Passenger Car Security Systems Market Size 2024-2028

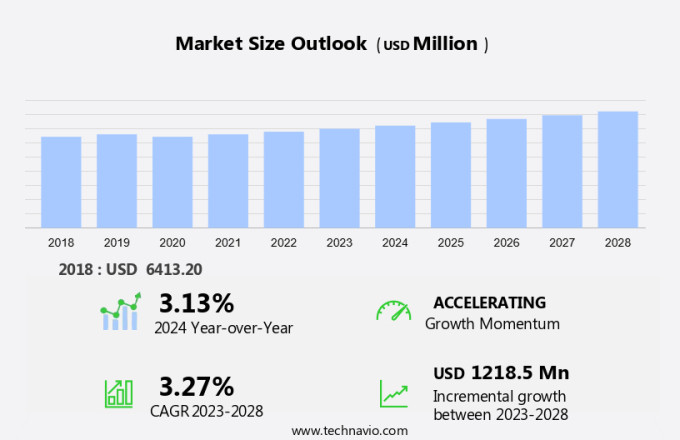

The passenger car security systems market size is forecast to increase by USD 1.22 billion at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth due to the rising number of car thefts and the increasing adoption of advanced security technologies. One of the key trends driving market growth is the integration of biometric technology into car security systems, providing enhanced security features and convenience for consumers. However, the slowdown in automobile manufacturing may pose a challenge to market growth. The implementation of stringent regulations and the increasing demand for connected and autonomous vehicles are also influencing market dynamics. Moreover, The passenger car market is witnessing significant growth in the integration of digital security and smart technology features. Overall, the market is expected to witness steady growth in the coming years as consumers prioritize safety and security in their vehicles.

What will be the Size of the Market During the Forecast Period?

- Automotive manufacturers are prioritizing the development of advanced car security systems to cater to the increasing demand for enhanced vehicle protection. Immunizers, car alarms, central locking, and automation of vehicles are no longer considered luxury features but essential components of modern passenger cars. Legislation plays a crucial role in driving the adoption of these security systems. Governments worldwide are implementing stringent regulations to ensure vehicle safety and security. Anti-theft devices, electronic steering locks, and biometric car access are some of the measures being taken to mitigate the risk of vehicle theft.

- The automotive electronics industry is at the forefront of this trend, with remote operating features, sensors, and machine-learning algorithms becoming increasingly common in passenger cars. Artificial intelligence and the Internet of Things are also being integrated into car security systems to provide real-time monitoring and analysis of vehicle data. The integration of digital security features is not limited to passenger vehicles alone. Commercial vehicles, three-wheelers, and two-wheelers are also witnessing a surge in the adoption of advanced security systems. The increasing sales of passenger vehicles are further fueling the growth of the car security systems market.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Immobilizer

- Central lock system

- Alarm system

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

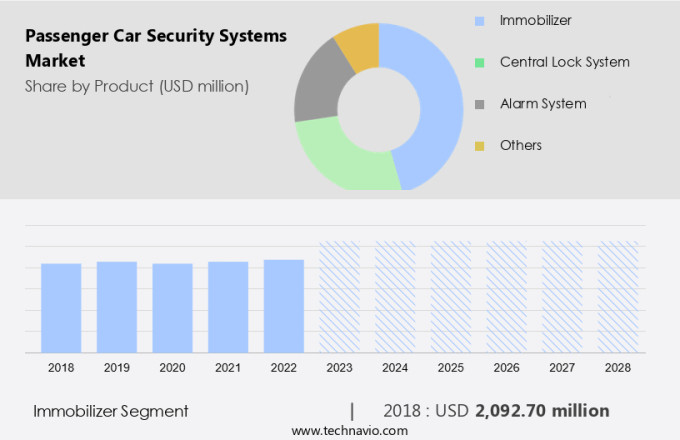

- The immobilizer segment is estimated to witness significant growth during the forecast period.

Car immobilizer systems are advanced security features integrated into modern passenger cars. These systems prevent unauthorized access and engine start-up by requiring the correct transponder key or smart key fob for operation. The key contains a digitally coded chip that communicates with the engine control unit (ECU) to grant access and enable the vehicle's fuel and ignition systems. Central locking, automation, artificial intelligence, IoT, and machine learning technologies are increasingly integrated into these systems, offering remote operating features and enhanced security. Sensors monitor the vehicle's surroundings and alert the driver of potential threats. The immobilizer system is an essential component of a comprehensive vehicle security solution.

Get a glance at the market report of share of various segments Request Free Sample

The Immobilizer segment was valued at USD 2.09 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 60% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in APAC is projected to dominate the global market due to rising car sales and the presence of prominent automobile manufacturers. Key players in the region include Hero MotoCorp Ltd. (Hero), Hyundai Motor Company Ltd. (Hyundai), Suzuki Motor Corp. (Suzuki), Tata Motors Ltd. (Tata), and Toyota Motor Corp., who are significant buyers of these systems. The passenger car segment in APAC is poised for substantial growth, aligning with the expanding economies of China and India. GPS tracking and biometric authentication are among the popular security features in passenger vehicles, ensuring enhanced safety and convenience for consumers. The National Science Foundation and the University of Michigan's Battery Sleuth are conducting research to develop advanced security systems for passenger cars, while the Passenger car segment in commercial vehicles also benefits from these advancements. The global market for passenger car security systems is expected to experience significant growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Passenger Car Security Systems Market?

An increase in car thefts is the key driver of the market.

- The market is experiencing significant growth due to the rising number of car thefts and increasing consumer awareness about security features. According to the National Highway Traffic Safety Administration (NHTSA), there were over 721,000 motor vehicle thefts in the US in 2020. In response, legislative bodies in 11 states have established auto theft prevention departments. Moreover, automobile manufacturers, including Ford Motor Company, Porsche AG, and Tesla Inc., have integrated security systems and advanced sensors as standard features in their vehicles. Digital security is a key focus in passenger car security systems, with smart technology features such as car alarms, immobilizers, and central locking systems becoming increasingly popular.

- The automotive electronics industry is also investing in automation, artificial intelligence, and the Internet of Things (IoT) to enhance security features. For instance, Tencent Cloud and Anheng Information Technology have developed AI-powered car security systems that use machine learning and sensors to detect and prevent theft. Safety features such as GPS tracking, biometric car access, and electronic steering locks are also gaining traction in the passenger car segment. Luxury cars, SUVs, and light commercial vehicles are particularly popular targets for theft, making security systems essential for these vehicle types. The University of Michigan Transportation Research Institute and the National Science Foundation have also researched car security systems, developing technologies such as Battery Sleuth to prevent car battery theft.

What are the market trends shaping the Passenger Car Security Systems Market?

The growth of biometric technology is the upcoming trend in the market.

- Biometrics is a digital security technology that identifies physical parameters, such as voice, fingerprints, palm prints, iris structures, and typing rhythm, to provide accurate matches. In the automotive industry, biometrics is increasingly being used to enhance vehicle security and functionality. Applications of biometric technology in passenger cars include vehicle access, ignition permission, and anti-theft systems. While remote or passive keyless entry systems using radio frequency are common, automakers and tire suppliers are exploring additional uses to improve vehicle security, safety, and comfort. Other potential applications include onboard communication programs and predictive maintenance systems. The use of biometric technology in automobiles is expected to continue growing as automotive electronics become more advanced and the automation of vehicles increases.

- Additionally, the integration of artificial intelligence, the Internet of Things, machine learning, and sensors in vehicles is driving the adoption of biometric systems for biometric car access, facial recognition, and electronic steering locks. The passenger car segment, including luxury cars, SUVs, and light commercial vehicles, is expected to lead the market for passenger car security systems. With the increasing sales of passenger vehicles and the growing importance of safety features, such as GPS tracking, collision avoidance systems, and central locking systems, the market for passenger car security systems is expected to experience significant growth. Companies like Tencent Cloud and Anheng Information are investing in biometric systems for automobiles, while universities, such as the University of Michigan, are researching advanced biometric systems for vehicle applications.

What challenges does the Passenger Car Security Systems Market face during the growth?

The slowdown in automobile manufacturing is a key challenge affecting the market growth.

- The market is witnessing significant growth due to the integration of digital security features and smart technology in passenger cars. Automobile manufacturers are increasingly focusing on the development of advanced security systems to cater to the rising demand for automotive electronics and remote operating features. Immobilizers, car alarms, central locking systems, and biometric car access are some of the common anti-theft devices being used in passenger cars. Legislation plays a crucial role in the adoption of passenger car security systems. Governments worldwide are implementing stringent regulations to ensure the safety and security of vehicles and their occupants. The automotive industry is also leveraging artificial intelligence, machine learning, sensors, and the Internet of Things to enhance the security features of passenger cars.

- The use of facial recognition and biometric authentication for car access is gaining popularity in the luxury car segment, including SUVs and light commercial vehicles. Companies like Tencent Cloud and Anheng Information are investing in AI-based car security systems to provide real-time monitoring and alert services. The University of Michigan, National Science Foundation, and Battery Sleuth are researching advanced car security systems using GPS tracking and collision avoidance systems. The passenger vehicle sales in key markets such as the US, China, India, Japan, Russia, and Europe, were affected by the pandemic in 2020. However, the demand for car security systems remains strong due to the increasing number of road accidents and the need for safety features.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alps Alpine Co. Ltd. - The company offers OEM keyless entry systems for passenger cars, enhancing both the driving experience and security.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Changhui Group

- Continental AG

- Crimestoppers Trust

- DENSO Corp.

- Firstech LLC

- HELLA GmbH and Co. KGaA

- KIRAMEK inc

- Lear Corp.

- Marquardt GmbH

- Mitsubishi Electric Corp.

- Nostaa Group Ltd.

- Robert Bosch GmbH

- Scorpion Automotive Ltd.

- Tokai Rika Co. Ltd.

- Valeo SA

- VOXX International Corp.

- Xtreme Auto Glass and Window Tint

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the automotive electronics industry, driven by the increasing demand for advanced safety and security features in vehicles. This market encompasses a wide range of technologies, including immobilizers, car alarms, central locking systems, biometric car access, and automation of vehicles, among others. The integration of digital security and smart technology features in passenger cars has been a major trend in the market. Immobilizers, which prevent the engine from starting without the correct key, have become standard in most vehicles. Car manufacturers are now focusing on developing more sophisticated immobilizer systems that use microprocessors and transponder technology to enhance security. Legislation plays a crucial role in the market. Governments worldwide are implementing regulations to mandate the installation of certain security features in vehicles. For instance, in the European Union, all new passenger cars must be equipped with an engine immobilizer system. The automotive industry is witnessing a surge in the adoption of anti-theft devices, such as car alarms and GPS tracking systems. These devices help prevent theft and aid in the recovery of stolen vehicles. Biometric car access systems, which use facial recognition or fingerprint scanning, offer enhanced security and convenience. The integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT) in passenger cars is another significant trend.

Moreover, these technologies enable remote operating features, such as starting the engine or locking the doors using a smartphone app. They also enable advanced safety features, such as collision avoidance systems and automatic emergency braking. The market for passenger car security systems is diverse and includes automobile manufacturers, suppliers of automotive electronics, and providers of cloud-based services. Tencent Cloud and Anheng Information Technology are some of the key players in the market, offering cloud-based services for vehicle security and remote monitoring. The passenger car segment, which includes luxury cars, SUVs, and light commercial vehicles, dominates the market for security systems. Three-wheelers and two-wheelers, while significant in terms of volume, contribute a smaller share of the market due to their lower price points and different market dynamics. The sales of passenger vehicles have been on the rise, driven by increasing disposable income and urbanization in developing economies. This trend is expected to continue, leading to increased demand for advanced security systems in passenger cars. The market is a dynamic and innovative space, driven by technological advancements and regulatory requirements. The market is expected to grow significantly in the coming years, offering opportunities for companies to develop and offer innovative solutions to meet the evolving needs of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 1218.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch