Gum Arabic Market Size 2024-2028

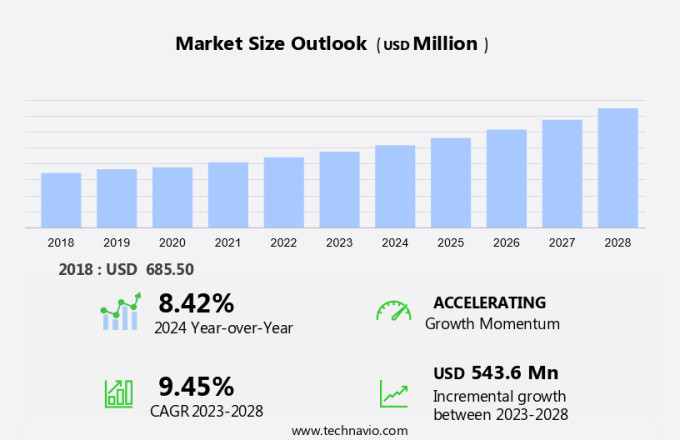

The gum arabic market size is forecast to increase by USD 543.6 million at a CAGR of 9.45% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for natural and clean-label ingredients in the food and beverage industry. This trend is driving the market as consumers are increasingly preferring products with minimal processing and no artificial additives. Additionally, the use of gum arabic in producing plant-based meat alternatives is another growth factor.

However, fluctuations in the availability of gum arabic, primarily due to weather conditions and geopolitical issues, pose a challenge to market stability. Producers must ensure a consistent supply chain to meet the increasing demand and maintain market competitiveness.

Market Analysis

Gum arabic, also known as acacia gum, is a natural hydrocolloid derived from the sap of the Acacia Senegal and Acacia Seyal trees. This gum is primarily composed of glycoproteins and polysaccharides, with a complex structure containing arabinose and galactose units. The natural gum is obtained by making incisions in the bark of the tree and collecting the exudate, which is then purified and dried to produce gum arabic powder. The global market is driven by its extensive applications in various industries. In the food and beverage sector, it is used as a thickening agent, additive, and stabilizer in soft drinks, confectionery, beverages, bakery, and dairy production.

Moreover, in the personal care industry, it functions as an emulsifier, suspending agent, and thickener in cosmetics and toiletries. Gum arabic also finds applications in the pharmaceutical industry as a binder, disintegrant, and tablet coating agent. Moreover, gum arabic is used in nanotechnology for microencapsulating agents and in watercolor paints as a binder and fixative. The versatility of gum arabic is attributed to its unique properties, including its ability to form stable dispersions, provide good film-forming properties, and act as an effective adhesive. The increasing demand for natural ingredients in various industries is expected to fuel the growth of the market in the coming years.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Confectionery

- Beverages

- Bakery

- Pharmaceuticals

- Others

- Source

- Acacia Senegal

- Acacia seyal

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- India

- Middle East and Africa

- South America

- North America

By Application Insights

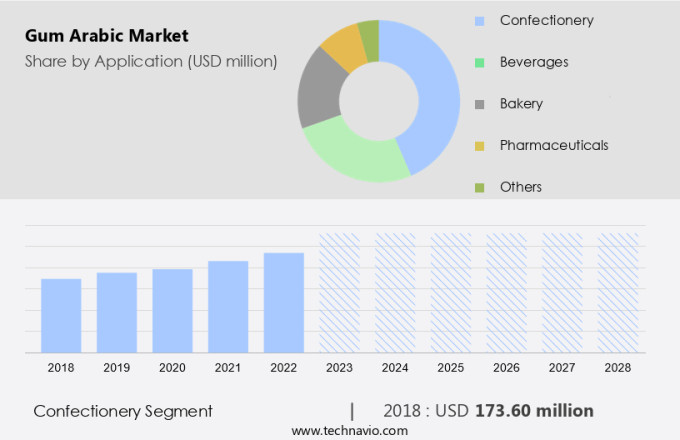

The confectionery segment is estimated to witness significant growth during the forecast period.Gum Arabic, derived from the sap of Acacia Senegal, Seyal, Vachellia, or Senegalia trees, plays a significant role in various industries, including ceramics, printmaking, and the food and beverage sector. In the food industry, it serves as a thickener, stabilizer, and gelling agent in jams, jellies, sauces, and beverages, enhancing texture and viscosity. Its use as a natural additive extends to the dairy production of flavored emulsions, confectionery, and bakery items. In the personal care industry, gum arabic powder functions as a thickener, adhesive, and microencapsulating agent in cosmetics and pharmaceuticals. Regulatory clearance is crucial for its application as a food additive and colorant in liquid products.

Moreover, nanotechnology has led to innovative uses of gum arabic in the production of gels and films, expanding its scope in the food and personal care industries. Gum Arabic's versatility extends to the dairy, food additives, and flavor industries, where it acts as a stabilizer, thickener, and emulsifier in various applications. Its role as a natural ingredient in the production of gums, flavors, and sauces adds to its value in the food industry. In the personal care industry, it is used as a thickener and stabilizer in various personal care products, contributing to their texture and viscosity.

Get a glance at the market share of various segments Request Free Sample

The confectionery segment accounted for USD 173.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Gum Arabic, derived from the sap of Acacia Senegal, Seyal, Vachellia, or Senegalia trees, plays a significant role in various industries, including ceramics, printmaking, and the food and personal care sectors. In the food industry, it serves as a thickener, stabilizer, and gelling agent in jams, jellies, sauces, and beverages, enhancing texture and viscosity. As a food additive, it functions as a colorant, flavor enhancer, and microencapsulating agent in confectionery, bakery, and dairy production. In the personal care industry, gum arabic powder is used as an additive, adhesive, and thickener in cosmetics and pharmaceuticals. Its application in nanotechnology enables the production of flavored emulsions and liquid products, expanding its utility in diverse industries. Regulatory clearance is essential for its use as a food additive and in the production of dairy products, ensuring safety and quality.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Gum Arabic Market Driver

Increasing demand for natural and clean-label ingredients in food and beverages is the key driver of the market. The global market is experiencing significant growth due to the increasing demand for natural and clean-label ingredients in various industries, particularly in food and beverages. Consumers are increasingly preferring natural alternatives to synthetic additives, which have been linked to negative health and environmental impacts. Gum arabic, a natural ingredient derived from the sap of acacia trees, is widely used in the food and beverage industry due to its emulsifying, stabilizing, and viscosity-enhancing properties. Its organic and clean-label status makes it a popular choice for manufacturers producing baked goods, beverages, and confections. By incorporating gum arabic into their products, manufacturers can make health claims and attract health-conscious consumers.

Furthermore, the pharmaceuticals and nutraceuticals industries also utilize gum arabic as an essential emulsifier and stabilizer in their products. Ashland Oil, a leading player in the market, provides high-quality gum arabic solutions to various industries, ensuring product stability and consistency.

Gum Arabic Market Trends

Increasing use of gum arabic in producing plant-based meat alternatives is the upcoming trend in the market. The market is witnessing significant growth due to its increasing usage in the production of food and beverages, particularly in the manufacturing of plant-based meat substitutes. Gum arabic acts as an essential emulsifier and stabilizer in these products, enabling manufacturers to achieve the desired texture and mouthfeel. By stabilizing and emulsifying ingredients, gum arabic enhances the binding ability of water, ensuring that the finished plant-based meat substitutes retain moisture and juiciness.

Moreover, in the pharmaceuticals and nutraceuticals industry, gum arabic is also widely used due to its ability to improve product stability and shelf life. Ashland Oil, a leading gum arabic supplier, highlights the versatility of this natural ingredient, making it a preferred choice for manufacturers seeking to render clean label claims, a growing concern among health-conscious consumers.

Gum Arabic Market Challenge

Fluctuations in availability of gum arabic is a key challenge affecting the market growth. The global market faces challenges due to the unpredictable availability of this natural emulsifier and stabilizer, primarily sourced from Acacia trees in Africa's arid and semi-arid regions, such as Sudan and Chad. Climate change, deforestation, and desertification pose significant threats to the growth and yield of these trees. Droughts, a common issue in these areas, negatively impact the development of acacia trees, leading to a decrease in the global gum arabic supply. Human activities and climate change exacerbate these environmental issues, increasing the risk of overusing acacia trees to meet the growing demand. This overuse can result in environmental degradation and biodiversity loss.

However, in the food and beverages and pharmaceuticals industries, including nutraceuticals and the pharmaceuticals sector, gum arabic is essential as an emulsifier and stabilizer. Its scarcity can hinder the growth and productivity of these industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Agrigum International Ltd. - The company offers gum acacia used in bakery and other vegan products.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Agriculture Processing Co. Ltd.

- Archer Daniels Midland Co.

- Ashland Inc.

- ASIYLA GUM Co. SARL

- Colony Gums Inc.

- Farbest Brands

- Foodchem International Corp.

- Gulf Agency Co. Ltd.

- Gum Arabic Co Nigeria Ltd.

- Hawkins Watts Ltd.

- Ingredion Inc.

- Jumbo Trading Co. Ltd.

- Kerry Group Plc

- Morouj Commodities UK Ltd.

- NEXIRA

- RR Srl

- SOMAR Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Gum arabic, also known as acacia gum, is a natural product derived from the sap of the Acacia Senegal and Acacia Seyal trees. This gum is primarily composed of glycoproteins and polysaccharides, including arabinose and galactose. The gum is typically extracted from the trees through a process of incising the bark and collecting the exudate. Gum arabic has a wide range of applications in various industries. In the food and beverage sector, it is used as a natural emulsifier in soft drinks, pharmaceuticals, personal care industries, chewing gums, watercolour paints, ceramic glazes, rolling papers, and bakery products. It is also used in the baking industry as a soluble gum arabic for confectionary manufacturers.

Moreover, the health benefits of gum arabic are attributed to its high adhesion power, making it an ideal ingredient for various applications. However, the market is facing challenges due to climatic change and political instability in the major producing countries, leading to supply chain disruptions. Chemical manufacturers are exploring synthetic substitutes for gum arabic, but the natural product continues to hold a significant market share due to its unique properties and consumer preference for natural products. The market is expected to grow due to increasing consumer expenditure on packaged food goods, beverages, and pharmaceutical products. The market is also driven by the growing demand for natural products in various industries, including the baking industry, where gum arabic is used as a soluble gum for bakery applications. Syrups, soft drinks, and pharmaceutical products are also significant contributors to the market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 543.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 38% |

|

Key countries |

US, France, UK, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agrigum International Ltd., Alpha Agriculture Processing Co. Ltd., Archer Daniels Midland Co., Ashland Inc., ASIYLA GUM Co. SARL, Colony Gums Inc., Farbest Brands, Foodchem International Corp., Gulf Agency Co. Ltd., Gum Arabic Co Nigeria Ltd., Hawkins Watts Ltd., Ingredion Inc., Jumbo Trading Co. Ltd., Kerry Group Plc, Morouj Commodities UK Ltd., NEXIRA, RR Srl, and SOMAR Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch