Factory Automation Platform As A Service Market Size 2025-2029

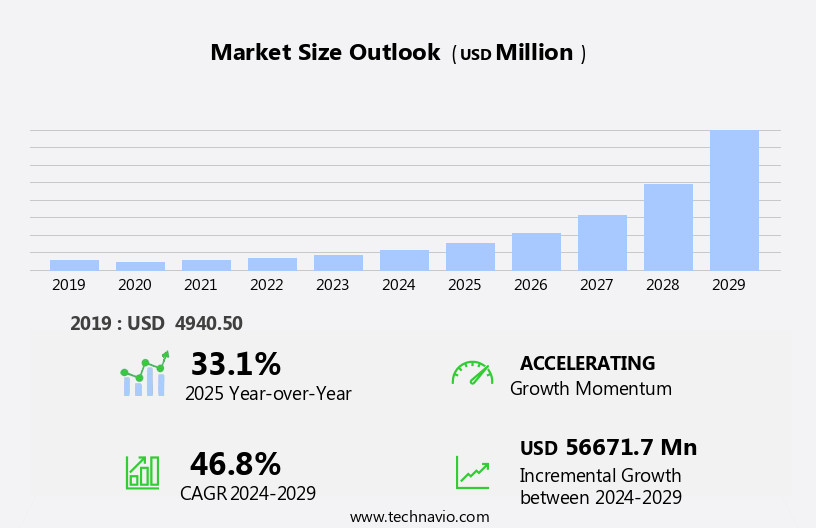

The factory automation platform as a service market size is forecast to increase by USD 56.67 billion at a CAGR of 46.8% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The convergence of Information Technology (IT) and Operational Technology (OT) is a major driver, enabling businesses to streamline their operations and improve efficiency. Another trend is the increasing focus on edge computing, which allows data processing to occur closer to the source, reducing latency and improving response times. Data privacy and security concerns are also fueling the adoption of FaaS solutions. With the proliferation of industrial sensors, Internet of Things (IoT) devices, and artificial intelligence (AI) and machine learning (ML) applications, there is a growing need for strong data security measures.

- FaaS providers offer advanced security features, including encryption, access control, and threat detection, to help mitigate these risks. Other areas where FaaS is making a significant impact are professional services and asset management. FaaS platforms provide analytics capabilities, enabling predictive maintenance and optimization of industrial processes. This is particularly important in industries such as cement, aluminum, semiconductor, medical devices, and logistics, where downtime can result in significant losses. Cloud infrastructure services and IT services are also benefiting from the adoption of FaaS. Containers and payment gateways are being used to facilitate seamless integration with existing systems. The market is expected to continue growing, driven by the increasing adoption of Industry 4.0 and the digital transformation of manufacturing processes.

What will be the Size of the Factory Automation Platform As A Service Market During the Forecast Period?

- The Factory Automation Platform as a Service (FaaS) market is experiencing significant growth due to the increasing demand for industrial digitalization and automation. This market encompasses cloud-based solutions that enable businesses to manage and optimize their manufacturing processes remotely. FaaS offerings provide advanced capabilities, such as artificial intelligence (AI) and machine learning (ML), business process automation, Internet of Things (IoT), and IT infrastructure management. This market's key drivers include increased efficiency, reduced costs, and improved productivity. Security is a critical consideration, with FaaS providers offering strong encryption, access control, and compliance features. The market's size is substantial, with numerous industries adopting FaaS solutions, including healthcare services, agricultural, pharmaceutical, and general manufacturing.

- The integration of FaaS with other technologies, such as AI, ML, and IoT, is further expanding its potential applications. Banking and financial services play a crucial role in facilitating financial transactions, while sectors like healthcare and life sciences, as well as retail and consumer goods, rely on efficient systems to support their patients and customers.

How is this Factory Automation Platform As A Service Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Platform

- Professional service

- End-user

- Large enterprises

- SMEs

- Application

- Manufacturing operations

- Supply chain management

- Quality control

- Deployment

- Public cloud

- Private cloud

- Hybrid cloud

- Geography

- North America

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- North America

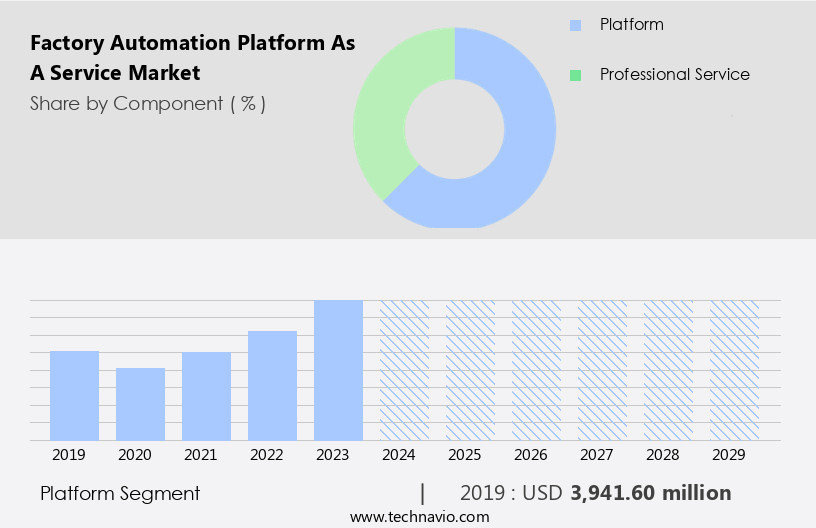

By Component Insights

- The platform segment is estimated to witness significant growth during the forecast period.

The market encompasses asset management, remote monitoring, data processing and analytics, application development and management, and security management segments. FAPaaS enables companies to create cloud-based services for factory automation applications, including asset management, remote monitoring, data processing, and security management. The rise of IoT-enabled devices in discrete industries for manufacturing process optimization necessitates effective cloud-based platforms to execute data processing and analytical tasks. To address this demand, industry-specific cloud applications must be developed for optimal performance. Key areas of application include IT, operations, finance, human resources, rule-based automation, knowledge-based automation, unstructured data, data security, and skilled workforce in sectors like telecom and IT, energy and utility, transportation and logistics, media and entertainment, cloud computing, IoT, healthcare services, artificial intelligence, machine learning, business process automation, and more.

Security and equity investments are crucial considerations in the FAPaaS market. Companies are investing in FAPaaS to streamline their operations and enhance productivity. The FAPaaS market's growth is driven by the need for secure, efficient, and intelligent automation solutions.

Get a glance at the market report of share of various segments Request Free Sample

The Platform segment was valued at USD 3.94 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

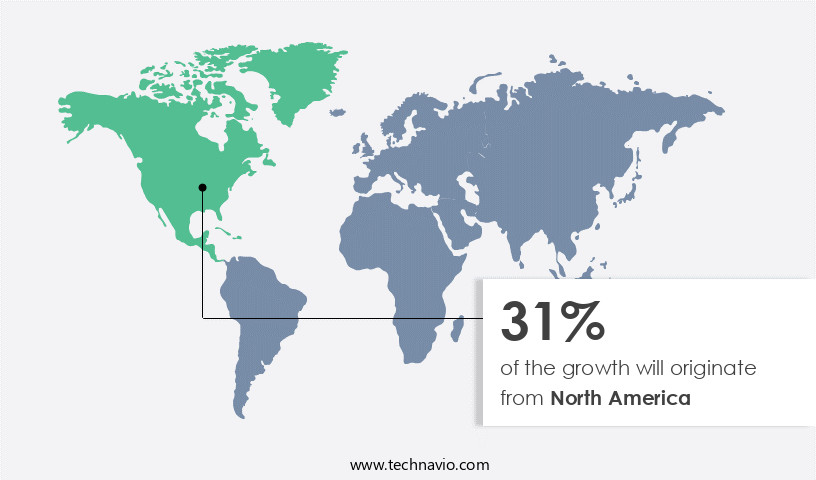

- North America is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is experiencing significant growth due to the region's advanced economies and the increasing adoption of IoT-enabled solutions and cloud platforms in manufacturing industries. With a focus on constructing smart factories and developing advanced products, manufacturers in North America are prioritizing high-level cloud infrastructure services. The healthcare, automotive, and other discrete industries are driving this demand, contributing to the region's economic growth and industrialization. FaaS solutions offer benefits such as workload management, security, and the integration of rule-based and knowledge-based automation for business functions in IT, operations, finance, human resources, and more.

The adoption of FaaS in North America is expected to continue as companies seek to optimize their manufacturing processes and improve efficiency, while ensuring data security and managing a skilled workforce. Key industries such as telecom and IT, energy and utility, transportation and logistics, media and entertainment, healthcare services, artificial intelligence, machine learning, and business process automation are also investing in FaaS solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Factory Automation Platform As A Service Industry?

Ease of IT and OT convergence is the key driver of the market.

- The market is witnessing significant growth due to the integration of information technology (IT) and operational technology (OT) through cloud-based platforms. IT comprises physical storage, networking devices, and computers, while OT includes industrial control systems such as DCS, SCADA, and PLC. The traditional separation of IT and OT communication networks is being bridged by digital platforms based on open APIs and agile application architectures using containers or micro-services. The increasing adoption of the Internet of Things (IoT) in discrete manufacturing industries, including automotive, semiconductor, and electronics, necessitates the streamlining of factory automation software and solutions with digital platforms.

- This trend is driving the demand for Professional services to ensure seamless workload management, data security, and skilled workforce development. Rule-based and knowledge-based automation, artificial intelligence, machine learning, and business process automation are key technologies fueling the market growth. Security is a critical concern, with data security being a priority for financial transactions, medical devices, medical record systems, and other business functions in sectors like telecom and IT, energy and utility, transportation and logistics, media and entertainment, healthcare services, and more. Equity investments from IT companies and financial institutions, such as Generali, Amperity, and Truist Invest, are further propelling the market growth.

What are the market trends shaping the Factory Automation Platform As A Service Industry?

Increasing focus on edge computing is the upcoming market trend.

- In today's data-driven business landscape, the demand for efficient workload management and automation solutions is on the rise. Professional services are increasingly turning to Factory Automation Platform as a Service (FaaS) to streamline operations and enhance productivity across various industries. FaaS enables the processing and analysis of large volumes of data generated by medical devices, medical record systems, business functions in IT, finance, human resources, and more. Security is a critical concern in this context, and FaaS providers ensure data security through advanced encryption techniques and access control mechanisms. Rule-based and knowledge-based automation, coupled with artificial intelligence and machine learning, facilitate the processing of unstructured data and enable quicker, more accurate decision-making.

- Telecom and IT, energy and utility, transportation and logistics, media and entertainment, healthcare services, and other sectors are leveraging FaaS to automate business processes and optimize workflows. Cloud computing and IoT are key enablers of FaaS, providing the necessary infrastructure and connectivity. Leading IT companies are making equity investments in FaaS to expand their offerings and cater to the growing demand for professional services. The responsible use of AI and adherence to ethical guidelines are essential in this context, ensuring a responsible AI layer that benefits both businesses and their workers.

What challenges does the Factory Automation Platform As A Service Industry face during its growth?

Data privacy and security concerns is a key challenge affecting the industry growth.

- In today's business landscape, data security is a paramount concern for organizations as they transition to cloud-based applications and services, including Factory Automation Platforms. Advanced security features are increasingly in demand to mitigate risks such as man-in-the-middle (MiTM) attacks and secure socket layer (SSL) connection vulnerabilities. However, despite advancements in cloud security, threats persist, including DDoS attacks, data breaches, unsecured APIs, data loss, and account hijacking. Enterprises require professional services to address these challenges and ensure compliance with data security policies. The focus on security extends to OpenStack cloud models, a new concept in the market.

- As the adoption of IoT, artificial intelligence, machine learning, and business process automation continues to grow across industries such as telecom and IT, energy and utility, transportation and logistics, media and entertainment, healthcare services, and industrial automation, the need for strong security measures becomes even more critical. Equity investments in companies specializing in cloud security and responsible AI are on the rise, with players like Generali, Amperity, GreyOrange, and others leading the way. Security remains a top priority as organizations navigate the digital transformation journey.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company provides a factory automation Platform-as-a-Service (PaaS) solution, encompassing process automation applications for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Advantech Co. Ltd.

- Blue Prism Ltd.

- ClearBlade Inc.

- Crosser Technologies

- Emerson Electric Co.

- FANUC Corp.

- General Electric Co.

- Honeywell International Inc.

- Litmus Automation Inc.

- Microsoft Corp.

- Mitsubishi Electric Corp.

- Panasonic Holdings Corp.

- PTC Inc.

- Schneider Electric SE

- Siemens AG

- Telit Cinterion

- Veea Inc.

- YASH Technologies Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth as businesses seek to streamline operations, enhance security, and optimize workloads. This market caters to various industries, including Telecom and IT, Energy and Utilities, Transportation and Logistics, Media and Entertainment, Healthcare Services, and more. FaaS offers a range of benefits for businesses looking to automate their IT operations. It enables the deployment of rule-based and knowledge-based automation solutions, allowing for the efficient handling of structured and unstructured data. This, in turn, leads to improved business functions such as finance, human resources, and operations. One of the primary drivers of the FaaS market is the need for enhanced security.

With the increasing digitization of business processes, data security has become a top priority. FaaS providers offer strong security features, including encryption, access control, and intrusion detection, ensuring that businesses can protect their sensitive information. Another factor fueling the growth of the FaaS market is the requirement for a skilled workforce. As businesses look to automate complex processes, there is a growing need for professionals with expertise in areas such as artificial intelligence, machine learning, and business process automation. FaaS platforms provide a platform for these professionals to build and deploy automation solutions, making it easier for businesses to access the talent they need.

Moreover, the market is also being driven by the adoption of cloud computing and IoT technologies. These technologies are transforming industries such as Agriculture, Pharmaceuticals, and Manufacturing, enabling real-time data processing and analysis. FaaS platforms provide a cost-effective and scalable solution for businesses looking to leverage these technologies. Moreover, FaaS is increasingly being used in industries such as Healthcare Services, where it is being used to automate medical record systems and medical device integration. This not only leads to improved patient care but also helps to reduce costs and increase efficiency. Despite the numerous benefits of FaaS, some challenges need to be addressed.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 46.8% |

|

Market growth 2025-2029 |

USD 56.67 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

33.1 |

|

Key countries |

US, China, Japan, UK, Brazil, Germany, France, South Korea, Saudi Arabia, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Factory Automation Platform As A Service Market Research and Growth Report?

- CAGR of the Factory Automation Platform As A Service industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the factory automation platform as a service market growth of industry companies

We can help! Our analysts can customize this factory automation platform as a service market research report to meet your requirements.