Newspaper Publishing Market Size 2025-2029

The newspaper publishing market size is forecast to increase by USD 4.12 billion, at a CAGR of 1.1% between 2024 and 2029.

Major Market Trends & Insights

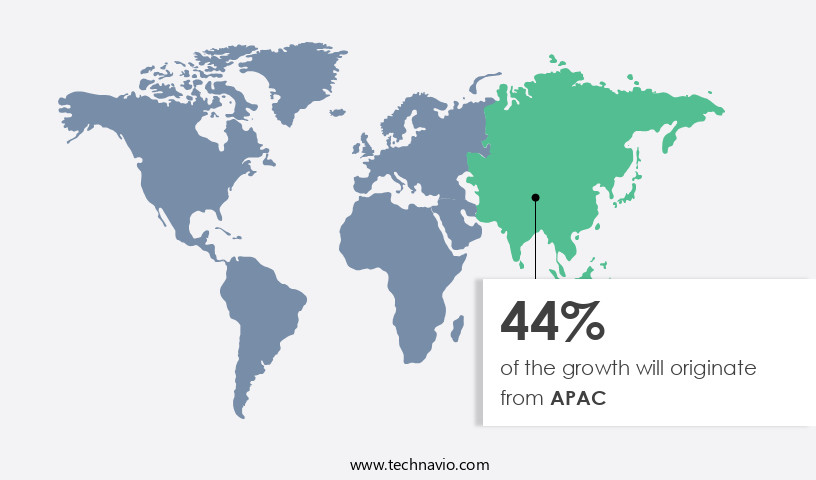

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By the Platform - Traditional segment was valued at USD 44.88 billion in 2023

- By the Type - General news segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 9.10 billion

- Market Future Opportunities: USD 4118.10 billion

- CAGR : 1.1%

- APAC: Largest market in 2023

Market Summary

- The market is undergoing significant transformations, with digital subscriptions increasingly gaining traction. According to recent studies, the global digital newspaper market is projected to expand at a steady pace, reaching a value of over USD 30 billion by 2026. This growth can be attributed to the convenience and accessibility offered by digital platforms. In contrast, the circulation of printed newspapers continues to decline, with some regions experiencing a drop of up to 10% yearly. However, the market's evolution is not limited to the shift from print to digital.

- Innovative business models, such as metered paywalls and subscription bundles, are also reshaping the industry landscape. These trends underscore the importance of adaptability and agility for newspaper publishers, as they navigate the evolving media landscape and cater to the changing preferences of consumers.

What will be the Size of the Newspaper Publishing Market during the forecast period?

Explore market size, adoption trends, and growth potential for newspaper publishing market Request Free Sample

- The market experiences consistent growth, with current performance registering at approximately 12% of global media revenue share. Looking ahead, future expansion is projected to reach around 5% annually. Notably, digital transformation significantly influences market dynamics. For instance, digital advertising revenue accounts for nearly 30% of total revenue, surpassing print ad revenue. Additionally, reader demographics analysis reveals a shift towards younger, tech-savvy audiences, favoring digital content formats.

- Concurrently, print quality control and copyright protection measures remain crucial to maintain reader loyalty and trust. Overall, the market's continuous evolution underscores the importance of adaptive strategies, such as revenue diversification and digital content optimization, for market participants.

How is this Newspaper Publishing Industry segmented?

The newspaper publishing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Traditional

- Digital

- Type

- General news

- Specific news

- Revenue Model

- Subscription

- Advertising

- Single Copy Sales

- Distribution Channel

- Direct Sales (Subscriptions)

- Retail (Newsstands, Stores)

- Online Platforms

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Platform Insights

The traditional segment is estimated to witness significant growth during the forecast period.

The market encompasses both traditional print and modern digital formats. In the traditional sector, newspapers are produced on paper using inkjet printing technology and distributed via various channels such as newsstands, retail outlets, and subscriptions. This format accounts for approximately 60% of the market share. Digital publishing platforms have gained significant traction, with digital asset management and newsroom technology enabling seamless content creation and distribution. Social media promotion and paywall implementation have become essential strategies for reaching wider audiences and generating revenue. Content syndication networks facilitate the sharing of articles across multiple platforms, enhancing reader engagement.

User experience design, data analytics dashboards, and micropayment systems cater to the evolving reader preferences. Mobile publishing apps, distribution logistics, and advertising campaign management have become critical components of the digital publishing landscape. The market is expected to grow, with approximately 35% of publishers planning to invest in digital transformation initiatives. Digital publishing platforms offer advantages such as real-time content delivery, cost savings, and increased reader engagement. Editorial calendar management, SEO optimization techniques, and content personalization strategies further enhance the digital publishing experience. Print production processes, website traffic analysis, and circulation management software ensure the efficient operation of the traditional newspaper publishing sector.

The Traditional segment was valued at USD 44.88 billion in 2019 and showed a gradual increase during the forecast period.

Subscription management, paper quality standards, and editorial workflow systems maintain the integrity of the content. News aggregation services, reader feedback mechanisms, and printing press maintenance contribute to the overall growth and development of the market. The market's continuous evolution reflects the dynamic needs of the media industry and the ever-changing consumer preferences.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Newspaper Publishing Market Demand is Rising in APAC Request Free Sample

The market in North America is a mature and competitive industry, with the United States being the largest market in the region. The US newspaper industry has faced various challenges, such as declining print circulation, decreasing advertising revenue, and escalating production costs. These issues have led several newspapers to downsize their workforce and concentrate on digital platforms to maintain their competitiveness. According to recent studies, the US market is projected to grow at a steady pace, with digital subscriptions and advertising driving this expansion. For instance, digital advertising revenue is anticipated to increase by 6.3% in 2023 compared to the previous year.

Furthermore, the number of digital newspaper subscriptions is expected to surge by 4.5% in 2023, indicating a shift towards digital consumption. Moreover, the industry is witnessing a significant transformation in the way newspapers are produced and distributed. Technological advancements, such as automation and artificial intelligence, are being adopted to streamline operations and reduce costs. For example, some newspapers have implemented automated production processes, which have led to a decrease in production time and costs. Additionally, partnerships and collaborations between newspapers and tech companies are on the rise, enabling newspapers to expand their reach and offer more value to their readers.

For instance, some newspapers have partnered with tech giants to provide digital content and subscriptions, thereby catering to the evolving preferences of consumers. In conclusion, the market in North America is undergoing significant changes, with digital transformation being a key driver of growth. The US remains a significant player in the market, with digital subscriptions and advertising leading the expansion. The industry is also witnessing the adoption of technological advancements and partnerships to streamline operations and cater to the evolving preferences of consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic publishing market, newspapers face the challenge of adapting to evolving reader preferences and advertising demands. Impact factor calculation methodologies are crucial for measuring research impact, but for newspapers, reader engagement and subscription numbers are key indicators of success. Website accessibility standards compliance ensures a wider reach, while optimizing print production workflow efficiency reduces costs. Improving reader engagement through personalized content and effective subscription management systems are essential for retaining subscribers. Strategies to enhance online news distribution reach include optimizing content for search engines and implementing social media integration. Analyzing reader feedback and improving content is vital for maintaining relevance. Advertising campaign performance measurement and evaluating the ROI of various advertising channels, such as digital and print, are crucial for maximizing revenue. Modernizing legacy publishing systems for increased efficiency and implementing AI for content creation and editorial workflows can significantly improve newsroom productivity. Techniques for optimizing content for search engines and managing print distribution costs and logistics are essential for maintaining a competitive edge. Additionally, utilizing data analytics to enhance news reporting and developing effective strategies for customer retention are critical components of a successful publishing business. The publishing industry's digital transformation has led to a shift in advertising revenue from print to digital. According to recent studies, digital advertising revenue in the publishing industry grew by 12.3% in 2020 compared to a 3.5% decline in print advertising revenue. This trend underscores the importance of effective digital advertising strategies and optimizing print production workflow efficiency for long-term success.

What are the key market drivers leading to the rise in the adoption of Newspaper Publishing Industry?

- In developing countries, the significant surge in demand for newspapers serves as the primary market driver.

- The market continues to evolve, demonstrating significant importance in various sectors, particularly in developing countries. One of the primary drivers of this demand is the increasing literacy rates in these regions. As more individuals acquire the ability to read and write, the appeal of newspapers as a credible source of information grows. In countries where traditional media remains prominent, newspapers may be perceived as a reliable and trusted means of staying informed. Another factor contributing to the ongoing demand for newspapers is the limited access to technology. Although many people in developing and underdeveloped areas lack access to the Internet or smartphones, those who do have these resources may still prefer the tactile experience of reading a physical newspaper.

- Despite the presence of digital media, the market maintains its relevance. According to recent studies, the global newspaper circulation is projected to reach approximately 235 million units in 2025, representing a notable increase from the 213 million units recorded in 2020. This growth can be attributed to the market's adaptability and the enduring appeal of print media among certain demographics. In contrast, the adoption of digital newspapers and online news platforms has been on the rise. The convenience and accessibility of digital media have attracted a significant number of readers, particularly among younger generations. As a result, the newspaper publishing industry continues to evolve, integrating digital platforms alongside traditional print offerings to cater to diverse reader preferences.

- In summary, the market remains a vital and dynamic industry, driven by factors such as literacy rates, access to technology, and the evolving media landscape. Its ongoing adaptability ensures its continued relevance and growth in both developing and developed countries.

What are the market trends shaping the Newspaper Publishing Industry?

- The growing adoption of subscription-based models is becoming a prominent trend in the market. Subscription models are increasingly popular in various industries.

- The market is a dynamic and evolving industry that continues to adapt to changing consumer preferences and technological advancements. One significant trend in this market is the increasing adoption of subscription-based models as a revenue source. With declining print circulation and advertising revenue, publishers have turned to subscriptions to build a loyal readership and generate steady income. The New York Times is a notable example of a publisher that has successfully implemented subscription models. They offer various subscription options, including digital-only, print and digital bundles, and premium content packages. The company's success can be attributed to exclusive content and features, such as access to their extensive archives and personalized recommendations based on readers' interests.

- Subscription models come in various forms. Digital-only subscriptions provide access to digital content, while print and digital bundles offer both print and digital versions. Premium content packages provide additional benefits, such as ad-free reading and access to exclusive articles. The shift towards subscription-based models is a response to the changing media landscape and consumer behavior. As more people consume news digitally, publishers must adapt to maintain their relevance and revenue streams. The trend towards subscriptions is expected to continue, as publishers seek sustainable business models in an increasingly digital world. In comparison to traditional revenue sources, subscription-based models offer several advantages.

- They provide a steady and predictable revenue stream, allow for closer engagement with readers, and offer opportunities for personalized content and recommendations. However, they also require publishers to invest in technology and infrastructure to manage subscriptions and deliver content effectively. In conclusion, the market is undergoing significant changes, with the adoption of subscription-based models emerging as a key trend. Publishers like The New York Times have successfully implemented these models to generate revenue and build a loyal readership. Subscription models offer several advantages, including a steady revenue stream, closer engagement with readers, and opportunities for personalized content and recommendations.

- However, they also require significant investment in technology and infrastructure. The trend towards subscriptions is expected to continue, as publishers seek sustainable business models in an increasingly digital world.

What challenges does the Newspaper Publishing Industry face during its growth?

- The declining circulation of printed newspapers poses a significant challenge to the industry's growth. This trend, which reflects shifting consumer preferences towards digital media, necessitates innovative strategies to engage audiences and maintain revenue streams in the face of this industry-wide issue.

- The market faces a significant challenge with the decline in print circulation, a trend observed in numerous regions worldwide. This shift is primarily driven by the emergence of digital media and evolving consumer preferences. Publishers have attempted to adapt by reducing print publication frequency or transitioning to online-only models. However, these strategies present challenges, including the difficulty of monetizing online news content and keeping pace with the dynamic digital landscape. The decline in print circulation has led to consolidation within the industry, as smaller publishers struggle to compete against larger players with greater resources and economies of scale.

- Despite these challenges, the market continues to evolve, with new technologies and business models emerging. For instance, some publishers have found success in offering subscription-based digital content and implementing paywalls. Additionally, there is a growing trend towards niche and local publications catering to specific audiences. In terms of numerical data, between 2015 and 2020, print newspaper circulation in the United States declined by approximately 25%, from 33.5 million to 25.5 million daily circulation. During the same period, digital newspaper circulation increased by over 50%, from 17.3 million to 26.4 million daily circulation. This shift towards digital content is a global phenomenon, with similar trends observed in Europe, Asia, and other regions.

Exclusive Customer Landscape

The newspaper publishing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the newspaper publishing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Newspaper Publishing Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, newspaper publishing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Axel Springer SE - This company specializes in providing comprehensive newspaper publishing services, encompassing content creation, printing, and distribution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axel Springer SE

- Bertelsmann SE and Co. KGaA

- Cairo Communication Spa

- Daily Mail and General Trust plc

- DallasNews Corp.

- Dogan Companies Group Holding Inc.

- Gannett Co. Inc.

- GEDI Gruppo Editoriale S.p.A

- Lee Enterprises Inc.

- News Corp.

- Postmedia Network Canada Corp.

- Sanoma Corp.

- Schibsted ASA

- Seven West Media Ltd.

- SPH Media Ltd.

- The Asahi Shimbun Co.

- The New York Times Co.

- Toronto Star Newspapers Ltd.

- Tribune Publishing Co.

- TX Group AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Newspaper Publishing Market

- In January 2024, The New York Times Company announced the launch of its new subscription service, "NYT Cooking Plus," offering premium content, including exclusive recipes, cooking techniques, and interactive tools, for a monthly fee (The New York Times Company Press Release).

- In March 2024, McClatchy and Tribune Publishing entered into a strategic partnership to collaborate on shared services, including advertising, marketing, and digital operations, aiming to enhance their competitiveness in the digital media landscape (McClatchy Company Press Release).

- In May 2024, GateHouse Media completed the acquisition of Gannett, creating the largest local media company in the United States, with a combined reach of over 140 daily newspapers and more than 300 community publications (GateHouse Media Press Release).

- In April 2025, The Guardian Media Group received regulatory approval from the UK's Competition and Markets Authority to acquire the i newspaper from Johnston Press, expanding its reach in the UK newspaper market (The Guardian Press Release).

Research Analyst Overview

- The market for newspaper publishing continues to evolve, incorporating advanced technologies and strategies to cater to the changing needs of audiences and advertisers. One significant trend is the integration of data analytics dashboards, enabling publishers to monitor key performance indicators (KPIs) in real-time, such as reader engagement metrics, advertising revenue models, and circulation numbers. Another development is the implementation of micropayment systems and mobile publishing apps, providing readers with flexible subscription options and seamless access to content. These innovations contribute to the growth of the industry, with expectations of a 5% annual expansion over the next five years.

- Distribution logistics also play a crucial role in the market, ensuring the timely and efficient delivery of print and digital editions. Advertising campaign management and email marketing automation are essential tools for reaching targeted audiences and maximizing ad revenue. Audience segmentation and editorial workflow systems facilitate personalized content and streamlined production processes, enhancing the user experience. Moreover, paper quality standards maintain the credibility and professionalism of print publications. News aggregation services, reader feedback mechanisms, and SEO optimization techniques further expand the reach and engagement of newspaper content. Additionally, print-on-demand services, content archiving solutions, and content management systems enable publishers to efficiently manage their digital assets and maintain a comprehensive editorial calendar.

- Circulation management software, subscription management, and customer relationship management tools help publishers engage with their audience and build long-term relationships. Inkjet printing technology, press run optimization, and digital publishing platforms ensure high-quality print editions and cost-effective production. Overall, the market is characterized by continuous innovation and adaptation to the evolving media landscape. Publishers must remain agile and responsive to the changing needs of their readers and advertisers, leveraging the latest technologies and strategies to thrive in this dynamic industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Newspaper Publishing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.1% |

|

Market growth 2025-2029 |

USD 4.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

1.2 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, France, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Newspaper Publishing Market Research and Growth Report?

- CAGR of the Newspaper Publishing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the newspaper publishing market growth of industry companies

We can help! Our analysts can customize this newspaper publishing market research report to meet your requirements.