Germany Frozen Snack Market Size 2024-2028

The Germany frozen snack market size is forecast to increase by USD 1.73 billion at a CAGR of 12.1% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. With increasing health consciousness and changing lifestyles, consumers are turning to frozen snacks as a convenient and nutritious alternative to fresh food. These snacks often contain added vitamins and minerals, making them an attractive option for those seeking to maintain a healthy diet. Additionally, the rise of plant-based meat, gluten-free food, and other dietary restrictions has led to an increase in demand for frozen ready meals. Another trend driving market growth is the increasing use of technology, such as food delivery services and e-commerce platforms, which make it easier for consumers to access a wide range of frozen snacks from the comfort of their homes.

- Convenience is a major factor in consumer decision-making, and the availability of frozen snacks in convenience stores and cold storage facilities further enhances their appeal. However, challenges remain, including concerns over packaging waste and the potential negative health effects of consuming too many processed snacks. The market is also seeing a growing demand for frozen desserts, ice cream, baked goods, pizza, and meal replacement options. Protein-rich snacks are also gaining popularity, particularly among athletes and fitness enthusiasts. Overall, the market is expected to continue growing as consumers seek out convenient, nutritious, and conveniently packaged options to meet their dietary needs and lifestyle preferences.

What will be the size of the Germany Frozen Snack Market during the forecast period?

- The market exhibits strong growth, driven by several factors. The working class demographic's preference for quick preparation and affordable meals continues to fuel demand. Innovation in frozen food technology, such as improved shelf life and convenient cooking methods, caters to the busy lifestyles of consumers. Food safety remains a top priority, with stringent regulations ensuring product quality and consumer trust. Frozen food trends extend beyond traditional offerings, with an increasing focus on healthy options, including frozen fruits, vegetables, and plant-based meals. Frozen poultry, meat, and seafood continue to dominate the market, while frozen baked goods and confectionery provide indulgent alternatives.

- Sustainability is a growing concern, with eco-friendly packaging and storage solutions gaining traction. Frozen food delivery and online distribution channels further enhance convenience, allowing for instant consumption and meal prep. Frozen food brands cater to various dietary needs, offering a wide range of products from fresh fruits and vegetables to microwave meals and on-the-go options. Overall, the frozen food market in Germany is a dynamic and evolving sector, driven by consumer preferences, technological advancements, and a focus on food safety and sustainability.

How is this market segmented and which is the largest segment?

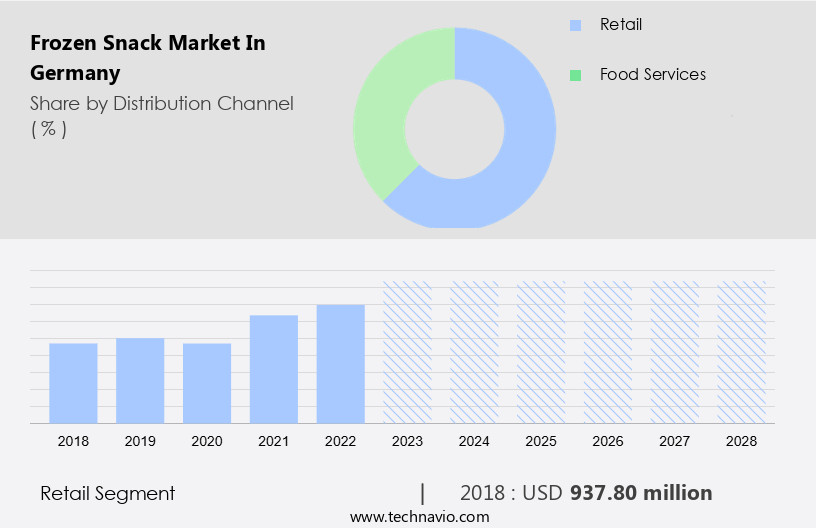

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Retail

- Food services

- Product

- Pizza

- Potato snack

- Meat snacks

- Others

- Geography

- Germany

By Distribution Channel Insights

- The retail segment is estimated to witness significant growth during the forecast period.

The German frozen snacks industry has experienced notable growth, driven by the increasing popularity of convenient and nutritious food options. With hectic lifestyles becoming the norm, ready-to-eat meals and snacks have gained significant traction. Frozen snacks, including pizzas, momos, burgers, and vegan products, cater to various dietary lifestyles and preferences. Product innovation, such as nutrient-rich and organic ingredients, distinct flavor profiles, and plant-based meat alternatives, has fueled market expansion.

E-commerce channels have emerged as a significant distribution platform, allowing for long shelf life and easy accessibility. Convenience stores and working professionals continue to be key consumer groups. Frozen desserts and ready meals, along with frozen-backed products, offer high nutrient levels, vitamins, and minerals. Brands focus on branding, ingredients, and catering to specific consumer needs, such as gluten-free, keto, and vegan options. The industry's future looks promising, with continued innovation and adaptation to consumer demands.

Get a glance at the market share of various segments Request Free Sample

The retail segment was valued at USD 937.80 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Germany Frozen Snack Market?

Rising health concerns along with changing lifestyles and diets and increasing replacement of meals with snacks is the key driver of the market.

- The market has experienced significant growth due to the increasing preference for convenient and healthier food options. With hectic lifestyles becoming the norm, consumers are turning to frozen snacks and meals for their nutritional value and long shelf life. The market caters to various dietary lifestyles, including vegan and gluten-free, with product innovation being a key driver. Frozen snacks, such as pizzas, momos, burgers, and desserts, offer distinct flavor profiles and high nutrient levels, including vitamins, minerals, and essential nutrients. These nutritious offerings appeal to working professionals and those following specific diets, such as keto. The convenience of impulse buying from supermarkets, convenience stores, and e-commerce channels has also contributed to the market's growth.

- Frozen-backed products, like plant-based meat alternatives, have gained popularity due to their health benefits and ethical considerations. Branding and ingredient transparency are essential factors in consumer decision-making, with organic ingredients and cold storage being preferred. Overall, the frozen snacks industry is expected to continue growing due to its ability to cater to the increasing demand for healthy, convenient, and nutritious food options.

What are the market trends shaping the Germany Frozen Snack Market?

Increasing internet and e-commerce users is the upcoming trend In the market.

- The market is experiencing significant growth, driven by the increasing popularity of convenient foods and impulse buying. Product innovation, such as nutrient-rich frozen snacks and plant-based meat alternatives, is a key trend In the industry. Frozen meals, pizzas, and desserts are popular choices, catering to various dietary lifestyles including gluten-free and vegan. E-commerce platforms, including Amazon, are expanding their offerings in this sector, increasing competition and putting pressure on companies to maintain customer satisfaction through competitive pricing and service. The convenience of online retail channels, long shelf life, and fast-food items' nutrient levels and flavor profiles are major factors contributing to the market's growth.

- Working professionals and convenience stores are significant consumers, and the market is expected to continue expanding during the forecast period. Frozen products, including momos, burgers, and vegan frozen foods, are gaining popularity due to their high nutrient levels, vitamins, minerals, and nutritional value. Cold storage and ready-to-eat meals are also popular choices for those with hectic lifestyles.

What challenges does Germany Frozen Snack Market face during the growth?

Increasing incidences of health issues due to high consumption of snacks is a key challenge affecting the market growth.

- The frozen snacks industry in Germany caters to the growing demand for convenient and nutritious food options, particularly among working professionals with hectic lifestyles. Frozen snacks, including frozen meals, desserts, and ready-meals, offer long shelf life and ease of preparation, making them popular choices for impulse buying. Product innovation in this sector focuses on catering to various dietary lifestyles, such as gluten-free, vegan, and keto, and incorporating nutrient-rich ingredients like plant-based meat, minerals, vitamins, and organic ingredients.

- Frozen pizzas, momos, burgers, and other frozen food products are gaining popularity due to their distinct flavor profiles and high nutrient levels. E-commerce and convenience stores are significant distribution channels for these products, enabling easy access to consumers. Frozen snacks offer health benefits, making them a preferred choice over fast-food items for those seeking quick, nutritious meals. The industry's growth is driven by the increasing preference for nutritious, ready-to-eat meals and snacks, as well as the convenience they provide.

Exclusive Germany Frozen Snack Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agrarfrost Holding GmbH and Co. KG

- Ajinomoto Co. Inc.

- ARYZTA AG

- Back Shop Tiefkuhl GmbH

- Cooperatie Koninklijke Cosun UA

- Del Monte Foods Inc.

- Dr. August Oetker KG

- Fonterra Cooperative Group Ltd.

- FRoSTA AG

- General Mills Inc.

- McCain Foods Ltd.

- Nestle SA

- Nomad Foods Ltd.

- Sudzucker AG

- Tonnies Holding APS and Co. KG

- The Hain Celestial Group Inc.

- Tyson Foods Inc.

- Unilever PLC

- Upfield BV

- Youngs Seafood Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The frozen snack market in Europe, with a particular focus on Germany, has experienced significant growth in recent years. This trend can be attributed to several factors, including the increasing popularity of convenient foods and the rise of impulse buying. Frozen snacks and meals have become staples in modern diets due to their convenience and time-saving benefits. With hectic lifestyles becoming the norm for many consumers, the demand for ready-to-eat meals and snacks has grown. Frozen snacks offer a solution to this need for quick and easy meals and snacks. Product innovation is another key driver In the frozen snack industry. Companies are constantly introducing new and distinct flavor profiles to cater to diverse consumer preferences. The market for nutrient-rich frozen snacks has gained traction, with a focus on high nutrient levels, vitamins, minerals, and other essential nutrients. Plant-based meat alternatives have also gained popularity In the frozen food market, including plant-based frozen burgers, momos, and other frozen products. This trend is driven by dietary lifestyles, such as veganism and vegetarianism, as well as health-conscious consumers seeking to reduce their meat intake.

The frozen snack industry has also seen a shift towards e-commerce and online retail channels. With the convenience of ordering groceries online and having them delivered to one's doorstep, frozen snacks have become a popular choice for consumers. This trend is particularly prevalent among working professionals who may not have the time to shop for groceries in person. Branding and ingredients play a crucial role In the frozen snack market. Consumers are increasingly seeking out organic ingredients and gluten-free options. Frozen pizzas, a staple In the frozen food market, have also seen a grown in demand for vegan and plant-based options. Long shelf life is another advantage of frozen snacks, making them a popular choice for convenience stores and other retail outlets.

Furthermore, frozen-backed products, which are frozen and then shipped to retailers, have become increasingly common In the industry. Thus, the frozen snack market in Europe, and specifically in Germany, is experiencing significant growth due to the convenience and time-saving benefits of frozen snacks and meals. Product innovation, including the introduction of plant-based meat alternatives and nutrient-rich options, is driving the market forward. The shift towards e-commerce and online retail channels is also impacting the industry, with frozen snacks becoming a popular choice for working professionals and health-conscious consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.1% |

|

Market growth 2024-2028 |

USD 1.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Germany

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch