What is the Brushless Motor Driver Market Size?

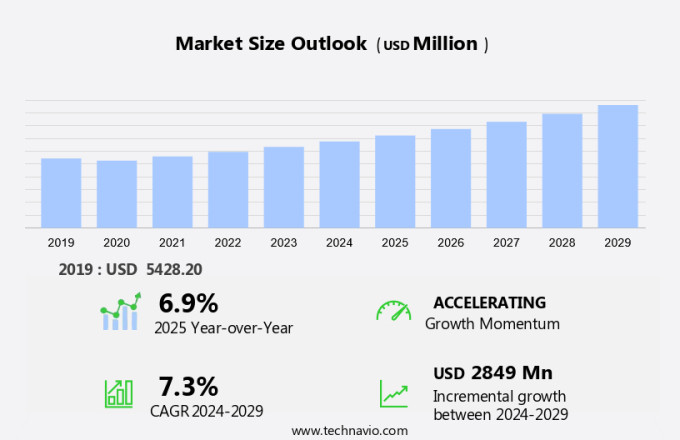

The brushless motor driver market size is forecast to increase by USD 2.85 billion, at a CAGR of 7.3% between 2024 and 2029. The market is experiencing significant growth due to the increasing application of three-phase brushless motor drivers in various industries such as automotive, industrial, and consumer electronics. This trend is driven by the advantages of brushless motor drivers, including higher efficiency, longer lifespan, and improved performance. Additionally, the market is witnessing an influx of new product launches, further fueling growth. However, the availability of counterfeit products poses a challenge to market players, requiring stringent measures to ensure product authenticity and maintain consumer trust. Overall, the market is expected to continue its growth trajectory in the coming years, driven by these key trends and challenges.

What will be the size of the Market during the forecast period?

Request Free Brushless Motor Driver Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Type

- Sensorless

- Sensor-based

- End-user

- Industrial

- Automotive and transportation

- Consumer electronics

- Healthcare

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

Which is the largest segment driving market growth?

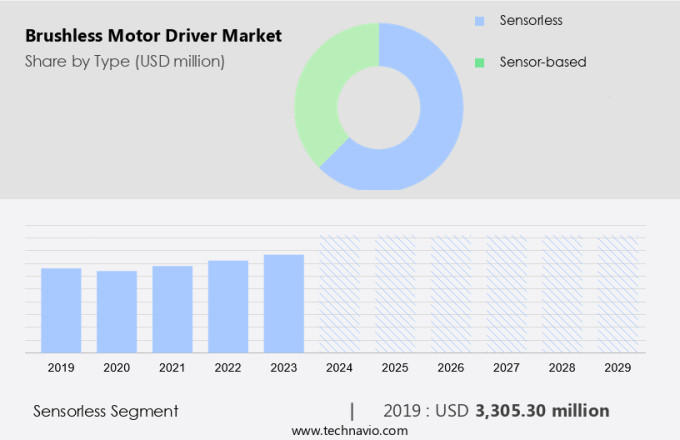

The sensorless segment is estimated to witness significant growth during the forecast period. The sensorless segment of the market is experiencing growth due to its cost-effective and efficient motor control solutions, which eliminate the need for physical sensors. This approach is particularly beneficial in applications where space, cost, and reliability are paramount.

Get a glance at the market share of various regions. Download the PDF Sample

The sensorless segment was valued at USD 3.31 billion in 2019. By simplifying the design and reducing overall system costs, the MLX90416 contributes to energy savings and low maintenance costs in various industries, including robotics, air conditioners, and electromechanical systems.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia-Pacific (APAC) region is a major contributor to the market, fueled by urbanization, industrialization, and the increasing demand for energy-efficient solutions. In May 2023, Hitachi and NASH INDUSTRIES announced a strategic partnership in India to produce controllers for brushless motors using Hitachi Power Semiconductor Device, Ltd.'s integrated single-chip ICs. This collaboration aims to boost efficiency and performance, catering to the expanding demand for brushless motors in the APAC market. The single-chip ICs, designed in Japan, streamline production and reduce costs, making them an appealing choice for various applications. This partnership underscores Hitachi's commitment to innovation and collaboration in the brushless motor driver industry.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABB Ltd - This company offers brushless motor drivers in its MicroFlex and BSM R series.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Allegro MicroSystems Inc.

- Allied Motion Technologies Inc.

- Amtek Co. Inc.

- Arc Systems Inc.

- Hitachi Ltd.

- Infineon Technologies AG

- Kollmorgen Corp.

- maxon

- Mitsubishi Electric Corp.

- Monolithic Power Systems Inc.

- Nanotec Electronic GmbH and Co. KG

- Parker Hannifin Corp.

- Renesas Electronics Corp.

- Rotex Electric

- Siemens AG

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Corp.

- Yaskawa Electric Corp.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

6.9 |

Market Dynamics

The market is experiencing significant growth due to the increasing demand for energy-saving solutions and motor design innovations. Alternating current motors, such as brushless motors, are gaining popularity in various industries, including automotive and consumer electronics, for their high efficiency and maintenance-free operation. Electric motor technology continues to evolve, with synchronous motor design and inverter motor technology leading the way. Brushless motors are increasingly being used in electric vehicle powertrains, sunroof technology, HVAC system optimization, and door automation systems. These applications require high-performance motors that offer minimal torque ripple, high efficiency, and precise speed control. In the automotive industry, brushless motor control is becoming essential for vehicle chassis design, as it enables wireless power transfer and reduces the need for traditional DC motor maintenance. The trend towards energy-efficient motors is also driving innovation in consumer electronics, where brushless DC motors are used in humanoid robot motors, pump motors, and fan motors. The future of DC motor technology lies in motor efficiency improvements and torque control. Regulations are being implemented to promote the use of energy-efficient motors in various industries, and manufacturers are responding by innovating in areas such as DC motor repair, industrial motor design, and manufacturing processes.

Robotics and automation are other areas where brushless motors are making a significant impact. The use of energy-efficient motors in robotics motor applications is helping to improve the performance and reliability of robotic systems, while also reducing their environmental footprint. In conclusion, the market is driven by the need for energy-saving solutions and motor design innovations. Brushless motors offer high efficiency, maintenance-free operation, and precise control, making them ideal for a wide range of applications, from electric vehicles to consumer electronics and robotics. The focus on motor efficiency improvements and torque control is expected to continue driving innovation in this market. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

The growing application of three-phase brushless motor drivers is notably driving the market growth. The market is experiencing significant growth due to the increasing adoption of three-phase brushless motors in various industries. These motors offer numerous advantages, such as higher efficiency, better performance, longer lifespan, and lower maintenance costs, making them an ideal choice for modern battery-powered equipment. However, challenges such as reducing size and weight while extending battery life persist. Infineon addressed these challenges with the introduction of the MOTIX IMD700A and IMD701A, fully programmable motor controllers, in June 2022. These controllers cater to the stringent requirements of various applications, including HVAC systems, automotive sector, industrial machinery, and healthcare equipment.

With their high-speed, low-power consumption, and reliable performance, these brushless motor drivers contribute to energy savings and reduced carbon emissions, making them a preferred choice for environmentally-conscious consumers. Additionally, their self-controlled electronic commutation eliminates the need for mechanical power, resulting in vibration-free operation and improved thermal comfort in applications such as doors, sunroofs, and air conditioners. Overall, the market is poised for growth as these motors continue to gain popularity in industries ranging from automotive to manufacturing, driven by their efficiency gains and energy-saving benefits. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

Product launches are an emerging trend shaping market growth. The market has experienced substantial growth, driven by the integration of intelligent power devices (IPDs) in various applications. In October 2023, Toshiba Corp. introduced two new 600V IPDs, the TPD4163K and TPD4164K, designed for brushless DC motor applications, such as HVAC systems, air conditioners, and pumps. These IPDs offer output current ratings of 1A and 2A, respectively. One significant innovation is their packaging. Both models are housed in a through-hole type HDIP30 package, which reduces the mounting area by approximately 21% compared to previous models. This size reduction is essential for minimizing the footprint of motor drive circuit boards, leading to more compact and efficient designs.

Further, the HVAC industry, automotive sector, healthcare, and industrial machinery are among the major beneficiaries of these advancements. Brushless DC motors, with their high-efficiency, energy-saving, and low-maintenance characteristics, are increasingly preferred over traditional brushed DC motors. The use of electronic commutation and self-controlled motors in adjustable rear-view mirrors, doors, sunroofs, and chassis further enhances vehicle powertrain systems' performance. The shift towards battery-powered electric vehicles and equipment also contributes to the market's growth. These developments aim to provide high-speed, low-power consumption, and reliable performance while reducing carbon emissions and environmental pollution. Thus, such market trends will shape the growth of the market during the forecast period.

What are the major market challenges?

The availability of counterfeit products is a significant challenge hindering the market growth. The market is experiencing significant growth due to the increasing adoption of high-efficiency, energy-efficient motors in various industries. Brushless DC motors, with their inner rotor design and electronic commutation, offer efficiency gains and low maintenance costs, making them ideal for use in HVAC systems, vehicle powertrain systems, and industrial machinery. In the automotive sector, brushless motor drivers are used in adjustable rear-view mirrors, doors, sunroofs, and self-controlled wiper systems, contributing to high-performance, vibration-free operation and reduced carbon emissions. Moreover, the shift towards battery-powered electric vehicles and equipment is driving demand for brushless motor drivers in wireless battery power applications.

These motor drivers enable high speeds and low power consumption, enhancing the overall performance of the electric motor. In the healthcare industry, brushless motor drivers are used in medical equipment to ensure reliable performance and efficient energy usage. However, the proliferation of counterfeit products poses a significant challenge to the market. These counterfeit parts can severely damage the reputation of legitimate manufacturers and pose risks to consumers, leading to subpar performance and reliability issues. Regulations and laws are being implemented to combat this issue and ensure the quality and safety of brushless motor drivers. Overall, the market is expected to continue growing due to its energy savings, low maintenance costs, and increasing applications in various industries. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Brushless motor drivers have emerged as a game-changer in various industries, offering numerous advantages over their brushed counterparts. These drivers are integral components of motor systems, enabling efficient energy conversion and optimal motor performance. In this article, we delve into the market dynamics of brushless motor drivers and explore their diverse applications. Brushless motor drivers have gained significant traction in various sectors due to their high-efficiency and energy-saving properties. They are increasingly being adopted in HVAC systems to ensure thermal comfort and reduce energy consumption. In the automotive sector, brushless motor drivers are used in vehicle powertrain systems, wireless battery power for electric vehicles, and adjustable rear-view mirrors. The healthcare industry benefits from these drivers in equipment such as pumps and fans, while industrial machinery relies on them for reliable performance and reduced maintenance costs. The use of brushless motor drivers extends beyond these industries. They are employed in self-controlled systems like doors, sunroofs, and wiper systems, providing high-speed operation with low power consumption.

In the manufacturing sector, these drivers contribute to efficient production processes by powering high-performance electric motors in various machinery. Brushless motor drivers operate on the principle of electronic commutation, eliminating the need for mechanical power and reducing friction. This results in a vibration-free operation, enhancing the overall performance and reliability of the motor system. Furthermore, brushless motor drivers are known for their efficiency gains, making them an attractive choice for applications where energy savings and low maintenance costs are essential. The adoption of brushless motor drivers is driven by several factors, including the growing emphasis on energy efficiency and environmental concerns. As governments worldwide implement stricter regulations on carbon emissions and environmental pollution, industries are turning to brushless motor drivers to meet these requirements. Moreover, the increasing popularity of electric vehicles and the shift towards renewable energy sources further boost the demand for these drivers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market Growth 2025-2029 |

USD 2.85 billion |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 52% |

|

Key countries |

China, US, Japan, South Korea, Germany, Italy, India, France, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd, Allegro MicroSystems Inc., Allied Motion Technologies Inc., Amtek Co. Inc., Arc Systems Inc., Hitachi Ltd., Infineon Technologies AG, Kollmorgen Corp., maxon, Mitsubishi Electric Corp., Monolithic Power Systems Inc., Nanotec Electronic GmbH and Co. KG, Parker Hannifin Corp., Renesas Electronics Corp., Rotex Electric, Siemens AG, STMicroelectronics NV, Texas Instruments Inc., Toshiba Corp., and Yaskawa Electric Corp. |

|

Market Segmentation |

Type (Sensorless and Sensor-based), End-user (Industrial, Automotive and transportation, Consumer electronics, Healthcare, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies