Cloud Discovery Market Size 2024-2028

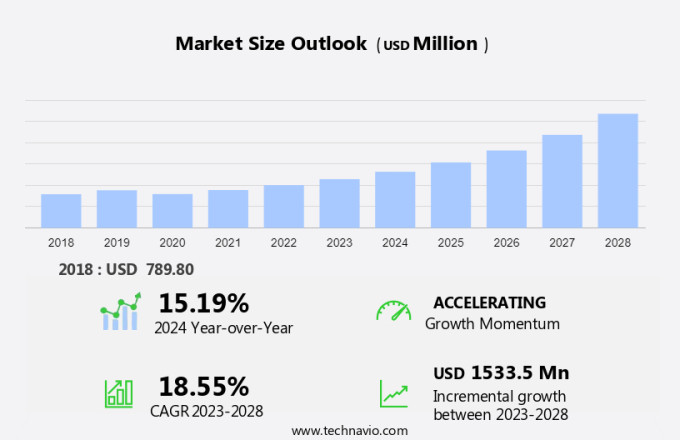

The cloud discovery market size is forecast to increase by USD 1.53 billion at a CAGR of 18.55% between 2023 and 2028. The market is experiencing significant growth due to the increasing adoption of cloud-based applications and services. Multi-cloud environments are becoming increasingly common, leading to the need for efficient tools to manage and discover cloud activities. The lack of technical expertise in certain regions presents an opportunity for analyst support and auto discovery tools to gain traction. Additionally, the rise of container technology and cloud databases require consolidated views for effective IT infrastructure management. Data security remains a top priority, making cloud discovery solutions essential for organizations seeking to maintain visibility and control over their cloud environments.

What will the size of the market be during the forecast period?

The market is witnessing significant growth due to the increasing adoption of cloud services and the need for efficient IT infrastructure management. With businesses shifting towards cloud-native apps, Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS), there is a growing requirement for automated tools to discover and manage cloud activities. Cloud Discovery refers to the process of identifying and cataloging cloud resources, services, and applications. It provides a consolidated view of an organization's cloud infrastructure, enabling IT teams to optimize costs, ensure security, and improve overall IT management.

Moreover, automated monitoring plays a crucial role in Cloud Discovery. This data is essential for IT teams to make informed decisions regarding strategic cloud planning, migration to cloud, and cost efficiency. Security and audit are key concerns for businesses adopting cloud services. Cloud Discovery tools help address these concerns by providing a comprehensive view of cloud infrastructure and activities. They enable IT teams to identify potential security threats and vulnerabilities, ensuring high-quality delivery and data security. Cloud Spanning, a critical aspect of Cloud Discovery, involves managing cloud services across multiple providers and environments.

Further, auto Discovery tools simplify this process by automatically discovering and managing cloud resources, containers, and cloud services, regardless of the underlying infrastructure. Interactive use and data sharing are becoming increasingly important in today's business landscape. Cloud Discovery tools facilitate these requirements by providing a unified view of an organization's cloud infrastructure. They enable easy access to cloud data and services, fostering collaboration and productivity. Market hindrances, such as the complexity of cloud environments and the lack of standardization, pose challenges to the market. However, the benefits of Cloud Discovery, including cost savings, improved security, and enhanced IT management, far outweigh these challenges.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Solutions

- Services

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Component Insights

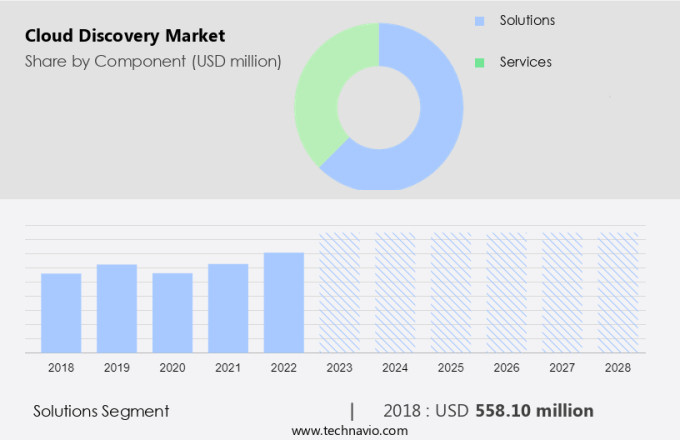

The solutions segment is estimated to witness significant growth during the forecast period. In the realm of business intelligence, Fortune Business Insights reports that the application discovery segment held a substantial share in the market in 2023. This segment encompasses solutions designed to identify, manage, monitor, and gather information from applications running within an organization's IT infrastructure or networks. Application discovery solutions serve multiple purposes, including enhancing security by identifying potential risks or data breaches. These solutions employ automated application performance monitoring (APM) software that scans all systems and servers within an IT environment or network to collect relevant data.

The APM application then processes and analyzes this data to provide valuable insights for IT teams. In the telecommunication sector and other industries, the increasing adoption of client cloud services, virtualization infrastructure, and collaboration tools has led to a wave in ICT spending. As a result, the demand for cloud discovery solutions, particularly application discovery, is expected to grow significantly.

Get a glance at the market share of various segments Request Free Sample

The solutions segment accounted for USD 558.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

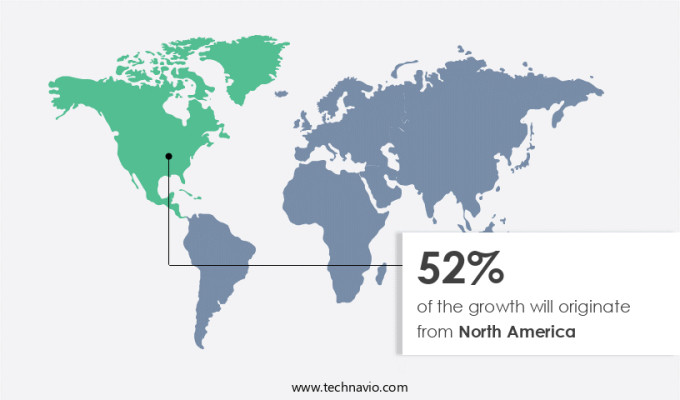

North America is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the market, North America held the largest revenue share in 2023. This can be attributed to the region's early adoption of cloud-based services. Cloud solutions streamline the delivery of IT and services from producers to consumers or within organizations. In the US, there is a significant push towards multi-cloud solutions to enhance business efficiency. Big Data Technology plays a significant role in Cloud Discovery, enabling Automated Monitoring, Interactive Use, and Data Sharing. Automation tools facilitate Auto Discovery of IT infrastructure, ensuring Cost Efficiency and High-quality delivery. Security and Audit are crucial aspects of Cloud Discovery, with Zero Trust CASB+ ensuring Data Security.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for cloud-based applications is the key driver of the market. The utilization of cloud discovery solutions is experiencing significant growth globally due to the financial advantages and flexibility offered by cloud services. Companies worldwide are striving to decrease their total capital expenditures (CAPEX) and are turning to technologies with minimal CAPEX. Small and medium-sized enterprises (SMEs) and start-ups are embracing cloud solutions to take advantage of the scalability of hardware and resources provided by cloud service providers. Concurrently, large organizations are implementing cloud-based solutions to expand their workloads as needed, thereby eliminating the necessity of establishing their own data centers, which entails substantial CAPEX and operating expenditure (OPEX). Multi-cloud environments, which involve the use of cloud services from multiple providers, are gaining popularity due to their ability to offer increased flexibility and improved disaster recovery capabilities.

Big Data Technology plays a crucial role in cloud discovery, enabling automated monitoring, security, audit, and management of cloud-native apps and infrastructure. Cloud Provider APIs are essential for seamless integration and management of cloud services. The Data Bridge Market, which connects various cloud services and applications, is expected to grow significantly due to the increasing adoption of cloud solutions. Ensuring security and compliance is a top priority for organizations, making security a significant consideration in cloud discovery solutions. Docker Containers are also gaining traction in cloud discovery, providing an additional layer of abstraction and portability for applications.

Market Trends

Multi-cloud services gaining traction is the upcoming trend in the market. In today's business landscape, the adoption of cloud computing solutions is on the rise as enterprises seek to optimize their IT infrastructure and enhance their digital capabilities. Major tech companies like Amazon, Google, and Microsoft are responding to this trend by continually expanding their offerings in the cloud services market. One of the latest developments in cloud technology is multi-cloud computing, which allows organizations to use multiple cloud services from various providers. In April 2019, Google launched Anthos, a new multi-cloud services platform, enabling users to run applications across multiple clouds. The advantages of multi-cloud services include increased flexibility, faster disaster recovery, and the ability to distribute workloads across multiple providers.

Furthermore, enterprises value multi-cloud services due to concerns over company lock-in and the desire for greater choice and control. To stay competitive, businesses must keep abreast of the latest cloud trends and leverage the benefits of multi-cloud services.

Market Challenge

Lack of technical expertise in developing countries is a key challenge affecting market growth. In today's business landscape, an increasing number of companies are adopting cloud services due to their affordability, scalability, and ease of use. Cloud services offer various functionalities, such as reliability, advanced IT capabilities, and flexible data access. However, security and compliance concerns have emerged as major hindrances to the widespread adoption of cloud discovery solutions. Regulations like the General Data Protection Regulation (GDPR) impose restrictions on data storage locations. While cloud solutions offer security measures, the Internet's open nature makes data accessible to anyone. To mitigate these concerns, companies are investing in Zero Trust Cloud Access Security Brokers (CASB+) to ensure data security and compliance.

This technology provides an additional layer of security by controlling access to cloud applications based on user behavior and risk level. The emergence of Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS) has accelerated the shift towards cloud adoption. In the US, this trend is particularly significant in emerging economies and industries undergoing technological changes.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BMC Software Inc. - The company offers cloud discovery which supports multi-cloud applications and services.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AO Kaspersky Lab

- ASG Technologies Group Inc.

- AT and T Inc.

- BlueCat Networks Inc.

- Certero Ltd.

- Cisco Systems Inc.

- International Business Machines Corp.

- Lookout Inc.

- McAfee LLC

- Microsoft Corp.

- Netskope Inc.

- Nippon Telegraph And Telephone Corp.

- Palo Alto Networks Inc.

- Puppet Inc.

- Qualys Inc.

- ServiceNow Inc.

- TechNEXA Technologies Pvt. Ltd.

- Virima Inc.

- Zscaler Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cloud Discovery is an essential aspect of managing modern IT infrastructure. With the increasing adoption of Multi-cloud environments, discovering and managing cloud activities, cloud services, and cloud databases across various platforms and providers has become a complex task. In this context, Big Data Technology plays a crucial role in automating the process of Cloud Discovery. Cloud Discovery tools offer Automated Monitoring and Interactive Use, enabling IT teams to gain a Consolidated View of their cloud infrastructure.

Technological Changes and Emerging Economies are driving the need for Cloud Discovery, as more companies invest in Infrastructure-as-a-Service, Platform-as-a-Service, and Software-as-a-Service. Strategic cloud planning, Migration to the cloud, and Smart technology innovations are crucial for overcoming Market hindrances. Analyst Support and IT expertise are essential for successful Cloud Discovery, ensuring IT infrastructure remains secure and cost-effective. In conclusion, Cloud Discovery is a critical component of IT infrastructure management in the Multi-cloud era. By leveraging the latest technologies and best practices, companies can gain a competitive edge and ensure their cloud investments deliver the desired outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.55% |

|

Market growth 2024-2028 |

USD 1.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.19 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 52% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AO Kaspersky Lab, ASG Technologies Group Inc., AT and T Inc., BlueCat Networks Inc., BMC Software Inc., Certero Ltd., Cisco Systems Inc., International Business Machines Corp., Lookout Inc., McAfee LLC, Microsoft Corp., Netskope Inc., Nippon Telegraph And Telephone Corp., Palo Alto Networks Inc., Puppet Inc., Qualys Inc., ServiceNow Inc., TechNEXA Technologies Pvt. Ltd., Virima Inc., and Zscaler Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch