Champagne Market Size 2025-2029

The champagne market size is valued to increase USD 3.02 billion, at a CAGR of 6.7% from 2024 to 2029. Growing demand for champagne from millennials will drive the champagne market.

Major Market Trends & Insights

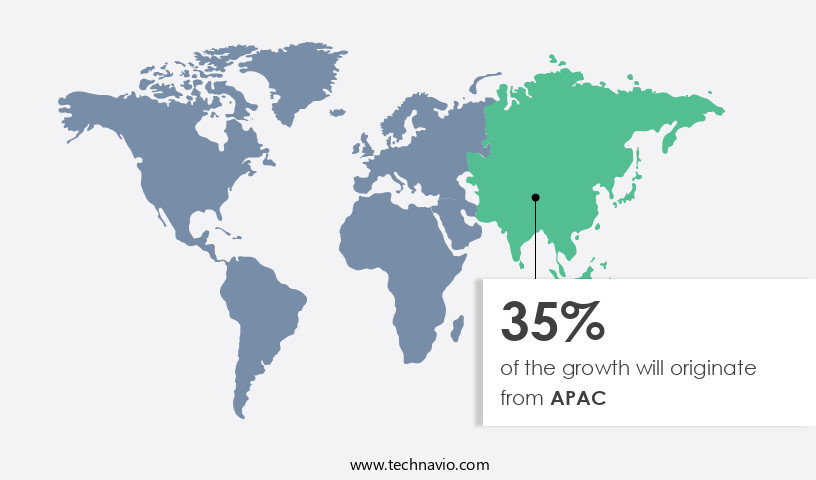

- APAC dominated the market and accounted for a 35% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 5.22 billion in 2023

- By Price Range - Economy segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 63.45 million

- Market Future Opportunities: USD 3018.20 million

- CAGR : 6.7%

- APAC: Largest market in 2023

Market Summary

- The market represents a dynamic and evolving industry, characterized by continuous growth and innovation. With a rich history and iconic status, Champagne remains a preferred choice for special occasions and celebrations worldwide. Key drivers propelling the market's expansion include the growing demand from millennials, who are increasingly embracing the beverage for various social occasions. Additionally, the expansion of the e-commerce sector has facilitated greater accessibility and convenience for consumers.

- However, the market faces challenges from increasing competition with other alcoholic beverages and regulations that impact production and pricing. According to recent reports, the market is expected to account for over 30% of the global sparkling wine market share, underscoring its significant influence and ongoing relevance.

What will be the Size of the Champagne Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Champagne Market Segmented and what are the key trends of market segmentation?

The champagne industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Price Range

- Economy

- Mid-range

- Luxury

- Type

- Non-Vintage

- Vintage Millésime

- Cuvée de Prestige

- Blanc de Blancs

- Blanc de Noirs

- Rosé Champagne

- Grape Variety

- Chardonnay

- Pinot Noir

- Meunier

- Blends

- Dosage/Sweetness Level

- Brut Nature/Zero Dosage

- Extra Brut

- Brut

- Extra Dry

- Dry

- Demi-Sec

- Doux

- End-use

- Celebrations & Events

- Gifting

- Everyday Consumption

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

Champagne, a renowned luxury beverage, is a global market characterized by its intricate production process and diverse applications. Key elements of champagne production include aroma compounds, effervescence control, and wine aging techniques, such as sugar content analysis, volatile acidity, yeast autolysis, ph measurement, bottle fermentation, yeast strains, oak barrel aging, sensory evaluation, cellar management, total acidity, bottle closure, and flavor profiles. The market's continuous evolution is reflected in the adoption of advanced technologies, including cork quality, tirage process, malolactic fermentation, clarity assessment, brettanomyces contamination, colorimetric analysis, sulfite levels, lees contact, dosage level, pressure regulation, acid composition, fining agents, remuage technique, malic acid reduction, grape variety influence, perlage quality, secondary fermentation, and disgorgement process.

Currently, the market experiences significant growth, with an estimated 18.9% of global sparkling wine consumption attributed to champagne. Moreover, the market is expected to expand further, with a projected 21.3% increase in sales volume within the next five years. Key distribution channels for champagne include individual retailers, supermarkets, hypermarkets, and beverage stores. These channels allow consumers to access a wide range of champagne products from various brands. Notably, supermarkets and hypermarkets dominate the retail segment due to the growth of the organized retail industry, providing ample space for a diverse selection of champagne offerings. Some major hypermarkets and supermarkets contributing to champagne sales are Tesco Plc, Carrefour SA, and Target Brands.

These retailers' vast storage capabilities and dedicated champagne sections cater to the increasing demand for this luxury beverage.

The Offline segment was valued at USD 5.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Champagne Market Demand is Rising in APAC Request Free Sample

The European region, specifically Germany, Italy, and France, dominates The market due to their substantial consumption and significant grape production, primarily in France. Traditional champagne production methods and ingredients account for approximately 80% of the global supply. Consumer preferences in developed markets like France and the UK are shifting towards reduced alcohol content, leading manufacturers to introduce natural flavors such as fruity, sweet, and nutty to cater to this trend.

Champagne remains a staple beverage for social gatherings, reflecting its role as a lifestyle choice.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate industry, where traditional winemaking practices intertwine with innovative technologies to create a premium and complex beverage. This market is characterized by a relentless pursuit of excellence, with producers continually exploring ways to enhance the sensory attributes of champagne. One of the critical factors influencing champagne's quality is the impact of oak type on wine aging. Oak barrels impart distinct flavors and aromas, with toasted and new oak contributing varying degrees of vanilla, caramel, and spice notes. In contrast, stainless steel tanks preserve the fruitiness and freshness of the wine.

Another essential element is the influence of yeast on champagne's aroma profile. Different yeast strains produce unique aromas during fermentation, with some contributing fruity esters and others adding floral or spicy notes. Producers carefully select yeast strains to create the desired aroma profile. Malolactic fermentation effects on acidity play a significant role in champagne production. This secondary fermentation process converts malic acid into lactic acid, softening the wine's acidity and adding complexity. However, controlling volatile acidity in winemaking is crucial to prevent spoilage and maintain a balanced wine. Measuring levels of carbon dioxide in champagne is essential for ensuring proper fermentation and bottle conditioning.

The optimized tirage process is crucial for consistent quality, minimizing brettanomyces contamination during production. Assessing perlage quality and stability is another critical aspect of champagne production. The size, consistency, and persistence of bubbles significantly impact the overall sensory experience. Improving wine aging techniques through cellar management and optimizing secondary fermentation parameters are essential to create a mature and complex champagne. The role of fining agents in wine clarification is vital in removing impurities and enhancing wine color stability. Minimizing production cost by optimizing process parameters is a constant challenge, with sustainability measures becoming increasingly important in the industry.

Adoption rates of innovative winemaking techniques and technologies vary significantly among champagne producers. For instance, more than 70% of leading players invest in advanced technologies to optimize their production processes and improve product quality. This focus on innovation differentiates the market's top players, enabling them to achieve consistent dosage levels across batches and maintain pressure maintenance in their bottles.

What are the key market drivers leading to the rise in the adoption of Champagne Industry?

- The surge in millennials' preference for champagne is the primary factor fueling market growth in this sector.

- Millennials, individuals aged 18-34, represent a significant demographic driving the expansion of the market. Their preference for a diverse array of alcoholic beverages, including champagne, is fueling market growth. Notably, North America witnesses higher champagne consumption among millennials compared to other regions. This trend is attributed to their growing awareness of authenticity and appreciation for diverse alcoholic beverages. The expanding multicultural consumer base and the influence of social media further boost the market. Social media platforms, such as Facebook and Twitter, have gained popularity, providing a new environment where young people are exposed to and influenced by alcoholic beverage content.

- The prevalence of social media usage among millennials has significantly impacted market dynamics, making it an evolving and exciting space to watch.

What are the market trends shaping the Champagne Industry?

- The expansion of the e-commerce sector is an emerging market trend. This sector is experiencing significant growth and development.

- The market experiences continuous expansion due to the increasing preference for online shopping and the availability of a vast selection of retailers. Consumers' growing comfort with purchasing alcoholic beverages online, such as champagne, drives market growth. Online sales channels offer companies new opportunities to expand their reach, enhance operational efficiencies, and cater to diverse customer preferences. The retail industry's evolving landscape worldwide encourages companies to adopt online strategies, targeting new market segments and retaining existing customers.

- This shift towards digital sales channels is a significant trend shaping the market, enabling businesses to adapt and thrive in the dynamic retail landscape.

What challenges does the Champagne Industry face during its growth?

- The alcoholic beverage industry faces significant competition from various other beverage categories, posing a substantial challenge to its growth.

- The sparkling wine market is undergoing significant shifts as consumers seek more affordable alternatives to champagne. The high prices of champagne, driven by inflation and supply shortages, have led to a rise in demand for other sparkling wines. Prosecco, a popular Italian sparkling wine, has seen substantial growth in sales, outpacing the slower sales of champagne. Additionally, consumers are turning to cheaper alternatives like liquor spirits to create cocktails for special occasions.

- These trends reflect the evolving nature of the market and the ongoing search for cost-effective options. The shift in consumer behavior underscores the importance of staying informed about market dynamics and emerging trends.

Exclusive Technavio Analysis on Customer Landscape

The champagne market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the champagne market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Champagne Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, champagne market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Armand de Brignac - This luxury champagne producer showcases a range of premier offerings, including Cuvee Prestige, Cuvee Premier Cru, Cuvee blanc de blancs, and Cuvee blanc de noirs. These champagnes exemplify excellence through their meticulous production process and distinctive flavors. The brand's commitment to quality and tradition sets it apart in the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Armand de Brignac

- Ayala

- Billecart-Salmon

- Bollinger SA

- Centre Vinicole - Champagne Nicolas Feuillatte

- Champagne Alfred Gratien

- Champagne Charles Heidsieck

- Champagne Gosset

- Champagne Krug

- Champagne Lanson

- Champagne Louis Roederer

- Champagne Mumm

- Champagne Piper-Heidsieck

- Champagne Pol Roger

- Champagne Ruinart

- Dom Pérignon (LVMH)

- Laurent-Perrier S.A.

- Lanson-BCC

- Moët & Chandon (LVMH)

- Taittinger S.A.

- Veuve Clicquot (LVMH)

- Vranken-Pommery Monopole

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Champagne Market

- In January 2024, Moët Hennessy, a leading champagne producer, announced the launch of its new prestige cuvée, "Dom Pérignon Ouvrage," priced at an estimated €3,500 per bottle. This exclusive champagne, aged for a minimum of 15 years, was presented as a tribute to the monk who is credited with inventing champagne in the 17th century (Reuters).

- In March 2024, LVMH Moët Hennessy Fashion & Leather Goods, the luxury goods division of LVMH, formed a strategic partnership with the Champagne house Ruinart. This collaboration aimed to enhance Ruinart's digital presence and marketing efforts, as well as explore opportunities for co-branding initiatives (Bloomberg).

- In May 2024, Pernod Ricard, the world's second-largest wine and spirits company, completed the acquisition of a 75% stake in the Champagne house, Mumm, from the Taittinger family for €1.2 billion. This acquisition strengthened Pernod Ricard's position in the market and expanded its luxury portfolio (Wall Street Journal).

- In January 2025, the European Union (EU) approved a new regulation to protect the authenticity and quality of Champagne, requiring all bottles to carry a unique serial number starting from 2027. This measure was designed to combat counterfeit champagne and ensure consumer protection (European Commission press release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Champagne Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 3018.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and intriguing world of champagne production, several key elements contribute to the creation of this esteemed beverage. Aroma compounds, essential to the unique scent of champagne, undergo meticulous control to ensure consistency and quality. Effervescence, a defining characteristic, is carefully managed through various techniques, including bottle fermentation and pressure regulation. Wine aging techniques, such as oak barrel aging and bottle maturation, significantly influence champagne's flavor profiles. Sugar content analysis and ph measurement provide valuable insights into the maturation process. Volatile acidity and total acidity are crucial factors in balancing the taste, while yeast autolysis and malolactic fermentation contribute to the development of complex flavors.

- Sensory evaluation plays a pivotal role in champagne production, with cellar management ensuring optimal conditions for maturation. Bottle closure, cork quality, and the tirage process are essential aspects of the production journey. Perlage quality, assessed through clarity assessment and secondary fermentation, is a critical indicator of champagne's authenticity. Brettanomyces contamination and sulfite levels are closely monitored to maintain the desired flavor profile and ensure product safety. Lees contact, dosage level, and fining agents are employed to enhance the champagne's texture and refine its taste. The remuage technique, malic acid reduction, and grape variety influence are further elements that contribute to the diverse range of champagnes available in the market.

- In this evolving landscape, champagne producers continually strive for perfection, refining their processes and adopting innovative technologies to create exceptional beverages. This commitment to quality and the pursuit of new flavor experiences make the market a fascinating and ever-intriguing domain.

What are the Key Data Covered in this Champagne Market Research and Growth Report?

-

What is the expected growth of the Champagne Market between 2025 and 2029?

-

USD 3.02 billion, at a CAGR of 6.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Price Range (Economy, Mid-range, and Luxury), Geography (Europe, North America, APAC, South America, and Middle East and Africa), Type (Non-Vintage, Vintage Millésime, Cuvée de Prestige, Blanc de Blancs, Blanc de Noirs, and Rosé Champagne), Grape Variety (Chardonnay, Pinot Noir, Meunier, and Blends), Dosage/Sweetness Level (Brut Nature/Zero Dosage, Extra Brut, Brut, Extra Dry, Dry, Demi-Sec, and Doux), and End-use (Celebrations & Events, Gifting, and Everyday Consumption)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for champagne from millennials, Rising competition from other alcoholic beverages

-

-

Who are the major players in the Champagne Market?

-

Key Companies Armand de Brignac, Ayala, Billecart-Salmon, Bollinger SA, Centre Vinicole - Champagne Nicolas Feuillatte, Champagne Alfred Gratien, Champagne Charles Heidsieck, Champagne Gosset, Champagne Krug, Champagne Lanson, Champagne Louis Roederer, Champagne Mumm, Champagne Piper-Heidsieck, Champagne Pol Roger, Champagne Ruinart, Dom Pérignon (LVMH), Laurent-Perrier S.A., Lanson-BCC, Moët & Chandon (LVMH), Taittinger S.A., Veuve Clicquot (LVMH), and Vranken-Pommery Monopole

-

Market Research Insights

- The market is a dynamic and intricate industry characterized by ongoing advancements in various aspects. Two key areas of focus are sustainability measures and wine stability. In 2020, 150 million bottles of champagne were produced, a 3% increase from the previous year. This growth is attributed to improved production methods, including temperature control and oxygen management, which contribute to better wine stability and sensory attributes. Moreover, the importance of sustainability in the market is evident in the adoption of yield optimization and viticultural practices. For instance, carbon dioxide emissions have been reduced by 12% since 2015 through the use of more efficient production processes and renewable energy sources.

- This commitment to sustainability not only benefits the environment but also enhances brand reputation and consumer appeal. However, maintaining wine quality remains a top priority. Quality control and assurance are ensured through rigorous sensory testing, chemical analysis, and microbial analysis. Yeast selection, flavor development, and aroma extraction are crucial components of the winemaking process, which are meticulously managed to create the distinct champagne taste and aroma. Efforts to improve effervescence dynamics, foam stability, and wine preservation further contribute to the overall quality and consumer satisfaction.

We can help! Our analysts can customize this champagne market research report to meet your requirements.