Content Delivery Network Security Market Size 2024-2028

The CDN security market size is forecast to increase by USD 38.49 billion at a CAGR of 48.33% between 2023 and 2028. The market is undergoing significant growth due to the increasing consumption of digital content online and the growing reliance on the internet. As digital threats become more complex and sophisticated, organizations are placing greater emphasis on Content Delivery Network (CDN) security solutions to shield their online assets and ensure seamless content delivery. The proliferation of cyber threats necessitates the adoption of robust CDN security measures and advanced cybersecurity services. Protecting digital infrastructure has become a top priority, and the demand for these solutions reflects the importance of providing a latency-free online gaming experience while safeguarding against potential disruptions.

What will be the Size of the Content Delivery Network Security Market During the Forecast Period?

To learn more about this CDN security market report, Request Free Sample

Content Delivery Network Security Market Segmentation

The CDN security market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- End-user Outlook

- Media and entertainment

- Retail

- IT and telecommunication

- Public sector

- Others

- Type Outlook

- DDoS protection

- Web application firewall

- Bot mitigation and screen scraping protection

- Data security

- DNS protection

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

By End-User

The market size by the media and entertainment segment will be significant during the market forecast period. The media and entertainment segment of the market is growing, owing to the growth in OTT and e-advertising. OTT refers to the content that providers distribute on streaming media as a standalone product directly to viewers over the internet. Companies are providing digital video content through the Internet. Also, the OTT market is growing rapidly owing to the high Internet speed and the declining prices of Internet packages. As per OTT companies, the number of subscribers is increasing. This market growth analysis report also includes key size, drivers, trends, and challenges.

Get a glance at the market contribution of various segments. Request PDF Sample

The media and entertainment segment was the largest and was valued at USD 621.70 million in 2018. Piracy is a major concern in the video and audio content industry. File sharing, copying, and downloading from illegal online sources are major problems for OTT service providers. Thus, premium content protection is a critical need for all OTT service providers. The importance of CDN security solutions has increased in this industry as they help operators create service models that enable consumers to navigate through a vast portfolio of movies, music, TV shows, sports, and entertainment programs in a secure platform. The growth of this segment is primarily attributed to the increasing adoption of content protection solutions, which is driven by an increase in the global demand for the CDN security industry. These solutions are crucial for safeguarding digital content from piracy and unauthorized distribution, ensuring that OTT providers can deliver high-quality, secure streaming experiences to their subscribers.

Regional Analysis

For more insights on the market share of various regions, Request PDF Sample now!

North America is estimated to contribute 41% to the growth of the global content delivery network security market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the market forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the market forecast period. North America is a pioneer in the early adoption of technologies across industries. As a result, the region would help the market thrive successfully. The US and Canada dominate the market in North America. The expanding IT, healthcare, BFSI, telecom, retail, and education industries and the large presence of OTT providers in North America are driving the market size in North America.

Content Delivery Network Security Market Dynamics

The market size is witnessing robust growth driven by the increasing demand for web performance optimization and protection against security threats. CDNs, with their localized caching and dynamic content delivery capabilities, play a crucial role in enhancing mobile engagement and digital experience delivery. As CDN providers bolster security measures such as DNS protection and QoS enhancement, they cater to diverse industries, especially the media and entertainment sector, where high-quality audio and video content delivery is paramount. With the proliferation of OTT and VOD services, CDN security solutions ensure the safe and seamless delivery of digital content, including 4K and Ultra HD video streaming, across high-speed networks worldwide.

Key Market Driver

The growing consumption of online content is the key factor driving CDN security market growth. The global over-the-top (OTT) market has witnessed high growth in recent years. In addition, the Internet speed is increasing globally. The global average speed of the Internet increased to 85 Mbps in 2020, as compared to around 64 Mbps in 2019. Developing countries such as India and China witnessed a dramatic increase in internet speed. Furthermore, network providers globally are providing monthly or weekly Internet packages at low prices. These schemes allow consumers to connect to the Internet at an affordable price.

Further, low-cost data plans offered by network providers have led to an increase in the number of Internet users. This has increased the demand for digital content as consumers can easily access the Internet via various mediums. Various OTT platforms provide country-specific content. They provide the required CDN for data transmission specific to a region and prevent the delivery of content in specific regions due to government regulations.

Significant Market Trends

The proliferation of mobile applications is one of the major content delivery network security market trends. The number of mobile applications has increased significantly and is expected to rise further during the forecast period. Besides social media applications, two-thirds of the total number of smartphone users globally watch the news, listen to music, or access entertainment or sports applications. These mobile applications use a CDN for data delivery. Companies are targeting their audience based on the type of mobile applications that they download.

Moreover, the proliferation of mobile applications has triggered the demand among OTT providers. Brands and agencies no longer focus on web content because of the proliferation of mobile applications and latency-free online gaming experience. The consumption of digital content via smartphones is increasing rapidly with the penetration of smartphones worldwide. Such factors will increase the market size during the forecast period.

Major Market Challenge

System integration and interoperability issues are major challenges to content delivery network security market growth. The adoption of advanced technologies in various industries, including the BFSI, telecommunication, transportation, media and entertainment, and public sector companies, is increasing significantly. The adoption of advanced technologies leads to system integration and interoperability issues. Many organizations face integration issues while implementing CDN security solutions. The companies should provide unified IT solutions that can be seamlessly integrated with the existing IT infrastructure of organizations.

Moreover, technical glitches during operations can incur high costs for organizations and reduce their operational efficiency. Technical defects, server errors, and other malfunctions caused by hacking are some of the key issues faced. Therefore, to ensure high accuracy, companies must conduct several trials before introducing to the market. This factor is expected to hinder the market size during the forecast period.

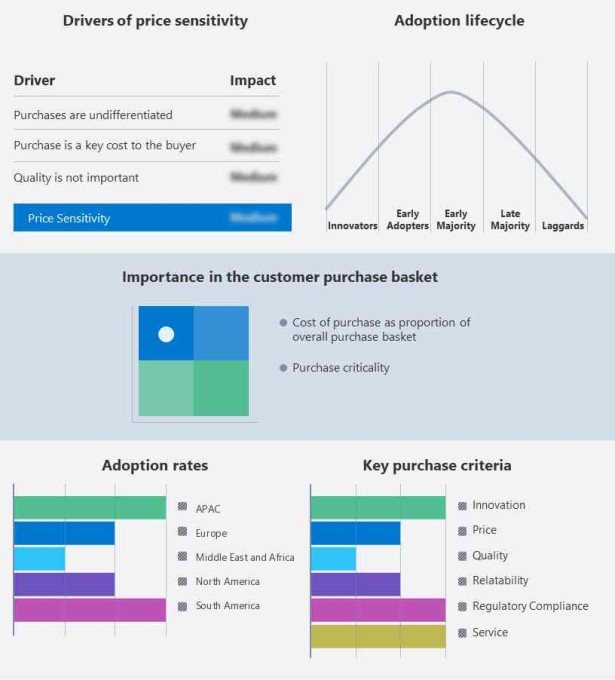

Customer Landscape

The content delivery network security market research and growth report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the CDN security market forecasting report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their strategies.

Market Customer Landscape

Who are the Major Content Delivery Network Security Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akamai Technologies Inc. - The company offers content delivery network security for media and communications on various platforms.

The CDN security market growth and forecasting report also includes detailed analyses of the competitive landscape of the content delivery network security (CDN) market size and information about 19 market companies, including:

- Amazon.com Inc

- Broadcom Inc.

- Lumen Technologies Inc.

- Fastly Inc.

- Imperva Inc.

- International Business Machines Corp.

- Microsoft Corp.

- Verizon Communications Inc.

- ChinaCache International Holdings Ltd.

- The Goldman Sachs Group Inc.

- Cloudflare Inc

- Limelight Networks Inc.

- NetScout Systems Inc.

- Nexusguard Ltd.

- Proinity LLC

- Radware Ltd.

- StackPath LLC

- Wangsu Science and Technology Co. Ltd.

Qualitative and quantitative market analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

The content delivery network security market is shaped by various critical factors. The rise of e-commerce websites, government agencies, and healthcare businesses necessitates robust security measures to safeguard against security vulnerabilities and cyberattacks, including automated attacks, injection attacks, and phishing attempts. As 5G technology and internet penetration rate expand, there is a growing need for enhanced protection for high-quality video services and video streaming services, particularly with the increase in mobile video streaming and video content consumption. Cloud-based CDNs and cloud security segment are crucial in managing bandwidth and privacy protection. Traditional CDNs are evolving into more secure cloud-based CDNs and P2P CDN (peer-to-peer CDN) solutions to counteract cyberattacks and viruses. Investments in web application firewall (WAF) technologies, including cloud-based WAF, are essential for protecting B2C and B2B web applications and API-driven applications.

In addition, the CDN security market is experiencing significant growth driven by various factors. CDNs (content delivery networks) are essential for managing internet traffic and ensuring optimal web performance. Content delivery network (CDN) companies offer solutions to enhance QoS (quality of service) and protect against security threats. The media and entertainment industry relies heavily on high-quality content and original content delivery, especially through over-the-top (OTT) services and video-on-demand (VOD) services. The shift towards cloud-based solutions has increased the need for robust security measures, including protection for API (application programming interface) integrations and BYOD (bring your own device) and CYOD (choose your own device) policies. On-premise CDN service subscriptions are also important for organizations needing tailored security solutions. These elements collectively influence the market for CDN security, driving innovation and investment.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 48.33% |

|

Market growth 2024-2028 |

USD 38.49 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

33.96 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 41% |

|

Key countries |

US, Germany, Canada, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akamai Technologies Inc., Alphabet Inc., Amazon.com Inc., Broadcom Inc., Cloudflare Inc., EdgeNext, Fastly Inc., Imperva Inc., International Business Machines Corp., Edgio Inc., Lumen Technologies Inc., Microsoft Corp., NetScout Systems Inc., Nexusguard Inc., proinity LLC, Radware Ltd., StackPath LLC, The Goldman Sachs Group Inc., Verizon Communications Inc., and Wangsu Science and Technology Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our content delivery network security market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Content Delivery Network Security Market Research Report?

- CAGR of the market during the forecast period.

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the market in focus on the parent market.

- Accurate predictions about upcoming trends and changes in consumer behavior.

- Market industry growth across North America, Europe, APAC, South America, and Middle East and Africa.

- A thorough market analysis of the market's competitive landscape and detailed information about companies.

- Comprehensive market analysis of factors that will challenge the growth of market companies.

We can help! Our analysts can customize this CDN security market research and growth report to meet your requirements. Get in touch

_security_market_size_abstract_2023_v1.jpg)

_security_market_segments_abstract_2023_v2.jpg)

_security_market_regions_abstract_2023_geo_v2.jpg)