Education Consulting Market Size 2025-2029

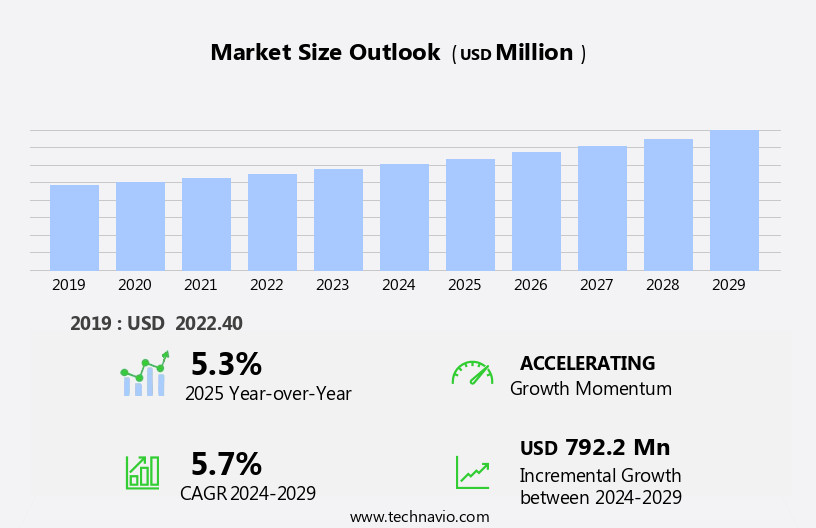

The education consulting market size is forecast to increase by USD 792.2 million, at a CAGR of 5.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for customized learning solutions. As students and educational institutions seek personalized educational experiences, the role of education consulting firms becomes increasingly valuable. Moreover, the integration of technology in education is transforming the landscape, with educational technologies playing a pivotal role in delivering effective learning solutions. Another trend shaping the market is the increasing popularity of open educational resources, which offer cost-effective and accessible learning opportunities. However, the market faces challenges, including the need for regulatory compliance and data security, as well as the high competition and the challenge of providing measurable outcomes to clients.

- To capitalize on market opportunities and navigate challenges effectively, education consulting firms must stay abreast of technological advancements, regulatory requirements, and client needs. By offering customized, technology-driven solutions and demonstrating clear value to clients, firms can differentiate themselves and thrive in this dynamic market.

What will be the Size of the Education Consulting Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its various sectors. Instructional design firms innovate to integrate student success strategies, mentorship programs, and assessment tools into their offerings. Online assessments and adaptive learning solutions are increasingly adopted in higher education and corporate training. Educational psychology experts contribute to the development of needs assessment methodologies and professional development programs. Compliance training providers offer solutions that address change management, cross-cultural communication, equity and inclusion, and leadership development. In the realm of international education, consultants focus on global education and admissions consulting. E-learning platforms and online courses are revolutionizing K-12 education and teacher training.

Moreover, the integration of learning analytics, data-driven instruction, and performance improvement tools is transforming the educational landscape. Career counseling services and test preparation offerings cater to students and professionals seeking personalized learning and succession planning. Behavioral science and executive coaching services are essential components of organizational development and talent management initiatives. The ongoing unfolding of market activities in the education consulting sector underscores the need for continuous innovation and adaptation to meet the evolving needs of diverse clients. The integration of blended learning, mobile learning, e-learning platforms, and proctoring services further expands the reach and impact of educational consulting services.The application of cognitive science and research methods in instructional design and curriculum development ensures that these offerings remain effective and evidence-based.

How is this Education Consulting Industry segmented?

The education consulting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- K-12

- Higher education

- Corporate Training

- Platform

- Online

- Offline

- Hybrid

- End User

- Educational Institutions

- Government Agencies

- Private Enterprises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

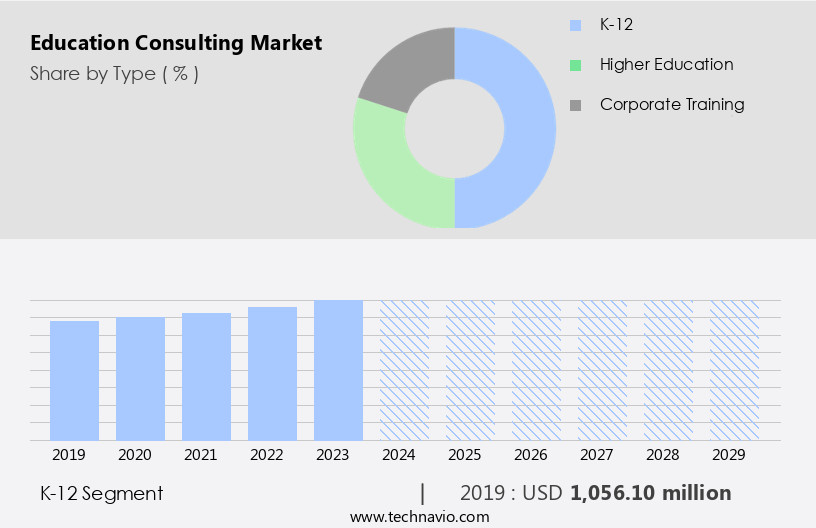

The k-12 segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing number of K-12 educational institutions worldwide. This trend is driving the demand for professional services, as these institutions adopt interactive and example-oriented learning approaches. Innovative measures, such as the adoption of bundled content packages offered by education consultants, are becoming increasingly popular. These packages provide relevant course materials and assignments, enabling schools to offer comprehensive education. Moreover, government organizations are supporting virtual schools for K-12 education, further fueling market growth. In higher education, institutions are focusing on performance improvement through faculty development, blended learning, and learning analytics.

Career counseling, student success, and assessment tools are also essential components of higher education consulting services. Corporate training is another significant segment, with a growing emphasis on compliance training, change management, cross-cultural communication, and equity and inclusion. Educational psychology, leadership development, test preparation, and training needs analysis are also key areas of focus. The integration of technology in education, including mobile learning, adaptive learning, e-learning platforms, and proctoring services, is transforming the education landscape. Additionally, special education, instructional design, mentorship programs, and curriculum development are crucial elements of educational consulting services. Overall, the market is dynamic and evolving, with a strong focus on enhancing student success and improving educational outcomes.

The K-12 segment was valued at USD 1056.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, with a focus on the US and Canada, is experiencing significant growth due to the increasing demand for STEM education. Approximately one-fifth of US students graduated with STEM degrees in 2024, while the numbers in China and India were notably higher. The complexity of STEM subjects is a significant barrier, leading to a smaller number of students pursuing these courses in K-12 education. To address this challenge, educational consulting firms offer data-driven instruction, faculty development, and blended learning solutions to improve student performance and engagement. Career counseling, learning analytics, and adaptive learning are other essential services that help students and educators navigate the intricacies of STEM education.

Additionally, professional development, performance improvement, and compliance training are crucial for educators and organizations to stay updated on the latest teaching methodologies and regulatory requirements. International education, global education, and study abroad programs broaden horizons and promote cross-cultural communication and equity and inclusion. Furthermore, educational consulting firms provide expertise in instructional design, mentorship programs, student success, assessment tools, online assessments, higher education, corporate training, educational psychology, and organizational development. The integration of eLearning platforms, social-emotional learning, executive coaching, cognitive science, and succession planning adds to the comprehensive range of services offered by these firms.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The higher education market is transforming through innovations aimed at developing online learning experiences and implementing learning management systems to meet diverse student needs. Institutions focus on measuring student learning outcomes and improving teacher effectiveness programs while creating engaging digital curricula and designing effective assessment strategies. Success also depends on managing diverse student populations, strategic planning for higher education, and enhancing student support services to drive retention. Key initiatives like boosting student retention rates, building effective leadership teams, and optimizing learning technology help schools remain competitive. Educators emphasize improving teaching practices, implementing effective learning programs, and promoting student engagement strategies. The market also addresses the need for supporting international students, effective faculty development, and improving college enrollment. Emerging trends include creating personalized learning paths and ultimately enhancing student success through holistic and technology-driven approaches.

What are the key market drivers leading to the rise in the adoption of Education Consulting Industry?

- The surge in demand for personalized learning experiences is the primary catalyst fueling market growth. The market is experiencing significant growth due to the increasing demand for personalized learning experiences. Traditional education methods often limit the flow of knowledge and access to resources. However, with the abundance of online databases and diverse knowledge sources, students seek customized learning solutions. Education consulting firms offer services such as data-driven instruction, faculty development, career counseling, blended learning, needs assessment, professional development, performance improvement, international education, adaptive learning, and special education.

- These solutions cater to the unique requirements of students, enabling them to optimize their learning experience and improve academic performance. The market's growth is driven by the need for customized learning solutions, which is a response to the changing educational landscape and students' evolving needs.

What are the market trends shaping the Education Consulting Industry?

- The evolving role of educational technologies is a significant market trend. This trend signifies the increasing importance of technology in enhancing and delivering education effectively.

- The market is experiencing significant growth due to the integration of advanced technologies in instructional design and assessment. Institutions are adopting digital badging and micro-credentials to enhance student success, with companies like Pearson leading the way in higher education. These technologies enable teachers to monitor student progress and provide personalized learning experiences, resulting in improved performance. Moreover, assessment tools, such as online assessments and compliance training, are essential for change management, cross-cultural communication, equity and inclusion, and leadership development in both higher education and corporate training.

- The incorporation of learning management systems (LMS) and content management systems (CMS) further balances student assessment and learning outcomes. The need for consulting services, planning, and assessment is increasing as educational institutions and organizations adapt to these technological advancements. Educational psychology plays a crucial role in ensuring the harmonious implementation of these technologies and promoting immersive and engaging learning experiences.

What challenges does the Education Consulting Industry face during its growth?

- The rising adoption of open educational resources poses a significant challenge to the growth of the educational industry. This trend, driven by increasing accessibility and affordability, necessitates traditional educational institutions and providers to adapt and innovate in order to remain competitive.

- The market faces challenges from the proliferation of free or low-cost educational resources, including open educational depositories and online courses. These sources reduce the need for consulting services in areas such as test preparation, training needs analysis, admissions consulting, teacher training, diversity training, and executive coaching. However, the market continues to grow due to the increasing emphasis on social-emotional learning (SEL) and the adoption of elearning platforms. Behavioral science research and proctoring services are also driving demand. Market dynamics include the development of new online courses, the integration of research methods into consulting practices, and the increasing importance of SEL in education.

- Despite these challenges, the market remains a significant industry, offering valuable expertise and insights to clients in the global education sector.

Exclusive Customer Landscape

The education consulting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the education consulting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, education consulting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

McKinsey & Company (United States) - This company specializes in educational consulting, providing services for British school and university entrance preparation, individual consultations, guardianship, and summer language courses. Their offerings aim to support students in achieving academic success and navigating the complexities of the international education system.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- McKinsey & Company (United States)

- Boston Consulting Group (BCG) (United States)

- Bain & Company (United States)

- Deloitte Touche Tohmatsu Limited (United Kingdom)

- PricewaterhouseCoopers (PwC) (United Kingdom)

- Ernst & Young (EY) (United Kingdom)

- KPMG International (Netherlands)

- Accenture PLC (Ireland)

- Huron Consulting Group Inc. (United States)

- Navigant Consulting, Inc. (United States)

- The Education Company (United Kingdom)

- Educomp Solutions Ltd. (India)

- NIIT Limited (India)

- Pearson PLC (United Kingdom)

- FTI Consulting, Inc. (United States)

- Hobsons (United States)

- Times Higher Education (United Kingdom)

- QS Quacquarelli Symonds Limited (United Kingdom)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Education Consulting Market

- In January 2024, Coursera, a leading online education platform, announced the launch of its new consulting service, "Coursera for Business Consulting," aimed at helping organizations upskill their workforce. This service offers customized training programs based on companies' specific needs (Coursera Press Release, 2024).

- In March 2024, EY, a global professional services firm, entered into a strategic partnership with edX, a non-profit online learning platform, to provide executive education programs. This collaboration aimed to offer EY's clients access to edX's extensive course catalog and enhance their professional development offerings (EY Press Release, 2024).

- In May 2024, Byjus, an Indian edtech company, raised USD200 million in a Series F funding round, led by BlackRock and TPG Growth. This investment will support Byjus' expansion into international markets and the development of new educational products and services (Byjus Press Release, 2024).

- In January 2025, the European Union introduced the Digital Education Action Plan 2025, focusing on digital transformation in education and training. This initiative includes a â¬6 billion investment in digital education infrastructure and services (European Commission Press Release, 2025).

Research Analyst Overview

- The market is characterized by the integration of various digital marketing strategies, including social media marketing and influencer marketing, to expand business development and lead generation. Sales funnels are utilized to manage client relations and ensure effective program evaluation and stakeholder management. Risk management and legal compliance are crucial aspects of the industry, with professional certifications serving as valuable tools for consultants. Web analytics and data analysis are essential for measuring marketing strategy success and informing instructional strategies. Contract negotiation skills are vital in securing projects and maintaining client satisfaction. Business development initiatives encompass content marketing, community engagement, and predictive analytics to identify trends and opportunities.

- Project management and continuing education are integral to maintaining a competitive edge, with learning theories and assessment design playing a significant role in instructional strategies. Financial management and digital marketing are also essential components, enabling consultants to effectively manage resources and reach broader audiences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Education Consulting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 792.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Education Consulting Market Research and Growth Report?

- CAGR of the Education Consulting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the education consulting market growth of industry companies

We can help! Our analysts can customize this education consulting market research report to meet your requirements.