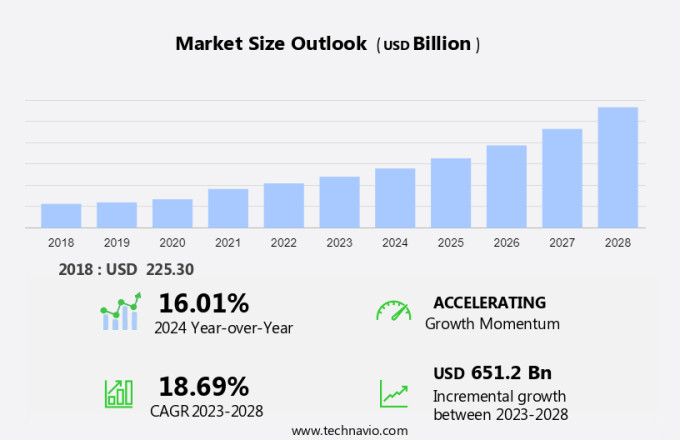

Internet Advertising Market Size 2024-2028

The internet advertising market size is forecast to increase by USD 651.2 billion at a CAGR of 18.69% between 2023 and 2028. The market is experiencing significant growth, driven by various sectors such as media and entertainment, transport and tourism, and IT and telecom. One of the primary growth factors is the digital transformation that is reshaping industries, leading to increased online presence and advertising spend. Another trend is the advancement of advertising technology, including the emergence of streaming platforms and the widespread use of smartphones and high-speed internet. However, challenges persist, such as the rise of ad fraud and the increasing use of ad blockers. To address these challenges, the industry is embracing automation, with automated bidding strategies, ad copy, PPC reporting, and rules becoming increasingly common. By leveraging these tools, businesses can optimize their ad campaigns and improve their return on investment.

The market continues to evolve, providing businesses with numerous opportunities to reach their target audiences and drive conversions. By implementing strategic ad formats across various channels, companies can increase website traffic, generate brand exposure, and ultimately, boost sales. Promotional messages play a crucial role in capturing the attention of potential customers. In the digital realm, businesses can utilize banners, pop-ups, and e-newsletters to engage their target consumers. These ad formats offer precision in reaching specific demographics and geographic locations, ensuring that businesses maximize their return on investment.

Simultaneously, search engines are a primary digital channel for advertising, as they cater to users actively seeking information or products. By optimizing ad campaigns for search engines, businesses can reach consumers who are most likely to make a purchase. However, the Internet advertising landscape extends beyond digital channels. Traditional media, such as magazines, newspapers, and television, also offer valuable opportunities for businesses to reach their target audiences. By integrating ad strategies across both digital and print channels, companies can create a cohesive marketing approach that resonates with consumers. The mobile segment represents a significant portion of internet usage, making it an essential channel for businesses to consider.

Moreover, mobile-optimized ads, including banners and pop-ups, can effectively reach consumers on the go, increasing the likelihood of conversions. Demographics and geographic locations are essential factors in determining the most effective ad strategies. By understanding the unique characteristics of their target audiences, businesses can tailor their messaging and channel selection to maximize conversions and sales. Precision is key in the market. Businesses must continually refine their ad strategies to ensure they are reaching the right consumers with the most effective messages. By monitoring ad performance and adjusting tactics as needed, companies can optimize their advertising efforts and drive growth.

In conclusion, the market offers businesses a wealth of opportunities to reach their target audiences and drive conversions. By implementing strategic ad formats across various channels, businesses can increase website traffic, generate brand exposure, and ultimately, boost sales. Effective ad strategies require a deep understanding of consumer demographics, geographic locations, and channel selection, ensuring that businesses maximize their return on investment.

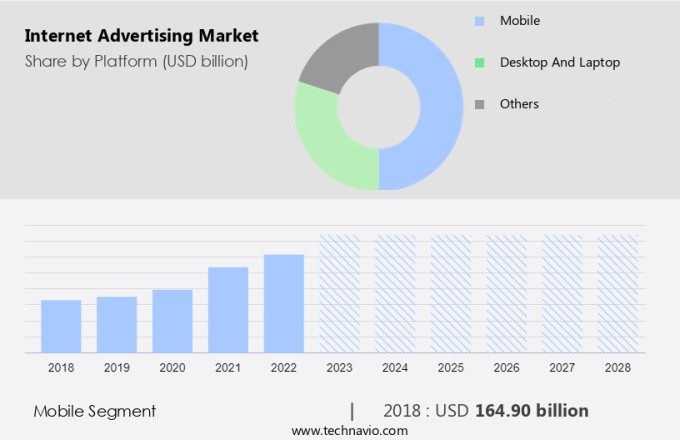

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Platform

- Mobile

- Desktop and laptop

- Others

- Type

- Large enterprises

- SMEs

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Platform Insights

The mobile segment is estimated to witness significant growth during the forecast period. The market holds significant value in fostering human connection and storytelling for brands, reaching increasingly diverse target audiences through various ad strategies on digital channels. With the dominance of mobile devices, this sector has gained prominence, as mobile phone ownership has reached 78% of the global population aged 10 and above, according to ITU data. In 2023, approximately 5.4 billion people, or 67% of the world population, accessed the internet. European and American regions boasted high internet penetration rates of nearly 90%, while the Arab States and Asia-Pacific regions saw about two-thirds of their populations using the internet, aligning with the global average. Advertisers leverage these demographic and geographic locations for precision, aiming to convert consumers effectively across digital channels, surpassing traditional mediums like print and television.

Get a glance at the market share of various segments Request Free Sample

The mobile segment was valued at USD 164.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is a significant and prosperous sector, projected to expand further in the upcoming years. Comprising the US and Canada, this region boasts a well-established digital advertising infrastructure, characterized by a vast user base and extensive Internet connectivity. Key industry players, including Google, Facebook, and Amazon, dominate the market with their advertising platforms, such as Google Ads, Instagram, and Amazon Advertising, respectively. These companies hold a substantial share of the total digital ad expenditures. Programmatic advertising, which employs automated systems for buying and selling ad inventory, is increasingly preferred by businesses due to its efficiency and convenience.

Further, native advertising, another popular format, seamlessly integrates advertisements into the user experience, fostering a higher level of empathy and engagement. Full-screen interstitials, while controversial, can be effective in capturing users' attention on mobile, laptops, and desktops. Retail and consumer goods, IT and telecom sectors are major contributors to the market in North America.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising digital transformation is the key driver of the market. The market has experienced significant growth due to the digital transformation sweeping across businesses in various industries. This transformation involves integrating digital technology into business operations, processes, and customer interactions. As a result, companies are shifting their marketing focus towards digital channels, including the Internet, and away from traditional methods such as magazines, newspapers, and television.

Additionally, internet advertising provides targeted and measurable promotional messages, making it an attractive option for businesses seeking to optimize their marketing budgets. This form of advertising includes banners, pop-ups, e-newsletters, and search engine marketing. The mobile segment is also gaining traction in the market. Businesses can reach a larger, more targeted consumer base through these digital channels, ultimately leading to increased website traffic and brand exposure.

Market Trends

The advancements in ad tech is the upcoming trend in the market. The market has experienced substantial growth due to advancements in advertising technology (ad tech). Ad tech encompasses the tools and technologies utilized for planning, executing, and optimizing digital advertising campaigns. These advancements have introduced innovative capabilities and efficiencies, transforming how advertisers connect with their audience. Programmatic advertising, an automated approach to ad buying, has revolutionized digital advertising.

Similarly, it employs real-time bidding and algorithms to purchase ad inventory, enabling precise audience targeting and minimizing ad waste. Programmatic advertising has gained significant traction, accounting for a substantial portion of global ad spending. Media and entertainment, transport and tourism, and IT and telecom industries are major contributors to the market. Ad formats have evolved, with streaming platforms and smartphones leading the way. High-speed internet has facilitated the growth of digital advertising, while ad blockers pose a challenge. Advertising automation includes automated bidding strategies, ad copy, PPC reporting, and rules.

Market Challenge

The rise in ad fraud is a key challenge affecting the market growth. The market in the US has seen a notable increase in ad fraud, posing a significant challenge for retailers and other businesses. Ad fraud refers to deceitful practices aimed at generating illicit financial gains within the digital advertising ecosystem. This issue results in substantial financial losses for advertisers due to fake impressions, clicks, and conversions, which lead to wasted ad budgets and decreased return on investment.

However, ad fraud not only negatively impacts advertisers but also harms legitimate publishers, potentially reducing their ad revenue despite having genuine audiences. Social media, mobile devices, search engine marketing, display advertising, social media advertising, video advertising, and online classifieds ads are all susceptible to ad fraud. Advertisers must remain vigilant to safeguard their investments and ensure their ads reach real users, generating authentic engagement.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accenture Plc: The company offers internet advertising services which help to grow the advertising business effectively and profitably at scale.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon.com Inc.

- Baidu Inc.

- Boostability Pvt. Ltd.

- Conversant Solutions LLC

- Dentsu Group Inc.

- International Business Machines Corp.

- Meta Platforms Inc.

- Microsoft Corp.

- PBJ Marketing LLC

- PricewaterhouseCoopers LLP

- The Walt Disney Co.

- Thrive Internet Marketing Agency

- Twitter Inc.

- Verizon Communications Inc.

- Web Net Creatives

- WebFX

- Yahoo

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve, offering businesses various promotional messages to reach their targeted consumers and drive purchase decisions. Website traffic and brand exposure are key benefits of Internet advertising, with businesses utilizing various ad formats such as banners, pop-ups, e-newsletters, and more. Search engines, magazines, newspapers, social media, and retailers are popular digital channels for advertising. The mobile segment, including mobile devices, has become a significant focus with the increasing usage of mobile phones and high-speed internet. Ad spending on digital advertising has grown, with search engine marketing, display advertising, social media advertising, video advertising, online classifieds ads, and native ads being popular choices.

In conclusion, advanced analytics enable businesses to reach precise target audiences based on demographics and geographic locations, increasing conversions and sales. However, ad blockers and budget constraints can pose challenges, leading to the adoption of advertising automation, automated bidding strategies, and automated PPC reporting. Human connection and storytelling are essential in brand value creation, with businesses leveraging channels like streaming platforms, smartphones, desktops, laptops, and mobile apps to engage consumers in the retail & consumer goods, healthcare, media and entertainment, travel industry, IT and telecom, and other sectors. Ad formats like full-screen interstitials offer an opportunity for empathy and creativity, allowing businesses to connect with consumers and build brand value.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.69% |

|

Market growth 2024-2028 |

USD 651.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.01 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 52% |

|

Key countries |

US, Japan, Germany, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture Plc, Alibaba Group Holding Ltd., Alphabet Inc., Amazon.com Inc., Baidu Inc., Boostability Pvt. Ltd., Conversant Solutions LLC, Dentsu Group Inc., International Business Machines Corp., Meta Platforms Inc., Microsoft Corp., PBJ Marketing LLC, PricewaterhouseCoopers LLP, The Walt Disney Co., Thrive Internet Marketing Agency, Twitter Inc., Verizon Communications Inc., Web Net Creatives, WebFX, and Yahoo |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch