Cannabis Packaging Market Size 2025-2029

The cannabis packaging market size is forecast to increase by USD 11.21 billion at a CAGR of 28.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing purchasing power of the millennial demographic in key cannabis markets. This generation's preference for legal, high-quality, and convenient cannabis products is fueling the demand for innovative and effective packaging solutions. Another key trend shaping the market is the emergence of smart packaging for cannabis. As consumer safety and product authenticity become increasingly important, companies are investing in advanced packaging technologies to ensure product freshness, child-resistance, and tamper-evident features.

- To capitalize on opportunities and navigate challenges effectively, companies must stay informed of market trends, invest in research and development, and build robust supply chain strategies. However, the market faces challenges due to the volatility of raw material prices for cannabis packaging. The fluctuating costs of materials like glass, plastic, cannabis bottles and vials, film and laminates, tapes and adhesives, and caps and closures and paper pose a significant risk for manufacturers and retailers, requiring them to adapt to market conditions and optimize their supply chains accordingly.

What will be the Size of the Cannabis Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The marijuana business daily reports a significant shift in cannabis packaging trends, with plastic containers and caps, such as those manufactured by Hippo Packaging and Impak Corporation, gaining popularity. High-density polyethylene (HDPE), a type of plastic, is favored due to its durability and resistance to moisture. CBD products, including tinctures and pills, also require specialized packaging to maintain product integrity. As the legalization of cannabis continues, sustainability is becoming a priority, with some companies opting for eco-friendly options like ocean-reclaimed plastic.

Chinese suppliers are also entering the market, offering cost-effective alternatives for marijuana businesses. CR Packaging, for instance, provides a range of containers for various cannabis product types. Containers for chronic pain products, like those used for hemp-derived CBD, must adhere to strict regulations, further driving the demand for specialized packaging solutions. In response, packaging has innovated to meet evolving consumer demands, offering solutions in materials such as high-density polyethylene (HDPE), plastic, hemp, and ocean-reclaimed plastic.

How is this Cannabis Packaging Industry segmented?

The cannabis packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Glass

- Metal

- Plastics

- Cardboard containers

- Type

- Rigid packaging

- Flexible packaging

- Application

- Medical use

- Recreational use

- CBD products

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Italy

- The Netherlands

- APAC

- Australia

- India

- South Korea

- Thailand

- Rest of World (ROW)

- North America

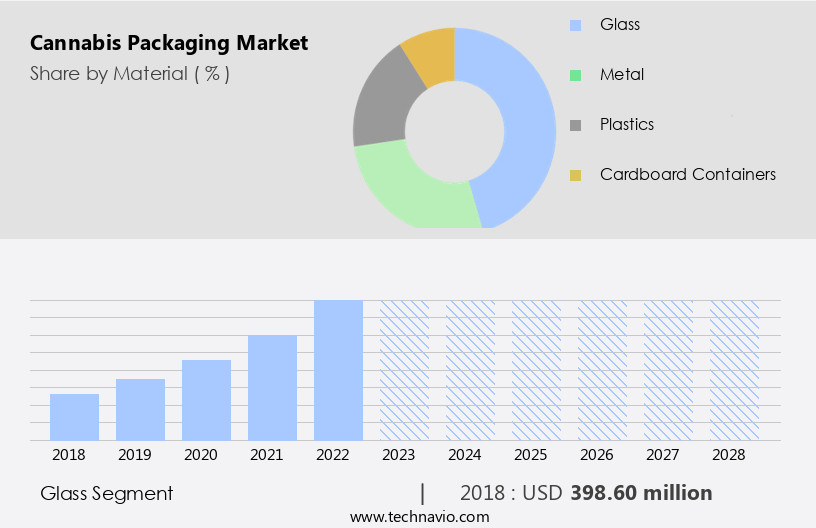

By Material Insights

The glass segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth with the increasing legalization of cannabis for both recreational and medical use. Glass packaging, such as Hemp Sacks and Hippo Packaging, is gaining popularity due to its non-hazardous nature and ability to preserve the product's flavor and freshness. Glass containers, including bottles and jars from companies like CR Packaging and Green Rush Packaging, protect cannabis from external elements and maintain its quality. Semi-rigid packaging, like Containers and caps, offer an alternative to glass, providing durability and protection. CBD products, including Cannabis-infused chocolates and tinctures, also require specialized packaging solutions. High-density polyethylene and flexible packaging are used for edibles and vape items, while rigid packaging is preferred for pre-roll joints and pills.

Sustainable options, such as ocean-reclaimed plastic, are also gaining traction in the market. Chinese suppliers are providing cost-effective solutions for plastic packaging, while companies like Marijuana Business Daily and C Class Jars focus on providing high-quality, branded packaging. Packaging plays a crucial role in ensuring product safety and consumer appeal, with trends leaning towards child-resistant and tamper-evident designs. Medical conditions like Dravet syndrome and Lennox-Gastaut syndrome require specific packaging considerations for safe and effective treatment. Overall, the market is evolving to meet the diverse needs of the industry, with a focus on safety, sustainability, and consumer appeal.

The Glass segment was valued at USD 520.90 billion in 2019 and showed a gradual increase during the forecast period.

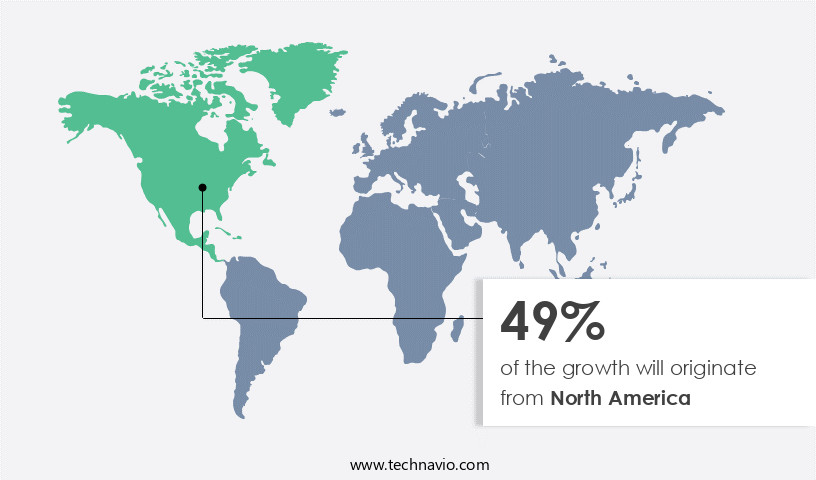

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the legalization of medical cannabis in the US and Canada is fueling market growth. The US and Canada are significant markets in North America for cannabis products, with a mature industry and numerous major global companies based in the region. As a result, there is a high demand for cannabis packaging, including semi-rigid packaging for cannabis-infused chocolates, hemp sacks for hemp fiber, containers and caps for CBD products, and bottles & jars for tinctures and pills. Additionally, the legalization of recreational use in some states of the US and Canada is further expanding the market.

Hemp packaging, such as rigid packaging for pre-roll joints and blisters & clamshells for cannabis-infused butter, is also gaining popularity. The use of sustainable materials, like high-density polyethylene and ocean-reclaimed plastic, is a trend in the industry. Chinese suppliers are providing competition with cost-effective solutions, while vape items and medical use for conditions like Dravet and Lennox-Gastaut syndromes continue to drive demand. Overall, the North American the market is expected to experience significant growth due to these factors. Rigid, flexible, and semi-rigid packaging options, including bottles and jars, tubes, tins, pouches, blisters, and clamshells, are used for various cannabis products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Cannabis Packaging market drivers leading to the rise in the adoption of Industry?

- The increasing purchasing power of the millennial demographic is the primary catalyst fueling market growth in the cannabis industry. The cannabis industry, driven by the growing popularity of CBD products, has witnessed significant growth in recent years. Millennials, with their changing attitudes towards cannabis, have been a major contributing factor to this trend. This demographic's interest in cannabis and its legalization in various jurisdictions have led to an increase in demand for legal cannabis products. Millennials, known for their experimentation and openness to new experiences, are more likely to engage with cannabis for wellness, relaxation, and socializing. This cultural shift has fueled the demand for various cannabis products, including CBD. High-density polyethylene (HDPE) and flexible packaging have emerged as popular choices for cannabis packaging due to their durability and ability to protect the product from light and air.

- Plastic packaging, such as HDPE, is also preferred for its cost-effectiveness and ease of use. Moreover, the increasing use of cannabis for medical purposes, particularly in the treatment of conditions like Dravet syndrome, has further boosted the demand for cannabis packaging. Chinese suppliers have also entered the market, offering competitive pricing and production capabilities. The cannabis industry, driven by the growing acceptance of cannabis and the demand for CBD products, is expected to continue its growth trajectory. The use of high-quality packaging solutions, such as HDPE and flexible packaging, will remain essential to protect and preserve the product's quality and freshness.

What are the Cannabis Packaging market trends shaping the Industry?

- Smart packaging for cannabis is an emerging market trend. This innovative approach to cannabis product presentation and preservation is gaining significant traction in the industry. The market is experiencing significant growth due to the adoption of advanced packaging solutions. Smart packaging, in particular, is gaining popularity for its ability to provide additional product information, regulate temperature, and prevent theft. This type of packaging utilizes indicators and sensors, such as QR codes and near-field communication (NFC) technology, to enhance the consumer experience and increase product transparency.

- The use of ocean-reclaimed plastic in cannabis packaging is also becoming more prevalent, as sustainability becomes a priority for consumers and businesses alike. These advancements are expected to drive the growth of the market in the coming years. Moreover, the incorporation of anti-microbial films with additives that control microorganism growth is another key trend in the market. In the medical sector, smart packaging is increasingly being used for conditions like Lennox-Gastaut syndrome, ensuring the safety and efficacy of vape items.

