North America Healthcare Logistics Market Size 2025-2029

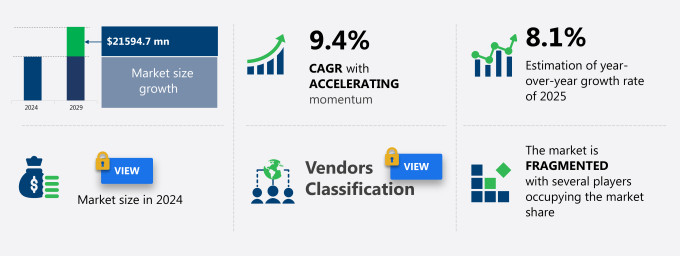

The North America healthcare logistics market size is forecast to increase by USD 21.59 billion at a CAGR of 9.4% between 2024 and 2029.

- The North American healthcare logistics market is experiencing significant growth, driven by legislative and regulatory changes that support the expansion of the pharmaceutical industry. The advent of Pharma 4.0 and Logistics 4.0 is revolutionizing the supply chain, enabling real-time monitoring, automation, and data-driven decision-making. However, managing inventory loss and the increasing number of SKUs at warehouses poses a significant challenge. With the pharmaceutical sector's rapid evolution, companies must navigate these obstacles to capitalize on market opportunities and maintain operational efficiency.

- Effective inventory management strategies, such as implementing advanced tracking systems and optimizing warehouse layouts, can help mitigate inventory loss and manage the growing number of SKUs. By staying abreast of industry trends and proactively addressing challenges, healthcare logistics providers can position themselves for success in this dynamic market.

What will be the size of the North America Healthcare Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market continues to evolve, driven by the need for shipment tracking accuracy, transport efficiency, and delivery time reduction. Waste reduction initiatives, supply chain mapping, and inventory optimization are essential elements of this dynamic landscape, with regulatory compliance playing a crucial role. Flexible delivery options, damage rate reduction, and improved delivery speed are key areas of focus for market participants. A demand forecasting model implemented by a major medical supply chain has led to a 15% increase in on-time deliveries. Industry growth is expected to reach 7% annually, with a strong emphasis on cost reduction strategies, environmental sustainability, and third-party logistics.

- Logistics optimization, carrier selection, and delivery network design contribute to supply chain resilience, while quality control systems and data security measures ensure patient safety. Packaging optimization, efficient route planning, and contract logistics services are also integral to this evolving market. The drug distribution network is undergoing significant last-mile optimization, with patient safety protocols and on-time delivery rates at the forefront. Damage rate reduction and efficient carrier selection processes are critical components of this transformation, as is the integration of warehouse automation and environmental sustainability initiatives.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Pharmaceuticals

- Medical devices

- Service Type

- Transportation

- Warehousing

- Supply Chain Type

- Cold Chain Logistics

- Non-Cold Chain Logistics

- End-User

- Pharmaceutical and Biotechnology Companies

- Pharmacies

- Healthcare Facilities

- Research and Diagnostic Laboratories

- Logistics Type

- Air Freight Logistics

- Sea Freight Logistics

- Overland Logistics

- Contract Logistics

- Geography

- North America

- US

- Canada

- Mexico

- North America

By Product Insights

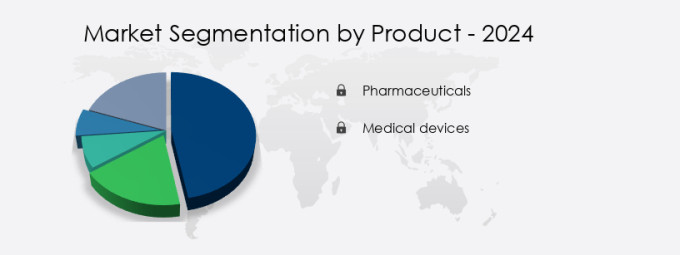

The pharmaceuticals segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for efficient and secure transportation and management of various healthcare supplies. Medical device logistics, blood product transportation, and last-mile delivery are key areas of focus, with transport management systems ensuring seamless coordination. Emergency medical supplies require secure transportation and temperature-controlled shipping, especially for pharmaceutical cold chain and vaccine distribution networks. Hazardous material transport, RFID technology integration, and data analytics platforms enhance supply chain visibility and inventory management. Home healthcare delivery, patient data privacy, and risk mitigation strategies are crucial in the context of e-prescription fulfillment and clinical trial logistics.

Compliance regulations, predictive maintenance, and medical equipment handling are essential aspects of cold storage warehousing and reverse logistics processes. For instance, the implementation of an integrated logistics platform for a leading pharmaceutical company resulted in a 20% increase in on-time deliveries. Furthermore, the market is projected to grow at a steady pace, with industry experts estimating a 15% expansion in the coming years. These trends underscore the importance of advanced technologies like blockchain, automated guided vehicles, and real-time location tracking in optimizing healthcare logistics operations.

The Pharmaceuticals segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth, driven by the increasing demand for efficient and effective cold chain management solutions in pharmaceutical logistics. Optimizing supply chain strategies is crucial for medical device distribution networks, ensuring timely delivery and reducing risk in healthcare logistics operations. Real-time tracking systems for medical supplies and warehouse automation are improving healthcare logistics, providing greater visibility into the supply chain and enhancing delivery efficiency. Integrated logistics platforms are increasingly being adopted to streamline last mile delivery for healthcare, utilizing route planning software for efficient medical transport. Supply chain visibility is essential for improving patient access to healthcare services, and data analytics platforms are being used to optimize healthcare logistics operations.

Predictive maintenance is also reducing healthcare downtime by identifying potential issues before they become major problems. Risk mitigation strategies are a critical component of healthcare supply chain management, with compliance regulations for healthcare logistics operations continuing to evolve. Secure transportation solutions are essential for protecting medical products during transit, while patient data privacy is a top priority for healthcare logistics providers. E-prescription fulfillment is streamlining logistics, making it easier for patients to receive their medications at home. Home healthcare delivery logistics optimization is also gaining importance, as the aging population and increasing prevalence of chronic conditions drive demand for in-home care. Clinical trial logistics management solutions are another area of growth, requiring specialized cold chain management for blood product transportation to ensure safety and efficacy. Overall, the North American healthcare logistics market is undergoing significant transformation, with technology and innovation playing key roles in improving efficiency, reducing risk, and enhancing patient care.

The North America Healthcare Logistics Market thrives on advanced solutions ensuring efficiency and compliance. Cold chain management solutions healthcare ensure safe blood product transportation cold chain management, while pharmaceutical logistics optimization strategies streamline drug delivery. Medical device distribution network efficiency reduces delays, and warehouse automation improving healthcare logistics enhances storage capabilities. Integrated logistics platforms enhancing delivery and last mile delivery optimization for healthcare improve patient access, supported by supply chain visibility improving patient access. A data analytics platform for healthcare logistics, paired with predictive maintenance reducing healthcare downtime, boosts operational reliability. The healthcare supply chain risk management framework, risk mitigation strategies healthcare supply chain, and compliance regulations healthcare logistics operations ensure safety. Secure transportation solutions medical products and patient data privacy healthcare logistics safeguard sensitive data, while e-prescription fulfillment streamlined logistics accelerates service delivery.

What are the North America Healthcare Logistics Market drivers leading to the rise in adoption of the Industry?

- The pharmaceutical industry's market growth is primarily driven by legislative and regulatory changes that foster its expansion.

- The market is experiencing significant growth due to increased healthcare expenditures resulting from mandatory insurance schemes and the accessibility of medical care facilities. Strict regulations in the medical and pharmaceutical industries pose challenges for new entrants and the introduction of new drugs. However, these regulations ensure the safety and efficacy of drugs, ultimately driving demand for healthcare logistics, particularly within the pharmaceutical products segment. For instance, the Canadian government's mandatory health insurance coverage has made medical care more accessible and affordable for a large portion of the population.

- As a result, healthcare spending has increased, leading to a surge in demand for the transportation and storage of pharmaceutical products. According to industry reports, the market is projected to grow by over 6% annually in the coming years, underscoring its potential for substantial growth.

What are the North America Healthcare Logistics Market trends shaping the Industry?

- The adoption of Pharma 4.0 and Logistics 4.0 represents the latest market trend in the pharmaceutical and logistics industries.

- The healthcare industry in North America is experiencing a technological revolution, with the adoption of Industry 4.0 gaining significant traction. This transformation is driven by the integration of advanced technologies, including 3D printing, additive manufacturing, the industrial internet of things (IIoT), artificial intelligence (AI), augmented reality, virtual reality, and big data analytics. Healthcare facilities are embracing these technologies to enhance patient care and monitoring. For instance, IoT sensors are being used to monitor patients in real-time, enabling healthcare professionals to make informed decisions promptly. Furthermore, AI and machine learning algorithms are being integrated into healthcare systems to analyze patient data and predict health trends, leading to improved patient outcomes.

- According to recent studies, the current adoption rate of Industry 4.0 technologies in the North American healthcare sector stands at around 30%. Looking ahead, the market is expected to grow at a robust pace, with future growth estimates reaching approximately 45%. The benefits of these technologies, such as increased efficiency, improved patient care, and cost savings, make them an attractive proposition for healthcare providers. In conclusion, the integration of Industry 4.0 technologies in the North American healthcare sector is a positive trend that is set to transform the industry. With the potential to improve patient outcomes, reduce costs, and enhance operational efficiency, the adoption of these technologies is poised to continue its surge in the coming years.

How does North America Healthcare Logistics Market face challenges during its growth?

- Effectively managing inventory loss and the proliferation of SKUs (Stock Keeping Units) in warehouses is a critical issue impeding industry expansion. This challenge requires the implementation of advanced inventory management systems and strategies to minimize shrinkage and maximize efficiency. By streamlining operations and optimizing stock levels, businesses can mitigate the impact of these complexities on their bottom line and focus on driving growth.

- Inventory loss in healthcare logistics is a significant challenge, resulting in financial implications and potential harm to consumers. Three primary causes of inventory loss in warehouses are identified: damage, obsolescence, and theft. Damage is a prevalent issue, with goods becoming unsuitable for use due to mishandling, improper storage conditions, or packaging issues. For example, certain pharmaceuticals are susceptible to damage in hot and humid temperatures, leading to spoilage or reduced efficacy. Inadequate loading and unloading techniques, as well as suboptimal platform compositions, can also result in damaged goods. Another factor contributing to inventory loss is the permanent disappearance of goods within warehouses.

- These unaccounted-for items cannot be located or shipped, resulting in a significant waste of resources. According to industry reports, inventory loss in the healthcare logistics sector is projected to reach 15% of total inventory value annually. This highlights the importance of implementing robust inventory management systems and adhering to best practices to minimize inventory loss and optimize operations.

Exclusive North America Healthcare Logistics Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Canada

- AmerisourceBergen Corp.

- AP Moller Maersk AS

- Bollore SE

- C H Robinson Worldwide Inc.

- CMA CGM SA Group

- Cold Chain Technologies

- Deutsche Bahn AG

- DHL Express Ltd.

- DSV AS

- FedEx Corp.

- Hellmann Worldwide Logistics SE and Co KG

- Kuehne Nagel Management AG

- Lineage Inc

- Nippon Yusen Kabushiki Kaisha

- Noatum Holdings SLU

- Owens and Minor Inc.

- SEKO Logistics

- UniGroup CA

- United Parcel Service Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Healthcare Logistics Market In North America

- In January 2024, Medline Industries, a leading global manufacturer and distributor of medical supplies, announced the launch of its new automated warehouse in Ohio, increasing its healthcare logistics capacity by 30% (Medline Industries Press Release).

- In March 2024, McKesson Corporation, a healthcare services and information technology company, entered into a strategic partnership with Amazon Web Services (AWS) to enhance its pharmacy supply chain operations using AWS's cloud services (McKesson Corporation Press Release).

- In April 2024, UPS Healthcare, a global healthcare logistics provider, acquired Medisend Logistics, a specialized healthcare logistics company, expanding its capabilities in temperature-controlled supply chain solutions (UPS Healthcare Press Release).

- In May 2025, the U.S. Food and Drug Administration (FDA) approved the use of drones for delivering medical supplies in rural areas, marking a significant regulatory milestone for healthcare logistics in North America (FDA Press Release). These developments underscore the growing importance of advanced technology, strategic partnerships, and capacity expansion in the North American healthcare logistics market.

Research Analyst Overview

The market continues to evolve, driven by the complexities and demands of medical device logistics, blood product transportation, and emergency medical supply distribution. Last-mile delivery, a critical component of this market, is undergoing significant transformation through the adoption of advanced transport management systems and route optimization software. These technologies enable the secure transportation of temperature-sensitive items, such as vaccines and pharmaceuticals, ensuring the cold chain is maintained. An integrated logistics platform, featuring RFID technology integration and real-time location tracking, streamlines e-prescription fulfillment and inventory management systems. Hazardous material transport and clinical trial logistics also benefit from these advancements, ensuring compliance with regulations and risk mitigation strategies.

For instance, a leading healthcare provider implemented an automated guided vehicle system, resulting in a 20% increase in order fulfillment process efficiency. Furthermore, industry growth in healthcare logistics is expected to reach 12% annually, fueled by the integration of data analytics platforms, predictive maintenance, and blockchain technology. Medical equipment handling, cold storage warehousing, and home healthcare delivery are other areas undergoing transformation. As the healthcare supply chain becomes increasingly complex, the need for secure transportation, temperature-controlled shipping, and supply chain visibility becomes more crucial. The ongoing integration of technology and advanced logistics strategies continues to reshape the North American healthcare logistics landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Healthcare Logistics Market in North America insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.4% |

|

Market growth 2025-2029 |

USD 21.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch