe use and disposal of batteries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Battery Management IC Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

253 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.8% |

|

Market growth 2025-2029 |

USD 3400.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.5 |

|

Key countries |

US, China, Japan, India, Germany, UK, Canada, South Korea, Australia, France, Rest of World (ROW), Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Battery Management IC Market Research and Growth Report?

- CAGR of the Battery Management IC industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the battery management ic market growth of industry companies

We can help! Our analysts can customize this battery management ic market research report to meet your requirements.