Enterprise Data Storage Market Size 2025-2029

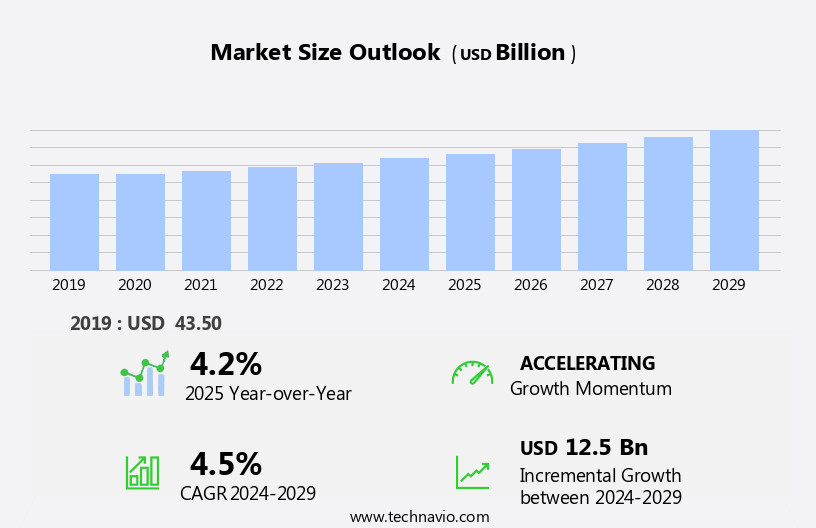

The enterprise data storage market size is forecast to increase by USD 12.5 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of cloud applications. Businesses are shifting towards cloud-based solutions to manage their data more efficiently and effectively. This trend is leading to a surge in demand for enterprise data storage systems that can support the growing volume and complexity of data generated by these applications. However, this market is not without challenges. companies face high operating expenses as they strive to meet the demands of this dynamic market. The need to continuously innovate and offer competitive pricing, while maintaining quality and reliability, presents a significant challenge. Additionally, data security and compliance remain critical concerns for enterprises, adding to the complexity and cost of implementing and managing enterprise data storage solutions.

- Companies seeking to capitalize on this market must navigate these challenges effectively, offering innovative solutions that address both the technical and financial needs of their customers. By focusing on efficiency, security, and cost-effectiveness, companies can differentiate themselves and capture market share in the competitive enterprise data storage landscape.

What will be the Size of the Enterprise Data Storage Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing volume, variety, and velocity of data. Capacity planning plays a crucial role as businesses strive to manage their data efficiently. Data archiving and access control ensure regulatory compliance and secure access to critical information. Direct-attached storage (DAS) and scale-out Network Attached Storage (NAS) provide optimal performance for specific workloads. Business intelligence, data visualization, and performance monitoring enable data-driven decision-making. Data backup and fault tolerance ensure business continuity, while block storage and high availability cater to mission-critical applications. Big data, data lifecycle management, and data mining unlock valuable insights from vast datasets.

Data durability and cost optimization are essential considerations, with data deduplication, compression, and tiered storage solutions helping to reduce costs. Metadata management and data governance ensure data accuracy and consistency. Data encryption, disaster recovery, and energy efficiency address security and sustainability concerns. Emerging technologies like machine learning, artificial intelligence, and software-defined storage are transforming the landscape. Predictive analytics, ETL processes, and API integrations streamline data processing and integration. Data replication and virtualization offer flexibility and scalability. Optical storage, data warehousing appliances, hybrid cloud storage, and storage-as-a-service provide additional options for businesses. Regulatory compliance, data security, and disaster recovery remain top priorities.

The market is a dynamic and complex ecosystem, continually adapting to meet the evolving needs of businesses across various sectors.

How is this Enterprise Data Storage Industry segmented?

The enterprise data storage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Solution

- SAN

- NAS

- DAS

- Type

- Storage

- Backup

- Others

- Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

- End-User

- IT and Telecom

- Healthcare

- BFSI (Banking, Financial Services, Insurance)

- Retail

- Manufacturing

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

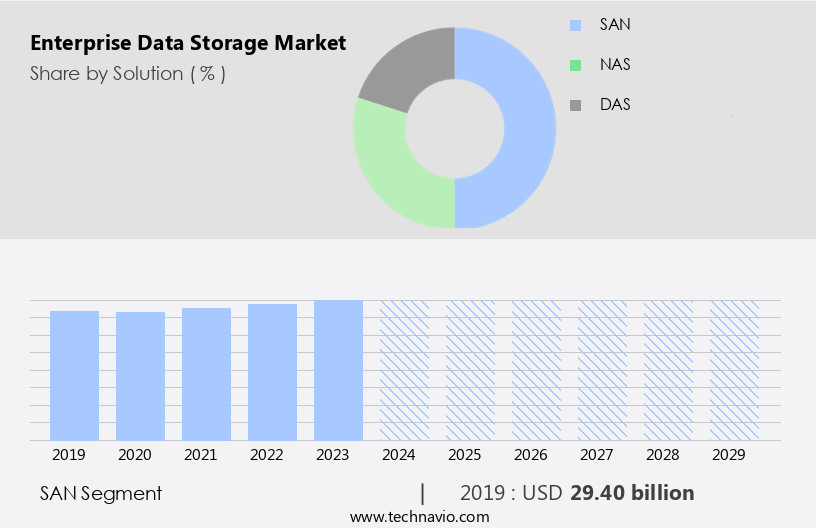

By Solution Insights

The san segment is estimated to witness significant growth during the forecast period.

The market trends reflect a growing emphasis on PCI DSS compliance, data security, and cost optimization. Machine learning and artificial intelligence are driving the adoption of advanced storage solutions, such as software-defined storage (SDS) and predictive analytics. Metadata management and data governance are crucial for ensuring regulatory compliance and maintaining data integrity. Scale-out NAS and hybrid cloud storage provide businesses with the flexibility to manage data across multiple tiers, including on-premise storage, cloud storage, and tape storage. Data deduplication, compression, and versioning are essential for optimizing storage capacity and reducing costs. Data lifecycle management, including data archiving and migration, is a key focus area for enterprises to manage their growing data volumes.

High availability, fault tolerance, and disaster recovery are essential for ensuring data durability and business continuity. Business intelligence, data visualization, and performance monitoring are critical for gaining insights from data. Data warehousing appliances, data lakes, and data warehouses are popular solutions for data analytics and reporting. Data integration, ETL processes, and API integrations enable seamless data flow between systems. Data modeling, data mining, and data replication are essential for data warehousing and analytics. Data encryption, access control, and data security are paramount for protecting sensitive data. Energy efficiency and cost optimization are essential considerations for enterprises looking to reduce their environmental footprint and lower storage costs.

Storage optimization, cost optimization, and capacity planning are essential for managing the ever-growing data volumes. Data archiving, data migration, and data backup are crucial for disaster recovery and business continuity. Enterprises are increasingly adopting hyperconverged infrastructure (HCI) and flash memory for faster data access and improved performance. Big data and data warehousing are driving the demand for high-performance, scalable storage solutions. In conclusion, the market is evolving rapidly, with a focus on data security, cost optimization, and advanced analytics. The adoption of cloud storage, hybrid cloud storage, and software-defined storage is increasing, along with the use of machine learning and predictive analytics to optimize storage and improve data management.

Data governance, regulatory compliance, and energy efficiency are also critical considerations for enterprises.

The SAN segment was valued at USD 29.40 billion in 2019 and showed a gradual increase during the forecast period.

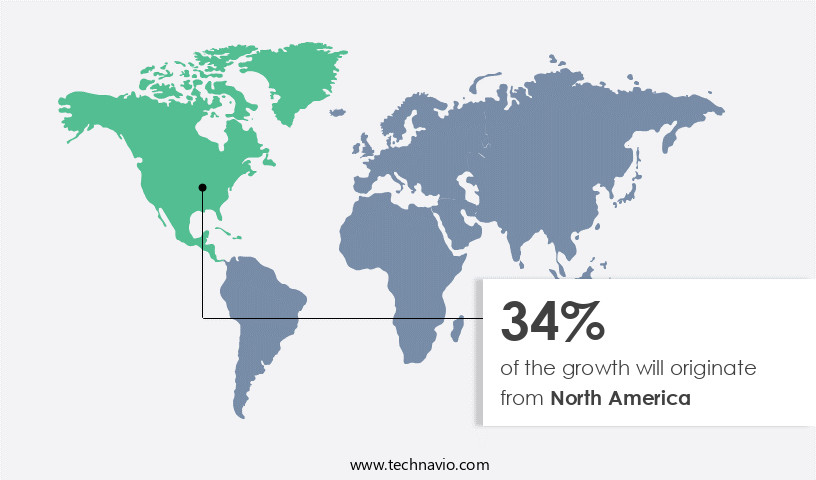

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, North America leads the growth due to the benefits of low power consumption and enhanced write speeds driving adoption among Small and Medium-sized Enterprises (SMEs). SMEs face constant pressure to upgrade and compete, and the proliferation of IoT and third-platform technologies, including cloud computing and analytics, necessitate IT solution implementation. Storage optimization, a critical component, is achieved through techniques like data deduplication, compression, and tiered storage. Machine learning and metadata management enable efficient data access and governance, while data versioning ensures data consistency and integrity. Data durability and fault tolerance are essential for business continuity, and cost optimization and capacity planning are key considerations.

Data security is paramount, with encryption, access control, and regulatory compliance ensuring data privacy and protection. Direct-attached storage (DAS) and scale-out Network Attached Storage (NAS) cater to various storage requirements, while high availability and performance monitoring ensure uninterrupted access. Big data, data warehousing, and data lakes require specialized storage solutions, including object storage, data warehousing appliances, and hybrid cloud storage. Data recovery, disaster recovery, and backup are essential for business resilience. Software-defined storage (SDS) and flash memory offer flexibility and agility, while predictive analytics and data migration enable proactive management. Energy efficiency and data lifecycle management are crucial for sustainable operations.

Artificial intelligence (AI) and data analytics enhance operational efficiency and decision-making. In summary, the market is evolving to meet the dynamic needs of businesses, with a focus on optimization, security, and innovation. SMEs, in particular, are adopting enterprise data storage to stay competitive and leverage technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and ever-evolving enterprise data storage landscape, businesses continue to grapple with managing and optimizing their growing data volumes. Enterprise data storage solutions offer scalable, reliable, and secure options for organizations, enabling them to efficiently store, manage, and protect critical information. These solutions encompass various technologies such as network-attached storage (NAS), storage area networks (SAN), cloud storage, and object storage. Key features include high availability, data protection, data tiering, and data compression. Additionally, the market trends include the integration of artificial intelligence and machine learning, flash storage, and software-defined storage. These advancements enhance data accessibility, improve performance, and reduce costs. Ultimately, enterprise data storage solutions are essential for businesses seeking to maintain a competitive edge, ensure business continuity, and mitigate risks in today's data-driven economy.

What are the key market drivers leading to the rise in the adoption of Enterprise Data Storage Industry?

- The significant growth in the utilization of cloud applications serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing adoption of cloud applications, particularly Software as a Service (SaaS) and Platform as a Service (PaaS). Cloud-based storage solutions offer organizations the ability to store and access data on-demand from anywhere, making them an attractive alternative to traditional on-premises storage. This trend is driving the development of cloud-based storage solutions that offer scalable, flexible, and cost-effective storage options. Cloud-based storage solutions provide several advantages over on-premises storage. They offer increased accessibility, as data can be accessed from anywhere with an internet connection. Scalability is another advantage, as cloud storage can easily be expanded to meet the growing demand for enterprise data storage.

- Reliability is also a key benefit, as cloud storage providers typically offer robust data durability and disaster recovery solutions. In addition to these advantages, cloud-based storage solutions offer features such as PCI DSS compliance, storage optimization through data versioning and deduplication, machine learning for data modeling and metadata management, data governance, and data encryption. Scale-out Network Attached Storage (NAS) and storage tiers are also common in cloud-based storage solutions, providing cost optimization and efficient data management. As organizations continue to generate and collect large amounts of data, the need for enterprise data storage solutions that can effectively manage and protect this data is becoming increasingly important.

- Cloud-based storage solutions offer a scalable, flexible, and cost-effective solution to meet this demand, making them an essential component of modern enterprise data management strategies.

What are the market trends shaping the Enterprise Data Storage Industry?

- Software-defined storage is an emerging market trend that is gaining significant traction. This modern approach to data management separates the storage software from the hardware, providing greater flexibility and efficiency in managing data infrastructure.

- The market is experiencing significant growth due to the increasing demand for efficient and flexible storage solutions. Software-defined storage (SDS), a separating of the control plane from the data plane, is a key trend in this market. SDS enables organizations to manage storage resources across various hardware platforms using software, providing greater flexibility and cost savings. The market's expansion is driven by the exponential growth of data from businesses, governments, and consumers. Traditional storage systems are becoming insufficient due to the unprecedented increase in data volumes. SDS offers an effective solution by allowing businesses to scale up their storage infrastructure quickly and cost-effectively.

- Capacity planning, data archiving, access control, direct-attached storage (DAS), business intelligence, data visualization, performance monitoring, data backup, fault tolerance, block storage, high availability, big data, data lifecycle management, data mining, and object storage are all integral components of the enterprise data storage landscape. SDS's ability to address these requirements makes it an attractive option for organizations seeking to optimize their storage systems.

What challenges does the Enterprise Data Storage Industry face during its growth?

- The escalating operating expenses for companies pose a significant challenge to the industry's growth trajectory.

- The market is characterized by continuous innovation and high operating expenses for companies. The development of advanced storage technologies, such as optical storage, data warehousing appliances, hybrid cloud storage, and software-defined storage (SDS), necessitates substantial research and development costs. Moreover, maintaining a robust infrastructure, including data centers, servers, networking equipment, and storage systems, adds to the operational expenses. Other factors contributing to the high operating expenses include data recovery solutions, data compression, and integration with various ETL processes. The increasing adoption of flash memory, cloud storage, data lakes, and artificial intelligence (AI) further complicates the infrastructure requirements and increases costs.

- companies must also invest in disaster recovery solutions to ensure business continuity and minimize downtime. Tape storage remains a viable option for long-term data retention due to its cost-effectiveness, but it requires significant investment in tape media and maintenance. The shift towards storage-as-a-service (STaaS) and hyperconverged infrastructure (HCI) is expected to bring cost savings and simplified management, but it also requires a significant upfront investment. Overall, the market is dynamic and complex, with companies constantly balancing the need for innovation and the need to control costs.

Exclusive Customer Landscape

The enterprise data storage market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the enterprise data storage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, enterprise data storage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Broadcom Inc. - The company specializes in enterprise-level data storage solutions, featuring CA 1 Flexible Storage. This innovative approach allows businesses to efficiently manage and scale their storage infrastructure, optimizing resource utilization and enhancing data accessibility. CA 1 Flexible Storage offers flexibility in deployment models, enabling organizations to choose the best fit for their unique requirements. By implementing this advanced storage solution, businesses can improve operational efficiency, ensure data security, and ultimately, gain a competitive edge in their respective industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- Commvault Systems Inc.

- DataDirect Networks Inc.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- Infinidat Ltd.

- Inspur Group.

- International Business Machines Corp.

- Lenovo Group Ltd.

- NetApp Inc.

- Nutanix Inc.

- Oracle Corp.

- Pure Storage Inc.

- Seagate Technology LLC

- Veritas Technologies LLC

- Western Digital Corp.

- Zadara Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Enterprise Data Storage Market

- In January 2024, Dell Technologies announced the launch of its new all-flash Unity XC series, which offers up to 300% more capacity and 50% better performance than its previous models (Dell Technologies Press Release). This development underscores Dell's commitment to providing advanced data storage solutions for enterprises.

- In March 2024, IBM and Seagate Technology formed a strategic partnership to co-develop advanced data storage systems using IBM's AI and cloud technologies and Seagate's storage hardware expertise (IBM Press Release). This collaboration aims to deliver more efficient and intelligent storage solutions to businesses.

- In April 2025, NetApp completed its acquisition of SolidFire, a leading provider of all-flash storage systems for the software-defined data center market, for approximately USD870 million (NetApp Press Release). This acquisition expands NetApp's portfolio and strengthens its position in the all-flash storage market.

- In May 2025, Hitachi Vantara, a wholly-owned subsidiary of Hitachi, Ltd., received approval from the European Commission for its acquisition of Western Digital's Gold Fields Data Center business (Hitachi Vantara Press Release). This acquisition adds significant data center capacity and capabilities to Hitachi Vantara's offerings, enabling it to better serve European customers.

Research Analyst Overview

- The market is experiencing significant evolution, driven by the increasing demand for efficient data management and security. Data mesh architectures are gaining traction, enabling organizations to decentralize data ownership and improve data accessibility. Data retention policies are becoming more stringent, necessitating advanced IT infrastructure libraries and data archiving strategies. Edge computing and serverless computing are transforming data processing, requiring new data center designs and data lineage tracking. Data security policies and encryption key management are paramount, with data masking and anonymization essential for data privacy. Audit trails, metadata repository, and data catalogs are crucial for data governance frameworks, ensuring data quality and compliance.

- Data observability and discovery tools are essential for identifying and addressing data issues in real-time. Fibre channel and storage networking continue to play a vital role in high-performance data transfer, while data fabric and reference data management optimize data access and consistency. Overall, the market is dynamic, with trends leaning towards decentralized data architectures, advanced security, and real-time data processing.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Enterprise Data Storage Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 12.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Germany, China, Canada, Japan, UK, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Enterprise Data Storage Market Research and Growth Report?

- CAGR of the Enterprise Data Storage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the enterprise data storage market growth of industry companies

We can help! Our analysts can customize this enterprise data storage market research report to meet your requirements.