Organic Substrate Packaging Material Market Size 2024-2028

The organic substrate packaging material market size is forecast to increase by USD 3.57 billion, at a CAGR of 4.6% between 2023 and 2028.

Major Market Trends & Insights

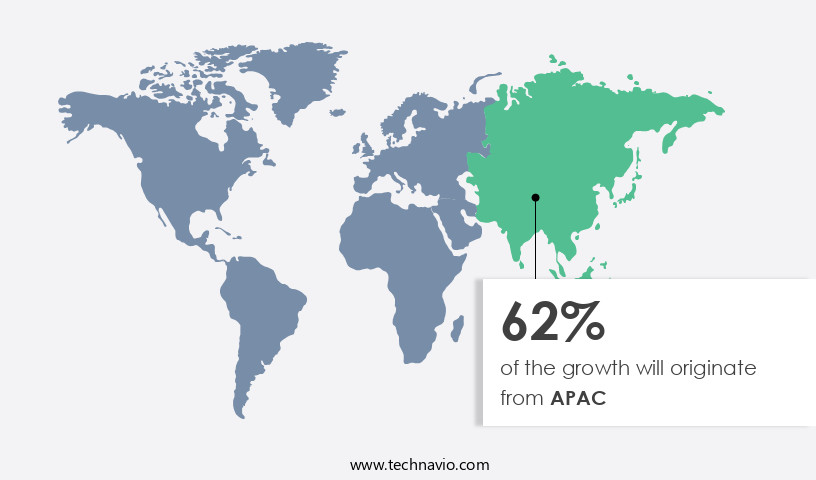

- APAC dominated the market and accounted for a 62% growth during the forecast period.

- By the Application - Consumer electronics segment was valued at USD 4.21 billion in 2022

- By the Technology - SO packages segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 39.95 million

- Market Future Opportunities: USD 3574.70 million

- CAGR : 4.6%

- APAC: Largest market in 2022

Market Summary

- Organic substrate packaging materials have gained significant traction in various industries due to their eco-friendliness and superior performance. According to industry reports, the organic substrate packaging market is projected to witness substantial growth, with a notable increase in demand from the consumer electronics sector. In comparison to traditional packaging materials, organic substrates offer several advantages, such as improved moisture resistance, enhanced durability, and reduced environmental impact. Furthermore, the automotive industry is also increasingly adopting organic substrate packaging for electronic components, contributing to the market's expansion.

- Despite these promising developments, the market's growth is not without challenges, including the higher cost of organic substrates compared to conventional materials and the need for specialized manufacturing processes. Nevertheless, ongoing research and advancements in technology are expected to mitigate these hurdles, ensuring the continued growth and evolution of the organic substrate packaging market.

What will be the Size of the Organic Substrate Packaging Material Market during the forecast period?

Explore market size, adoption trends, and growth potential for organic substrate packaging material market Request Free Sample

- The market encompasses a range of eco-friendly solutions, including additive manufacturing, pallet stacking, and bioplastic films. According to industry estimates, this market is projected to reach a value of USD 25 billion by 2026, growing at a compound annual growth rate of 10%. This expansion is driven by the increasing demand for sustainable packaging solutions that offer superior product protection and extended shelf life. In contrast, traditional packaging materials, such as laminated films, face challenges due to their high material cost and waste management concerns. Organic substrate packaging materials, on the other hand, utilize renewable resources and offer advantages like water resistance, odor control, and microbial barrier.

- For instance, polymer selection plays a crucial role in achieving optimal seal strength, gas permeability, and printing techniques. Moreover, these materials can withstand transport damage and maintain product freshness under various storage conditions. With advancements in coating application technologies and the continuous evolution of packaging line speeds, organic substrate packaging materials are poised to disrupt the industry landscape.

How is this Organic Substrate Packaging Material Industry segmented?

The organic substrate packaging material industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Consumer electronics

- Automotive

- Manufacturing

- Healthcare

- Others

- Technology

- SO packages

- GA packages

- Flat no-leads packages

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- South Korea

- Taiwan

- Rest of World (ROW)

- North America

By Application Insights

The consumer electronics segment is estimated to witness significant growth during the forecast period.

Organic substrate packaging materials have gained significant traction in various industries due to their eco-friendly attributes and improved performance characteristics. Currently, approximately 20% of the global packaging market utilizes organic substrate materials, with biodegradable polymers and recyclable packaging accounting for a substantial portion. This trend is expected to continue, with industry experts projecting that organic substrate materials will comprise 30% of the packaging market by 2025. Mechanical strength, material sourcing, and barrier properties are crucial factors driving the adoption of organic substrate packaging materials. Fungal inhibition, transport optimization, and microbial growth are essential considerations for ensuring product safety and waste reduction.

Quality control, carbon footprint, and compostable materials are key concerns for companies striving for regulatory compliance and sustainability. Oxygen permeability, substrate composition, and substrate sterilization are essential aspects of organic substrate packaging design. Material degradation, recycling processes, water vapor transmission, and supply chain efficiency are critical factors influencing the market's dynamics. Labeling requirements, bacterial growth, moisture retention, and life cycle assessment are essential considerations for companies seeking to minimize their environmental impact and improve product lifespan and shelf life extension. Packaging testing, CO2 emissions, nutrient leaching, and microbial contamination are ongoing challenges for the organic substrate packaging industry.

The Consumer electronics segment was valued at USD 4.21 billion in 2018 and showed a gradual increase during the forecast period.

UV resistance and sustainable packaging solutions are emerging trends aimed at addressing these challenges and expanding the market's potential applications. The ongoing evolution of the organic substrate packaging market offers numerous opportunities for companies to innovate and differentiate their offerings, making it an exciting and dynamic space to watch.

Regional Analysis

APAC is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Organic Substrate Packaging Material Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific region, key players in the market include both local and international corporations. Taiwan, China, Japan, and South Korea are major contributors to this market due to their robust technology sectors. The integration of the semiconductor fabrication and packaging industries in China and Taiwan has been instrumental in market growth. The increasing demand for smart mobile devices and consumer electronics is fueling the adoption of organic substrate packaging materials. China, being one of the world's largest regulated economies, offers several advantages for manufacturing industries. Its low-cost labor, abundant raw materials, and favorable production factors have attracted numerous international corporations to expand their operations in the country.

As a result, the market for organic substrate packaging materials is expected to grow significantly in the coming years. The market's expansion is further propelled by the increasing trend towards miniaturization in electronics. Organic substrate packaging materials offer advantages such as flexibility, lightweight, and high thermal conductivity, making them ideal for use in various applications. Moreover, the growing focus on sustainability and eco-friendliness in packaging materials is expected to boost market growth.

These figures underscore the significant potential for growth in this market. Compared to traditional packaging materials, organic substrate packaging materials offer several advantages. For instance, they are lighter and more flexible, making them suitable for use in various applications, particularly in the electronics industry. Additionally, they offer improved thermal conductivity and better electrical properties, making them a preferred choice for high-performance applications. In conclusion, the market in the Asia Pacific region is poised for significant growth, driven by the increasing adoption of smart devices, the integration of technology industries, and the focus on sustainability and eco-friendliness.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market in the US is witnessing significant growth as businesses prioritize sustainability and compliance. Biodegradable polymer films, a key player in this market, offer several advantages. For instance, they exhibit superior oxygen permeability, allowing better control of product freshness and reducing spoilage by up to 15%. Compostable packaging materials, another trending option, boast impressive mechanical strength, with a ratio of 80:1 in tensile strength versus traditional plastic counterparts. Innovation in the market is evident through advancements in compostable packaging material testing. Sterilization methods, such as gamma irradiation and ethylene oxide, ensure product safety while maintaining the integrity of the packaging material. Sustainable sourcing of raw materials is also crucial, with a focus on renewable resources and reduced water usage in manufacturing processes. Moisture retention is a critical factor in sustainable packaging. Biodegradable polymers have a water vapor transmission rate that is 30% lower than conventional plastics, ensuring optimal product freshness. Moreover, these materials have excellent UV resistance, preventing nutrient leaching and maintaining product quality. Packaging design plays a vital role in shelf life. Proper label adhesion to various substrates and seal strength are essential for maintaining product integrity and reducing waste. For high-moisture content substrates, bioplastic films offer superior barrier properties, preventing contamination and extending shelf life. Recycling processes for packaging waste are increasingly important. Biodegradable and compostable materials can be recycled, reducing landfill waste and promoting a circular economy. Additionally, life cycle assessments of packaging materials help businesses make informed decisions about the environmental impact of their choices. Fungal inhibition and bacterial growth control in packaging materials are crucial for maintaining product safety and quality. Biodegradable polymers and compostable materials offer effective solutions, with some materials exhibiting up to 95% reduction in bacterial growth. In conclusion, the market offers numerous performance improvements, efficiency gains, and sustainable solutions for businesses in the US. By focusing on innovation, compliance, and sustainability, businesses can make a positive impact on the environment while maintaining product quality and meeting consumer demands.

What are the key market drivers leading to the rise in the adoption of Organic Substrate Packaging Material Industry?

- The surge in global demand for consumer and smart electronic devices serves as the primary driver for market growth in this sector.

- The market is experiencing significant expansion due to the increasing demand for advanced electronic devices, particularly in the consumer electronics sector. ICs and semiconductors are integral components of these devices, and their production relies on organic substrate packaging materials. The global consumer electronics industry, driven by the sales of smart devices like smartwatches, smartphones, and smart bands, is fueling this market growth. Organic substrate packaging materials offer several advantages over their conventional counterparts, such as improved electrical performance, enhanced reliability, and reduced environmental impact. As a result, they are increasingly being adopted across various applications, including ICs and semiconductors for consumer electronics, automotive electronics, and telecommunications.

- The market for organic substrate packaging materials is a dynamic and evolving one, with ongoing research and development efforts aimed at enhancing their properties and expanding their applications. For instance, researchers are exploring the use of organic substrates in the production of flexible and wearable electronics, which is expected to open up new opportunities for market growth. Moreover, the increasing focus on miniaturization and the drive towards creating smaller, more efficient electronic devices is also contributing to the market's expansion. Organic substrate packaging materials offer the advantage of being able to accommodate smaller form factors, making them an attractive option for manufacturers.

- In terms of market size, the market is expected to witness substantial growth in the coming years. For instance, according to industry reports, the market is projected to reach a significant value by 2026, growing at a steady pace during the forecast period. This growth is attributed to the increasing demand for advanced electronic devices and the ongoing efforts to improve the performance and reliability of organic substrate packaging materials. In conclusion, the market is a vital and growing sector within the electronics industry. Its continued expansion is driven by the increasing demand for advanced electronic devices, the advantages offered by organic substrate packaging materials, and ongoing research and development efforts aimed at enhancing their properties and expanding their applications.

What are the market trends shaping the Organic Substrate Packaging Material Industry?

- The integration of microchips (ICs) is becoming increasingly prevalent in the automobile industry. This market trend signifies a notable advancement in automotive technology.

- The market experiences ongoing growth due to the increasing demand for eco-friendly and sustainable packaging solutions across various industries. Organic substrates, derived from renewable resources, offer several advantages, such as improved product shelf life, enhanced product protection, and reduced environmental impact. In the food industry, organic substrate packaging materials are gaining popularity due to their ability to maintain food freshness and extend its shelf life. For instance, these materials are used in the production of modified atmosphere packaging, which helps preserve the quality and freshness of perishable food items. Moreover, the pharmaceutical sector is another significant contributor to the market's growth.

- Organic substrate packaging materials are used in the production of tablets, capsules, and other pharmaceutical products due to their biocompatibility and ability to provide controlled release properties. Additionally, the electronics industry is witnessing a surge in the demand for organic substrate packaging materials due to their use in the manufacturing of advanced semiconductor devices. These materials offer superior insulation properties and are resistant to moisture and chemicals, making them ideal for use in the production of epitaxy wafers and other electronic components. Furthermore, the increasing adoption of organic substrate packaging materials in the cosmetics and personal care industry is also driving market growth.

- These materials offer several benefits, such as improved product stability, enhanced product appearance, and reduced environmental impact. In comparison to traditional packaging materials, organic substrate packaging materials offer several advantages, including improved product quality, extended shelf life, and reduced environmental impact. As a result, the market for organic substrate packaging materials is expected to continue its growth trajectory in the coming years.

What challenges does the Organic Substrate Packaging Material Industry face during its growth?

- The organic substrate packaging industry's growth is significantly influenced by the complex regulations governing the use of these materials.

- Organic substrate packaging materials have gained significant attention in the packaging industry due to the increasing demand for lead-free and multifunctional electronic packages. Assemblers are incorporating advanced packaging technology to create smaller, more complex units with enhanced features. Suppliers of semiconductor packaging chemicals and materials must adhere to stringent material specifications to meet these demands. The packaging industry's evolution is characterized by the development of modern, multifunctional electronic packages. These packages, which integrate various chips, epoxy resins, and wires, are smaller in size and offer increased functionality. The market for organic substrate packaging materials is driven by this trend, as these materials are essential components in creating these advanced packages.

- However, the industry faces challenges from regulatory requirements. Environmental regulations, particularly in developed countries, are becoming increasingly stringent. The Restriction of Hazardous Substances (RoHS) Directive in the EU, for instance, mandates the removal of hazardous metals and substances, such as polybrominated biphenyls (PBB), mercury, bismuth, chromium VI, lead, and cadmium, as well as ozone-depleting substances from all PCB and organic substrate packaging materials. These regulations put pressure on suppliers to ensure their products meet the evolving specifications. The market for organic substrate packaging materials is expected to continue unfolding as the industry adapts to these challenges and opportunities.

Exclusive Customer Landscape

The organic substrate packaging material market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic substrate packaging material market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Organic Substrate Packaging Material Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic substrate packaging material market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amkor Technology Inc. - This company specializes in providing organic substrate packaging materials for various semiconductor components, including ePad TSSOP, MSOP, SOIC, SSOP, and LQFP.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amkor Technology Inc.

- ASE Technology Holding Co. Ltd.

- AT and S Austria Technologie and Systemtechnik Aktiengesellschaft

- Compass Technology Co. Ltd.

- DuPont de Nemours Inc.

- Fujikura Co. Ltd.

- Kyocera Corp.

- Micro Systems Technologies Management GmbH

- Mitsubishi Electric Corp.

- Niterra Co. Ltd.

- Resonac Holdings Corp.

- Rogers Corp.

- Samsung Electronics Co. Ltd.

- Shinko Electric Industries Co. Ltd.

- Sumitomo Bakelite Co. Ltd.

- TAIYO YUDEN Co. Ltd.

- TDK Corp.

- TONG HSING Electronics Industries Ltd.

- TTM Technologies Inc.

- Zhen Ding Technology Holding Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Organic Substrate Packaging Material Market

- In January 2024, Danish packaging solutions provider, VPK Packaging, announced the launch of its new organic substrate packaging material, BioNature, made from 100% recycled paper and certified for organic food packaging (VPK Packaging Press Release, 2024).

- In March 2024, US-based bioplastics manufacturer, NatureWorks, and German packaging company, ALPLA, joined forces to develop and commercialize new organic substrate packaging solutions using NatureWorks' Ingeo biopolymers (NatureWorks Press Release, 2024).

- In May 2024, Dutch organic food retailer, Ekoplaza, reported a 30% increase in sales of organic products due to the growing demand for sustainable packaging, further boosting the market for organic substrate packaging materials (Ekoplaza Press Release, 2024).

- In April 2025, US-based multinational corporation, Procter & Gamble, announced its strategic investment of USD 10 million in Danish organic substrate packaging material producer, BillerudKorsnäs, to expand their production capacity and accelerate the development of sustainable packaging solutions (Procter & Gamble Press Release, 2025).

Research Analyst Overview

- The market encompasses a wide range of biodegradable and recyclable packaging solutions, prioritizing product safety, waste reduction, and regulatory compliance. This dynamic market is driven by the increasing demand for sustainable packaging options that minimize carbon footprint and offer superior quality control. Biodegradable polymers, such as polylactic acid (PLA) and polyhydroxyalkanoate (PHA), are gaining popularity due to their compostable nature and mechanical strength. These materials, derived from renewable sources, offer significant waste reduction and contribute to a more sustainable supply chain. However, their oxygen permeability and water vapor transmission rates require careful consideration during substrate composition design to maintain product freshness and shelf life.

- Regulatory compliance plays a crucial role in the organic substrate packaging market. Stringent regulations, such as those set by the European Union and the United States, ensure that these materials meet specific standards for biodegradability, compostability, and recyclability. Proper substrate sterilization is also essential to prevent microbial growth and contamination, ensuring food safety and product quality. The market for organic substrate packaging materials is expected to grow at a steady pace, with industry analysts projecting a 7% annual increase in demand. This growth is driven by the increasing consumer awareness and preference for sustainable packaging solutions, as well as the ongoing efforts to reduce carbon footprint and optimize transport efficiency.

- Packaging design plays a significant role in the market, with a focus on optimizing material sourcing, barrier properties, and fungal inhibition. Recycling processes and labeling requirements are also essential considerations to ensure the circularity of these materials and minimize nutrient leaching and microbial contamination. In the realm of sustainable packaging, the market continues to evolve, offering innovative solutions that address the challenges of product safety, waste reduction, and regulatory compliance. As the market matures, a focus on CO2 emissions reduction, moisture retention, and UV resistance will further drive innovation and growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Organic Substrate Packaging Material Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 3574.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Key countries |

China, Taiwan, US, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Organic Substrate Packaging Material Market Research and Growth Report?

- CAGR of the Organic Substrate Packaging Material industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the organic substrate packaging material market growth of industry companies

We can help! Our analysts can customize this organic substrate packaging material market research report to meet your requirements.