How does Cannabis Packaging market faces challenges during its growth?

- The volatility in the pricing of raw materials used in cannabis packaging is a significant challenge that negatively impacts industry growth. This price instability can create uncertainty and financial risks for businesses in the cannabis sector, potentially hindering their ability to maintain profitability and scale operations effectively. The market is influenced by the cost fluctuations of raw materials, primarily soda ash, which accounts for over 50% of the total cost of manufacturing containers. The price of soda ash has been on the rise since January 2018, with prices in the US estimated at around USD340 per metric ton in late 2023. By early 2025, soda ash prices had increased to approximately USD360/MT in January and reached close to USD380/MT by April. This trend poses a significant challenge for manufacturers producing glass containers for various cannabis products, including Cannabis-infused butter, C Class Jars, pre-roll joints, tinctures, and pills.

- The high demand for these containers in the cannabis industry, driven by the increasing prevalence of chronic pain and the growing acceptance of cannabis for medicinal purposes, further exacerbates the issue. Manufacturers must closely monitor raw material prices and adapt to the market dynamics to maintain profitability and meet the growing demand for robust packaging solutions. Cannabis packaging caters to various product types, including edibles, vape items, pre-roll joints, and cannabis-infused chocolates, butter, and tinctures.

Exclusive Customer Landscape

The cannabis packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cannabis packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cannabis packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - This company specializes in innovative cannabis packaging solutions, providing flexible pouches, child-resistant bags, and eco-friendly alternatives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Berry Global Inc.

- Cannabis Promotions

- Cannaline

- Diamond Packaging

- Drug Plastics Group

- Dymapak Quark Distribution Inc.

- Elevate Packaging Inc.

- Green Rush Packaging

- Greenlane Holdings Inc.

- Kaya Packaging

- Kynd Packaging LLC

- Max Bright Packaging Ltd.

- MMC Depot

- N2 Packaging Systems LLC

- Packaging Bee

- RXD Co.

- Sana Packaging

- Silgan Dispensing Systems

- The Boxmaker Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cannabis Packaging Market

- In January 2024, Sealed Air, a leading global provider of packaging solutions, announced the launch of its new line of sustainable cannabis packaging called "Protect-R-Cann," designed to meet the unique requirements of the cannabis industry. This innovative solution incorporates Cryovac brand technology to ensure optimal product freshness and protection (Sealed Air Press Release).

- In March 2024, AmorCann Medicinals, a California-based cannabis company, entered into a strategic partnership with TerraVita Packaging to develop and manufacture child-resistant, eco-friendly cannabis packaging. This collaboration aimed to address the growing demand for sustainable and compliant packaging solutions in the California market (AmorCann Press Release).

- In May 2024, Greenhouse Growers Co. Ltd., a leading Canadian cannabis producer, completed the acquisition of Packaging Innovations Inc., a specialized cannabis packaging manufacturer. This strategic move enabled Greenhouse Growers to expand its product offerings and improve its control over the packaging supply chain (Greenhouse Growers SEC Filing).

- In February 2025, The Kraft Heinz Company, a multinational food and beverage corporation, invested USD10 million in TerraVita Packaging to support the development and commercialization of innovative, sustainable cannabis packaging solutions. This investment underscored the growing interest of traditional consumer goods companies in the cannabis industry and the importance of sustainable packaging (Bloomberg News).

Research Analyst Overview

The market continues to evolve, reflecting the dynamic nature of the industry. Hemp sacks and semi-rigid packaging have given way to containers and caps for cannabis-infused chocolates and other edibles. Hemp fiber, once used primarily for sacks, is now utilized in high-density polyethylene containers and bottles & jars. The legalization of cannabis for recreational use has led to a rise in demand for vape items and pre-roll joints, necessitating flexible packaging solutions. In the medical sector, blisters & clamshells and c class jars are increasingly popular for CBD products and cannabis-infused butter. Lennox-gastaut syndrome and Dravet syndrome patients require specialized packaging for their medications.

Ocean-reclaimed plastic is gaining traction as a sustainable alternative to traditional plastic packaging. Marijuana Business Daily reports that Green Rush Packaging and CR Packaging are leading the charge in innovation, offering customizable solutions for various cannabis products. The market's continuous unfolding is evident in the emergence of new applications, such as cannabis-infused tinctures and pills. The industry's evolution is far from complete, with ongoing research and development shaping the future of cannabis packaging.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cannabis Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.7% |

|

Market growth 2025-2029 |

USD 11.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.9 |

|

Key countries |

US, Thailand, Australia, Canada, Germany, Mexico, South Korea, Italy, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cannabis Packaging Market Research and Growth Report?

- CAGR of the Cannabis Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cannabis packaging market growth of industry companies

We can help! Our analysts can customize this cannabis packaging market research report to meet your requirements.