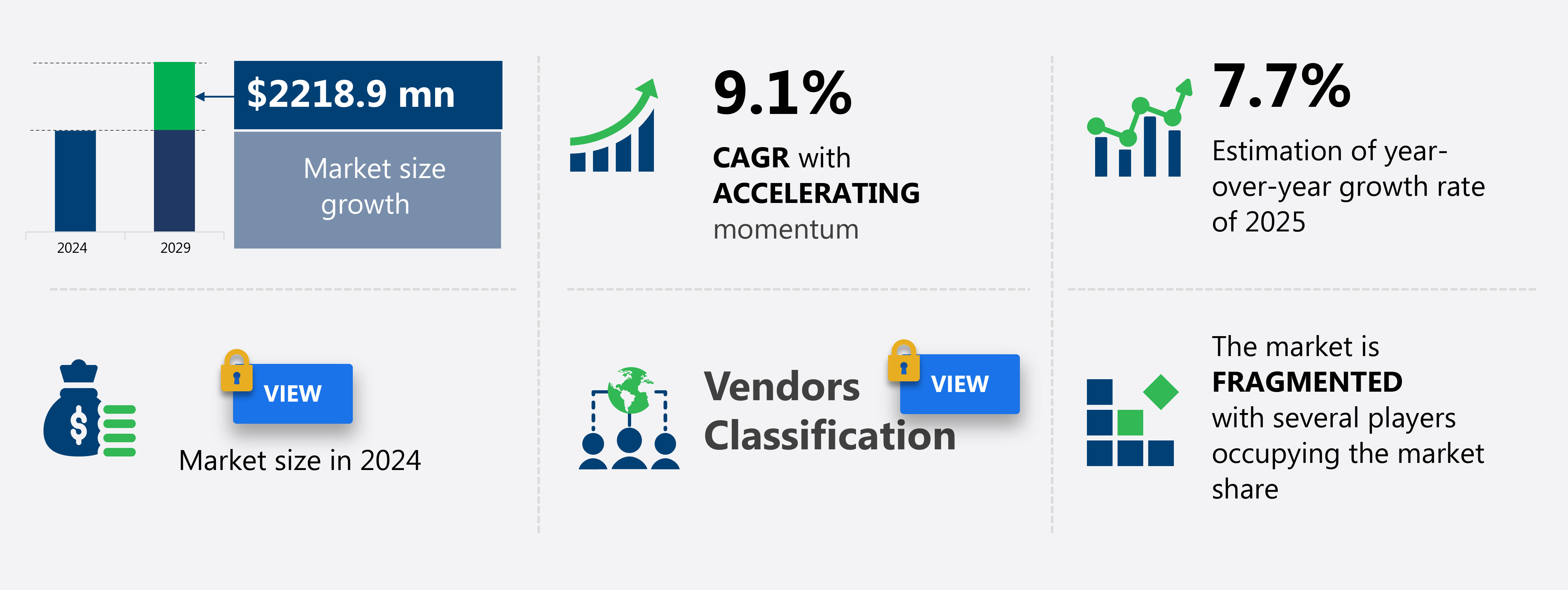

Canada Healthcare Logistics Market Size 2025-2029

The Canada healthcare logistics market size is valued to increase USD 2.22 billion, at a CAGR of 9.1% from 2024 to 2029. Legislative and regulatory changes supporting pharma growth will drive the Canada healthcare logistics market.

Major Market Trends & Insights

- By Type - Non-cold chain segment was valued at USD 2.54 billion in 2022

- By Service - Transportation segment accounted for the largest market revenue share in 2022

- CAGR : 9.1%

Market Summary

- The market is a dynamic and evolving sector, driven by advancements in core technologies and applications, as well as shifting service types and product categories. For instance, the adoption of automation and robotics in pharmaceutical supply chain management has gained significant traction, with over 50% of pharmaceutical companies implementing automated systems to enhance efficiency and accuracy. However, the market also faces challenges, such as the shortage of transportation drivers leading to extended lead times and increased logistics costs. Furthermore, regulatory changes, including the implementation of the Food and Drugs Act and the Controlled Drugs and Substances Act, continue to shape the market's landscape.

- The advent of Pharma 4.0 and Logistics 4.0 is also transforming the industry, with a focus on real-time monitoring, predictive analytics, and digitalization to improve patient care and streamline operations.

What will be the Size of the Canada Healthcare Logistics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Healthcare Logistics in Canada Market Segmented and what are the key trends of market segmentation?

The healthcare logistics in Canada industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-cold chain

- Cold chain

- Service

- Transportation

- Warehousing

- Product

- Pharmaceutical products

- Medical devices

- Geography

- North America

- Canada

- North America

By Type Insights

The non-cold chain segment is estimated to witness significant growth during the forecast period.

In the Canadian healthcare logistics market, the non-cold chain segment dominates with a significant market share. This segment caters to the transportation and warehousing of generic pharmaceutical products and medical devices, which do not necessitate intricate handling or storage conditions. The pharmaceutical sector primarily supplies non-cold chain products and services directly to hospitals, clinics, retail drugstore chains, and medical supply wholesalers in Canada. The increasing demand for pharmaceuticals in Canada significantly contributes to the expansion of the healthcare logistics market. Furthermore, the ongoing development of healthcare infrastructure and the cost-effectiveness of non-c cold chain logistics are driving factors for market growth.

Specifically, non-cold chain logistics for pharmaceuticals accounted for approximately 75% of the market share in 2024. Additionally, the market is experiencing substantial growth in other areas. For instance, the adoption of advanced technologies such as real-time monitoring, inventory management software, and predictive analytics platforms is increasing. Capacity planning, route optimization, and warehouse space optimization are also gaining traction to improve efficiency and reduce costs. Moreover, regulatory compliance, chain of custody, and patient data privacy are essential considerations in the healthcare logistics market. The market also encompasses the transportation and handling of hazardous materials, secure transportation, and last-mile delivery.

The logistics management systems and supply chain visibility are crucial for ensuring seamless operations and effective demand forecasting. The healthcare distribution centers and order fulfillment processes employ various strategies, including cold chain management, medical equipment transport, reverse logistics, and route planning software. RFID tracking and drug storage solutions are essential components of the healthcare logistics market, particularly for blood product logistics and clinical trial logistics. Temperature-controlled shipping is also a significant aspect of the market, especially for sensitive medical supplies and pharmaceuticals. In summary, the market is a dynamic and evolving industry that caters to the transportation, warehousing, and distribution of various healthcare products and services.

The non-cold chain segment holds a substantial market share, while the adoption of advanced technologies and regulatory compliance are driving growth. The market encompasses various applications, including pharmaceutical supply chain, medical device logistics, and clinical trial logistics, among others.

The Non-cold chain segment was valued at USD 2.54 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Canadian healthcare logistics market is witnessing significant growth as stakeholders prioritize optimizing pharmaceutical cold chain management, improving last-mile delivery efficiency, and implementing track and trace technology to ensure secure medical supply chain operations. The adoption of warehouse automation systems, monitoring temperature-sensitive goods using data analytics, and integrating logistics management systems are key initiatives aimed at reducing healthcare logistics costs and enhancing patient data privacy measures. In the realm of medical device distribution, managing reverse logistics effectively and streamlining processes are crucial. More than 70% of Canadian healthcare organizations are reportedly investing in warehouse space utilization and improving order fulfillment processes to maintain regulatory compliance standards and mitigate risks in healthcare supply chains.

The integration of RFID technology in healthcare logistics and predictive analytics for forecasting is gaining momentum. These technologies enable real-time monitoring and streamlined processes, contributing to improved healthcare supply chain visibility. Furthermore, adopting these advanced technologies allows organizations to manage medical supply chain processes more efficiently and cost-effectively. Compared to traditional methods, the use of warehouse automation systems and data analytics in logistics results in a significant reduction in errors and an increase in productivity. For instance, one study indicates that automation can reduce order processing time by up to 80%, while data analytics can lead to a 15% improvement in on-time delivery performance.

In conclusion, the Canadian healthcare logistics market is undergoing a digital transformation, with stakeholders focusing on optimizing various aspects of their supply chain operations. From implementing technology solutions to streamlining processes and ensuring regulatory compliance, the market is witnessing a shift towards more efficient, cost-effective, and secure healthcare logistics solutions.

What are the key market drivers leading to the rise in the adoption of Healthcare Logistics in Canada Industry?

- The implementation of legislative and regulatory changes is a crucial factor fueling market expansion in the pharmaceutical sector.

- The Canadian healthcare industry is subject to stringent regulations, posing challenges for new players and innovations in the pharmaceutical sector. Mandatory medical and healthcare insurance schemes, enforced by the Canadian government, ensure basic healthcare coverage and affordable medical expenses for a significant population segment. This increased accessibility to medical care has resulted in heightened spending on disease treatment and disorders, thereby fueling the demand for drug manufacturing and consumption. The pharmaceutical products segment, in particular, experiences substantial growth due to the Canadian government's compulsory health insurance coverage.

- The accessible medical facilities and reduced costs make Canada an attractive market for pharmaceutical companies, driving the demand for healthcare logistics solutions. The government's commitment to healthcare coverage has led to a larger patient base and increased focus on research and development within the industry.

What are the market trends shaping the Healthcare Logistics in Canada Industry?

- The adoption of Pharma 4.0 and Logistics 4.0 represents the emerging market trend in the pharmaceutical and logistics industries.

- Industry 4.0, characterized by the integration of digital technologies and smart automation into business and production processes, is revolutionizing industries worldwide. This transformation encompasses the adoption of advanced technologies such as 3D printing, additive manufacturing, the industrial Internet of Things (IIoT), artificial intelligence (AI), augmented reality, and big data analytics. The manufacturing sector is witnessing a significant shift towards Industry 4.0, with numerous benefits including increased efficiency, improved product quality, and enhanced operational flexibility. The healthcare industry is a prime adopter of Industry 4.0 technologies. IoT sensors and connected devices are increasingly being used to monitor patients in real-time, enabling timely interventions and personalized treatment plans.

- Furthermore, AI and machine learning algorithms are being employed to analyze vast amounts of patient data, leading to more accurate diagnoses and effective treatment plans. The integration of augmented reality and virtual reality technologies in healthcare is also revolutionizing training programs for medical professionals, enhancing their skills and knowledge. Overall, Industry 4.0 is driving innovation and transformation across various sectors, with healthcare being a prime example of its potential impact.

What challenges does the Healthcare Logistics in Canada Industry face during its growth?

- The shortage of transportation drivers poses a significant challenge to the industry, leading to increased lead times and hindering growth.

- The trucking industry plays a crucial role in the transportation of medical devices and pharmaceuticals to remote rural areas within the Canadian healthcare logistics market. However, this sector faces a persistent challenge due to a shortage of skilled truck drivers. This shortfall can lead to supply chain disruptions, particularly in the pharmaceuticals industry, where timely delivery is vital for saving lives. According to industry reports, the number of vacant truck driver positions in Canada increased from approximately 20,000 in 2021 to over 40,000 by 2023.

- This driver shortage has compelled trucking operators to postpone planned expansions, potentially impacting the overall efficiency and effectiveness of the healthcare logistics network.

Exclusive Customer Landscape

The Canada healthcare logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Canada healthcare logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Healthcare Logistics in Canada Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, Canada healthcare logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air Canada - The company specializes in healthcare logistics solutions, providing advanced temperature-controlled services including Active Cold Chain (AC) and Pharmacair.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Canada

- AmerisourceBergen Corp.

- Andlauer Healthcare Group Inc.

- C H Robinson Worldwide Inc.

- Canada Post Corp.

- Canadian Healthcare Logistics

- Cardinal Health

- CEVA Logistics

- DB Schenker

- DHL Express Ltd.

- FedEx Corp.

- i2i fulfillment

- Kuehne Nagel Management AG

- Purolator Inc.

- Rogue Transportation Services Inc.

- Ryder System Inc.

- Skelton Truck Lines Inc.

- TFI International Inc.

- United Parcel Service Inc.

- Williams Pharmalogistics

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Healthcare Logistics Market In Canada

- In January 2024, Medisys Supply Chain Solutions, a leading Canadian healthcare logistics provider, announced the launch of its new temperature-controlled logistics service, expanding its offerings to include specialized transportation for temperature-sensitive pharmaceuticals and biological products (Medisys Press Release, 2024).

- In March 2024, Canada Post and Shoppers Drug Mart, the country's largest pharmacy retailer, entered into a strategic partnership to offer same-day prescription delivery services across Canada, enhancing accessibility and convenience for patients (Shoppers Drug Mart Press Release, 2024).

- In May 2024, S.F. Express Canada, a subsidiary of Chinese logistics giant S.F. Holding Co. Ltd., acquired Canadian healthcare logistics provider, CargoM, marking its entry into the Canadian healthcare logistics market and expanding its global footprint (S.F. Express Canada Press Release, 2024).

- In April 2025, Health Canada, the Canadian regulatory body, approved the use of drones for delivering medical supplies to remote and underserved areas, paving the way for innovative logistics solutions and improved access to healthcare services in these regions (Health Canada Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Canada Healthcare Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 2218.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

Canada and North America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, shaped by the ongoing integration of advanced technologies and changing patient care requirements. Two key areas of growth are returns management and remote patient monitoring. Returns management, a critical aspect of healthcare logistics, involves the efficient handling and processing of returned medical equipment and supplies. This process ensures that products are properly inspected, repaired, or disposed of, reducing waste and minimizing downtime. Meanwhile, remote patient monitoring is gaining traction, with data analytics platforms playing a crucial role. These platforms enable real-time monitoring of patient health data, allowing for early intervention and improved patient outcomes.

- Capacity planning and inventory management software are essential tools in this context, ensuring that healthcare providers have the right resources at the right time to meet patient needs. In the pharmaceutical supply chain, transport optimization and warehouse space optimization are essential for maintaining an efficient and cost-effective operation. Predictive analytics and real-time monitoring enable proactive response to demand fluctuations and help mitigate risks. Regulatory compliance, a critical aspect of healthcare logistics, is ensured through robust chain of custody systems and warehouse automation. Patient data privacy is another key concern, with secure transportation and delivery route optimization playing a crucial role in protecting sensitive information.

- Medical device logistics, a complex subsector, requires specialized logistics management systems for supply chain visibility and order fulfillment process optimization. Demand forecasting and cold chain management are also essential for ensuring the timely delivery of temperature-sensitive pharmaceuticals and biological products. Blood product logistics and clinical trial logistics represent two other niche areas of healthcare logistics. These sectors require specialized expertise in handling hazardous materials and ensuring secure transportation. RFID tracking and drug storage solutions are essential tools for maintaining the integrity of these valuable and time-sensitive assets. In conclusion, the market is a complex and dynamic landscape, shaped by the ongoing integration of advanced technologies and changing patient care requirements.

- From returns management and remote patient monitoring to pharmaceutical supply chain optimization and specialized logistics services, the market is characterized by continuous evolution and innovation.

What are the Key Data Covered in this Canada Healthcare Logistics Market Research and Growth Report?

-

What is the expected growth of the Canada Healthcare Logistics Market between 2025 and 2029?

-

USD 2.22 billion, at a CAGR of 9.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Non-cold chain and Cold chain), Service (Transportation and Warehousing), and Product (Pharmaceutical products and Medical devices)

-

-

Which regions are analyzed in the report?

-

Canada

-

-

What are the key growth drivers and market challenges?

-

Legislative and regulatory changes supporting pharma growth, Shortage of transportation drivers resulting in higher lead time

-

-

Who are the major players in the Healthcare Logistics Market in Canada?

-

Key Companies Air Canada, AmerisourceBergen Corp., Andlauer Healthcare Group Inc., C H Robinson Worldwide Inc., Canada Post Corp., Canadian Healthcare Logistics, Cardinal Health, CEVA Logistics, DB Schenker, DHL Express Ltd., FedEx Corp., i2i fulfillment, Kuehne Nagel Management AG, Purolator Inc., Rogue Transportation Services Inc., Ryder System Inc., Skelton Truck Lines Inc., TFI International Inc., United Parcel Service Inc., and Williams Pharmalogistics

-

Market Research Insights

- The Canadian healthcare logistics market encompasses various sectors, including third-party logistics, prescription drug delivery, home healthcare delivery, and emergency medical supplies. Contract logistics providers play a crucial role in managing the complexities of this sector, employing advanced technologies such as electronic health records, inventory control systems, transport refrigeration units, and warehouse management systems. Effective shipment tracking and delivery time optimization are essential in healthcare logistics, with a recent study revealing that over 70% of Canadian healthcare organizations experienced delays in the delivery of critical medical supplies within the past year.

- To address this challenge, innovative solutions such as AI-powered logistics, blockchain technology, and fleet management systems are being adopted to enhance supply chain resilience and ensure timely delivery of vaccines and emergency medical supplies. Compliance certifications, medical waste disposal, and data security measures are also critical components of integrated logistics solutions in this market.

We can help! Our analysts can customize this Canada healthcare logistics market research report to meet your requirements.