Neon Gas Market Size 2024-2028

The neon gas market size is forecast to increase by USD 116.6 million at a CAGR of 7.55% between 2023 and 2028.

- Neon gas, a rare inert gas, holds significant importance in various industries, including lighting, semiconductors, and industrial gases. In the lighting sector, neon gas is extensively used In the production of neon lamps, which find applications in outdoor advertising and signage. In the semiconductor industry, neon gas is used In the production of ICs and LCD panels due to its unique properties, such as high electrical conductivity and ability to emit a red-orange light. Moreover, the aviation industry utilizes neon gas in aircrafts for holography and vacuum tubes. Neon gas is also employed in cryogenic applications, such as In the production of ABS and steel, and as a cooling agent in oscilloscopes and spectroscopy equipment.

- The increasing demand for enhanced power density and advanced technology in consumer electronics, such as smartphones and sensors, is driving the growth of the market. However, the negative impacts of geopolitical issues, such as the Russia-Ukraine war, on the supply of helium, a by-product of neon gas extraction, may hinder market growth. In summary, the market is witnessing significant growth due to the increasing demand for ICs, LCD panels, and advanced technology in consumer electronics. Neon gas also finds extensive applications In the aviation, industrial gases, and holography industries. However, the geopolitical instability affecting the supply of helium may pose a challenge to market growth.

What will be the Size of the Neon Gas Market During the Forecast Period?

- The market encompasses the production, consumption, and trade of neon, a noble gas primarily utilized in various industries due to its unique properties under an electric field. Neon gas finds extensive applications in diverse sectors such as lasers, electronics, military and defense, sensors, aviation, and advertising. In the electronics industry, neon is employed in semiconductors, LCD and plasma displays, imaging technologies, and lithography stages for manufacturing semiconductor devices. Neon's role in lasers is significant for applications in various industries, including medical, scientific research, and material processing. The market is experiencing growth, driven by the increasing demand for advanced technologies in consumer electronics, aviation, military, and defense sectors.

- Neon's use in neon lights, fog lights, and advertising further bolsters market growth. The market's size and direction are influenced by factors such as the periodic table position of neon, its unique electrical conductivity, and the ongoing advancements in technology. Neon's primary competitors In the gas market are other noble gases, including helium and argon.

How is this Neon Gas Industry segmented and which is the largest segment?

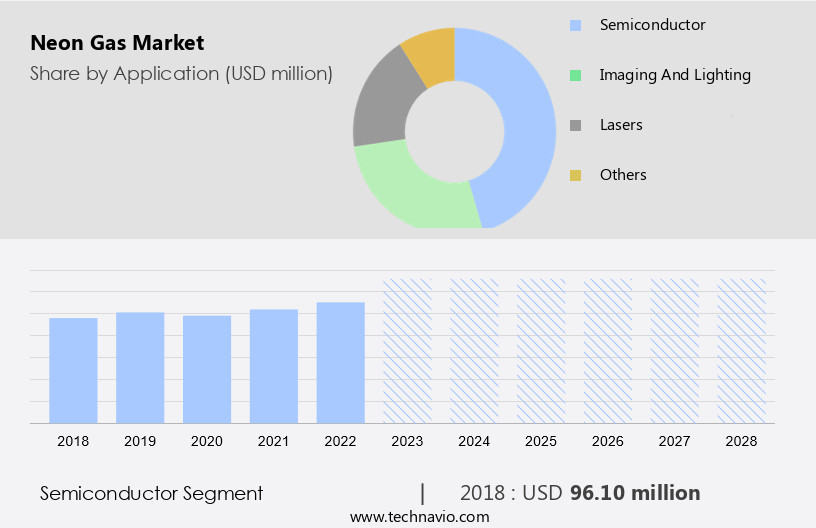

The neon gas industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Semiconductor

- Imaging and lighting

- Lasers

- Others

- Distribution Channel

- Cylinders

- Bulk and micro bulk

- On-site

- Geography

- Europe

- France

- APAC

- China

- North America

- US

- Middle East and Africa

- South America

- Europe

By Application Insights

- The semiconductor segment is estimated to witness significant growth during the forecast period.

Neon gas plays a significant role In the semiconductor industry due to its application In the production process. The increasing demand for semiconductors, driven by the electronic content in military defense equipment and the global electronics sector, will fuel market growth. Semiconductors are integral to military forces and civilian applications, including aviation, radar systems, and high-performance computing. The emergence of multi-core digital signal processing (DSPs) in defense technology reduces power consumption and enhances performance, making it essential for advanced radar and avionics systems. The defense sector's reliance on efficient DSP algorithms necessitates the use of neon gas in semiconductor manufacturing.

Get a glance at the market report of share of various segments Request Free Sample

The semiconductor segment was valued at USD 96.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Neon gas is a noble gas extensively utilized in various industries, including lasers, electronics, military and defense, sensors, aviation, air separation units, semiconductors, neon lights, and advertising. Its application spans from illuminating buildings and creating vibrant advertising signs to powering high-tech equipment such as Helium Neon lasers, holography scanners, and particle colliders. The increasing demand for advanced technologies in sectors like consumer electronics, semiconductors, aerospace, and automotive is driving the growth of the market. European markets, in particular, are experiencing significant growth due to rising investments in wireless communication systems and the presence of major companies like INGAS and Cryoin. Neon gas's versatile properties, including its unique emission spectrum, make it an essential component in various lighting technologies and defense equipment.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Neon Gas Industry?

An increasing demand for ICs is the key driver of the market.

- Neon gas plays a crucial role In the semiconductor industry, specifically In the manufacturing process of integrated circuits (ICs) used in automobiles, consumer electronics, and other electronic equipment. The lithography step in semiconductor chip production utilizes it in lasers to carve patterns into silicon. The global automotive industry's increasing focus on advanced safety systems, such as passenger airbags, antilock braking systems (ABS), electronic stability control (ESC), traction control systems (TCS), and tire-pressure monitoring systems (TPMS), drives the demand. For instance, In the US, the National Highway Traffic Safety Administration (NHTSA) mandates the installation of TPMS in all vehicles under 10,000 lbs.

- Neon gas also finds applications in various industries, including military and defense, aviation, sensors, cryogenic applications, and lighting technologies. Its unique emission spectrum, which includes red, green, orange, and yellow light, makes it suitable for neon lights, advertising signage, and illuminating buildings. Additionally, neon gas is used in rare gas mixtures with krypton, argon, and helium for various applications, such as wave meter tubes, rocket propulsion systems, particle colliders, and holography. In the electronics sector, it is used in electron tubes, glow lamps, plasma studies, and fluorescent starter tubes. Neon gas's boiling point and gaseous condition make it an essential component in gas lasers, cryogenic refrigeration, and DUV lithography methods. Furthermore, it is used in oxygen production facilities and the electronic goods sector for various applications, including barcode scanners, laser sensors, and lithography stages for semiconductor devices.

What are the market trends shaping the Neon Gas Industry?

The increasing demand for enhanced power density is the upcoming market trend.

- Neon gas, a noble rare gas, is widely used in various industries due to its unique properties. In the electronics sector, it is employed in lasers for applications such as holography, scanners, and blood analysis. The military and defense sector utilizes it in defense equipment, including sensors and lighting technologies for aviation and cryogenic applications in rocket propulsion systems and particle colliders. It is also used In the aviation industry for lighting signages and advertising, particularly in neon tubes that emit red, green, orange, and yellow light. The semiconductor industry relies on it for manufacturing semiconductor devices, LCDs, and imaging components. Neon gas is used in gas lasers, cryogenic refrigeration, and DUV lithography methods for producing electronic goods.

- In the consumer electronics sector, it is used in various lighting technologies, such as fog lights, lithography stages, and plasma studies. Neon gas is also used in fluorescent starter tubes, wave meter tubes, and spectroscopy. The increasing demand for high-power solutions and compact applications is driving the need for superior semiconductor materials. Neon gas, as a noble rare gas, is well-suited for high-power applications due to its inherent material properties. This eliminates the need for cooling systems, resulting in compact sizes and cost savings.Neon gas is also used in various industries, including oil and gas, mining, and cylinders and tanks for storage. Overall, neon gas plays a crucial role in various industries, from electronics to defense and lighting technologies.

What challenges does the Neon Gas Industry face during its growth?

The negative impacts of Russia Ukraine war is a key challenge affecting the industry growth.

- Neon gas is a noble gas commonly used in various industries, including lasers, electronics, military and defense, sensors, aviation, and lighting. Neon's emission spectrum produces red, green, orange, yellow, and other colors, making it essential for lighting technologies such as neon tubes in advertising and illuminating buildings. Neon is also used in cryogenic applications, rocket propulsion systems, particle colliders, wave meter tubes, and other high-tech equipment. Ukraine is a significant supplier of neon, with key companies like Cryoin and INGAS based there. However, the Russian invasion of Ukraine in 2022 led to the closure of Cryoin's manufacturing plants, causing a sharp financial crunch for the company. This event negatively impacted the semiconductor industry due to the rising costs of raw materials, including neon, used in semiconductor production. As a result, semiconductor manufacturers worldwide have faced challenges in procuring parts from Russia and Ukraine.

- Neon's applications span various sectors, including the electronics industry, where it is used in semiconductors, LCDs, imaging, smartphones, and televisions. The gas is also used in lighting technologies, such as neon signs, billboards, and signages. In the military and defense sector, neon is used in defense equipment, lamps, and bulbs. In the aviation industry, neon is used in air separation units and fog lights. In the industrial sector, neon is used in cryogenic refrigeration, DUV lithography methods, and oxygen production facilities. Neon is often used in conjunction with other rare gases, such as krypton and argon, and is available in cylinders and tanks. Its unique properties make it an essential component in various industries, from consumer electronics to aerospace.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the thre market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, neon gas market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- Air Products and Chemicals Inc.

- Axcel Gases

- Bhuruka Gases Ltd.

- Chemix Gases

- Chengdu Taiyu Industrial Gases Co. Ltd.

- Cryoin Engineering Ltd.

- Deluxe Industrial Gases

- INGAS LLC

- Jinhong Gas Co. Ltd.

- Linde Plc

- Merck KGaA

- Messer SE and Co. KGaA

- Mitsubishi Chemical Group Corp.

- Proton Gases India Pvt. Ltd.

- TEMC Co. LTD.

- Wesfarmers Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Neon gas is a noble gas with a distinctive red-orange glow when in its gaseous state. It is one of several rare gases that are essential in various industries due to its unique properties. It finds extensive applications in various sectors, including lasers, electronics, military and defense, sensors, aviation, and lighting. In the realm of lasers, it is widely used in helium-neon lasers, which are renowned for their stability and high-quality beam. These lasers are extensively employed in holography, scanners, and spectroscopy. Neon gas is also utilized in wave meter tubes and plasma studies. The electronics sector relies on it for various applications, such as in vacuum tubes, glow lamps, and electron tubes. These components are integral to the functioning of electronic devices, including televisions, smartphones, and computers. It plays a crucial role in military and defense applications, particularly In the production of defense equipment. Its unique properties make it an essential component in various defense technologies, including sensors, illuminating devices, and rocket propulsion systems. The aviation industry utilizes it in various applications, including in lighting technologies for aircraft interiors and exterior signage. Neon lights are also commonly used in advertising, illuminating buildings and billboards. It is also used In the production of semiconductors, which are integral to various industries, including consumer electronics and the semiconductor sectors.

Neon gas is used In the fractional distillation process to separate and purify other gases, such as helium and argon. In the field of sensors, it is used in various applications, including blood analysis, particle counting, and food categorization. Its unique properties make it an effective medium for detecting and measuring various substances. It is used in cryogenic applications, including In the production of liquid air and in cryogenic refrigeration systems. It is also used in particle colliders and in the production of oxygen in oxygen production facilities. It is also used in various lighting technologies, including lamps, bulbs, and lighting products. Its distinctive red-orange glow makes it a popular choice for advertising signs and billboards. The noble gases, including neon, are located in Group 18 of the periodic table. It has a boiling point of -246.08°C and a gaseous condition at standard temperature and pressure. It emits light In the red part of the emission spectrum, with wavelengths ranging from approximately 611.1 to 632.3 nanometers. It is used in various lighting applications, including neon tubes and glass tubes.

Thus, these lighting technologies are commonly used in advertising signs, billboards, and lighting products. Neon tubes are also used in fog lights and lithography stages. It is used in various industrial applications, including In the oil and gas industry and in mining. It is transported and stored in cylinders and tanks for easy transportation and use. In summary, it is a versatile noble gas with a wide range of applications in various industries, including lasers, electronics, military and defense, sensors, aviation, and lighting. Its unique properties make it an essential component in various technologies and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.55% |

|

Market growth 2024-2028 |

USD 116.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.66 |

|

Key countries |

Ukraine, Russia, China, US, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Neon Gas Market Research and Growth Report?

- CAGR of the Neon Gas industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the neon gas market growth of industry companies

We can help! Our analysts can customize this neon gas market research report to meet your requirements.