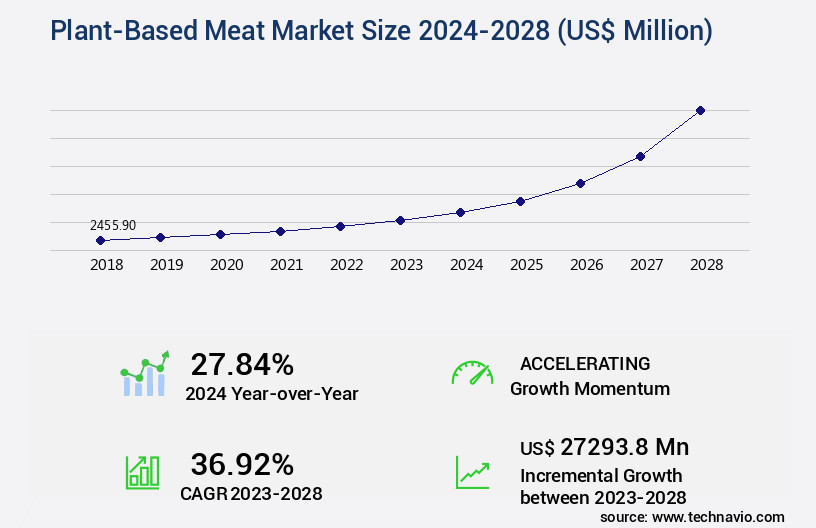

Plant-Based Meat Market Size 2024-2028

The plant-based meat market size is valued to increase USD 27.29 billion, at a CAGR of 36.92% from 2023 to 2028. New product launches will drive the plant-based meat market.

Major Market Trends & Insights

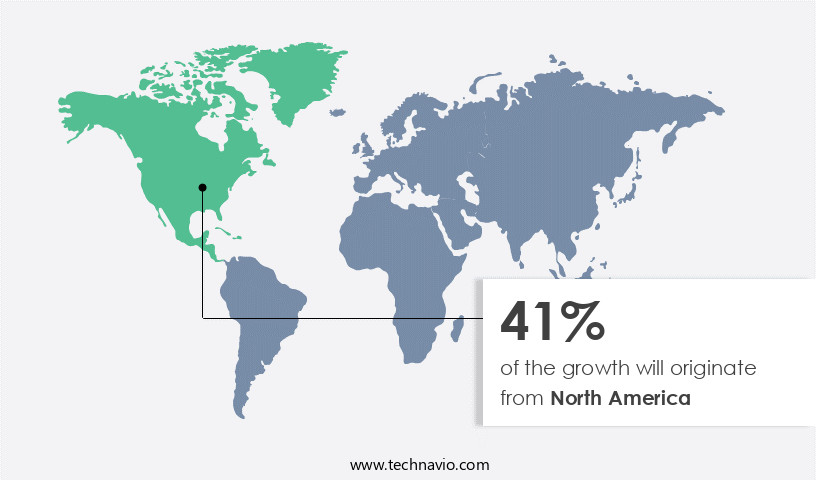

- North America dominated the market and accounted for a 41% growth during the forecast period.

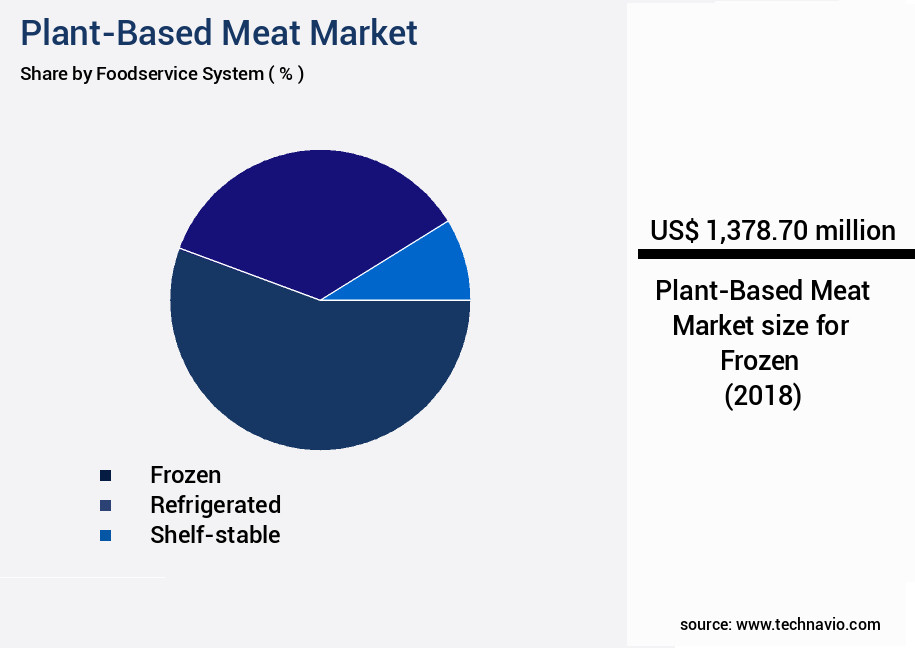

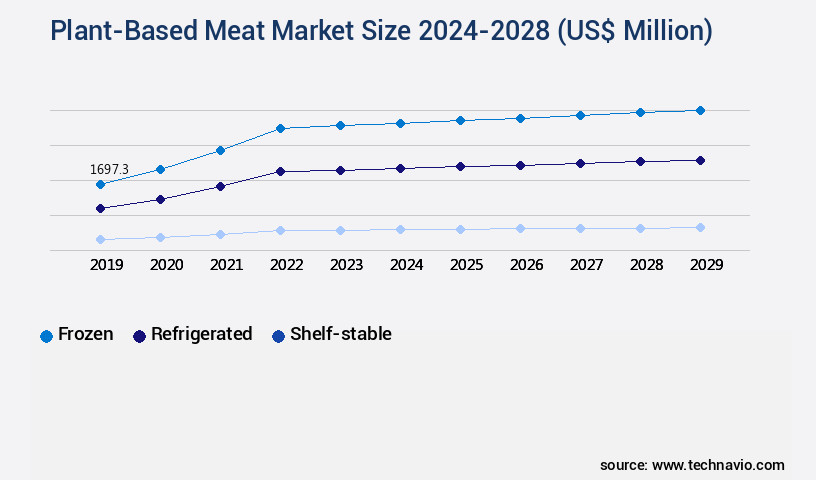

- By Foodservice System - Frozen segment was valued at USD 1.38 billion in 2022

- By Type - Plant based beef segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 1.00 million

- Market Future Opportunities: USD 27293.80 million

- CAGR : 36.92%

- North America: Largest market in 2022

Market Summary

- The market represents a dynamic and evolving business landscape, driven by the increasing adoption of plant-based alternatives to animal meat. According to recent reports, the market is projected to account for over 12% of the global meat market by 2025, reflecting a significant shift in consumer preferences. Core technologies, such as plant-based protein extraction and texturing, continue to advance, enabling the production of increasingly realistic plant-based meat products. Applications in various sectors, including foodservice, retail, and convenience stores, are expanding rapidly.

- Regulatory support and changing consumer demographics, including the growing number of flexitarian and vegetarian consumers, further fuel market growth. New product launches, such as Impossible Foods' Impossible Burger and Beyond Meat's Beyond Sausage, have gained significant market traction, demonstrating the potential for innovation in this sector. Despite challenges, including cost competitiveness and taste perception, the market presents substantial opportunities for growth and innovation.

What will be the Size of the Plant-Based Meat Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Plant-Based Meat Market Segmented and what are the key trends of market segmentation?

The plant-based meat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Foodservice System

- Frozen

- Refrigerated

- Shelf-stable

- Type

- Plant based beef

- Plant based chicken

- Plant based pork

- Others

- End User

- Retail/Household

- Foodservice

- Institutional

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Foodservice System Insights

The frozen segment is estimated to witness significant growth during the forecast period.

In the evolving food industry landscape, plant-based meat alternatives have gained significant traction, capturing the attention of both consumers and businesses alike. According to recent studies, the market currently accounts for approximately 12% of the global meat market, with this figure projected to reach 18% by 2026. Emulsion stability is a crucial factor in the production of plant-based meat, with soy protein isolate being a popular choice due to its ability to mimic the texture and taste of animal meat. Product formulation is a continuous process, with precision fermentation and alternative protein sources such as pea protein concentrate, fungal protein production, and algae protein extraction being explored to enhance the nutritional composition and taste of plant-based meat.

Food safety regulations play a pivotal role in the industry, with stringent guidelines ensuring the safety and quality of these products. Ingredient sourcing and plant protein extraction are essential aspects of production optimization, with microbial fermentation and myofibrillar protein structure modification techniques being employed to improve texture and taste. Lipid modification technology and texturized vegetable protein are used to create the desired fatty acid profile and mouthfeel. The amino acid profile of plant-based meat is a significant concern for consumers, with novel protein sources such as cellular agriculture and hydrocolloid functionality being explored to address this issue.

Protein denaturation effects and consumer acceptance testing are critical quality control metrics that manufacturers focus on to ensure product satisfaction. Supply chain management and packaging technology are essential components of the market, with shelf-life extension and 3D printing technology being employed to maintain product freshness and convenience. Legumes processing and flavor compound analysis are other key areas of research and development. The market is expected to grow by 15% in the next five years, with industry experts attributing this growth to increasing consumer awareness of health and sustainability, advancements in technology, and changing regulatory landscapes.

The market's continuous unfolding is driven by ongoing research and development efforts, with a focus on improving product taste, texture, and nutritional value.

The Frozen segment was valued at USD 1.38 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Plant-Based Meat Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth, fueled by increasing consumer health consciousness and environmental concerns. In 2023, the US accounted for the largest revenue share in the North American market. New product launches and investments are driving the market's expansion, with millennials leading the demand for plant-based meat alternatives. companies are innovating to meet this rising demand, introducing new products to cater to consumers' preferences.

The market's growth is expected to continue during the forecast period.

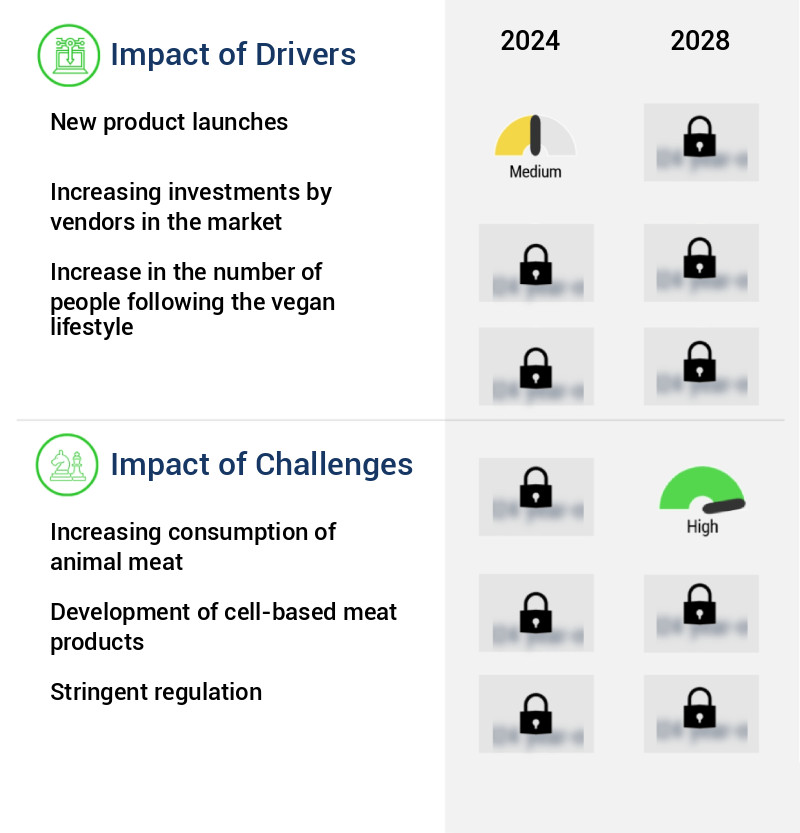

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth as consumers increasingly seek sustainable and ethical alternatives to traditional animal meat. One of the key drivers behind this trend is the development of advanced plant-based meat analogs, which mimic the texture and taste of animal meat through various processing techniques. Soy protein isolate and pea protein concentrate are commonly used in the production of plant-based meat due to their functionality in enhancing the structural integrity and gelation behavior of meat analogs. Moreover, 3D bioprinting technology is being employed to create complex plant-based meat structures, offering new opportunities for product innovation.

Microbial fermentation is another critical area of focus, with researchers optimizing the process to enhance flavor profiles and reduce production costs. Lipid modification is also essential for improving texture and mouthfeel, while hydrocolloids play a crucial role in emulsion stability. Consumer perception is a significant factor influencing the market's growth, with companies investing in evaluating novel protein sources for meat analogs to cater to diverse consumer preferences. Strategies for improving the shelf-life of plant-based meat and optimizing extrusion parameters for texture control are also gaining importance. Analysis of the amino acid profile in plant-based meat products and comparison of sensory attributes between plant-based and animal meat are essential for ensuring nutritional parity and consumer acceptance.

Furthermore, sustainable supply chain management for plant protein ingredients and reducing sodium content in plant-based meat without affecting taste are critical challenges that companies are addressing. Development of clean-label ingredients and improving water-holding capacity in plant-based meat analogs are other areas of research, with rheological studies providing valuable insights into predicting the texture of plant-based meat. Strategies to improve the color stability of plant-based meat products are also being explored to enhance their visual appeal. Functional properties of plant proteins in various food applications continue to be a topic of interest, with adoption rates in the food industry nearly doubling those in the pharmaceutical sector.

This trend is expected to drive the demand for plant-based meat alternatives, offering significant opportunities for innovation and growth in the market.

What are the key market drivers leading to the rise in the adoption of Plant-Based Meat Industry?

- The introduction of new products serves as the primary catalyst for market growth.

- The market is witnessing a surge in consumer demand due to growing health consciousness and environmental concerns. Animal meat production contributes substantially to greenhouse gas emissions, with every gram of beef production resulting in 221 grams of carbon dioxide emissions. To cater to this evolving trend, companies are introducing new plant-based meat products. These innovations contribute to expanding revenue streams and market presence.

- For instance, on March 6, 2024, a joint venture between The Kraft Heinz Company and Impossible Foods launched an plant-based burger in the US. Another example is Nestle's 2023 debut of its plant-based Awesome Burger in Europe. These product launches underscore the dynamic nature of the market.

What are the market trends shaping the Plant-Based Meat Industry?

- Consumer demographics are undergoing significant shifts, representing the emerging market trend. (Two-line sentence, formal tone, sentence case) Consumer demographics are evolving, signifying the prevailing market trend. (Alternative version, two-line sentence, formal tone, sentence case)

- The escalating health awareness among consumers is fueling a greater demand for healthier food and beverage options. Chronic health issues like diabetes, digestive disorders, allergies, and obesity have become increasingly common worldwide, leading consumers to prioritize their dietary choices to mitigate or prevent these conditions. This shift in consumer behavior has resulted in a surging preference for food products with fewer calories but rich in essential nutrients. Consequently, the global market for plant-based meat alternatives is experiencing significant growth as people seek healthier alternatives to traditional meat products.

- This trend is expected to persist throughout the forecast period, driven by the continuous evolution of plant-based meat technologies and increasing consumer acceptance. The market's expansion is not confined to any specific sector but is gaining traction across various industries, including food services, retail, and manufacturing.

What challenges does the Plant-Based Meat Industry face during its growth?

- The escalating consumption of animal meat poses a significant challenge to the industry's growth trajectory.

- The market faces challenges from the rising consumption of animal meat, particularly in major markets like the US, China, India, Russia, and Brazil. The increasing population, disposable income, and demand for protein-rich food products fuel the growth in meat consumption. In 2023, the US led in the consumption of beef and veal, while it, China, Brazil, India, and Russia were the largest consumers of chicken. Despite this trend, the market continues to evolve, driven by technological advancements and consumer preferences for sustainable and ethical food options.

- The market's growth is not limited to traditional plant-based meat substitutes but also includes innovative products like lab-grown meat and plant-based seafood. Companies are investing in research and development to create more realistic textures, tastes, and appearances, making plant-based meat an increasingly viable alternative to animal meat.

Exclusive Technavio Analysis on Customer Landscape

The plant-based meat market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plant-based meat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Plant-Based Meat Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, plant-based meat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albertsons Co. Inc - This company specializes in the development and distribution of innovative sports products, leveraging advanced technology and research to enhance athlete performance and consumer experience. Their offerings span various sports categories, catering to both professional and recreational markets. By focusing on functionality, durability, and design, they aim to set industry standards and exceed customer expectations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albertsons Co. Inc

- Beyond Meat Inc.

- Conagra Brands Inc.

- Ecozone Ltd.

- Gathered Foods Corp.

- Green Monday

- Hormel Foods Corp.

- Impossible Foods Inc.

- Jensen Meat Co.

- Kellogg Co.

- Kerry Group Plc

- Kroger Co.

- Maple Leaf Foods Inc.

- Monde Nissin Corp.

- Nestle SA

- New Wave Foods

- The Kraft Heinz Co.

- The Tofurky Co. Inc.

- Tyson Foods Inc.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plant-Based Meat Market

- In January 2024, Beyond Meat, a leading player in the market, announced the launch of its new Beyond Sausage product line in Germany, marking its entry into the European market (Beyond Meat Press Release, 2024). This expansion was a strategic move to tap into the growing demand for plant-based alternatives in Europe.

- In March 2024, Impossible Foods, another significant player, secured a strategic partnership with McDonald's, the world's largest fast-food chain, to roll out the Impossible Burger in select US locations (Impossible Foods Press Release, 2024). This collaboration was a major boost for Impossible Foods, expanding its reach and increasing market share.

