Dump Trucks Market Size and Trends

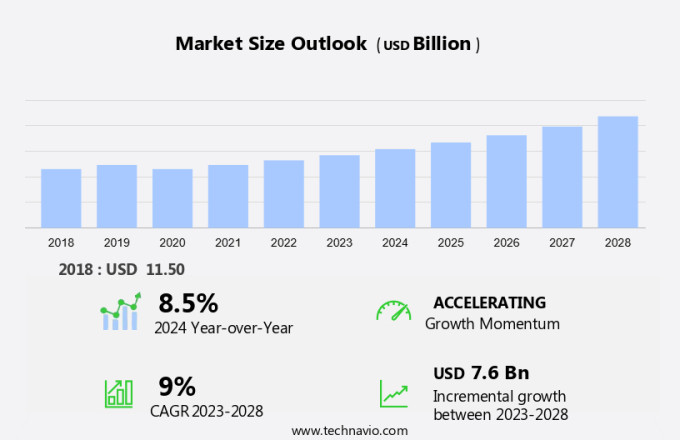

The dump trucks market size is forecast to increase by USD 7.6 billion at a CAGR of 9% between 2024 and 2028. The dump truck market is driven by the expansion of transportation infrastructure in various sectors, including construction and mining. The integration of Internet of Things (IoT) technology enables remote monitoring of vehicle performance and optimizes the transportation of loose materials such as sand, gravel, dirt, and debris. Compliance with emission regulations is another significant factor driving market growth. Dump trucks are equipped with dump bodies that can be raised and tilted to unload materials efficiently. The market is expected to experience steady growth due to the increasing demand for cost-effective and efficient transportation solutions. Key trends include the development of electric and hybrid to reduce carbon emissions and improve fuel efficiency. Additionally, the use of advanced technologies such as GPS tracking and telematics is gaining popularity to enhance fleet management and operational efficiency.

Heavy-duty dump trucks play a pivotal role in the transportation industry, particularly in the US, where the construction, mining, and agriculture sectors heavily rely on these vehicles for transporting and unloading loose materials such as sand, gravel, dirt, debris, and more. This analysis provides an intricate understanding of the anatomy and components of heavy-duty dump trucks, including standard, articulated, transfer, slinger, side dump, and bottom dump trucks. The primary function of a heavy-duty dump truck is to transport and unload loose materials. The unloading process begins with the dump body, which can be raised and tilted manually or hydraulically to release the contents. In the case of heavy-duty dump trucks, the dump body is usually raised and tilted at a 45-degree angle for efficient unloading. The heavy-duty dump truck comprises several essential components, starting with the chassis, which forms the foundation of the vehicle. The engine, an integral part of the chassis, powers the truck and provides the necessary torque for hauling heavy loads. The cab, located atop the chassis, houses the driver and provides a comfortable working environment. The hydraulic system is another critical component of heavy-duty, responsible for raising and lowering the dump body. This system includes various components, such as hydraulic cylinders, pumps, and valves, which work in harmony to facilitate the unloading process.

Additionally, the suspension system and tires play a vital role in the functionality of heavy-duty dump trucks. The suspension system ensures a smooth ride, while the tires provide the necessary traction for maneuvering on various terrain types. The tailgate, located at the rear of the dump body, can be lowered to facilitate the unloading process. Heavy-duty come in various types, including standard, articulated dump trucks, transfer dump trucks, slinger trucks, side dump trucks, and bottom dump trucks. Each type caters to specific transportation needs, with differences in design and functionality. Standard vehicles are the most common type, featuring a rear-hinged dump body that tilts backward to release the contents. Articulated dump trucks, on the other hand, have a pivoting joint between the cab and the dump body, allowing for better maneuverability in tight spaces. Transfer dump trucks are designed to transport and unload materials at a remote location, while slinger trucks use a rotating slinger arm to fling materials out of the dump body. Side feature a side-hinged dump body that opens to the side, making them ideal for unloading materials next to obstacles or in confined spaces.

Lastly, bottom dump trucks have a bottom-hinged dump body that opens from the bottom, making them suitable for transporting and unloading materials that cannot be handled by other types. In conclusion, heavy-duty play a crucial role in the transportation of loose materials such as sand, gravel, dirt, and debris in the US. Understanding the anatomy and components of these vehicles, including their various types, is essential for optimizing their usage and ensuring efficient operations in the construction, mining, and agriculture industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Rigid

- Articulated

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

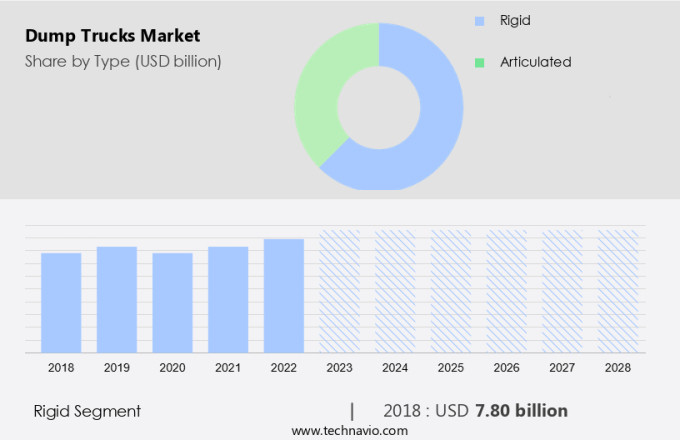

The rigid segment is estimated to witness significant growth during the forecast period. Dump trucks, also known as heavy-duty vehicles, play a crucial role in transporting and unloading loose materials such as sand, gravel, dirt, and debris. The dump body of these trucks is designed with a raised and tilted mechanism, allowing for easy unloading. Rigid dump trucks, in particular, feature a rigid chassis with all components, including the bed, axles, cab, engine, and steering rod, integrated around it. While effective on smooth roads, their components are not optimally designed for off-road conditions.

Get a glance at the market share of various segments Download the PDF Sample

The rigid segment was valued at USD 7.80 billion in 2018. The steering system, for instance, is delicate and can be damaged when used extensively on rocky terrain, and the tie rods, which hold the system together, may bend. Additionally, the low ground clearance and suspensions are not ideal for rough terrain and muddy surfaces.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

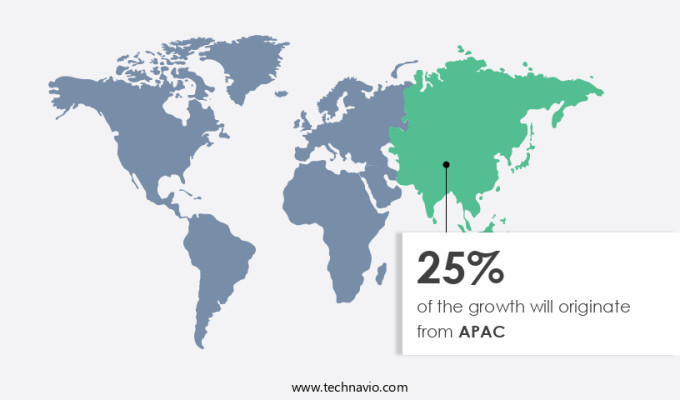

APAC is estimated to contribute 25% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The global construction industry is experiencing significant growth in regions such as India, Malaysia, and the Philippines, where infrastructure development is underway. These countries are anticipated to drive a substantial demand for dump trucks in the upcoming years. Chinese manufacturers have already established a strong presence in the Vietnamese construction market, with approximately two-thirds in Vietnam being Chinese-made. Urbanization is on the rise in major cities like Mumbai, Jakarta, and Shanghai, leading to transportation, housing, and infrastructure challenges. As populations grow, the requirement for public infrastructure becomes increasingly important. These coastal urban areas are exploring innovative solutions to alleviate these issues, such as developing water-borne transport infrastructure. These are essential machinery in the construction sector, and various types cater to different applications.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The growth of transportation infrastructure is notably driving market growth. The escalating urbanization trend worldwide has led to a heightened need for advanced transportation systems to meet the growing demand. With numerous countries focusing on enhancing their transport infrastructure, the sector is projected to experience substantial growth in the upcoming years. Notably, the demand for this infrastructure will primarily originate from countries like India and China. In the realm of transport infrastructure development, two significant segments are emerging: the construction of Bus Rapid Transit Systems (BRT) and High-Speed Rail (HSR). The Association of Southeast Asian Nations (ASEAN) members, together with those in Latin America and the Middle East, are anticipated to spearhead the demand for land transport infrastructure.

Moreover, these play a pivotal role in the completion of any infrastructure project, as they are essential for transporting diverse construction materials from one location to another. As the infrastructure development sector expands, the global dump truck market is poised to capitalize on the opportunities that arise. These large machinery vehicles are indispensable for various functions, including the transportation of asphalt, soil, sand, and other materials to construction jobsites, commercial spaces, and gardening projects. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The integration of IoT in dump trucks for remote monitoring is the key trend in the market. Rigid ones play a crucial role in various industries, including construction and mining, for hauling heavy materials such as old boxes, worn-down furniture, gardening materials, and other waste to the local dump or disposal sites. Integrating the Internet of Things (IoT) technology with these trucks offers numerous benefits, enhancing their functionality and efficiency. By combining remote monitoring systems with global positioning systems (GPS), rigid dump trucks can be tracked and monitored in real-time, enabling mine project owners to oversee vehicle activities from a central office. This integration not only ensures accuracy and improved efficiency but also reduces the need for human intervention.

Moreover, rigid type can transmit real-time data on ongoing tasks to the front office, allowing for seamless task assignment upon completion. This automation streamlines the workflow and contributes to the overall success of renovation projects, construction sites, and the transportation of household appliances and drywall. Incorporating IoT technology into rigid is a significant step towards modernizing the hauling industry. It provides valuable insights into the vehicle's performance and location, ensuring optimal utilization and productivity. This innovation is particularly beneficial for large-scale projects, where real-time data and efficient workflows are essential. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The impact of emission regulations on dump trucks is the major challenge that affects the growth of the market. The United States' stricter emission regulations for heavy-duty vehicles, including dump trucks, imposed by the Environmental Protection Agency (EPA,) have resulted in a shift in the market. Existing trucks that cannot meet these new standards will be exported to countries with less stringent regulations or no regulations at all, where the demand for used equipment is high. This regulatory change poses a significant challenge to the global dump truck market, as a substantial portion of the existing fleet will be rendered obsolete.

However, the market is preparing for the future with the introduction of next-generation equipment. Yet, the scarcity of ultra-low sulfur diesel, a necessary fuel, remains an obstacle to the market's growth. In colder climates, the removal of excess snow continues to be a primary application for dump trucks, with snowplows and melting agents essential for efficient snow removal. To mitigate the corrosive effects of these agents on the truck bed, dump truck liners have gained popularity. In the realm of residential moving, these vehicles play a crucial role in transporting heavy materials, ensuring a smooth transition. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB Volvo - The company offers dump trucks such as A60H and A45G.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- AEBI Schmidt Holding AG

- BAS Holding BV

- BELAZ Holding

- Bucher Industries AG

- BYD Co. Ltd.

- Caterpillar Inc.

- China FAW Group Co. Ltd.

- China National Heavy Duty Truck Group Co. Ltd.

- Dongfeng Motor Group Co. Ltd.

- Dover Corp.

- Dulevo International Spa

- ETF EUROPEAN TRUCK FACTORY GmbH

- Global Environmental Products Inc.

- Kubota Corp.

- Liebherr International AG

- Mercedes Benz Group AG

- Nilfisk AS

- Oshkosh Corp.

- Rosenbauer International AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Dump trucks are heavy-duty vehicles designed for transporting and unloading loose materials such as sand, gravel, dirt, debris, and other heavy hauling needs. The anatomy of a dump truck includes a chassis, engine, cab, hydraulic system, suspension system, tires, tailgate, and dump body. The dump body can be raised and tilted manually or hydraulically to facilitate unloading. For instance, off-road dump trucks are ideal for construction jobsites, road construction, and snow removal in colder climates, while slinger trucks are used for transporting wet or sticky materials. Accessories such as tarp systems, melting agents, and dump truck liners enhance the functionality of dump trucks in various projects. Dump trucks are essential in transporting large machinery, asphalt, and other heavy materials to construction jobsites, commercial spaces, and residential moving. Excess snow and corrosion are common challenges faced in snow removal applications, making dump trucks with snowplows and liners essential. Overall, dump trucks play a crucial role in various industries, making them indispensable in hauling building materials and other heavy loads.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2024-2028 |

USD 7.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.5 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 25% |

|

Key countries |

China, US, Germany, Japan, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB Volvo, AEBI Schmidt Holding AG, BAS Holding BV, BELAZ Holding, Bucher Industries AG, BYD Co. Ltd., Caterpillar Inc., China FAW Group Co. Ltd., China National Heavy Duty Truck Group Co. Ltd., Dongfeng Motor Group Co. Ltd., Dover Corp., Dulevo International Spa, ETF EUROPEAN TRUCK FACTORY GmbH, Global Environmental Products Inc., Kubota Corp., Liebherr International AG, Mercedes Benz Group AG, Nilfisk AS, Oshkosh Corp., and Rosenbauer International AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch