Industrial Welding Robots Market Size 2024-2028

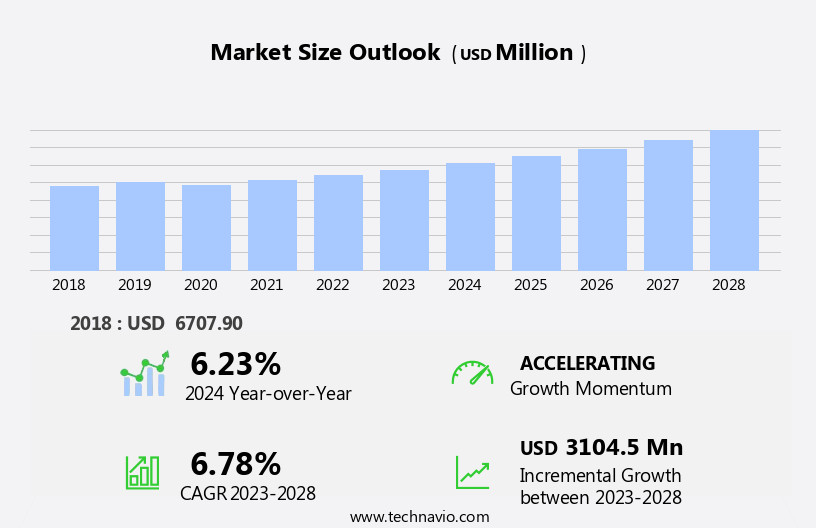

The industrial welding robots market size is forecast to increase by USD 3.1 billion at a CAGR of 6.78% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of robotics in the manufacturing sector, particularly in the Asia-Pacific region. Another trend influencing the market is the emergence of collaborative arc welding robots, which offer increased flexibility and improved safety features.

- However, operational challenges associated with welding robots, such as high initial investment costs and complex installation processes, remain key barriers to market growth. To address these challenges, market participants are focusing on developing more user-friendly and cost-effective solutions. Overall, the market is expected to witness robust growth in the coming years, driven by these trends and automation of manufacturing processes.

What will be the Size of the Industrial Welding Robots Market During the Forecast Period?

- The market is experiencing significant growth due to the integration of advanced technologies such as cyber-physical systems and cloud robotics. These innovations enable real-time data analytics, data-driven decision-making, and increased flexibility in modern manufacturing.

- Welding robot manufacturers continue to invest in research and development to enhance the capabilities of their solutions, integrating sensors and big data to optimize performance and improve efficiency.

- However, economic downturns and strict lockdowns have disrupted manufacturing facilities and supply chains, leading to production schedule disruptions and transport restrictions. Raw materials have become more expensive, further challenging the industry. Despite these challenges, the adoption of industrial robots in welding applications remains strong, driven by the need for increased productivity and improved quality.

- Cloud computing and advanced robotics are expected to continue shaping the market, enabling more efficient and agile manufacturing processes.

How is this Industrial Welding Robots Industry segmented and which is the largest segment?

The industrial welding robots industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Spot welding robots

- Arc welding robots

- Laser welding robots

- End-user

- Automotive

- Electrical and electronics

- Heavy machinery

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

- The spot welding robots segment is estimated to witness significant growth during the forecast period.

In the modern manufacturing landscape, industrial welding robots, particularly spot welding robots, play a pivotal role in enhancing productivity and efficiency across various industries. These robots, which employ advanced technologies such as cloud robotics, cyber-physical systems, and big data, are instrumental in executing complex welding tasks with high precision, repeatability, and minimal changes. They are widely adopted in sectors like automotive & transportation, metals & machinery, electrical & electronics, aerospace & defense, and construction, where welding applications are prevalent. These robots, equipped with machine vision technologies, laser welding, and advanced robotics, enable data-driven decision-making, real-time data analytics, and performance optimization.

With sensors and high-power density plasma welding technology, they deliver durable welds with high reliability, minimal distortion, and improved gap bridging. The payload segment of welding robots is expected to grow significantly due to the increasing demand for high-volume applications. The integration of industrial robots into manufacturing ecosystems fosters smart manufacturing, enabling consistent weld quality, reduced rework, and increased efficiency. Despite the challenges posed by economic downturns, strict lockdowns, labor costs, and supply chain disruptions, the demand for welding robots remains robust. The largest share of the market is held by the general manufacturing industry and the defense industry, with the welding process segment encompassing resistance spot welding, plasma welding, and ultrasonic welding.

Get a glance at the Industrial Welding Robots Industry report of share of various segments Request Free Sample

The Spot welding robots segment was valued at USD 3.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

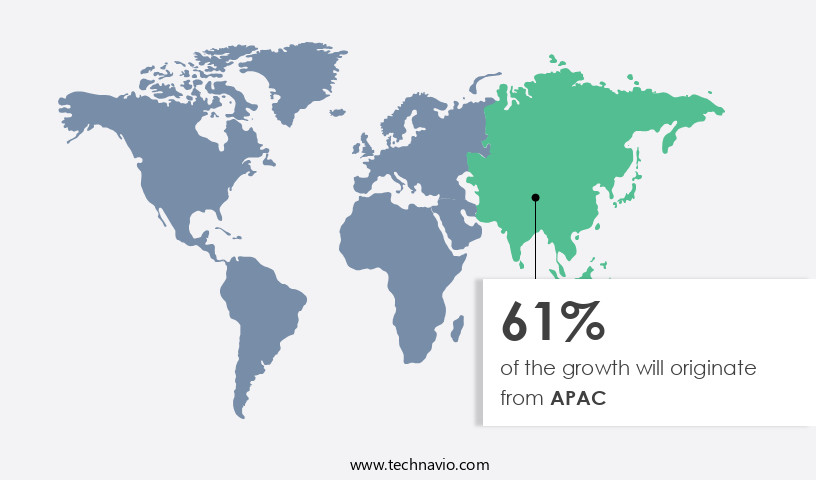

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to government initiatives, rising automobile production, and a robust manufacturing sector. Automotive manufacturers in China and India are investing in automation solutions, including welding robots, to enhance productivity and reduce cycle times, providing a competitive edge. Major contributors to market expansion in APAC are China, India, Japan, and South Korea. The adoption of robotics and automation is expected to increase In the region, addressing challenges such as outdated equipment, production instability, and reliance on manual labor. Key technologies driving growth include cyber-physical systems, cloud robotics, cloud computing, big data, and advanced robotics.

Industrial welding robots offer benefits such as increased efficiency, flexibility, and consistency in weld quality. Applications include welding tasks for aerospace, construction, metal parts, pipes, and structural elements. The market is expected to grow, driven by high-volume applications, plasma welding technology, and data-driven decision-making using real-time data analytics and sensors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Welding Robots Industry?

Growing popularity of industrial robots in APAC is the key driver of the market.

- Industrial welding robots have become a vital component of modern manufacturing, particularly In the cyber-physical systems era. Cloud robotics and cloud computing have enabled data-driven decision-making, with big data collection and real-time analysis playing a significant role in performance optimization. Welding robot manufacturers continue to innovate, offering advanced robotics solutions for various welding applications, including laser welding robots for high-volume, high-precision tasks and arc welding and spot welding for structural elements and metal parts. The demand for industrial robots, including welding robots, has been influenced by factors such as labor costs, consistency in weld quality, and the need for efficiency and flexibility in manufacturing.

- The aerospace, construction, automotive & transportation, metals & machinery, and electrical & electronics industries have been major application sectors for industrial robots. However, the economic downturn and strict lockdowns have led to demand reduction and production schedule disruptions, impacting the industrial sector. The component segment, which includes robots, controllers, articulated robots, cartesian robots, cylindrical robots, SCARA robots, collaborative robots, delta robots, welding torches, vision systems, feeder systems, plasma flow controllers, and other EOAT devices, holds the largest share In the industrial robots market. The focus on high safety standards and the increasing adoption of machine vision technologies have led to improvements in precision, repeatability, and minimal changes in welding tasks.

- The industrial sector's future relies on smart manufacturing ecosystems, which incorporate advanced robotics, sensors, and data analytics to optimize production processes. While the demand for industrial robots continues to grow, the need for reskilling and upskilling the workforce to operate and maintaIn these systems is crucial. The tax implications and regulatory frameworks surrounding the adoption of industrial robots are essential considerations for businesses. Laser welding technology, such as laser beam welding and carbon dioxide lasers with optics, offers high welding speed, rework reduction, and high reliability, making it a popular choice for industries with high-volume applications. Plasma welding technology, with its high power density, low distortion, and improved gap bridging capabilities, is also gaining popularity for its ability to produce durable welds.

- In conclusion, the market is expected to continue growing, driven by the need for increased precision, efficiency, and flexibility in manufacturing. The adoption of advanced robotics and data-driven decision-making will further enhance the capabilities of industrial robots, making them indispensable in various industries. However, the challenges posed by economic downturns, labor costs, and regulatory frameworks must be addressed to ensure the sustainable growth of the market.

What are the market trends shaping the Industrial Welding Robots Industry?

Emergence of collaborative arc welding robots is the upcoming market trend.

- Industrial welding robots have gained significant traction in modern manufacturing due to the integration of advanced technologies such as cyber-physical systems, cloud robotics, and cloud computing. Big data plays a crucial role in data-driven decision-making, enabling welding robot manufacturers to optimize performance through real-time data analytics and sensors. Rental companies like Hirebotics, Tokyo Century, and ORIX offer flexible solutions for end-users, providing robots, controllers, and manufacturing machinery as a single unit. This allows end-users to perform welding tasks without requiring extensive upskilling or reskilling in robot programming languages. Rental companies handle installation expenses and offer the latest technologies suitable for industries such as aerospace, construction, and automotive & transportation.

- With the increasing demand for efficiency, flexibility, and consistent weld quality, the adoption of robotics welding systems continues to grow, despite economic downturns, strict lockdowns, and production disruptions. The component segment, including robots, controllers, and other EOAT devices, holds the largest share In the industrial robots market. Payload segments such as high safety standards, high reliability, and improved gap bridging are driving the market forward. Robotic systems are increasingly being used for high-volume applications, including laser welding, plasma welding, and ultrasonic welding. The integration of machine vision technologies ensures high precision, repeatability, and minimal changes, making welding robots an essential part of the smart manufacturing ecosystems.

What challenges does the Industrial Welding Robots Industry face during its growth?

Operational challenges associated with welding robots is a key challenge affecting the industry growth.

- Industrial welding robots have gained significant traction in modern manufacturing due to their ability to enhance efficiency and flexibility in various sectors. Cyber-physical systems, cloud robotics, and cloud computing play a crucial role in optimizing the performance of welding robots by enabling data-driven decision-making through real-time data analytics. Welding robot manufacturers continue to invest in advanced robotics, machine vision technologies, and sensors to improve precision, repeatability, and consistency in welding tasks. The welding industry encompasses significant application sectors, including aerospace, construction, automotive & transportation, metals & machinery, and electrical & electronics. The demand for welding robots is influenced by factors such as labor costs, need for consistent weld quality, and the ability to work in remote welding locations.

- In high-volume applications, laser welding and plasma welding technology offer high welding speed, minimal changes, and high reliability. However, the implementation of welding robots is not without challenges. Economic downturns, strict lockdowns, and personnel restrictions can impact manufacturing facilities, supply chains, production schedules, and raw materials. The largest share of the market belongs to the general manufacturing industry, followed by the defense industry. The welding process segment includes resistance spot welding, plasma welding, and ultrasonic welding. The payload segment of welding robots includes robots, controllers, articulated robots, cartesian robots, cylindrical robots, SCARA robots, collaborative robots, delta robots, welding torches, vision systems, feeder systems, plasma flow controllers, and other EOAT devices.

- With increasing safety standards and the need for high precision, narrow welds, and improved gap bridging, durable welds are essential for various end-use industries. In conclusion, the market continues to grow due to the benefits they offer in terms of efficiency, flexibility, and consistency. The selection of welding robots depends on factors such as the type of metal parts, repeatability of operation, and accessibility of the workpieces. The integration of cyber-physical systems, cloud computing, and machine vision technologies is crucial for optimizing performance and enhancing the overall manufacturing ecosystem.

Exclusive Customer Landscape

The industrial welding robots market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial welding robots market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial welding robots market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - Notable offerings include the IRB 1200 Hygienic and IRB 1100 6 axis articulated robots, which deliver superior welding capabilities and adaptability. These robots are engineered to optimize welding processes, ensuring consistent quality and reducing labor costs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Acieta LLC

- Bystronic Laser AG

- Carl Cloos Schweisstechnik GmbH

- Daihen Corp.

- EWM AG

- FANUC Corp.

- HD Hyundai Co. Ltd.

- Illinois Tool Works Inc.

- Kawasaki Heavy Industries Ltd.

- Kemppi Oy

- MIDEA Group Co. Ltd.

- OMRON Corp.

- Panasonic Holdings Corp.

- Smenco Pty Ltd.

- SRDR Robotics

- Stellantis NV

- Teradyne Inc.

- The Lincoln Electric Co.

- Yaskawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial welding robots have become an integral part of modern manufacturing, revolutionizing the way industries produce metal parts and structural elements. These cyber-physical systems, which combine robotics, cloud computing, and big data, offer numerous benefits for various sectors, including aerospace, construction, and automotive & transportation. The industrial welding robot market is driven by several factors. One significant factor is the need for increased efficiency and flexibility in manufacturing processes. With the ability to work continuously without breaks, welding robots can significantly reduce rework and improve productivity. Additionally, they offer high precision and repeatability, ensuring consistent weld quality, even in complex welding tasks.

Another factor driving the market is the demand for high-volume applications in industries such as automotive & transportation and metals & machinery. Welding robots can weld different parts with high welding speed, enabling manufacturers to meet production schedules and reduce lead times. Furthermore, they offer high reliability, minimal changes, and the ability to perform welding tasks in remote locations. The use of advanced robotics, real-time data analytics, sensors, and machine vision technologies in welding applications has led to data-driven decision-making and performance optimization. Smart manufacturing ecosystems have emerged, allowing for the integration of welding robots into larger industrial systems.

However, the market for industrial welding robots is not without challenges. Economic downturns, strict lockdowns, and manufacturing facility closures have led to demand reduction in some sectors. Additionally, supply chain disruptions, transport restrictions, and raw material shortages have impacted production schedules. Despite these challenges, the market for industrial welding robots continues to grow. The component segment, which includes robots, controllers, articulated robots, cartesian robots, cylindrical robots, scara robots, collaborative robots, delta robots, welding torches, vision systems, feeder systems, plasma flow controllers, and other EOAT devices, is expected to see significant growth In the coming years. The largest share of the market is held by the general manufacturing industry, followed by the defense industry.

The welding process segment includes resistance spot welding, plasma welding, and ultrasonic welding. The payload segment includes robots with varying weight capacities, catering to different application requirements. In conclusion, the industrial welding robot market is driven by the need for increased efficiency, flexibility, and precision in manufacturing processes. The use of advanced technologies such as cloud robotics, big data, and machine vision technologies is transforming the industry, enabling manufacturers to optimize performance and reduce costs. Despite challenges such as economic downturns and supply chain disruptions, the market is expected to continue growing, offering significant opportunities for manufacturers and investors alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 3.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

China, Japan, US, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Welding Robots Market Research and Growth Report?

- CAGR of the Industrial Welding Robots industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial welding robots market growth of industry companies

We can help! Our analysts can customize this industrial welding robots market research report to meet your requirements.