Packaging Line Machinery Market Size 2024-2028

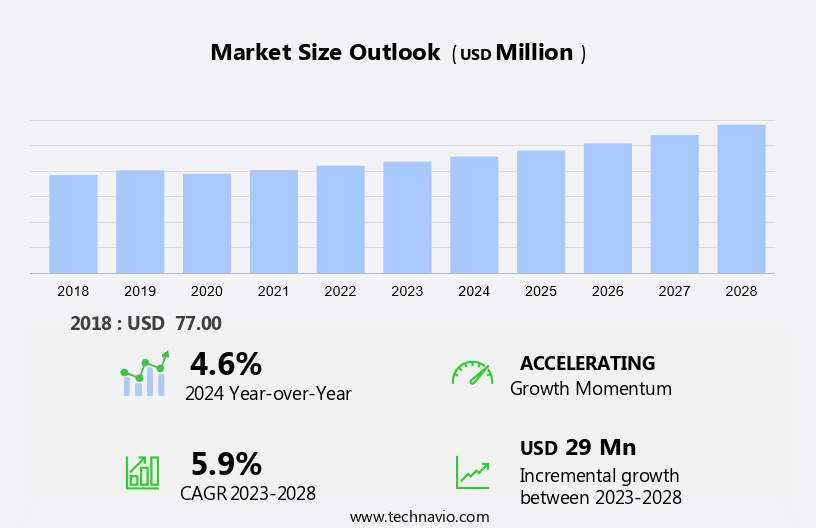

The packaging line machinery market size is forecast to increase by USD 29 million at a CAGR of 5.9% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. New product launches and mergers and acquisitions are driving market expansion. However, the high cost associated with advanced packaging equipment, such as counting machines, packaging automation systems, and specialized machinery for industries like pharmaceutical serialization, oncology packaging, respiratory packaging, and sterile packaging, presents a challenge for market growth. Moreover, hygiene and cleanliness are essential considerations in the food packaging industry, and machinery must be designed to meet these requirements. Packaging design plays a crucial role in the market, as companies strive to create innovative and efficient solutions to meet the evolving needs of various industries. Packaging equipment suppliers must innovate to stay ahead, embracing cutting-edge tech and efficiency. This report uncovers key trends and insights to help industry leaders thrive.

What will be the Size of the Market During the Forecast Period?

- The market is a significant sector in the manufacturing industry, playing a crucial role in ensuring the efficient production and distribution of various goods, including cosmetics, convenience packaging, pharmaceuticals, food, and beverages. This market is driven by several factors, including product quality, cost reduction, and automation techniques. One of the primary trends in the market is the increasing focus on product safety and traceability. With the growing concern for consumer safety, manufacturers are investing in machinery that can ensure the safety and quality of their products throughout the supply chain. Additionally, eco-friendly packaging solutions are gaining popularity due to increasing environmental awareness and regulations.

- Another trend in the market is the need for fast production processes and lean packaging operations. With labor shortages and rising labor costs, automation has become a necessity for many manufacturers to maintain competitiveness. Filling & dosing machines, cartoning systems, and case handling equipment are some of the machinery components that are being automated to increase production speed and reduce downtime. However, the market also faces several challenges. Price pressures from competition and supply chain disruptions can impact the purchasing price of machinery and raw materials, leading to increased production costs.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Packaging machinery

- Material handling

- End-user

- Food and beverage

- Pharma

- Chemical

- Consumer electronics

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

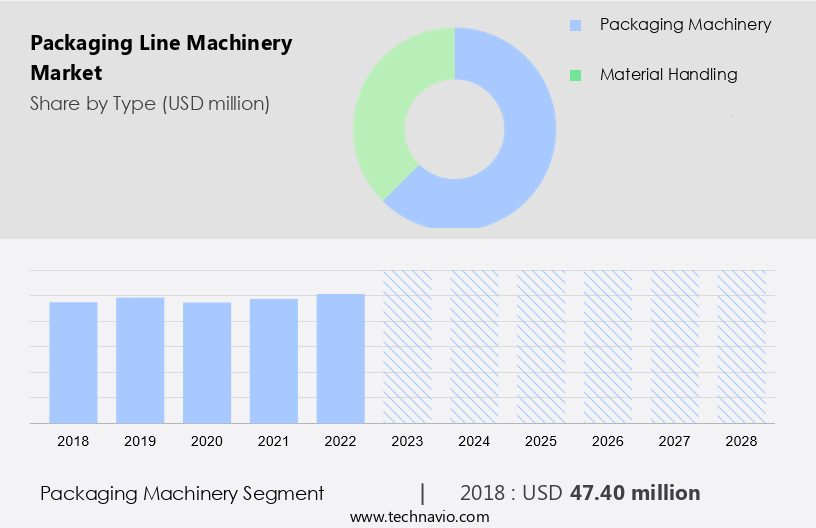

- The packaging machinery segment is estimated to witness significant growth during the forecast period.

The market in the United States is divided into various machinery types, with a primary focus on equipment used for packaging processes. This category includes machines designed for tasks such as filling, sealing, wrapping, and labeling. The increasing importance of flexible production and packaging line optimization in various industries, including food and beverage, pharmaceuticals, and consumer goods, is driving the demand for advanced packaging solutions. Filling machines are integral to the packaging process, ensuring precise product dispensing into containers for consistency and minimizing waste. Sealing machines play a critical role in maintaining product integrity by securely closing packages, which is especially important for perishable goods.

Packaging machinery also includes packaging automation software, which enhances production efficiency and reduces labor costs. Moreover, the packaging industry is increasingly focusing on sustainable packaging materials and practices, leading to the adoption of automated packaging solutions. Packaging material sourcing and logistics are essential aspects of the packaging process, and advancements in these areas can significantly impact the overall efficiency and cost-effectiveness of the packaging line. Packaging inspection systems are also gaining popularity due to their ability to ensure product quality and safety. In conclusion, the market in the United States is a dynamic and evolving industry, driven by the need for efficient, reliable, and sustainable packaging solutions. The various machinery types, including filling, sealing, wrapping, labeling, and automation software, serve specific functions within the packaging process, and advancements in these areas are continually shaping the future of the industry.

Get a glance at the market report of share of various segments Request Free Sample

The Packaging machinery segment was valued at USD 47.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

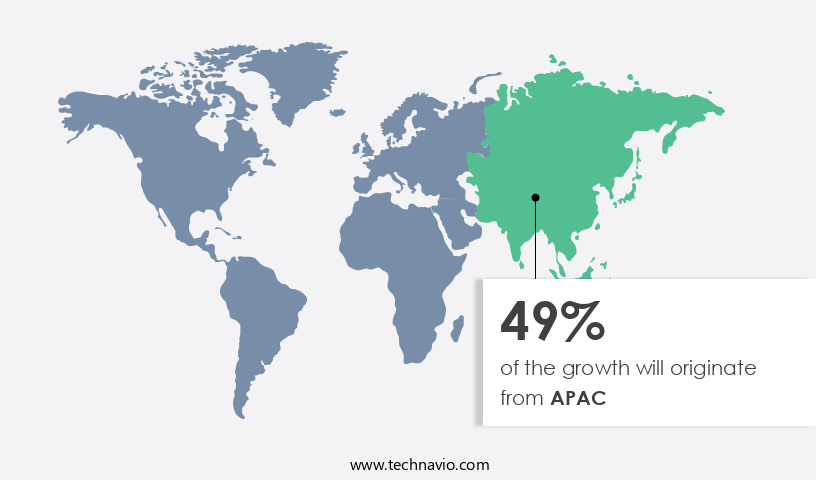

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region is experiencing significant growth in the market, fueled by industrialization, urbanization, and escalating consumer demands. One notable player in this sector is BENZ Packaging, which recently announced the acquisition of 1.5 acres of land for a new manufacturing facility in May 2024. This investment, worth over USD 5 million, underscores BENZ Packaging's dedication to innovation, expansion, and local development. The APAC market showcases vibrant growth and versatile applications in numerous industries, such as food and beverage, pharmaceuticals, consumer electronics, and chemicals. This market's expansion is driven by the increasing need for supply chain optimization, packaging marketing, and branding, as well as a growing emphasis on packaging sustainability.

Innovative machinery, such as accumulating machines and sorting machines, are becoming increasingly popular in the pharmaceutical packaging sector, ensuring drug safety and quality. The APAC region's the market is poised for continued growth, with companies like BENZ Packaging leading the way in technological advancements and community development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. Moreover, overall equipment effectiveness (OEE) is a critical metric for manufacturers, and troubleshooting machinery issues quickly is essential to maintain optimal production levels. Logistics and upstream manufacturing processes must also be streamlined to ensure the timely delivery of raw materials and finished goods. In conclusion, the market is a dynamic and evolving sector that plays a vital role in the manufacturing industry. With a focus on product safety, cost reduction, and automation, manufacturers are investing in advanced machinery to meet consumer demands and maintain competitiveness. However, challenges such as price pressures, supply chain disruptions, and the need for hygienic and eco-friendly solutions must be addressed to ensure the long-term success of packaging line machinery manufacturers.

What are the key market drivers leading to the rise in adoption of Packaging Line Machinery Market?

New launches is the key driver of the market.

- The market continues to evolve with new product introductions, addressing the industry's increasing demand for advanced technologies. One such innovation is Cama Group's latest top-loading packaging machine, launched on July 17, 2024. This machine caters to the multipack market, delivering increased productivity while minimizing machinery footprint. New product launches are essential for several reasons. They meet the market's evolving needs by integrating advanced technologies that boost operational efficiency. For instance, Cama Group's top-loading machine features a compact design, saving precious floor space in production facilities. In the context of the pharmaceutical and biopharmaceutical sectors, packaging solutions play a crucial role in ensuring product integrity and drug stability.

- As such, packaging line machinery must adhere to stringent validation processes to meet regulatory requirements. Refurbished packaging machinery can be a cost-effective alternative for small batch packaging operations in these sectors..

What are the market trends shaping the Packaging Line Machinery Market?

Mergers and acquisitions is the upcoming trend in the market.

- The market in the pharmaceutical supply chain is experiencing a notable trend of mergers and acquisitions. This activity is fueled by the need for technological advancements, market expansion, and improved competitive standing. For instance, in July 2024, ATS Corporation announced its acquisition of Paxiom Group, a leading provider of packaging machines for multiple industries. This strategic move underscores the industry's emphasis on consolidating knowledge and resources to foster innovation and growth.

- Companies are actively pursuing mergers and acquisitions to broaden their technology offerings and extend their product lines. By acquiring firms with specialized expertise and cutting-edge solutions, they aim to strengthen their market position and cater to evolving customer demands.The packaging line machinery sector's focus on strategic alliances and collaborations is a testament to its commitment to delivering value-added services and staying at the forefront of industry developments.

What challenges does Packaging Line Machinery Market face during the growth?

High cost associated with packaging line machinery is a key challenge affecting the market growth.

- The packaging industry faces a substantial financial hurdle due to the high cost of advanced packaging line machinery. This challenge disproportionately affects small and medium-sized enterprises (SMEs) with limited financial resources. The significant investment required for sophisticated packaging equipment, which can range from thousands to millions of dollars, poses a considerable economic barrier. For example, a food packaging machine can cost between USD10,900 and USD65,000. SMEs are often confronted with a tough decision: investing in expensive machinery could improve operational efficiency and productivity, but the upfront financial burden can strain their economic capabilities and competitive positioning. In the packaging sector, various types of machinery are essential, including packaging equipment suppliers, packaging design solutions, counting machines, and packaging automation systems.

- These systems are increasingly crucial in industries such as pharmaceuticals, where serialization and traceability are essential for oncology, respiratory, and sterile packaging, as well as aseptic processing. Despite their importance, the high cost of these advanced machinery solutions can hinder their adoption, particularly among SMEs. To remain competitive, manufacturers must consider the long-term benefits of investing in advanced packaging machinery. By enhancing productivity and operational efficiency, these investments can lead to cost savings, improved product quality, and increased customer satisfaction. Additionally, collaborating with packaging machinery suppliers and exploring financing options can help SMEs manage the upfront costs and make the necessary investments in their businesses. In conclusion, the high cost of advanced packaging line machinery presents a significant challenge for the industry, particularly for SMEs. However, by considering the long-term benefits and exploring financing options, manufacturers can make informed decisions and invest in the machinery necessary to remain competitive and meet the evolving demands of their customers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aetnagroup S.p.A

- Coesia SpA

- FUJI MACHINERY Co. Ltd.

- GEA Group AG

- Gerhard Schubert GmbH

- Ishida Co. Ltd.

- KBW Packaging Ltd

- Krones AG

- Marchesini Group Spa

- MFPACKAGING S.R.L

- Mollers Packaging Technology GmbH

- MULTIVAC Sepp Haggenmuller SE and Co. KG

- Paxiom

- Professional Packaging Systems inc.

- Sidel

- SN Maschinenbau GmbH

- Stevanato Group S.p.A

- Syntegon Technology GmbH

- TACOM SA

- Viking Masek Global Packaging Technologies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing focus on packaging quality control and the adoption of advanced packaging technologies. Packaging line training and design trends are also driving the market, as companies seek to improve packaging innovation, efficiency, and performance. Packaging line maintenance and safety are crucial factors in ensuring the reliability and productivity of packaging lines. Flexible production and optimization are key trends, with automation software playing a pivotal role in enhancing manufacturing efficiency. Sustainable packaging materials are gaining popularity, as companies strive to reduce their carbon footprint and meet evolving consumer demands. Packaging consulting and software solutions are increasingly being utilized to streamline packaging logistics, inspection, and labeling processes.

Pharmaceutical packaging, in particular, is a significant segment, with a focus on compliance, sterility, and integrity. The market is also witnessing the emergence of refurbished packaging machinery and biopharmaceutical packaging solutions. Packaging automation systems and serialization are also key trends in the pharmaceutical industry, with a focus on oncology, respiratory, and antiviral packaging. Overall, the market is poised for robust growth, driven by the need for improved packaging solutions, automation, and sustainability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 29 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.6 |

|

Key countries |

US, China, Japan, Italy, Germany, India, France, UK, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch