India Health Beverages Market Size 2025-2029

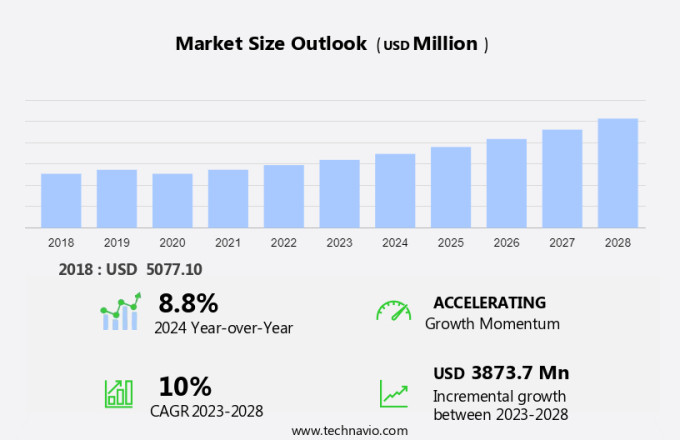

The India health beverages market size is forecast to increase by USD 4.55 billion at a CAGR of 10.6% between 2024 and 2029.

- The India Health Beverages Market is segmented by Distribution Channel (Offline, Online), Product (Packaged Fresh Fruit and Vegetable Juices, Functional Beverages, Nutritional Beverages, Others), Type (Conventional, Organic or Natural), and Geography (APAC: India). This segmentation reflects the market's diversity, driven by rising demand for Organic or Natural Functional Beverages and Packaged Fresh Fruit and Vegetable Juices, with Online channels gaining traction for Nutritional Beverages and Offline channels dominating for Conventional products, catering to health-conscious consumers across India in the APAC region.

- The Indian Health Beverages Market is experiencing significant growth, driven by the increasing urbanization and changing consumer lifestyles. With the rise in disposable income and the shift towards healthier food and beverage options, the demand for health and wellness food (beverages) is on the rise. This trend is further amplified by the growing popularity of e-commerce, making it easier for consumers to access these products from the comfort of their homes. However, the market faces challenges due to fluctuating prices of raw materials, which can impact the profitability of manufacturers.

- Navigating these price fluctuations and maintaining product affordability will be crucial for companies seeking to capitalize on the market's growth opportunities. Effective supply chain management and strategic sourcing of raw materials will be key to mitigating this challenge and ensuring long-term success in the Indian Health Beverages Market.

What will be the size of the India Health Beverages Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The Indian health beverages market is witnessing significant activity and trends, driven by consumer demand for products offering superior health benefits. Quality assurance and innovation pipeline are key focus areas for market players, with companies investing in rigorous testing and research to ensure shelf stability and adhere to hygiene standards. Calorie content and sodium levels are under scrutiny, as consumers seek out beverages with lower sugar and mineral content. Antioxidant properties and vitamin content are also important health claims, driving sales promotions and emerging trends. Retail channels, including supermarkets and online platforms, are expanding their offerings to cater to evolving consumer preferences.

- Environmental impact and sustainability initiatives are also gaining traction, with companies exploring aseptic packaging and corporate social responsibility measures. Flavor profiles and ingredient sourcing are critical factors influencing consumer taste preferences and market competitiveness. Food safety and health benefits remain top priorities, as market research indicates a growing awareness of the importance of these factors. Cold chain logistics and distribution networks are essential for maintaining product quality and ensuring timely delivery. Overall, the Indian health beverages market is dynamic and competitive, with companies continually innovating to meet consumer demands and stay ahead of the curve.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Packaged fresh fruit and vegetable juices

- Functional beverages

- Nutritional beverages

- Others

- Type

- Conventional

- Organic or natural

- Geography

- APAC

- India

- APAC

By Distribution Channel Insights

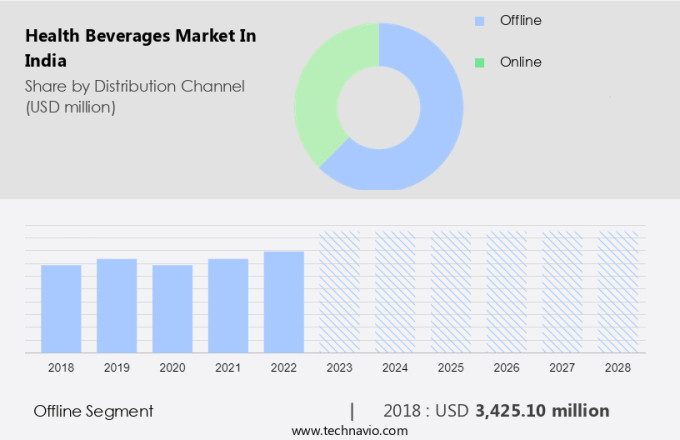

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic Indian beverage market, immunity-boosting drinks, sports drinks, and functional beverages, including turmeric drinks and herbal teas, are gaining popularity among consumers. Companies are leveraging social media marketing to reach their target demographics, primarily health-conscious individuals and those prioritizing lifestyle choices. The FMCG sector is witnessing a surge in demand for these beverages, with brands focusing on value proposition, customer satisfaction, and product differentiation. Coconut water, a natural hydration source, and probiotic drinks are also witnessing a rise in demand. Supply chain management and ingredient traceability are crucial aspects for companies, ensuring ethical sourcing and quality control.

Marketing campaigns, product labeling, and brand awareness are essential to build brand loyalty. Shelf life, pricing strategies, and regulatory compliance are significant factors in the market. E-commerce platforms and retail outlets, including Walmart and Walgreens, are stocking a wide range of health beverages, from fruit juices and vegetable purees to nutritional supplements and aloe vera juice. Packaging materials, carbon footprint, and waste management are becoming increasingly important, with recycling initiatives and eco-friendly practices gaining traction. Consumer preferences for natural sweeteners and minimal processing are driving innovation in the market. Functional beverages, including energy drinks, vitamin fortification, and mineral enrichment, cater to various health needs.

Wellness trends, such as plant-based proteins, dairy alternatives, and weight management drinks, are shaping the market. Companies are focusing on fair trade practices and sustainability to attract consumers. In conclusion, the Indian health beverages market is witnessing a significant transformation, driven by consumer preferences for healthier options, convenience, and innovation. Companies are adapting to these trends by introducing new products, focusing on marketing strategies, and ensuring regulatory compliance.

The Offline segment was valued at USD 3672.00 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The health beverages market size and forecast in India projects robust growth driven by health beverages market trends 2025-2029. B2B health beverage distribution solutions leverage functional beverage innovations in India to meet rising demand. Health beverages market growth opportunities 2025 highlight low-sugar health drinks for consumers and plant-based beverages in India, aligning with wellness trends. Beverage supply chain software optimizes operations, while health beverages market competitive analysis showcases key players. Sustainable health beverage packaging supports eco-friendly beverage trends in India. Health beverage regulations impact 2025-2029 shapes health drink demand in India 2025. Probiotic health drinks in India and organic beverage market insights boost appeal. Health beverages for fitness enthusiasts and customized health drink formulations target niches. Health beverages market challenges and solutions address logistics, with direct sourcing strategies for beverages and health beverage pricing optimization enhancing profitability. Data-driven beverage market analytics and functional wellness drink trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Health Beverages in India Industry?

- The primary factors fueling market growth are the escalating urbanization trends and evolving consumer lifestyles.

- The Indian health beverages market is experiencing significant growth due to several factors. The expanding urban population and rising purchasing power parity are key drivers, with consumers increasingly seeking convenient, on-the-go options for maintaining good health. Lifestyle changes and shifting dietary habits over the past two decades have also played a significant role in market expansion. The market encompasses various categories, including immunity-boosting drinks, sports drinks, turmeric drinks, protein drinks, and coconut water. Social media marketing and effective supply chain management are essential strategies for businesses in this sector. Customer satisfaction is paramount, and companies prioritize quality control, ingredient traceability, and local sourcing.

- Marketing campaigns emphasize the value proposition of these beverages, which cater to the health-conscious population's demands for convenient, nutritious, and natural options. The market's growth is further fueled by the increasing trend of snacking between meals and the need for quick, nutrient-dense beverages. Packaging waste remains a concern, and companies are focusing on sustainable and eco-friendly solutions to address this issue. Herbal extracts and natural ingredients are also gaining popularity, as consumers increasingly prioritize health and wellness.

What are the market trends shaping the Health Beverages in India Industry?

- The e-commerce market is experiencing significant growth and is becoming the latest market trend. This trend is driven by increasing consumer preference for convenience and the widespread availability of high-speed internet.

- The Indian health beverages market is experiencing notable growth due to increasing lifestyle choices that prioritize health consciousness. Functional beverages, including detox drinks, nutritional supplements, and ayurvedic drinks made with natural sweeteners, are gaining popularity. Brands are focusing on product differentiation through unique offerings and longer shelf life. Recycling initiatives and waste management are becoming essential aspects of the industry, with many companies implementing eco-friendly practices. Digtal commerce platforms are expanding distribution networks, making it more convenient for consumers to purchase health beverages online. The availability of a wide range of functional drink brands on these platforms is a significant factor driving sales.

- Health beverages are an attractive online purchase due to their bulk availability, which lowers the price per unit and simplifies shipping. Consumers can easily access product information and enjoy a seamless shopping experience on these platforms. Overall, the market is poised for continued growth, with companies focusing on sustainability, product innovation, and consumer convenience.

What challenges does the Health Beverages in India Industry face during its growth?

- The volatility in the prices of raw materials poses a significant challenge to the industry's growth trajectory.

- The Indian health beverages market incorporates probiotic drinks, vegetable juices, ginger drinks, and energy drinks, among others. Manufacturers source organic ingredients, adhere to ethical sourcing practices, and fortify their products with vitamins and minerals for enhanced health benefits. However, rising raw material prices pose a challenge, as fruits, vegetables, proteins, and other ingredients account for a significant portion of production costs. Unpredictable weather conditions, natural disasters, and supply chain disruptions further complicate matters, hindering the introduction of new product varieties and potentially increasing prices.

- Consumers, in turn, may be deterred from purchasing due to these higher costs, impacting market growth. E-commerce platforms have emerged as a popular distribution channel, enabling greater brand awareness and access to a diverse consumer base. Manufacturers prioritize product labeling transparency and fair trade practices to cater to health-conscious demographics seeking authentic, nutritious beverage options.

Exclusive Customer Landscape

The health beverages market in India forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the health beverages market in India report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, health beverages market in India forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in innovative, scientifically formulated health beverages. Ensure, Glucerna, and PediaSure cater to diverse nutritional needs: adults, diabetes management, and children. These meal replacement and nutritional drinks enhance consumer wellness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- CavinKare Pvt. Ltd.

- Dabur India Ltd.

- Drums Food International Pvt. Ltd.

- Enerzal

- Glanbia plc

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Herbalife International of America Inc.

- ITC Ltd.

- Mars Inc.

- Monster Beverage Corp.

- Mother Dairy Fruit and Vegetable Pvt. Ltd.

- MTR Foods Pvt. Ltd.

- Nestle SA

- PepsiCo Inc.

- Rakyan Beverages Pvt. Ltd.

- Red Bull GmbH

- Tata Consumer Products Ltd.

- The Coca Cola Co.

- Yakult Honsha Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Health Beverages Market In India

- In January 2024, Danone, a leading global food company, announced the launch of its new probiotic beverage, Actimel, in India. This entry marked Danone's expansion into the Indian health beverages market, aiming to cater to the growing demand for functional and nutritious drinks (Danone Press Release, 2024).

- In March 2024, Amul, an Indian dairy cooperative, partnered with Ionix Probiotics & Nutraceuticals to launch a range of probiotic beverages. This collaboration aimed to leverage Ionix's expertise in probiotic technology and Amul's strong market presence (Amul Press Release, 2024).

- In July 2024, PepsiCo's Quaker Oats India received regulatory approval for its new plant-based protein beverage, Quaker Protein Plus. This approval marked the company's entry into the rapidly growing plant-based beverages segment in India (PepsiCo India Press Release, 2024).

- In May 2025, HUL (Hindustan Unilever), India's largest consumer goods company, announced a strategic investment of INR 2,000 crores in its beverages business. This investment was aimed at expanding its production capacity and strengthening its position in the health beverages market (HUL Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by shifting consumer preferences towards healthier lifestyle choices and increasing health consciousness. The FMCG sector's dynamic nature is reflected in the ongoing unfolding of market activities, with a focus on immunity-boosting drinks, sports drinks, and turmeric drinks. Packaging waste management and recycling initiatives are essential considerations for brands seeking to enhance their value proposition and build customer loyalty. Natural sweeteners, herbal extracts, and local sourcing are key trends in the market, as consumers seek out products with ethical sourcing and ingredient traceability. Quality control and regulatory compliance are crucial elements of supply chain management, ensuring the delivery of safe and effective products.

Marketing campaigns for health beverages leverage social media platforms and e-commerce channels to reach consumers. Functional beverages, such as probiotic drinks and plant-based protein options, are gaining popularity, as are detox drinks and nutritional supplements. Retail outlets, from supermarkets to specialty stores, play a significant role in the distribution of health beverages. Brands must adapt to changing consumer preferences and pricing strategies to remain competitive. Sustainability initiatives, such as water usage reduction and carbon footprint minimization, are essential for long-term success. Wellness trends, such as mineral enrichment and vitamin fortification, are driving innovation in the market.

Brands must stay attuned to evolving consumer preferences and adapt quickly to remain competitive. The market's continuous dynamism is reflected in the emergence of new product categories, such as weight management drinks and vegetable purees, and the growing popularity of dairy alternatives and organic ingredients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Health Beverages Market in India insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.6% |

|

Market growth 2025-2029 |

USD 4547.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.3 |

|

Key countries |

India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Health Beverages Market in India Research and Growth Report?

- CAGR of the Health Beverages in India industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the health beverages market in India growth of industry companies

We can help! Our analysts can customize this health beverages market in India research report to meet your requirements.