Formwork And Scaffolding Market Size 2025-2029

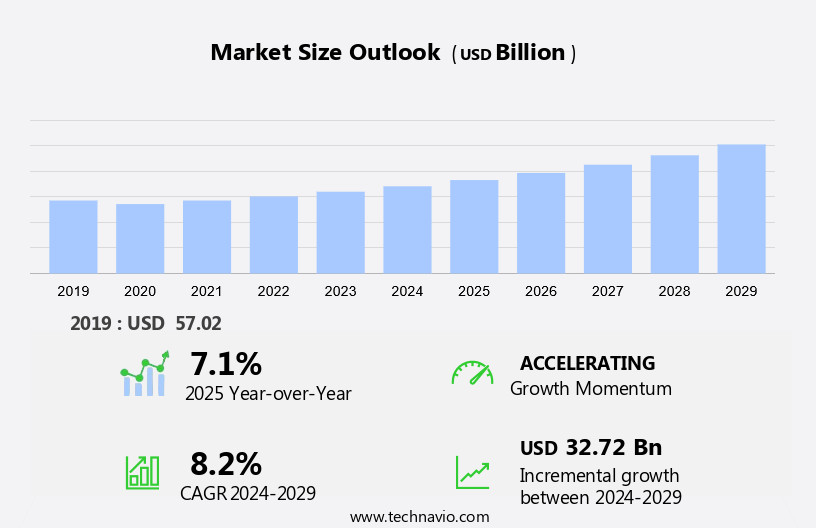

The formwork and scaffolding market size is forecast to increase by USD 32.72 billion at a CAGR of 8.2% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing construction activities In the civil engineering sector, particularly in urban areas. Urbanization and infrastructure development are key drivers for the market, as these initiatives require extensive use of formwork and scaffolding solutions for concrete and steel structures. New product introductions by companies, such as sensors, robotics, and digital solutions for fall protection and automation, are also contributing to the market growth.

- However, negligence in following safety regulations poses a significant challenge to the market, leading to potential accidents and increased insurance costs. Green building materials and building information modeling are emerging trends In the market, offering opportunities for innovation and cost savings. In North America, the market is expected to grow steadily, driven by the real estate sector's increasing demand for prefabricated construction and the need for efficient and safe construction methods.

What will be the Size of the Formwork And Scaffolding Market During the Forecast Period?

- The market encompasses the production and supply of systems and components used in constructing temporary structures to support and protect buildings under development. This market exhibits robust growth due to the increasing demand for infrastructure development and construction projects worldwide. The market's size is significant, with revenue generated from various segments, including steel and wood scaffolding, formwork components, rental companies, design software, project management, and training courses. Safety regulations and legal compliance are essential considerations in the formwork and scaffolding industry, with a focus on risk assessment and certification.

- In addition, innovation and automation are driving advancements, with the integration of robotics and construction technology in scaffolding design and project management. Sustainability is another key trend, with the adoption of green building materials and prefabricated construction methods. The future of construction is characterized by cost optimization, construction regulations, and workforce development, with a focus on financing, insurance, and smart city infrastructure. Construction technology advancements continue to shape the industry, enabling more efficient and effective construction processes. Overall, the market is dynamic and evolving, presenting opportunities for growth and innovation.

How is this Formwork And Scaffolding Industry segmented and which is the largest segment?

The formwork and scaffolding industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Scaffolding

- Formwork

- Material

- Steel

- Wood

- Aluminum

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- Middle East and Africa

- South America

- Brazil

- APAC

By Type Insights

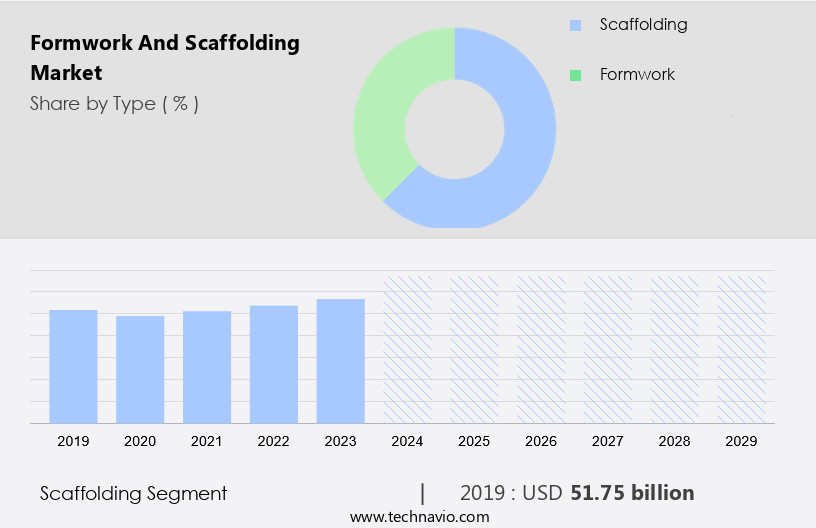

- The scaffolding segment is estimated to witness significant growth during the forecast period.

Scaffolding plays a vital role In the construction and infrastructure sectors, providing a safe working environment for workers and enabling access to elevated areas. Utilized in projects such as high-rise buildings, bridges, and industrial facilities, scaffolding systems ensure worker safety during painting, repairs, and installations at various heights. The market offers diverse scaffolding types, including Tube and Clamp Scaffolding, which is constructed from steel pipes and clamps, providing flexibility in construction due to its adaptability to various shapes and sizes.

Furthermore, innovative solutions, such as modular designs, recyclable mineral foam, lightweight materials, and 3D-printed formwork, are gaining popularity for their strength, efficiency, and sustainability. Regulations continue to shape the market, focusing on safety features and quality. Product lines include aluminum scaffolding, supported scaffolding, and bamboo scaffolding, among others. Urbanization and infrastructure development fuel demand, with new product releases catering to home remodeling, residential construction, and complex structures. Scaffolding systems offer smart solutions through IoT technology, real-time monitoring, and advanced materials, ensuring client satisfaction and repeat business.

Get a glance at the Formwork And Scaffolding Industry report of share of various segments Request Free Sample

The scaffolding segment was valued at USD 51.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

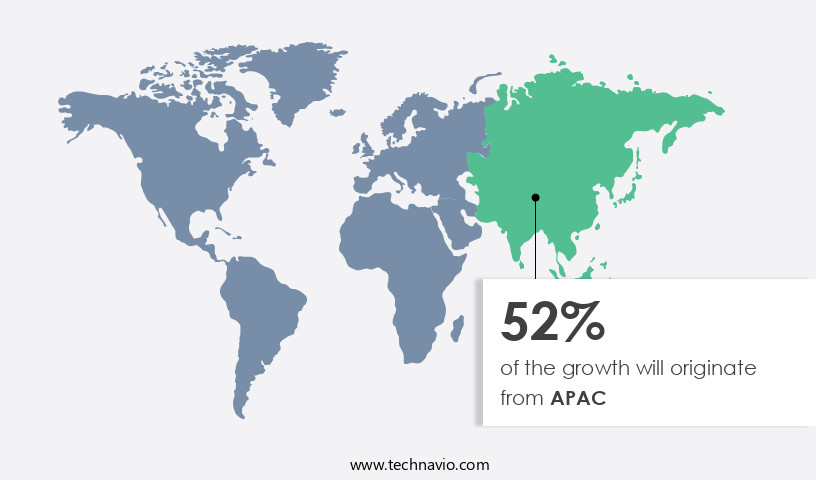

- APAC is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region, specifically in countries like China, India, and Australia, is undergoing rapid urbanization, leading to a significant increase in demand for advanced and efficient construction solutions, including formwork and scaffolding. In 2023, China's urbanization rate reached 66.16% of its permanent urban population, and the first half of the year witnessed a 16.2% increase in investment in new infrastructure projects compared to the previous year. Research institutions forecast that China's focus on new infrastructure will continue to expand, with its share in overall infrastructure investment projected to rise to approximately 15-20%. Advancements in technology have led to innovations in formwork and scaffolding systems, such as modular designs, recyclable mineral foam, lightweight materials, and 3D-printed formwork.

These solutions cater to various construction activities, including concrete work, electrical maintenance, and infrastructure projects. Safety features, such as IoT technology for real-time monitoring, are also becoming essential for contractual agreements. The market encompasses a wide range of product lines, including supported scaffolding, formwork, aluminum scaffolding, and traditional scaffolding. Materials used include steel, concrete, wood, bamboo, aluminum extrusions, and engineered wood. The complexity of structures and heights necessitate the use of smart scaffolding systems and temporary molds, which can help improve efficiency and execution In the building process. Regulations play a crucial role In the market, ensuring safety and quality for construction workers.

Urbanization and infrastructure development projects require a high level of client satisfaction, and construction solutions must cater to these demands while minimizing energy consumption. New product releases and home renovation projects also contribute to the market's growth. In summary, the market In the Asia-Pacific region is experiencing substantial growth due to urbanization and infrastructure development. Innovative solutions, such as modular systems and smart scaffolding systems, are gaining popularity to improve efficiency, safety, and execution In the construction process.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Formwork And Scaffolding Industry?

Urbanization and infrastructure development is the key driver of the market.

- The market is experiencing significant growth due to urbanization, which is driving the demand for efficient construction systems. With approximately 56% of the world's population, or 4.4 billion people, living in urban areas as of 2023, this trend is projected to continue, with nearly 70% of the global population expected to reside in cities by 2050. This urban expansion necessitates the development of new residential and commercial buildings, as well as infrastructure projects such as roads, bridges, and public utilities. Rolling scaffolding, modular designs, and lightweight materials like aluminum and engineered wood are gaining popularity In the construction industry due to their efficiency and safety features. Innovative solutions, such as 3D-printed formwork and smart scaffolding systems, are also being adopted to increase productivity and reduce energy consumption. Infrastructure projects, including electrical maintenance and civil engineering, require supported scaffolding and formwork to ensure safety and quality. Traditional scaffolding, such as bamboo scaffolding, is still used in some areas, but the market is shifting towards more advanced materials and systems. Regulations and contractual agreements play a crucial role In the market, ensuring compliance with safety standards and client satisfaction.

- Moreover, new product releases, such as those featuring IoT technology and recyclable mineral foam, are enhancing the capabilities of scaffolding systems and temporary molds. Construction activities, including home renovation and residential construction, also contribute to the market's growth. The use of formwork and scaffolding is essential to the building process, providing temporary molds and support for structures at various heights. In summary, the market is experiencing growth due to urbanization, infrastructure development, and the need for efficient and safe construction solutions. Innovative technologies, such as 3D-printed formwork and smart scaffolding systems, are enhancing the capabilities of traditional options, while regulations and contractual agreements ensure quality and client satisfaction.

What are the market trends shaping the Formwork And Scaffolding Industry?

Introduction of new products by market players is the upcoming market trend.

- The market is experiencing notable progress due to the launch of innovative products, enhancing construction efficiency, safety, and versatility. On April 16, 2024, PERI introduced the Alpha Column Formwork System, a pioneering solution designed for the evolving US construction industry. This system, featuring integrated accessories, minimizes on-site material usage and ensures improved safety during assembly. It is a highly efficient and safe option for construction professionals, addressing the increasing demand for user-friendly and adaptable formwork solutions. Additionally, market growth is driven by the adoption of modular designs, lightweight materials such as aluminum and aluminum extrusions, and sustainable options like recyclable mineral foam.

- Scaffolding systems, including rolling scaffolding and bamboo scaffolding, are also gaining popularity due to their flexibility and cost-effectiveness. Regulations continue to play a crucial role in market dynamics, ensuring quality and safety in construction activities, electrical maintenance, home remodeling, and infrastructure projects. New product releases, such as smart scaffolding systems and 3D-printed formwork, further contribute to market growth by offering advanced features and increased complexity in structures. Safety remains a top priority, with safety features becoming increasingly important for both traditional and innovative scaffolding systems. The building process benefits from IoT technology, which enables real-time monitoring and enhances overall execution efficiency. The market continues to expand, offering construction solutions that cater to the diverse needs of the industry while prioritizing energy consumption and client satisfaction.

What challenges does the Formwork And Scaffolding Industry face during its growth?

Negligence associated with following safety regulations is a key challenge affecting the industry growth.

- The market experiences continuous growth due to the increasing number of infrastructure projects and construction activities worldwide. Steel and aluminum are popular materials for scaffolding systems, with innovation in modular designs and lightweight materials, such as recyclable mineral foam and bamboo scaffolding, gaining traction. However, safety remains a top priority, with regulations enforced to ensure quality and prevent accidents. Scaffolding malfunctions, which account for approximately 10,000 annual injuries to construction workers, are primarily due to improper design and inadequate fall protection. Innovative solutions, such as smart scaffolding systems with real-time monitoring and IoT technology, are being introduced to enhance safety and efficiency In the building process.

- Contractual agreements between clients and construction firms focuses on the importance of safety features and compliance with regulations. Traditional scaffolding options, such as supported and rolling scaffolding, continue to be used in various industries, including residential construction, home remodeling, and civil engineering. The market's future growth is expected to be driven by the increasing urbanization, the need for energy-efficient construction solutions, and the demand for repeat business based on client satisfaction.

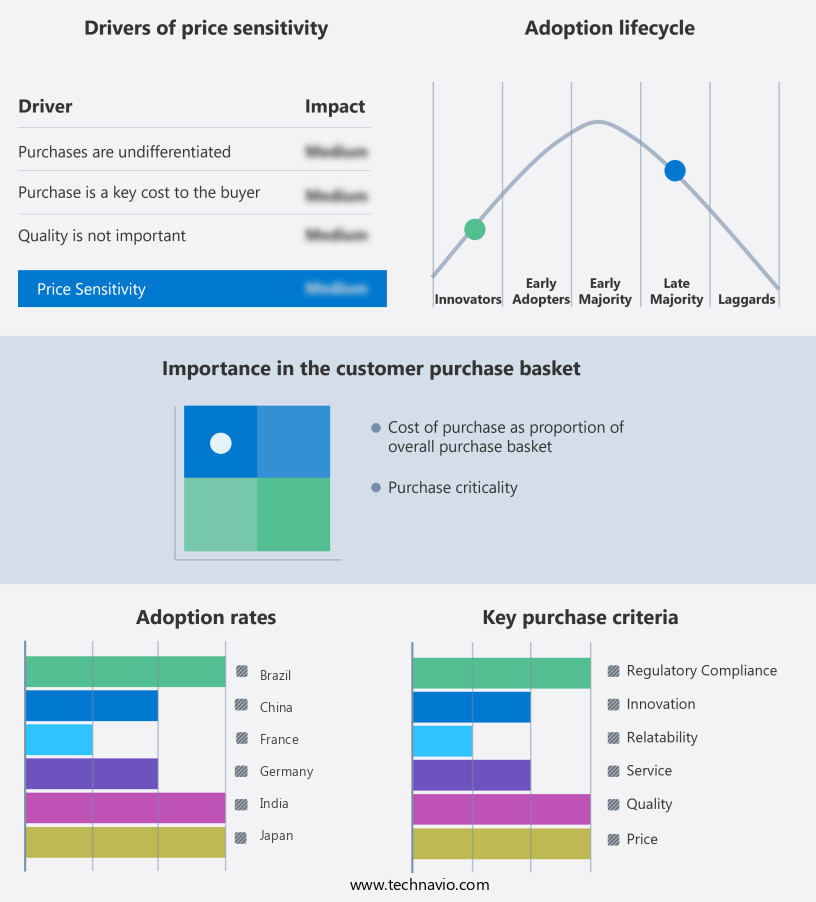

Exclusive Customer Landscape

The formwork and scaffolding market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the formwork and scaffolding market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, formwork and scaffolding market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altrad RMD Kwikform

- BSL Scaffolding Ltd.

- Constro Systems and Engineers Pvt Ltd.

- Doka GmbH

- Himskaf System Pvt Ltd

- Hunnebeck

- modscaff

- Navkaar Group

- PERI SE

- Pondhan Scaffolding Pvt. Ltd.

- SB Scaffolding India Pvt Ltd.

- Scaffco UAE

- Sscaffarm International

- Steelink India Pvt Ltd.

- ULMA C y E S Coop.

- Wheels Scaffolding India Ltd.

- Wilhelm Layher GmbH and Co. KG

- Winntus Formwork system Pvt Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of solutions essential to the construction industry. These systems provide the necessary support for concrete structures during their formation and serve as essential infrastructure for various maintenance activities. The sector's continuous evolution is driven by innovation, modular designs, and the adoption of advanced materials. Steel and aluminum are common materials in formwork and scaffolding systems due to their strength and durability. However, there is a growing trend towards lightweight materials such as recyclable mineral foam and engineered wood. These alternatives offer advantages in terms of energy consumption and ease of transportation, making them increasingly popular In the industry. Infrastructure projects and civil engineering applications are significant consumers of formwork and scaffolding systems. These structures must adhere to stringent regulations to ensure safety and efficiency. Innovative solutions, such as smart scaffolding systems and 3D-printed formwork, are gaining traction due to their ability to enhance the building process and improve client satisfaction.

Moreover, modular designs and systems have become increasingly popular in various construction activities, including residential and commercial projects. These solutions offer flexibility, ease of installation, and cost-effectiveness. They also contribute to the reduction of complexity in structures, allowing for more efficient execution and repeat business. Safety is a critical concern In the market. Unorganized firms and traditional options may pose risks to construction workers and hinder project progress. Advanced safety features, such as IoT technology for real-time monitoring, are becoming increasingly important to mitigate these risks and ensure optimal working conditions. The market is dynamic and diverse, with a wide range of products and services catering to various applications and industries. New product releases and home remodeling projects continue to drive demand for these essential construction solutions. Bamboo scaffolding and supported scaffolding systems have been traditional options In the market, but they are gradually being replaced by more advanced alternatives.

Thus, aluminum extrusions and aluminum scaffolding are gaining popularity due to their lightweight properties and ease of use. Urbanization and the need for temporary stages for electrical maintenance and home renovation projects further contribute to the market's growth. The formwork and scaffolding sector's continuous innovation and adoption of advanced materials and technologies ensure its relevance and importance In the construction industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 32.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.1 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Formwork And Scaffolding Market Research and Growth Report?

- CAGR of the Formwork And Scaffolding industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the formwork and scaffolding market growth of industry companies

We can help! Our analysts can customize this formwork and scaffolding market research report to meet your requirements.