Food Pathogen Testing Market Size 2025-2029

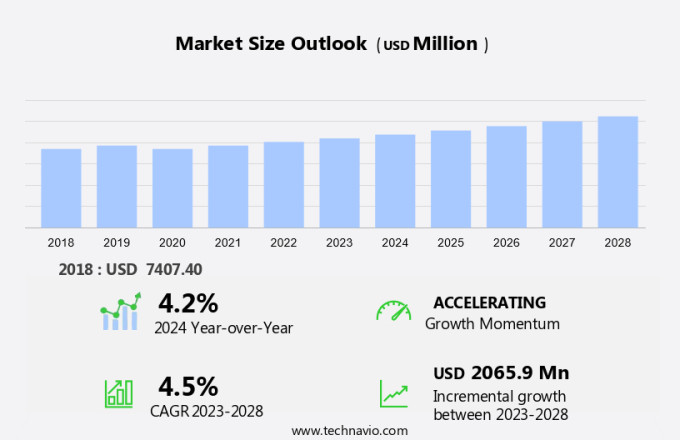

The food pathogen testing market size is forecast to increase by USD 2.23 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is driven by the increasing emphasis on food safety standards, ensuring consumer protection and regulatory compliance. Advanced robotics and automation technologies are transforming the food safety testing landscape, offering improved accuracy, efficiency, and cost savings. However, the market faces challenges with the evolving food regulations, necessitating continuous adaptation and innovation to meet changing requirements and consumer expectations.

- Companies must navigate these dynamics to capitalize on opportunities and maintain a competitive edge in the rapidly evolving food safety testing market. The market encompasses various analytical techniques and technologies to ensure food safety and quality. Key aspects of this market include the limit of detection (LOD) and limit of quantification (LOQ) for pathogens, which impact testing sensitivity and accuracy. Data analytics plays a crucial role in enhancing the efficiency and accuracy of these testing processes.

What will be the Size of the Food Pathogen Testing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Strict adherence to the chain of custody and laboratory accreditation is essential for maintaining data integrity. Protein analysis, strain typing, and bacterial identification are common methods for detecting foodborne pathogens. Incubation conditions and method validation are crucial for ensuring precision and reproducibility. Parasite detection and viral detection methods are also integral to the market, with regulatory compliance a top priority. Food safety audits and allergen testing are essential components of quality assurance programs. Regulatory bodies continue to set new standards for food safety, driving innovation and advancements in the market. Contaminants, including toxins, pathogens, allergens, pesticides, heavy metals, drug residues, and food additives, pose health risks to consumers.

RNA analysis, DNA sequencing, and metagenomic analysis are emerging technologies that enhance testing capabilities. Laboratory accreditation and equipment calibration ensure testing accuracy and sample traceability. Fungal contamination and toxin profiling are essential for identifying food spoilage organisms and potential health hazards. Validation standards, such as AOAC and FDA BAM, guide method development and ensure regulatory compliance. Antibiotic resistance testing is a growing concern, with precision and reproducibility critical for accurate results. Report generation and data interpretation are vital for effective communication of test results. Culture media preparation and DNA sequencing are essential for strain typing and pathogen identification.

How is this Food Pathogen Testing Industry segmented?

The food pathogen testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Meat and poultry

- Dairy

- Processed food

- Fruits and vegetables

- Cereals and grains

- Method

- Conventional methods

- Rapid methods

- Type

- Salmonella

- E. coli

- Listeria

- Campylobacter

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

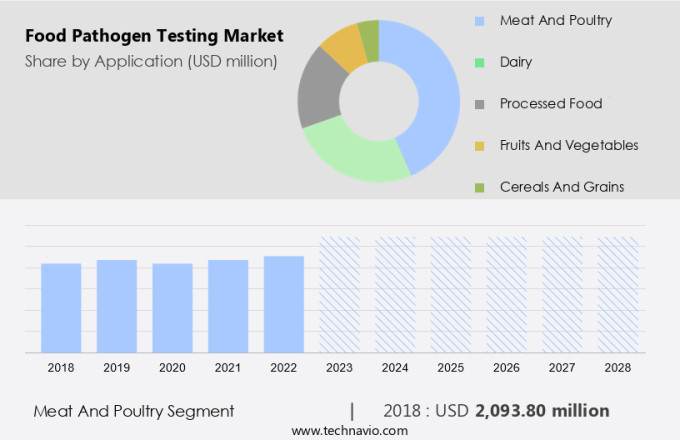

By Application Insights

The Meat and poultry segment is estimated to witness significant growth during the forecast period. The market encompasses various techniques and technologies to ensure food safety and prevent contamination. Meat and poultry accounted for the largest segment in 2024, driven by increasing demand for extended shelf life and enhanced taste. Rising meat prices in the US due to weather and economic factors further fuel market growth. Foodborne pathogens in meat and poultry pose significant risks, as evidenced by frequent recalls and safety scandals. To mitigate these risks, various testing methods are employed, including PCR testing, serological testing, culture-based detection, and biosensor technology. Sensitivity and specificity are crucial factors in choosing the right testing method, with real-time PCR and next-generation sequencing offering high accuracy.

Environmental monitoring, process validation, and microbial load assessment are essential quality control measures. Contamination prevention strategies include equipment sterilization, sample preparation methods, and immunological methods. Regulatory compliance and hygiene monitoring are integral to the food safety landscape, with food safety regulations mandating rigorous testing and detection of pathogens, toxins, and contaminants. Rapid diagnostic tests, mass spectrometry, and ELISA assay techniques are also employed for accurate and efficient detection. Molecular diagnostic tools and chromatographic techniques further enhance the market's capabilities.

The Meat and poultry segment was valued at USD 2.18 billion in 2019 and showed a gradual increase during the forecast period.

The Food Pathogen Testing Market is expanding as food safety remains a top global priority. Advanced PCR Testing Methods offer rapid, accurate detection of bacteria like Salmonella and E. coli, driving adoption in food processing facilities. Comprehensive Microbial Identification enables traceability and precise contamination control, reducing public health risks. Effective Surface Sanitation strategies, backed by routine testing, are crucial in preventing cross-contamination in production environments. Standardized Water Testing Protocols ensure potable water quality and food preparation safety. Meanwhile, minimizing the False Negative Rate is essential for regulatory compliance and consumer trust, prompting continuous improvements in test sensitivity and reliability.

Regional Analysis

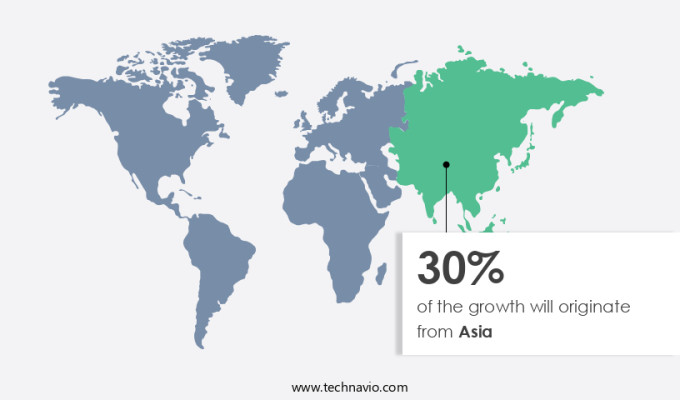

Asia is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, North America emerged as the largest geographical segment in 2024, driven by stringent food safety regulations and the increasing number of foodborne illness outbreaks. Food pathogen testing plays a crucial role in ensuring food safety and complying with regulatory requirements in the food and beverage industry. Various pathogens, such as Salmonella, Listeria, E. Coli, and Campylobacter, can contaminate food and cause severe health issues, including foodborne illnesses and potentially fatal diseases like diphtheria, pneumonia, typhoid, amoebiasis, botulism, cholera, and dysentery. To mitigate such risks, food and beverage manufacturers employ various testing methods, including PCR testing, serological testing, culture-based detection, and biosensor technology. Processed food manufacturers, meat, poultry, seafood, and fresh food producers all require regular testing to maintain food quality and ensure toxic-free food.

