Food And Beverage Cold Chain Logistics Market Size 2025-2029

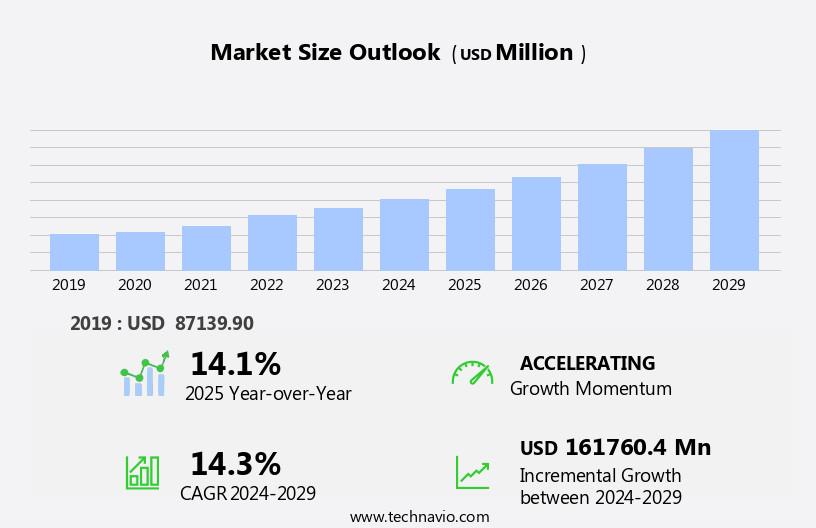

The food and beverage cold chain logistics market size is forecast to increase by USD 161.76 billion, at a CAGR of 14.3% between 2024 and 2029.

- The market is driven by the increasing consumption of frozen food, which necessitates efficient and reliable cold chain logistics solutions. This trend is particularly prominent in developing regions where the middle class population is growing and urbanization is leading to a shift towards convenience foods. Another key trend is the adoption of advanced technologies, such as fuel cell-based forklifts, in refrigerated warehousing to enhance productivity and optimize space utilization. However, the high cost involved in building and operating cold chains poses a significant challenge for market growth. Despite this, companies can capitalize on the market's potential by focusing on innovation, cost optimization, and partnerships to deliver efficient and cost-effective cold chain logistics solutions.

- Additionally, the integration of technology and automation in cold chain operations can help reduce costs, improve efficiency, and ensure food safety and quality. Overall, the market offers significant opportunities for growth, particularly in emerging economies, as the demand for temperature-controlled logistics solutions continues to rise.

What will be the Size of the Food And Beverage Cold Chain Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is a dynamic and evolving sector that plays a crucial role in ensuring the safe and efficient transportation and storage of temperature-sensitive products. Reefer containers, a key component of this market, are continually being innovated to reduce carbon footprint through improved fuel efficiency and the integration of renewable energy sources. Sustainability initiatives are also driving the adoption of insulation materials with lower environmental impact and the implementation of waste reduction strategies. Coolant systems, a critical element in maintaining optimal temperature conditions, are being optimized for energy efficiency and enhanced product quality through advanced temperature monitoring systems and data loggers.

Humidity control and air circulation systems are also essential for preserving the shelf life of perishable goods, reducing the risk of food spoilage and ensuring food safety regulations are met. Fleet management and order fulfillment are being streamlined through the integration of GPS tracking, warehouse automation, and RFID tracking, enabling real-time inventory management and reducing temperature fluctuations. The market is also witnessing the adoption of advanced insulated containers, such as those utilizing liquid nitrogen or dry ice, for the transportation of sensitive products. The ongoing focus on energy efficiency, product traceability, and risk management is driving the development of new technologies, including compressor systems and thermal packaging, to optimize the cold chain supply chain. Last-mile delivery and ambient storage solutions are also gaining traction as the market continues to adapt to evolving consumer demands and market dynamics.

How is this Food And Beverage Cold Chain Logistics Industry segmented?

The food and beverage cold chain logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Meat and seafood

- Dairy and frozen desserts

- Fruits vegetables and beverages

- Bakery and confectionary

- Type

- Warehouse

- Transportation

- End-user

- Retail

- Food service

- E-commerce

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

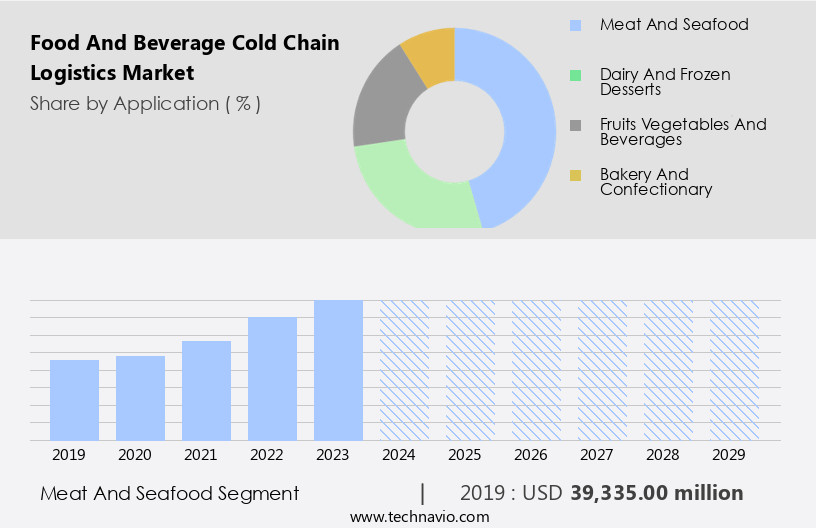

The meat and seafood segment is estimated to witness significant growth during the forecast period.

The market is a critical sector in ensuring the safe and efficient transportation and storage of perishable goods, particularly meat and seafood. These products, with their high-water, protein, and fat content, require careful handling to prevent spoilage and maintain food safety. Cold storage warehouses play a pivotal role in this process, employing various technologies such as humidity control, temperature monitoring systems, and refrigerated trucks to maintain optimal conditions. Carbon footprint is a significant concern for cold chain logistics companies, with the need for liquid nitrogen, fuel consumption, and energy efficiency being key areas of focus. Fleet management, GPS tracking, and route optimization are essential for reducing fuel consumption and minimizing waste.

Food safety regulations mandate stringent adherence to temperature requirements, and companies invest in data loggers and condenser units to ensure product traceability and maintain consistent temperatures. Sustainability initiatives are gaining momentum, with insulated containers, dry ice, and insulation materials being used to minimize the use of refrigerants and reduce the carbon footprint. Warehouse automation, RFID tracking, and inventory management systems help streamline operations and improve supply chain visibility. Perishable goods, including chilled food storage and frozen food storage, require specialized handling and storage conditions, making temperature fluctuations a major concern. Compressor systems and thermal packaging are essential for maintaining the required temperatures during transportation and storage.

Last-mile delivery is a critical aspect of cold chain logistics, with the need for precise temperature control and efficient delivery schedules. Risk management is a crucial component, with companies investing in maintenance schedules, air circulation, and shelf life extension technologies to minimize the risk of spoilage and ensure product quality. Reefer containers and ambient storage are used to accommodate various product types and meet the diverse needs of customers. In conclusion, the market is a dynamic and complex sector that requires a high level of expertise and investment to ensure the safe and efficient transportation and storage of perishable goods.Companies must navigate the challenges of maintaining consistent temperatures, reducing carbon footprint, and ensuring food safety while also addressing the evolving needs of customers and regulatory requirements.

The Meat and seafood segment was valued at USD 39.34 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

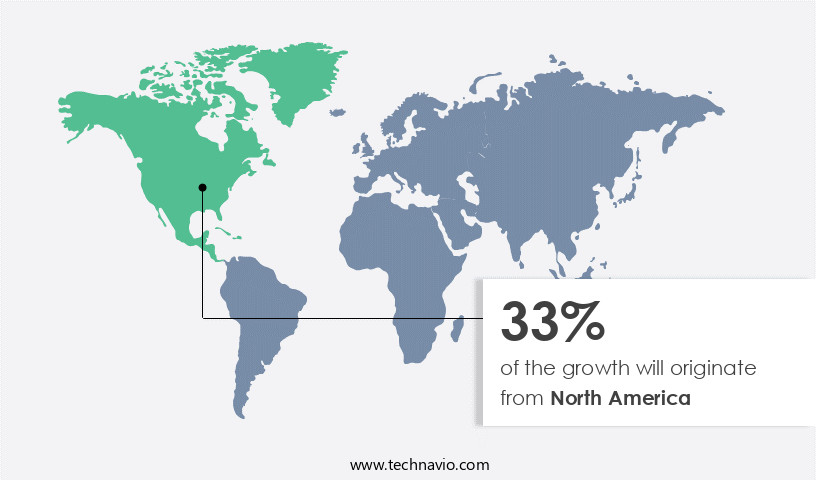

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with North America leading the charge. In 2024, North America held the largest market share and is projected to continue its dominance through 2029. This expansion is attributed to increased imports and exports of perishable goods, particularly fruits, vegetables, and meat, as well as the surge in online grocery sales. The United States, in particular, relies heavily on imports of asparagus and avocados, among other produce. To accommodate this growing demand, refrigerated warehouses are being established near ports, border crossings, and major trade gateways. Fleet management, order fulfillment, and temperature monitoring systems are crucial components of the cold chain logistics market.

Carbon footprint reduction and energy efficiency are also key priorities, with the implementation of sustainability initiatives, such as the use of liquid nitrogen and insulation materials. Humidity control and product traceability are essential for maintaining product quality and ensuring food safety regulations are met. GPS tracking and route optimization help minimize fuel consumption and reduce waste. Warehouse automation, including RFID tracking and inventory management, streamlines operations and enhances supply chain visibility. Perishable goods, such as chilled food and frozen food, require precise temperature control and regular maintenance schedules. Thermal packaging and compressor systems help maintain optimal temperatures during transportation, reducing the risk of temperature fluctuations and food spoilage.

Sustainability initiatives, such as the use of renewable energy sources and waste reduction strategies, are becoming increasingly important in the cold chain logistics market. Last-mile delivery and dry storage are also gaining traction, as consumers demand greater convenience and fresher products. The market is expected to continue evolving, with advancements in technology, such as data loggers and condenser units, playing a significant role.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global F&B cold chain logistics market size and forecast projects growth, driven by cold chain logistics market trends 2025-2029. B2B cold chain solutions leverage smart cold chain technologies for efficiency. Cold chain logistics market growth opportunities 2025 include cold chain for perishable foods and cold chain for pharmaceuticals, meeting demand. Cold chain management software optimizes operations, while F&B cold chain market analysis highlights key providers. Sustainable cold chain practices align with eco-friendly logistics trends. Cold chain regulations 2025-2029 shapes cold chain demand in Asia 2025. IoT-enabled cold chain solutions and premium cold chain insights enhance reliability. Cold chain for dairy products and customized cold chain services target niches. Cold chain logistics market challenges and solutions address energy costs, with direct procurement strategies for cold chain and cold chain pricing optimization boosting profitability. Data-driven cold chain analytics and green cold chain trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Food And Beverage Cold Chain Logistics Industry?

- The significant increase in the consumption of frozen food serves as the primary growth catalyst for the market. The market experiences growth due to the escalating consumption of chilled and frozen food products. The increasing popularity of these items, particularly frozen foods, is driven by their convenience and ease of use for consumers. Busy lifestyles and urbanization are significant factors contributing to the rise in frozen food consumption, as they offer an alternative to fresh, home-cooked, and canned options. To maintain the quality and safety of these perishable goods, energy-efficient solutions, such as temperature monitoring systems and optimized refrigerated trucks, are essential. Product traceability is also crucial for risk management purposes, and data loggers are employed to monitor temperature conditions throughout the supply chain.

- Packaging materials and condenser units must be designed to preserve the temperature and prevent cold chain breaks. Effective delivery schedules and coordination between various stakeholders are vital for the successful execution of the cold chain logistics process. The market's growth is expected to continue during the forecast period, driven by the expanding frozen food industry and the need for efficient, reliable, and sustainable cold chain solutions.

What are the market trends shaping the Food And Beverage Cold Chain Logistics Industry?

- The utilization of fuel cell-based forklifts in refrigerated warehousing is becoming increasingly popular due to its productivity benefits and space-saving capabilities. This market trend prioritizes the adoption of these advanced forklifts to enhance operational efficiency and reduce the carbon footprint in temperature-controlled facilities.

- In the market, reefer containers play a crucial role in preserving product quality by maintaining optimal temperatures. Sustainability initiatives have led to the adoption of advanced coolant systems, ensuring minimal temperature fluctuations and reducing energy consumption. Regular maintenance schedules are essential for the proper functioning of these systems, as well as for air circulation and shelf life. Frozen storage facilities utilize insulated containers and warehouse automation to streamline operations and improve inventory management. RFID tracking enables real-time monitoring of inventory levels and helps prevent stockouts or overstocking. Warehouse automation also reduces the need for manual labor, increasing efficiency and accuracy.

- Maintaining the cold chain is essential for preserving product quality and extending shelf life. Hydrogen fuel cell-powered forklifts, which are gaining popularity due to their combustion-free energy production, offer optimal performance in low temperatures, ensuring efficient material handling in refrigerated warehouses. By investing in advanced technologies and adhering to strict maintenance schedules, businesses can ensure the integrity of their perishable goods throughout the cold chain logistics process.

What challenges does the Food And Beverage Cold Chain Logistics Industry face during its growth?

- The high cost of constructing and maintaining cold chains poses a significant challenge to the growth of the industry. Cold chains, essential for preserving temperature-sensitive goods, entail substantial investments in infrastructure and ongoing operational expenses. This financial burden can hinder market expansion and profitability for industry players.

- In the Food and Beverage industry, maintaining the cold chain is crucial for preserving perishable goods and preventing food spoilage. This involves the use of insulation materials, thermal packaging, and compressor systems to regulate temperature fluctuations. Dry ice is often employed to keep goods frozen during transportation. Supply chain visibility and route optimization are essential for ensuring an uninterrupted flow of goods. Last-mile delivery poses a challenge due to the need for dry storage upon arrival. The infrastructure cost of constructing a new cold storage facility is significant, making location, connectivity, and land prices key considerations.

- Cold chains require a temperature-controlled environment, making it necessary to establish refrigerated warehouses near production facilities. The high infrastructure cost can be mitigated through the use of advanced technology, such as energy-efficient compressor systems and insulation materials. By optimizing the supply chain and investing in efficient infrastructure, businesses can minimize costs and ensure the timely delivery of temperature-sensitive goods.

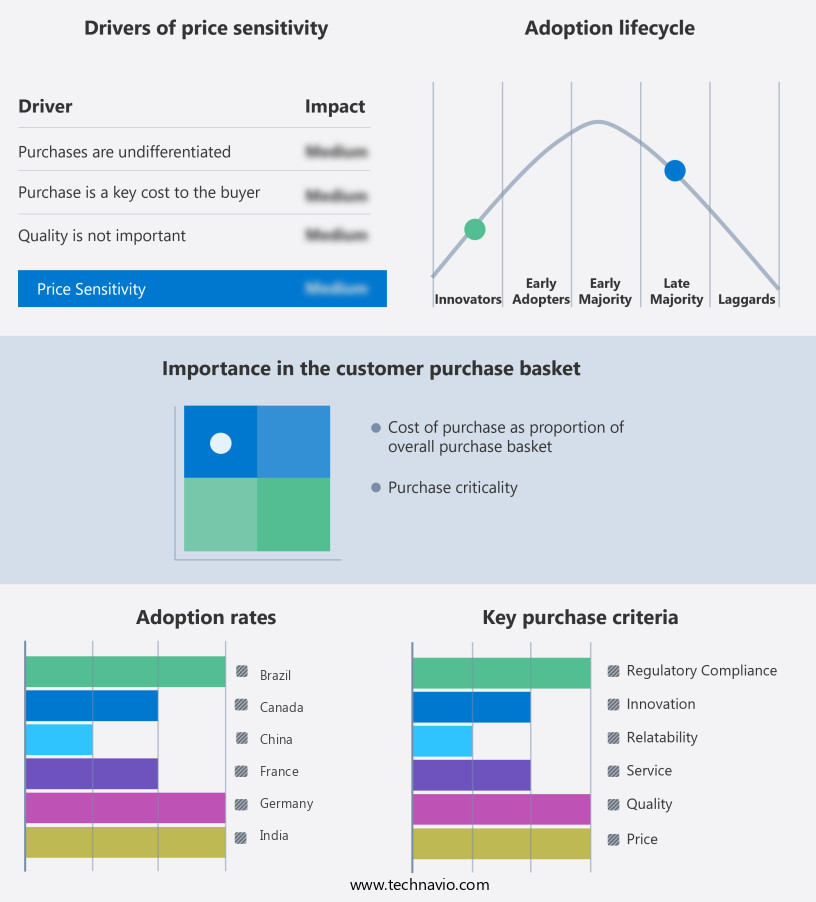

Exclusive Customer Landscape

The food and beverage cold chain logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food and beverage cold chain logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food and beverage cold chain logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Americold Realty Trust Inc. - Specializing in temperature-controlled logistics, our company caters to the unique needs of food and beverage industries. With various temperature rooms, we ensure optimal preservation for diverse product types, enhancing supply chain efficiency and product quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Americold Realty Trust Inc.

- Burris Logistics Co.

- Capstone Logistics LLC

- Claus Sorensen AS

- Coldco Logistics

- ColdEX Ltd.

- Frigoscandia AB

- Hanson Logistics Ltd.

- John Swire and Sons Ltd.

- Kalypso

- Kloosterboer

- Lineage Logistics Holdings LLC

- NewCold Cooperatief UA

- Nichirei Corp.

- Seafrigo Group

- Stockhabo

- Tippmann Group

- TRENTON COLD STORAGE

- VersaCold Logistics Services

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food And Beverage Cold Chain Logistics Market

- In January 2024, Danish logistics provider DHL Supply Chain announced the expansion of its cold chain logistics facility in the Netherlands, increasing its capacity by 50% to meet the growing demand for temperature-controlled food and beverage logistics services (DHL Press Release).

- In March 2024, American multinational corporation, C.H. Robinson, acquired German cold chain logistics provider, Kuehne+Nagel's Temperature-Controlled Logistics business, marking a significant strategic move to strengthen its position in the European cold chain market (C.H. Robinson Press Release).

- In April 2025, Blue Apron Holdings, an American meal kit and prepared food company, partnered with US-based cold chain logistics provider, Americold, to improve its supply chain efficiency and reduce food waste through optimized temperature control and storage solutions (Blue Apron Press Release).

- In May 2025, the European Union approved the Horizon 2020 project, "ColdLogNet," which aims to develop advanced technologies for energy-efficient cold chain logistics systems, addressing the environmental concerns and cost challenges in the market (European Commission Press Release).

Research Analyst Overview

- The market is characterized by the integration of advanced technologies and stringent regulations to ensure the safe and efficient transportation of perishable goods. IoT sensors enable real-time monitoring of temperature, humidity, and other critical conditions, while load optimization and AI-powered analytics improve supply chain efficiency. Customs regulations and compliance audits necessitate adherence to strict standards, necessitating the use of logistics software for delivery optimization and driver management. Sustainable packaging and ethylene management are crucial for food preservation techniques, reducing product damage during transit. Intermodal transportation and route planning software facilitate multimodal transportation, minimizing fuel consumption and carbon emissions.

- Refrigeration technology and temperature mapping ensure consistent product temperatures, while blockchain technology enhances cold chain security and traceability. Demand forecasting and cargo insurance mitigate risks and optimize inventory levels. Fuel management and energy auditing contribute to cost savings and sustainability. Last mile optimization and process optimization streamline delivery and reduce waste. Food safety certifications and quality control measures ensure regulatory compliance and consumer trust. Overall, the market is dynamic, with a focus on technological innovation, regulatory compliance, and operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food And Beverage Cold Chain Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.3% |

|

Market growth 2025-2029 |

USD 161.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.1 |

|

Key countries |

US, China, Japan, Germany, UK, Canada, France, Brazil, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food And Beverage Cold Chain Logistics Market Research and Growth Report?

- CAGR of the Food And Beverage Cold Chain Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food and beverage cold chain logistics market growth of industry companies

We can help! Our analysts can customize this food and beverage cold chain logistics market research report to meet your requirements.