HVAC Sensors Market Size 2024-2028

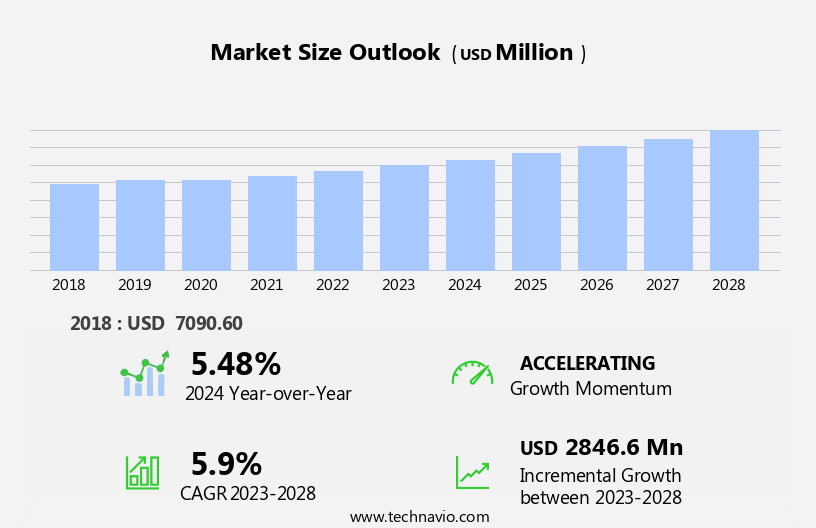

The hvac sensors market size is forecast to increase by USD 2.85 billion at a CAGR of 5.9% between 2023 and 2028.

What will be the Size of the HVAC Sensors Market During the Forecast Period?

How is this HVAC Sensors Industry segmented and which is the largest segment?

The hvac sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Residential

- Commercial

- Industrial

- Type

- Temperature sensors

- Humidity sensors

- Pressure sensors

- Air quality sensors

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

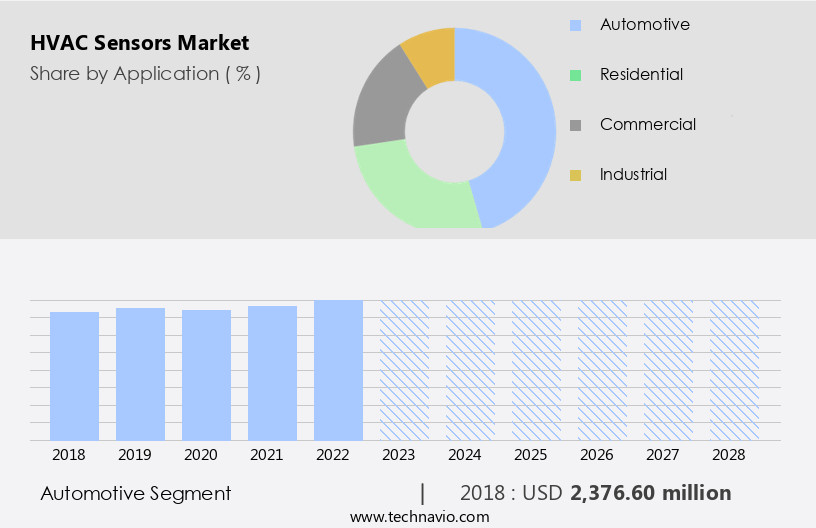

By Application Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

The market encompasses various applications, including industrial, residential, and commercial buildings, as well as automotive. In the automotive sector, the increasing adoption of advanced temperature control systems, such as solar load and carbon dioxide sensors, drives market growth. Despite a slower growth rate compared to other sectors, the automotive segment continues to contribute significantly due to the widespread use of HVAC systems in passenger cars. In buildings, HVAC sensors play a crucial role in maintaining thermal comfort, energy efficiency, and indoor air quality. Advanced technologies, such as automation software, IoT platforms, and remote monitoring, are transforming HVAC systems in industrial, residential, and commercial applications.

Key applications include space heating, cooling systems, ventilation control, humidity control, and air filtration. The integration of machine learning capabilities, energy management systems, and networked devices further enhances the functionality and efficiency of HVAC systems. The market is expected to grow significantly due to the increasing focus on energy-efficient buildings, urbanization, and the adoption of smart building technology.

Get a glance at the HVAC Sensors Industry report of share of various segments Request Free Sample

The Automotive segment was valued at USD 2.38 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

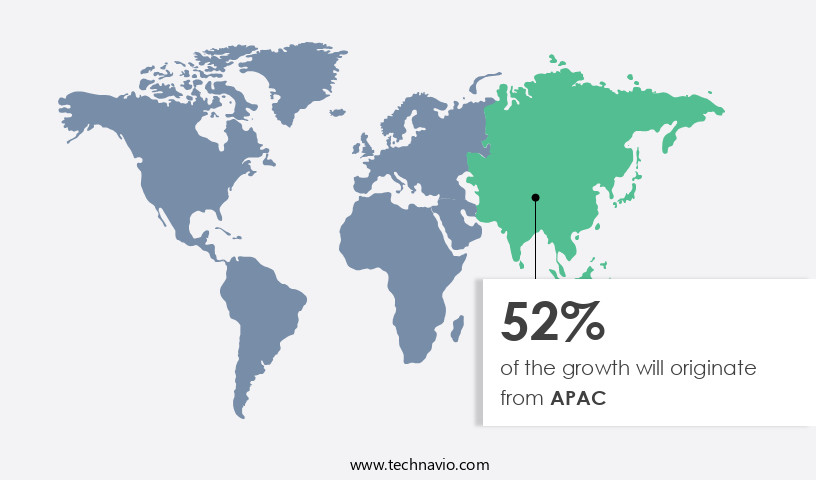

- APAC is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to increasing awareness of energy-efficient systems and the expanding construction industry. Countries like China, Japan, and South Korea are key contributors to this market, with a focus on advanced HVAC technologies. Urbanization and infrastructure development in India, Singapore, Taiwan, and South Korea are driving demand for HVAC systems and sensors. These regions attract investment from multinational companies in technology and healthcare sectors. HVAC sensors are essential components of energy-efficient HVAC systems, providing data on temperature, humidity, air pressure, and other environmental factors. The adoption of these sensors contributes to energy management, thermal comfort, and indoor air quality.

The revenue growth In the APAC the market is attributed to the increasing demand for IoT-connected devices, automation software, and networked sensors. HVAC sensors are also used in industrial, residential, and commercial buildings, as well as in automotive applications, medical and consumer electronics, and HVAC monitoring systems. Energy efficiency, carbon dioxide emissions reduction, and indoor climate control are key considerations In the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of HVAC Sensors Industry?

Advances in temperature sensors is the key driver of the market.

What are the market trends shaping the HVAC Sensors Industry?

Increasing focus on integrated building management systems is the upcoming market trend.

What challenges does the HVAC Sensors Industry face during its growth?

Cybersecurity issues in HVAC control systems is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The hvac sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hvac sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hvac sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - The market encompasses advanced technologies that optimize heating, ventilation, and air conditioning systems in various industries. These sensors enable efficient energy management, improved indoor air quality, and enhanced system performance. They measure parameters such as temperature, humidity, pressure, and occupancy to ensure optimal comfort and productivity. Market growth is driven by increasing energy efficiency regulations, rising demand for smart buildings, and the integration of IoT technologies. The market is expected to witness significant expansion due to these factors, providing opportunities for innovation and growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- All Sensors Corp.

- Amphenol Advanced Sensors

- Emerson Electric Co.

- ES Systems

- Fr. Sauter AG

- Greystone Energy Systems Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- Ingersoll Rand Inc.

- Johnson Controls

- KMC Controls Inc.

- OJ Electronics AS

- RTX Corp.

- Schneider Electric SE

- Senmatic AS

- Sensata Technologies Inc.

- Sensirion AG

- Siemens AG

- TE Connectivity Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of technologies designed to monitor and optimize heating, ventilation, and air conditioning systems in various types of buildings. These sensors play a crucial role in maintaining thermal comfort, ensuring energy efficiency, and safeguarding indoor air quality. HVAC sensors are integral to managing energy consumption in buildings. By continuously measuring temperature, humidity, and air pressure, these sensors enable automated adjustments to heating and cooling systems, reducing energy waste and enhancing overall power management. In industrial, commercial, and residential settings, HVAC sensors contribute significantly to energy efficiency and energy management. HVAC sensors are essential for maintaining optimal indoor climate conditions in buildings.

Temperature sensors monitor and regulate room temperatures, ensuring thermal comfort for occupants. Humidity sensors maintain appropriate moisture levels, contributing to overall indoor air quality and thermal comfort. Pressure sensors monitor air ducts and chambers, ensuring proper airflow and system performance. The increasing urbanization trend drives the demand for advanced HVAC sensors and systems. With the rise in energy standards and the push for energy-efficient buildings, HVAC sensors play a pivotal role in optimizing energy consumption and reducing greenhouse gas emissions. In addition, HVAC sensors are increasingly being integrated into smart building technology, enabling remote monitoring and automation through IoT platforms and networked devices.

HVAC sensors are not limited to traditional building applications. They are also employed in various industries, such as automotive, medical, and consumer electronics, to monitor and control temperature, humidity, and air quality. In the automotive sector, HVAC sensors are used to maintaIn thermal comfort in vehicle cabins and monitor carbon dioxide and toxicity levels. The integration of machine learning capabilities and automation software in HVAC systems further enhances their functionality. These advanced features enable predictive maintenance, optimized energy consumption, and improved indoor air quality, making HVAC sensors an indispensable component of modern buildings and industrial processes. In conclusion, the market is a dynamic and evolving industry, driven by the need for energy efficiency, thermal comfort, and indoor air quality.

These sensors play a vital role in various applications, from industrial and commercial buildings to residential settings and the automotive industry. As technology continues to advance, HVAC sensors will remain at the forefront of energy management and indoor climate control solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 2846.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.48 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HVAC Sensors Market Research and Growth Report?

- CAGR of the HVAC Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hvac sensors market growth of industry companies

We can help! Our analysts can customize this hvac sensors market research report to meet your requirements.