PCR testing offers high sensitivity and specificity, making it an effective method for detecting foodborne pathogens. Real-time PCR and quantitative PCR are advanced PCR techniques used for pathogen enumeration and microbial load assessment. Environmental monitoring and process validation are essential aspects of food safety, and food pathogen testing is an integral part of these processes. Quality control measures, such as colony forming units and detection limits, ensure accurate and reliable test results. Contamination prevention through proper equipment sterilization, sample preparation methods, and hygiene monitoring is also critical in maintaining food safety. Next-generation sequencing, ELISA assay techniques, and rapid diagnostic tests are emerging technologies in food pathogen testing, offering faster and more precise results.

Mass spectrometry and toxin detection kits are used for identifying specific toxins and ensuring the safety of food products. Governmental authorities and regulatory bodies, such as the FDA and USDA, enforce strict food safety regulations, mandating regular food pathogen testing. The food industry's increasing focus on food safety and quality, coupled with the growing awareness of foodborne illnesses, is expected to drive the growth of the market in North America during the forecast period. These robots are equipped with advanced features such as robotic vision systems that can read barcodes and interface with RFID tags for product identification.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Food Pathogen Testing market drivers leading to the rise in the adoption of Industry?

- The significance of food safety standards has emerged as a primary catalyst for market growth. In today's globalized food industry, ensuring the highest standards of food safety is not only a regulatory requirement but also a critical consumer preference. Consequently, companies are investing heavily in implementing stringent food safety protocols to meet regulatory compliance and enhance consumer trust. This trend is expected to continue, further fueling the market expansion. Food safety is a critical aspect of the food industry, ensuring the handling, preparation, and storage of food to prevent contamination and foodborne illnesses.

- Real-time PCR, a more advanced technique, identifies pathogens through DNA amplification. Quality control measures, including process validation and false positive rate reduction, are essential to ensure accurate and reliable food safety testing results. By implementing these measures, food manufacturers can maintain the highest standards of food safety and protect their brand reputation. The demand for stringent food safety standards arises from the need for nutritious and safe food for consumers.

What are the Food Pathogen Testing market trends shaping the Industry?

- Advanced robotics are increasingly being adopted for automating food safety testing, representing a significant market trend in the industry. This innovation offers improved accuracy, efficiency, and consistency in ensuring food safety standards are met. The food industry's focus on ensuring food safety and quality has led to significant advancements in food pathogen testing. Microbial load assessment plays a crucial role in maintaining food safety, and technologies such as quantitative PCR, next-generation sequencing, and mass spectrometry are revolutionizing the field. These techniques offer improved detection limits, enabling early identification of contamination and preventing potential outbreaks.

- Connected robots can read barcodes and interface with other product ID technologies, enhancing the efficiency and precision of testing processes. These innovations underscore the industry's commitment to preserving consumer trust and ensuring a safe and sustainable food supply. Food manufacturers invest significantly to mitigate risks related to contaminated foods, adhering to various food safety management system standards such as ISO 22000, FSSC 22000, IFS Food, and BRC Food Standards. Microbiological analysis plays a crucial role in food safety, employing techniques like culture-based detection, ATP bioluminescence, and real-time PCR for foodborne pathogen detection.

How does Food Pathogen Testing market face challenges during its growth?

-

Complexities and mandatory adjustments to evolving food regulations are significantly impacting industry growth, posing a major challenge for businesses to maintain compliance while ensuring operational efficiency. Food safety regulations in the European Union (EU) impose extensive obligations on the food industry, making it one of the most regulated sectors. These regulations can be categorized into three main areas: product, process, and presentation. The latest regulations, such as (EC) 178/2002, require food manufacturers to ensure product safety and implement a harmonized Hazard Analysis and Critical Control Points (HACCP) system.

- To maintain food safety, manufacturers employ various methods, including toxin detection kits, hygiene monitoring, immunological methods, equipment sterilization, and sample preparation methods. Molecular diagnostic tools and chromatographic techniques are also utilized for pathogen detection and identification. These methods enable manufacturers to ensure the safety and quality of their products, adhering to the stringent food safety regulations in the EU. Culture-based detection involves growing pathogens in a laboratory to identify them, while ATP bioluminescence detects the presence of microorganisms based on their ATP content.

Exclusive Customer Landscape

The food pathogen testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food pathogen testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food pathogen testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in food pathogen testing, utilizing advanced technologies to identify harmful microorganisms in food products, thereby enhancing food safety and protecting consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- ALS Ltd.

- AsureQuality Ltd.

- BioMerieux SA

- Bureau Veritas SA

- Campden BRI

- Eurofins Scientific SE

- FoodChain ID Group Inc.

- IFP Privates Institut fur Produktqualitat GmbH

- Intertek Group Plc

- LRQA Group Ltd.

- Merieux NutriSciences Corp.

- Microbac Laboratories Inc.

- RapidBio Systems Inc.

- SGS SA

- SunPower Corp.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food Pathogen Testing Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, announced the launch of its new food safety solution, the Thermo Scientific TSXpress Food Poisoning Detection Kit. This innovative product can detect six foodborne pathogens in just 24 hours, significantly reducing the time required for traditional testing methods (Thermo Fisher Scientific Press Release).

- In March 2024, 3M and Eurofins Scientific, global scientific and technical services providers, entered into a strategic partnership to expand Eurofins' food testing capabilities. Under the agreement, 3M's Food Safety business would provide Eurofins with exclusive access to its Molecular Detection Systems for a period of five years (3M Press Release).

- In May 2024, Neogen Corporation, a leading provider of food and animal safety solutions, announced the successful completion of a USD 100 million expansion project at its Lansing, Michigan facility. This expansion increased the company's production capacity for food safety diagnostics, further solidifying its position in the market (Neogen Corporation Press Release).

- In February 2025, the European Union approved the use of rapid molecular tests for the detection of Salmonella and Campylobacter in poultry, marking a significant regulatory milestone for the market. This approval is expected to accelerate the adoption of these tests in the EU food industry (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by the need for enhanced food safety and quality. Microbial load assessment plays a crucial role in ensuring food safety, with various techniques such as quantitative PCR and next-generation sequencing used for pathogen identification and enumeration. Sensitivity and specificity are key considerations in selecting testing methods, with ELISA assay techniques and immunological methods offering high specificity, while real-time PCR provides rapid and sensitive detection. Contamination prevention is another critical aspect of the food industry, with various techniques employed to minimize false negatives and false positives. Technological advancements, such as Polymerase Chain Reaction (PCR) and Enzyme-Linked Immunosorbent Assay (ELISA) for pathogen detection, and Rapid testing technology using Artificial Intelligence (AI) and machine learning, are essential tools for maintaining food safety standards.

Molecular diagnostic tools, including mass spectrometry and toxin detection kits, provide additional capabilities for food safety analysis. The ongoing development of new technologies, such as next-generation sequencing and rapid diagnostic tests, continues to expand the capabilities of the market. The market dynamics are shaped by evolving food safety regulations and the need for rapid and accurate testing methods to ensure food safety and quality. ELISA assay techniques and rapid diagnostic tests are also gaining popularity due to their speed and accuracy. Robotics and automation are increasingly being adopted for food pathogen testing, with small, lightweight, and flexible robots performing tasks previously done manually. This responsibility for food safety is crucial, as manufacturers are accountable for the products they produce. Understanding and implementing these regulations correctly is essential for food safety.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food Pathogen Testing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 2.23 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Germany, Canada, China, UK, Brazil, Japan, France, South Africa, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food Pathogen Testing Market Research and Growth Report?

- CAGR of the Food Pathogen Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food pathogen testing market growth of industry companies

We can help! Our analysts can customize this food pathogen testing market research report to meet your requirements.