- In May 2024, Memphis Meats, a pioneer in lab-grown meat, raised USD161 million in a Series B funding round, bringing its total funding to USD220 million (Bloomberg, 2024). This significant investment will help Memphis Meats scale up its production and bring lab-grown meat closer to commercialization.

- In January 2025, the European Union approved the use of plant-based alternatives to traditional meat labels, enabling plant-based meat companies to use terms like 'burger' and 'sausage' on their packaging (European Commission Press Release, 2025). This regulatory approval will make it easier for plant-based meat companies to compete with traditional meat producers in the European market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plant-Based Meat Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 36.92% |

|

Market growth 2024-2028 |

USD 27293.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

27.84 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, and KSA |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovation driving the sector forward. Emulsion stability studies play a crucial role in creating authentic meat-like textures, utilizing soy protein isolate as a primary ingredient. Product formulation is another key area, with precision fermentation and alternative protein sources, such as fungal proteins and texturized vegetable proteins, gaining traction. Food safety regulations remain a top priority, ensuring the nutritional composition of plant-based meat alternatives meets consumer expectations. Ingredient sourcing and process optimization are essential for maintaining consistent quality, with microbial fermentation and myofibrillar protein structure optimization playing significant roles. Lipid modification technology and amino acid profile analysis are essential for enhancing taste and texture, while novel protein sources, such as pea protein concentrate, are explored for their unique advantages.

- Consumer acceptance testing and sensory evaluation methods are used to assess the impact of protein denaturation effects on product quality. Furthermore, plant protein extraction techniques, such as algae protein extraction, are advancing to improve supply chain management and reduce reliance on traditional animal agriculture. Shelf-life extension and packaging technology are also critical areas of focus, with 3D printing technology and hydrocolloid functionality playing important roles. Market dynamics continue to shift, with legumes processing, flavor compound analysis, and cellular agriculture emerging as potential game-changers. Quality control metrics, such as color stability studies and meat texture simulation, are essential for ensuring product consistency and meeting consumer demands.

- In the realm of plant-based heme production, advances in this area are improving the taste and nutritional profile of plant-based meat alternatives, making them an increasingly viable option for consumers seeking sustainable protein sources. Overall, the market is a dynamic and evolving landscape, with ongoing innovation driving progress and shaping the future of the industry.

What are the Key Data Covered in this Plant-Based Meat Market Research and Growth Report?

-

What is the expected growth of the Plant-Based Meat Market between 2024 and 2028?

-

USD 27.29 billion, at a CAGR of 36.92%

-

-

What segmentation does the market report cover?

-

The report segmented by Foodservice System (Frozen, Refrigerated, and Shelf-stable), Type (Plant based beef, Plant based chicken, Plant based pork, and Others), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and End User (Retail/Household, Foodservice, and Institutional)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

New product launches, Increasing consumption of animal meat

-

-

Who are the major players in the Plant-Based Meat Market?

-

Key Companies Albertsons Co. Inc, Beyond Meat Inc., Conagra Brands Inc., Ecozone Ltd., Gathered Foods Corp., Green Monday, Hormel Foods Corp., Impossible Foods Inc., Jensen Meat Co., Kellogg Co., Kerry Group Plc, Kroger Co., Maple Leaf Foods Inc., Monde Nissin Corp., Nestle SA, New Wave Foods, The Kraft Heinz Co., The Tofurky Co. Inc., Tyson Foods Inc., and Unilever PLC

-

Market Research Insights

- The market showcases significant growth, with global sales projected to reach USD74.2 billion by 2027, up from USD14.4 billion in 2020. This expansion is driven by the increasing demand for sustainable production methods and clean label ingredients in the food industry. Structural integrity and emulsifying capacity are crucial factors in the development of plant-based meat alternatives. Gel strength measurement and shear stress analysis are essential to ensure the desired texture profile. Sustainability remains a priority, with scale-up challenges being addressed through process efficiency and yield optimization. Sodium reduction strategies and carbon footprint assessment are also key considerations. In terms of functional properties, plant-based meat alternatives exhibit water-holding capacity, viscosity determination, and protein solubility.

- Flavor profiles are enhanced through the use of aroma compounds and nutrient bioavailability is maintained. Packaging materials and color parameters are carefully selected to mimic traditional meat products. The market continues to evolve, with ongoing research focusing on digestibility studies, texture analysis, and sensory attributes. Microbial contamination and fat content reduction are also areas of ongoing investigation.

We can help! Our analysts can customize this plant-based meat market research report to meet your requirements.