In Mold Labelling Market Size 2025-2029

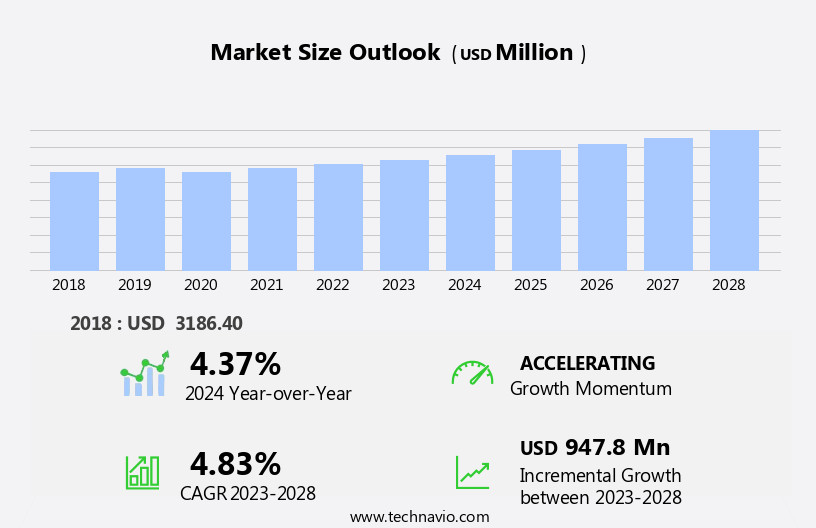

The in mold labelling market size is forecast to increase by USD 1.05 billion at a CAGR of 5.1% between 2024 and 2029.

- The In Mold Labelling (IML) market is experiencing significant growth due to the increasing global manufacturing output, particularly in sectors such as automotive, packaging, and electronics. IML technology offers several advantages, including improved product aesthetics, reduced material usage, and enhanced branding capabilities. However, the high initial investments required for IML equipment and tooling can act as a barrier to entry for some companies. Key market trends include the increasing adoption of digital technologies, such as 3D design and simulation software, to optimize the IML design process. Additionally, the growing demand for sustainable labeling solutions is driving innovation in the market, with biodegradable and recyclable IML materials gaining popularity. The in mold labelling (IML) market is experiencing significant growth due to the increasing production output in various industries, particularly In the spheres of spa, frozen food, packaging, personal care, and cosmetics.

- Companies seeking to capitalize on these opportunities must stay abreast of technological advancements and market trends while navigating the challenges of high upfront costs and regulatory compliance. By investing in research and development and forming strategic partnerships, companies can differentiate themselves in the competitive IML market and secure a strong market position.

What will be the Size of the In Mold Labelling Market during the forecast period?

- The in mold labeling market in the United States is experiencing significant growth, driven by the increasing demand for labeling solutions that offer superior durability, resistance, and sustainability. Key market dynamics include labeling data management for efficient production and supply chain tracking, labeling recycling and waste reduction, and labeling traceability for enhanced product safety and regulatory compliance. Chemical-resistant labels, label resistance, and labeling automation software are critical trends, enabling manufacturers to streamline processes and reduce production costs. Labeling system integration, labeling industry leaders, and high-definition printing are also driving innovation, with advancements in label durability testing, holographic labels, glossy labels, UV curing, heat-resistant labels, label peelability, scratch-resistant labels, waterproof labels, and labeling market forecasts. IML utilizes polypropylene as the label material, enabling multi-colored prints and intricate designs.

- Functional labels, such as tactile, embossed, and matte labels, are gaining popularity due to their aesthetic appeal and added functionality. Decorative labels, metallic labels, and embossed labels are also increasingly being used for brand differentiation and consumer appeal. Labeling market analysis indicates continued growth, with a focus on labeling sustainability assessment, label removal, and labeling upcycling. The market is expected to remain competitive, with ongoing innovation trends in labeling technology and certification standards. Overall, the in mold labeling market is a dynamic and evolving industry, responding to the changing needs of consumers and businesses alike. Eco-friendly options and automation are also driving the growth of the IML market, ensuring its continued relevance as a branding tool in today's competitive business landscape.

How is this In Mold Labelling Industry segmented?

The in mold labelling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Injection molding

- Blow molding

- Thermoforming

- End-user

- Food and beverage

- Cosmetics

- Pharmaceuticals

- Others

- Material

- Polypropylene

- Polyethylene

- Polyvinyl chloride

- Acrylonitrile butadiene styrene

- Others

- Geography

- Europe

- France

- Germany

- Italy

- Spain

- UK

- North America

- US

- Canada

- APAC

- China

- Japan

- Middle East and Africa

- South America

- Brazil

- Europe

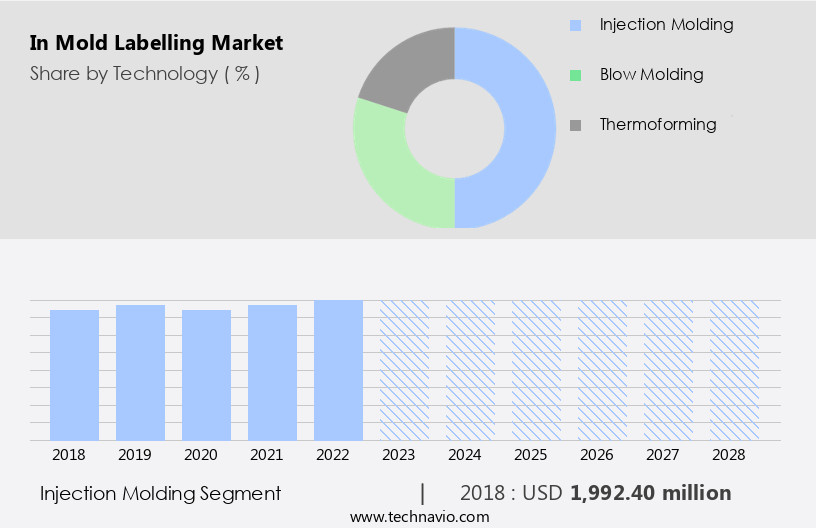

By Technology Insights

The injection molding segment is estimated to witness significant growth during the forecast period. The in mold labeling market experiences significant growth due to various factors. One of these factors is the increasing demand for labeling in various industries, including healthcare, packaging, automobile, consumer goods, and electronics. Injection molding machines, a crucial component in the in mold labeling process, are in high demand due to their versatility and efficiency. These machines, consisting of an injection unit and a clamping unit, enable the production of plastic products with integrated labels. Moreover, the circular economy initiative is driving the market as recyclable labels and digital transformation through RFID technology gain popularity. Injection molding machines are essential in the production of recyclable labels, making them a valuable investment for companies aiming to reduce their carbon footprint. The market is expected to grow significantly due to the increasing demand for injection molding machines In the eCommerce sector and the need for sensors for tampering detection and real-time location tracking.

Additionally, digital transformation in labeling solutions, such as RFID technology, offers benefits like real-time tracking, improved inventory management, and enhanced brand protection. Labeling innovations, including high-resolution printing, color matching, and design flexibility, are crucial in product differentiation and branding. Custom labeling services catering to various industries, such as household products, industrial goods, and food & beverage, offer unique label designs and labeling systems that meet specific requirements. Labeling efficiency, a critical factor in production speed and quality control, is addressed through automation and labeling software. PVC, PET, and polypropylene labels are popular choices due to their durability and suitability for various applications. This technique is commonly used for disposable consumer packaging, particularly in applications for food containers, cosmetics, personal care, and household items.

Labeling regulations, including those related to food & beverage and counterfeiting prevention, are driving the market towards stricter labeling standards. Labeling consultancy and technology play a vital role in optimizing costs and ensuring label sustainability. Injection molding machines, labeling equipment, and labeling services are essential investments for companies seeking to stay competitive and meet evolving consumer demands. Moreover, eco-friendly labeling solutions, such as linerless labels, are reducing plastic consumption and waste. Intelligent sensors, including tampering indicators and real-time location tracking, are also becoming increasingly common in IML labels, catering to the needs of the eCommerce sector and addressing concerns related to counterfeiting.

Get a glance at the market report of share of various segments Request Free Sample

The Injection molding segment was valued at USD 2.06 billion in 2019 and showed a gradual increase during the forecast period.

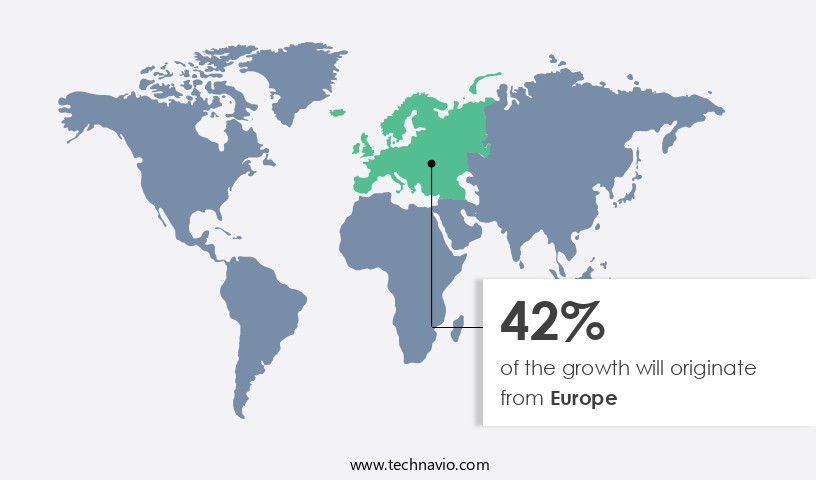

Regional Analysis

Europe is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The in mold labeling market is experiencing significant growth, particularly in Europe, where the demand for frozen foods is driving market expansion. The European frozen food industry's growth is attributed to the increasing popularity of ready-to-eat (RTE) foods, leading to a rise in the demand for in mold labels. In the European manufacturing sector, food and beverage is the largest industry, employing over 4.8 million people. This sector's growth has resulted in demand for in mold labels from food and beverage manufacturers. In-mold labeling offers advantages such as improved product differentiation, label durability, and brand protection, making it a preferred choice for manufacturers.

The market is also witnessing innovations in labeling technology, including high-resolution printing, digital printing, and RFID technology, to enhance labeling efficiency and sustainability. Additionally, the focus on circular economy initiatives and the development of recyclable labels is gaining traction in the market. Injection molding and label application automation are also key trends in the in mold labeling market. The market's evolution is shaped by labeling regulations, labeling standards, and labeling systems' integration with packaging equipment and software solutions. In-mold labeling is also being adopted across various industries, including household products, industrial goods, and consumer packaging, to optimize costs and improve labeling solutions' overall efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of In Mold Labelling Industry?

- Growing global manufacturing output is the key driver of the market. The global manufacturing sector has experienced consistent growth, expanding by over 4.5% over the past decade. Developing economies, driven by increasing consumer demand for goods and electronics, are primary contributors to this trend. In mold labelling, a technique used primarily in disposable consumer packaging, is particularly relevant for products with short lifespans, such as food and beverage containers, cosmetics and personal care items, and household products. The demand for in mold labelling is anticipated to escalate due to the rising need for food and beverage products, as various manufactured goods utilize distinct types of labels. This growth dynamic is expected to persist throughout the forecast period.

What are the market trends shaping the In Mold Labelling Industry?

- Advances in mold labelling technologies is the upcoming market trend. The market is projected to expand during the forecast period due to technological advancements, particularly in the realm of 3D labelling. Compared to traditional films, which offer a depth of draw of merely 0.5 inches, 3D labelling increases label depth by 3 inches. This enhancement leads to enhanced label durability and prevents image distortion. In April 2024, CCL Industries showcased their innovative 3D in mold labelling solutions at NPE2024 in Orlando, Florida. These groundbreaking offerings aim to boost label depth and durability, delivering superior aesthetic appeal and functionality for various packaging applications.

What challenges does the In Mold Labelling Industry face during its growth?

- High initial investments is a key challenge affecting the industry growth. In Mold Labeling Market: Significant Cost Factors for Manufacturers The In Mold Labeling (IML) market involves the production of labels that are formed within the mold during the injection molding process, resulting in a one-piece label and part. This process requires various machines and materials to create labels of varying sizes, designs, and degrees of flexibility. The production of these labels caters to the specific requirements of end-user companies, leading to increased costs for label manufacturers. The high cost of the fundamental machinery used for printing labels poses a risk for companies if their return on investment fails to meet expectations. Additionally, there are other expenses, such as maintenance costs, training and licensing fees, and costs associated with the installation and functionality of machinery, which manufacturers must cover during the initial stages of their business. These factors contribute to the overall cost structure of the In Mold Labeling market.

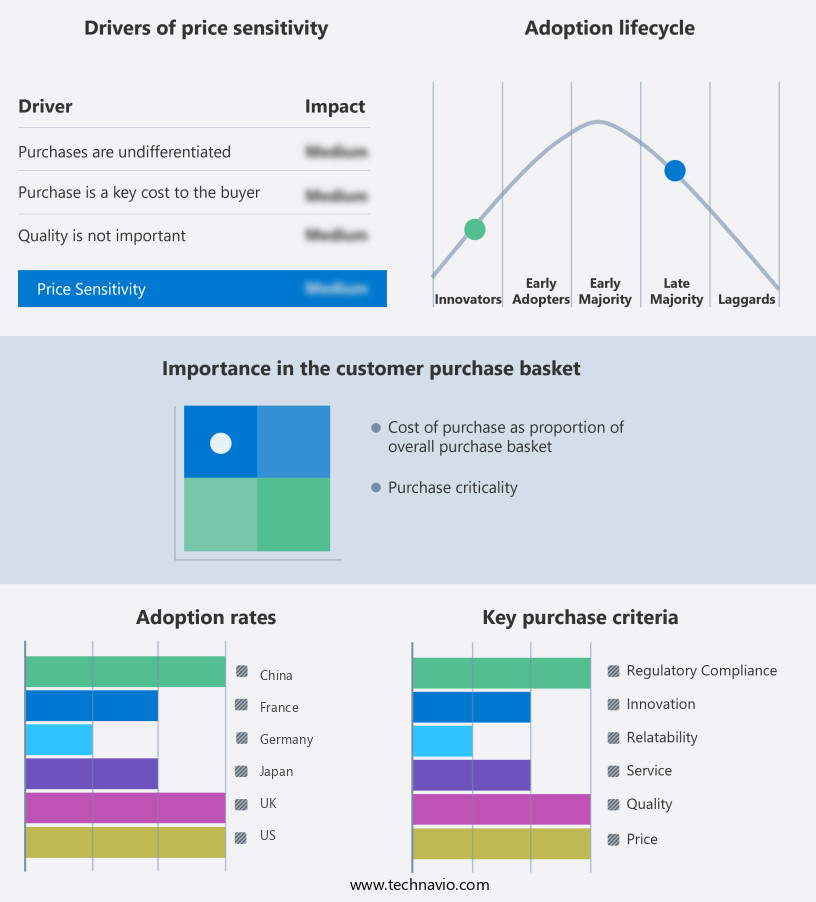

Exclusive Customer Landscape

The in mold labelling market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the in mold labelling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, in mold labelling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Admark Visual Imaging Ltd. - The company specializes in providing advanced visual imaging solutions, encompassing in-mold labeling for diverse plastic containers and components.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Admark Visual Imaging Ltd.

- Aspasie

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- EVCO Plastics

- Fort Dearborn Co.

- Fuji Seal International Inc.

- General Press Corp.

- Huhtamaki Oyj

- Inland Label and Marketing Services LLC

- Jindal Films Europe SARL

- Mitsubishi Chemical Group Corp.

- Multi Color Corp.

- Serigraph Inc.

- Smyth Companies LLC

- Taghleef Industries SpA

- Tsuchiya Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The in-mold labeling market is experiencing significant growth and innovation, driven by the increasing demand for smart packaging solutions and the need for product differentiation in various industries. In-mold labeling is a process that involves integrating labels into the plastic packaging during the injection molding process, resulting in a seamless and aesthetically pleasing design. One of the key factors driving the market is the adoption of label tracking technology, which enables better supply chain management and improved product traceability. This technology allows manufacturers to monitor the production process and ensure label accuracy, reducing the risk of errors and improving overall efficiency.

Another trend in the market is the integration of labeling technology with digital transformation initiatives. RFID technology, for instance, is being used to create interactive and informative labels that provide consumers with additional product information and enhance the overall shopping experience. Label quality control is another important consideration in the market, with manufacturers focusing on high-resolution printing and color matching to ensure consistent label design and branding across various product lines. Custom labeling services are also gaining popularity, as they offer greater design flexibility and the ability to create unique and eye-catching labels for specific products.

Sustainability initiatives are also driving innovation in the in-mold labeling market. Recyclable labels and the use of eco-friendly label materials are becoming increasingly important, as consumers become more conscious of the environmental impact of their purchasing decisions. Labeling consultancy services are also being sought after to help companies navigate the complex regulatory landscape and ensure compliance with labeling standards. In the industrial goods sector, in-mold labeling is being used to improve product branding and differentiation, with companies investing in labeling systems and labeling solutions to streamline their production processes and reduce costs. The food and beverage industry is also a major player in the market, with in-mold labeling being used to create eye-catching designs and improve product shelf appeal.

Labeling automation and labeling software are also becoming increasingly important in the market, as manufacturers seek to improve label application and label development processes. Labeling equipment and labeling technology are also being developed to increase labeling efficiency and reduce production time. In the household products sector, in-mold labeling is being used to create visually appealing and functional labels for various product lines. Label decoration is also gaining popularity, with companies investing in digital printing and offset printing to create custom designs and improve product differentiation. Injection molding and plastic packaging are also major trends in the market, with in-mold labeling being used to create seamless and integrated designs.

PVC labels and polypropylene labels are also popular choices for various industries due to their durability and resistance to environmental factors. Counterfeiting prevention is another important consideration in the market, with labeling solutions being developed to help prevent counterfeit products from entering the market. Label inspection technology is also being used to ensure label accuracy and reduce the risk of errors and recalls. The in-mold labeling market is experiencing significant growth and innovation, driven by the need for product differentiation, improved labeling efficiency, and sustainability initiatives. The market is also being shaped by the adoption of label tracking technology, digital transformation, and the integration of labeling technology with various industries and production processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 1.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, Germany, UK, China, France, Canada, Italy, Spain, Japan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this In Mold Labelling Market Research and Growth Report?

- CAGR of the In Mold Labelling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the in mold labelling market growth of industry companies

We can help! Our analysts can customize this in mold labelling market research report to meet your requirements.