Ferrochrome Market Size 2024-2028

The ferrochrome market size is forecast to increase by USD 7.59 billion, at a CAGR of 5.94% between 2023 and 2028.

- The market is experiencing significant growth due to the rising demand for electrical energy-intensive industries, particularly in developing countries, where the consumption of stainless steel and other alloy steels is increasing. This trend is being driven by digitalization and the integration of Industry 4.0 technologies into The market.

- However, the market is also facing challenges from stringent regulations and policies regarding the processing of ferroalloy waste. Chromite ore, a key raw material for producing ferrochrome, is in high demand due to its essential role in the production of ferrochrome and manganese alloys. The high-tension steel industry, which relies heavily on these alloys, is a significant consumer of ferrochrome. The market is expected to continue its growth trajectory, with revenue share projected to increase in the coming years.

What will be the Ferrochrome Market Size During the Forecast Period?

- Ferrochrome, a significant ferroalloy, plays a crucial role in the production of stainless steel and other special steels. The market is experiencing steady growth due to its extensive application in various industries, including automotive, construction, consumer goods, and infrastructural projects. Ferrochrome is an essential raw material for stainless steel production, accounting for approximately 50-60% of the total chromium content. The automotive industry is a significant consumer of ferrochrome, using it to manufacture high-strength and durable components. In the construction sector, ferrochrome is employed in the production of high-tension steel and alloys steel for infrastructure projects. Additionally, the consumer goods industry utilizes chromium stainless steel in various applications, such as cutlery, kitchen appliances, and water filtration systems. The increasing demand for stainless steel in various industries is driving the growth of the market.

- Moreover, the development of advanced chromium manganese grades and high carbon ferrochrome is expanding the market's scope. Infrastructural projects, such as water leakage issues in pipelines, are another potential application area for ferrochrome. The market faces challenges, including the volatility of raw material prices, especially manganese and chrome ore, and the high energy consumption involved in ferrochrome production. However, advancements in technology, such as the use of carbon fiber in steel production, may help mitigate these challenges. Despite the challenges, the market is expected to grow due to the increasing demand for stainless steel and special steels in various industries. The market's growth is further fueled by the development of new applications, such as high-performance alloys and tool steels.

How is this market segmented and which is the largest segment?

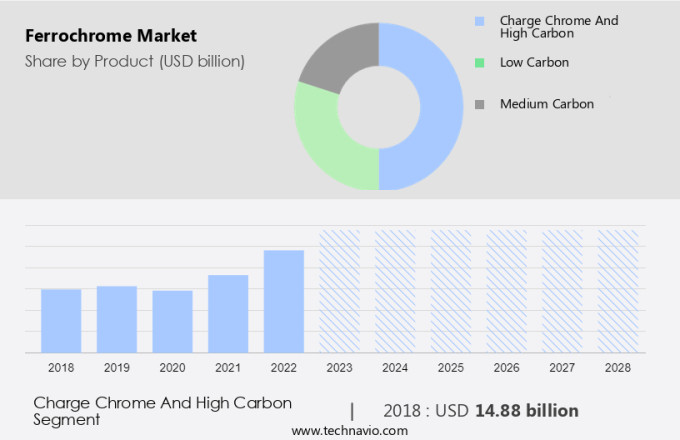

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Charge chrome and high carbon

- Low carbon

- Medium carbon

- End-user

- Stainless steel

- Carbon and other alloy

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

- The charge chrome and high carbon segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the demand for alloys, particularly tool steels and stainless steel. Ferrochromium (FeCr), a key component of these alloys, offers enhanced properties such as hardenability, temperature stability, and corrosion resistance. The market for ferrochromium can be segmented based on the type of alloy, with charge chrome and high carbon ferrochrome being the major segments. Charge chrome, which contains chromium (45-57%) and carbon (4-7%), is primarily produced in South Africa and Brazil. High carbon ferrochrome, also known as high-grade ferrochrome, has a chromium content of 65-72% and is mainly sourced from Kazakhstan.

Silicon is also present in charge chrome, with a composition ranging from 2.5% to 7%. The demand for ferrochromium is influenced by urbanization and the resulting increase in infrastructure development and construction projects. As a result, the market for ferrochromium is expected to grow steadily during the forecast period. Stainless steel manufacturers are the primary consumers of ferrochromium, and their increasing production capacity and demand for high-quality alloys are driving the market growth.

Get a glance at the market report of share of various segments Request Free Sample

The charge chrome and high carbon segment was valued at USD 14.88 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

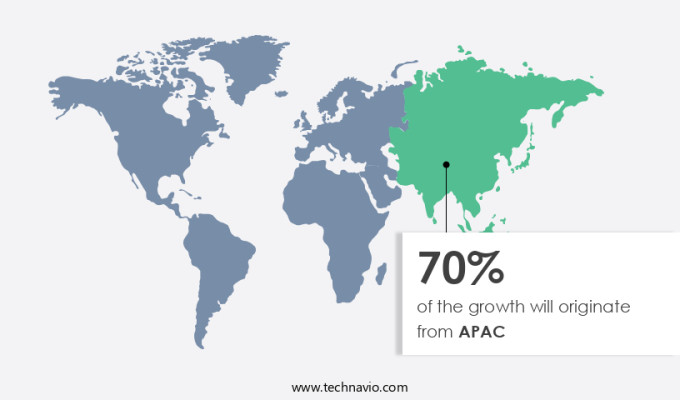

- APAC is estimated to contribute 70% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing demand for this essential alloy in the production of various types of steel, particularly stainless steel and special steels. Ferrochrome is primarily used as a raw material in the manufacture of high-voltage steel, which is a key component in various industries. APAC, being the largest producer of stainless steel, accounts for over 70% of the global production. Major stainless steel producers in APAC include China, Japan, India, and South Korea. The construction, transportation, and metallurgical industries in APAC are witnessing a rise in demand, leading to an increase in the consumption of ferrochrome. In particular, the construction sector in APAC is driving market growth due to an uptick in infrastructure projects and construction activities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Ferrochrome Market?

Increasing demand for stainless steel and other alloy steel from developing countries is the key driver of the market.

- The demand for ferrochrome is escalating in developing economies, particularly in China, India, South Africa, Brazil, and Indonesia, due to its essential role in the production of stainless steel and other alloys. Ferrochrome manufacturers are relocating their operations to these countries to take advantage of abundant raw materials, lower labor and transportation costs, and lenient regulations. This trend is projected to fuel the expansion of The market. The burgeoning automotive industry in Asia Pacific and South America, fueled by rising populations, disposable income, and purchasing power, is driving up investment in this sector.

- Moreover, the construction industry's increasing demand for durable and corrosion-resistant materials further boosts the consumption of chromium stainless steel. The chromium manganese grade, a significant type of ferrochrome, is in high demand due to its superior properties in various applications. Infrastructural projects, consumer goods manufacturing, and numerous other industries rely on ferrochrome for their production processes. As a result, the market for ferrochrome is poised for significant growth during the forecast period. By maintaining a professional tone and adhering to formal business writing standards, this content aims to provide valuable insights into the current state and future prospects of the market.

What are the market trends shaping the Ferrochrome Market?

Digitalization and Industry 4.0 integration into the market is the upcoming trend in the market.

- The market is undergoing a significant shift due to the integration of advanced technological solutions. Technologies such as sensors, automation, and data analytics are being employed to enhance the productivity and efficiency of ferrochrome production processes. In the smelting phase, automated systems and intelligent sensors are utilized to monitor real-time parameters, ensuring optimal temperature and chemical composition management.

- This data collection is precise, enabling predictive maintenance procedures that minimize downtime and boost overall production. Data analytics plays a pivotal role in optimizing ferrochrome production and informing strategic decisions. Machine learning algorithms analyze vast amounts of data to uncover trends and potential growth opportunities within the ferrochrome industry.

What challenges does the Ferrochrome Market face during the growth?

Stringent regulations and policies regarding ferroalloy processing waste are a key challenge affecting market growth.

- The market is subject to regulatory oversight from the Environmental Protection Agency (EPA) and REACH regulations, which may impede market expansion. Compliance with these regulations, particularly in the disposal of ferrochrome production waste, can lead to increased costs and reduced production efficiency. Under the Code of Federal Regulations 40 CFR Part 424, the EPA sets guidelines and standards for direct and indirect dischargers in ferroalloy manufacturing.

- These regulations are implemented through the National Pollutant Discharge Elimination System (NPDES). In the automotive sector, the focus on carbon fiber and automobile safety has led to an increased demand for structural steels and alloy steel. However, the environmental concerns surrounding ferrochrome production waste may pose challenges for market growth. Adhering to these regulations is essential for maintaining market competitiveness and ensuring sustainability in the industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Afarak Group SE

- African Rainbow Minerals Ltd.

- ArcelorMittal

- Balasore Alloys Ltd.

- EHUI METALLURGY GROUP

- Eurasian Resources Group.

- Ferbasa

- Glencore Plc

- Henan Star Metallurgy Material Co. Ltd.

- INDIAN METALS AND FERRO ALLOYS LTD.

- Merafe Resources Ltd.

- Metallic Ferro Alloys LLP

- Mintal Group Cleantech Development Co.Ltd

- Mitsubishi Corp.

- Outokumpu Oyj

- Samancor Chrome

- Tata Steel Ltd.

- Vedanta Ltd

- Visa Steel Ltd.

- YILDIRIM Group Of Companies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ferrochrome, also known as ferrochromium (FeCr), is a significant ferroalloy used in the production of various types of steel. This alloy is primarily made from chromite ore, which contains chromium. The process of producing ferrochrome involves reducing chromium oxide to chromium metal, which is then alloyed with iron to form ferrochrome. The global demand for ferrochrome is driven by the increasing consumption of stainless steel and special steels in various industries. The automotive industry is a major consumer of chromium stainless steel due to its corrosion resistance and high strength, making it ideal for automobile safety and structural applications.

In the construction industry, ferrochrome is used in the production of high-tension steel, structural steels, and alloy steels, which are essential for infrastructural projects and urbanization. Moreover, the consumer goods sector also contributes significantly to the demand for ferrochrome. Chromium stainless steel is widely used in the production of kitchen appliances, cutlery, and other household items due to its durability and resistance to rust. The construction of roads, bricks, and pavements also requires the use of ferrochrome in cement and concrete. The revenue share of ferrochrome in the steel industry is substantial due to its role as a crucial raw material.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.94% |

|

Market Growth 2024-2028 |

USD 7.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.85 |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.