Mobile Robot Charging Station Market Size 2024-2028

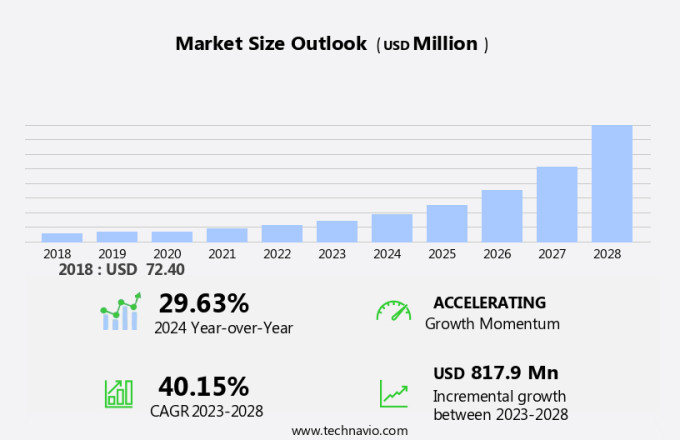

The mobile robot charging station market size is forecast to increase by USD 817.9 billion at a CAGR of 40.15% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of autonomous vehicles and the need for efficient charging solutions. Charging infrastructure is becoming increasingly important as the use of mobile robots continues to expand in various industries, from manufacturing to logistics. Contactless charging technology is gaining popularity due to its convenience and sustainability benefits, reducing the need for physical charging connectors. Additionally, the high replacement cost of charging stations necessitates the development of cost-effective and reliable solutions. These trends are driving innovation in the market and providing opportunities for companies to offer advanced charging solutions that cater to the evolving needs of businesses. By focusing on reducing the cost price of electronic components and improving the efficiency of charging systems, market participants can stay competitive and meet the demands of the growing mobile robot market.

What will be the Size of the Market During the Forecast Period?

- The market in North America is witnessing significant growth as businesses seek to optimize their operations through automation. Mobile robots, including those used in manufacturing, logistics, and healthcare, require efficient charging solutions to ensure continuous operation. This article explores the current state and future trends of the market in North America. Mobile robots are increasingly being adopted for various applications due to their flexibility, precision, and ability to perform repetitive tasks. However, ensuring these robots are always operational is crucial for businesses to maximize their return on investment.

- Charging stations, which come in the form of multi-robot chargers and stand-alone chargers, play a vital role in maintaining the performance of mobile robots. Contactless charging is a popular trend in the market. This technology eliminates the need for manual intervention during the charging process, reducing downtime and increasing efficiency. Furthermore, contactless charging minimizes the risk of damage to the robots and charging stations, ensuring a reliable charging experience. Electric vehicles and autonomous vehicles are also driving the demand for mobile robot charging stations. As more businesses adopt these technologies, the need for efficient charging solutions becomes increasingly important.

- In conclusion, the market in North America is poised for growth as businesses seek to optimize their operations through automation. Contactless charging, the increasing adoption of electric and autonomous vehicles, and the growth of the robotic industry are all driving factors in this market. Businesses looking to adopt mobile robots should consider investing in efficient charging solutions to ensure their robots are always operational and performing at their best.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Industrial

- Commercial

- Type

- Stand-alone chargers

- Multi-robot chargers

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

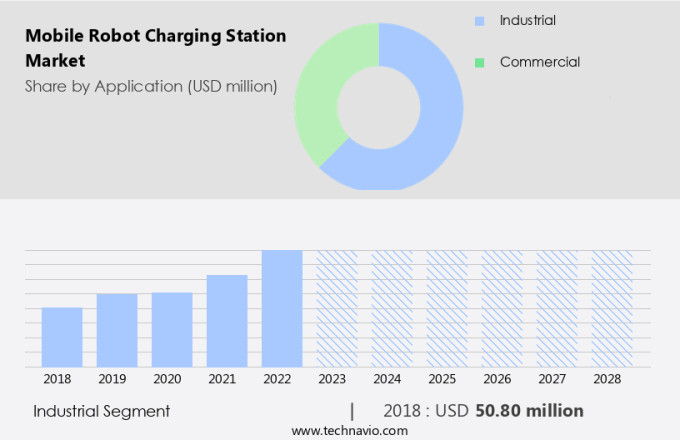

- The industrial segment is estimated to witness significant growth during the forecast period.

In various sectors such as manufacturing, oil and gas, aerospace and defense, healthcare, and mining and minerals, the adoption of Autonomous Mobile Robots (AMRs) is on the rise. AMRs are increasingly being utilized for tasks that are too complex or dangerous for human intervention, including land inspections, fuel and gas leakage detection, underwater operations, and rescue missions. Unmanned Ground Vehicles (UGVs) are commonly employed in manufacturing industries for transferring tools and goods, with AMRs guiding their navigation. These self-governing machines determine their own paths to reach their objectives. However, due to the continuous nature of shop floor operations, these robots require frequent charging to maintain productivity.

Moreover, carbon emissions are a growing concern, and contactless solutions are becoming increasingly popular in response. AMRs and UGVs are being deployed to minimize human intervention and reduce travel restrictions, thereby contributing to the reduction of carbon footprint. The integration of Artificial Intelligence (AI) in these robots enhances their efficiency and effectiveness. The utilization of AMRs and UGVs offers numerous benefits, including improved productivity, enhanced safety, and cost savings. With the increasing demand for automation and the need for efficient energy management, the market for Mobile Robot Charging Stations is expected to grow significantly in the coming years.

Get a glance at the market report of share of various segments Request Free Sample

The Industrial segment was valued at USD 50.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

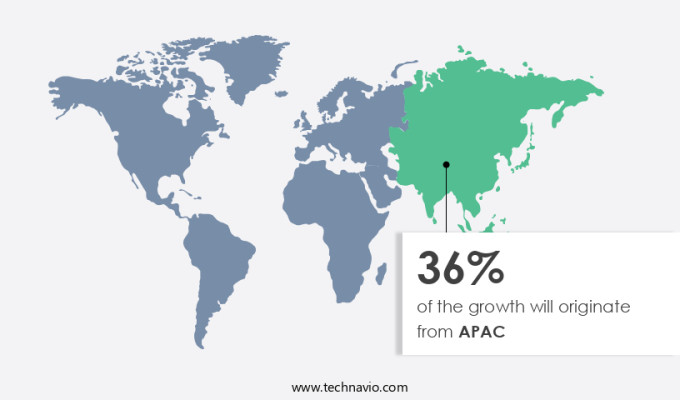

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the United States and Mexico, mobile robot charging stations have gained significant traction due to the widespread adoption of autonomous mobile robots (AMRs) in various industries such as oil and gas, defense, and hospitality. The implementation of robotic technologies in factory automation has led to the growth of AMRs and their charging stations. With increasing investments from the government, private sectors, and academia in research and development of robotics technology, the demand for mobile charging stations is expected to escalate during the forecast period. The reshoring of the manufacturing sector from overseas back to North America necessitates efficient energy sources and management tools. Consequently, the market for mobile robot charging stations is poised for substantial growth in the coming years. These charging stations come in different forms, including multi-robot chargers and stand-alone chargers, catering to the diverse needs of various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Mobile Robot Charging Station Market?

Reduced cost price of electronic components is the key driver of the market.

- The market has experienced notable growth due to advancements in microelectronics, nanotechnology, and wireless communication technology. Autonomous Mobile Robots (AMRs) are increasingly being utilized in various industrial and commercial settings, with contactless charging stations enabling seamless power transfer. The affordability of essential electronic components, such as infrasound sensors and cameras, has significantly contributed to the expansion of this market. Major components of mobile robots, including smart sensors, actuators, modulators, wires, and wheels, are readily available at competitive prices. The availability and affordability of these components have facilitated the development of mobile robot charging stations. The global market for mobile robot charging stations is poised for continued growth as the robotic industry integrates more automation into electric vehicles and other applications.

What are the market trends shaping the Mobile Robot Charging Station Market?

Contactless charging is the upcoming trend in the market.

- In the realm of autonomous mobile robots (AMRs) utilized for industrial and commercial applications, the significance of charging solutions cannot be overstated. Seamless operations on the shop floor necessitate the support of charging or docking stations for AMRs. However, the time consumed during the charging process can lead to operational delays. To mitigate such interruptions, advanced charging systems are being engineered to provide a consistent power supply to robots. For instance, some AMRs are designed to operate continuously in factories, necessitating a constant power source. These robots are engineered to function on pre-defined metallic tracks, which incorporate capacitive power transferring (CPT) technology.

- Previously, inductive power transferring (IPT) was employed for uninterrupted power supply; however, it was discovered that electromagnetic interference could disrupt the power transmission. In summary, the development of efficient and reliable charging solutions for AMRs is crucial for maintaining uninterrupted operations in industrial and commercial settings. The implementation of advanced charging technologies, such as CPT, is essential to ensure a consistent power supply and minimize downtime.

What challenges does Mobile Robot Charging Station Market face during the growth?

Replacement cost of charging station is a key challenge affecting the market growth.

- Mobile robot charging stations are essential components for ensuring uninterrupted operation of Automated Mobile Robots (AMRs) in various industries, particularly in underground car parking facilities. These charging stations are engineered specifically for AMRs based on their configurations and power requirements. However, technical issues or breakdowns in charging stations can hinder the recharging process, necessitating replacement. This adds to the overall cost of the charging stations and affects the robots' mobility. Moreover, in multi-robot charging stations, a technical malfunction can disrupt charging operations on a larger scale, impeding floor operations. Wireless charging kits and manual battery charging are alternative charging methods, but they come with their own advantages and disadvantages.

- For instance, manual battery charging requires human intervention and can be time-consuming, while wireless charging kits offer contactless charging but may not be as efficient as wired charging stations. When selecting a charging solution, it's crucial to consider factors such as the number of robots, charging frequency, and available space.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Clearpath Robotics Inc.

- DF Automation and Robotics Sdn Bhd

- Festo SE and Co. KG

- KUKA AG

- Locus Robotics Corp.

- Mobile Industrial Robots AS

- Neobotix GmbH

- Nidec Corp.

- OMRON Corp.

- PAL Robotics

- Paul Vahle GmbH and Co. KG

- Robotnik Automation SLL

- Shenzhen Tianyou Intelligence Co. Ltd.

- Singapore Technologies Engineering Ltd.

- SMP Robotics Systems Corp.

- Trossen Robotics

- Volkswagen AG

- WiBotic

- Wiferion GmbH

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Mobile robots have gained significant traction in various industries, including material handling, inventory management, assembly lines, material transportation, healthcare facilities, hospitals, and medical centers. These robots are increasingly being used to automate repetitive tasks, improve efficiency, and enhance productivity. However, ensuring these robots remain operational is crucial for their optimal performance. Enter charging stations, which play a vital role in keeping mobile robots running. Charging stations come in various forms, such as multi-robot chargers and stand-alone chargers. Docking stations and contactless charging solutions are popular choices for contactless and efficient charging. The robotic industry has seen a surge in the development of charging infrastructure, including wireless charging kits and charging connectors.

Moreover, electric vehicles and autonomous vehicles are driving the demand for advanced charging solutions. Sustainability and reducing carbon emissions are essential considerations in the design of these charging stations. The use of charging robots and swapping systems is gaining popularity in underground car parking facilities. The growth of automation and the increasing adoption of AI robots in various industries are expected to boost the market for mobile robot charging stations. Challenges such as travel restrictions and the need for efficient charging solutions are also driving innovation in the development of advanced charging technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 40.15% |

|

Market growth 2024-2028 |

USD 817.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.63 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch