Plant-Based Burger Patties Market Size 2024-2028

The plant-based burger patties market size is forecast to increase by USD 7.26 billion at a CAGR of 70.7% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the primary factors driving market growth is the increasing awareness of the adverse health effects associated with meat consumption. Consumers are increasingly seeking healthier alternatives to traditional meat-based burgers. This shift towards plant-based alternatives is driving the demand for meatless burgers made from various sources like peas, soybeans, black beans, lentils, grains, tofu, and vegetables. These alternatives not only cater to the growing health-conscious population but also to those following vegetarian and vegan diets.

- Additionally, partnerships with global food service chains have been instrumental in popularizing plant-based burger patties as a viable option for customers. Another trend contributing to market growth is the rising consumption of meat products, which has led to an increased demand for plant-based alternatives. These trends are expected to continue shaping the market dynamics In the coming years. The market analysis report provides a comprehensive outlook on the growth prospects and challenges of the market.

What will be the Size of the Plant-Based Burger Patties Market During the Forecast Period?

- The market has experienced significant growth in recent years, driven by increasing consumer demand for alternative protein sources. This trend is particularly evident In the vegetarian and flexitarian segments, where plant-based options are becoming an integral part of the diner experience. While traditional vegetarian burgers made from soy or black beans continue to dominate the market, innovative companies are exploring new ingredients such as peas, lentils, grains, tofu, vegetables, nuts, and seeds to create personalized, textured plant-based patties that mimic the taste and texture of flame-broiled meat burgers.

- Additionally, some companies are even experimenting with robot chefs and 3D printing technology to create revolutionary veggie burgers with juicy, meat-like textures. The market is expected to continue growing as consumers seek out plant-based alternatives to animal-derived products, including dairy and eggs. Ingredient sourcing remains a critical factor, with companies focusing on plant sources such as soybeans, black beans, and peas to meet the demand for high-protein, sustainable options.

How is this Plant-Based Burger Patties Industry segmented and which is the largest segment?

The plant-based burger patties industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

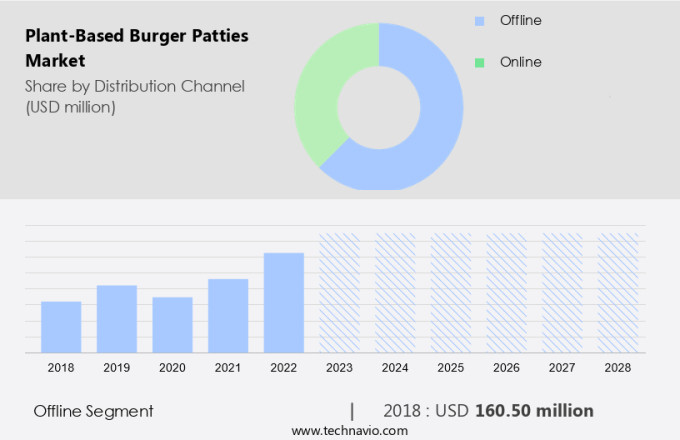

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses the sales of vegetarian and vegan burger patties through various distribution channels, including offline and online. In offline distribution, sales are derived from specialty stores, direct sales, and traditional retailers such as supermarkets, hypermarkets, and department stores. However, the revenue from this channel has been declining due to the increasing trend of online shopping. To counteract this, market players are expanding their physical presence in global and regional markets. The competition In the offline retail landscape is intense, with numerous retailers offering competitive pricing. Ingredients used in plant-based burger patties include tomato paste, smoked paprika, chili powder, salt, pepper, cooked rice, brown rice, and quinoa. These ingredients are combined with flax eggs as a binding agent to create vegan-friendly patties.

Get a glance at the Plant-Based Burger Patties Industry report of share of various segments Request Free Sample

The offline segment was valued at USD 160.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing consistent growth due to several key factors. The US dominates this market, driven by the entry of new plant-based burger patties brands, the increasing popularity of online grocery shopping, and partnerships between companies and foodservice chains. Additionally, the rising demand for plant-based food options is significantly contributing to market growth. Product launches and the increasing acceptance of plant-based meat alternatives, including burger patties, are further fueling market expansion in North America. These factors collectively underscore the promising future of the plant-based burger patties market in North America.

Market Dynamics

Our plant-based burger patties market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Plant-Based Burger Patties Industry?

Rising awareness of the adverse effects of meat consumption is the key driver of the market.

- The plant-based burger patties market is witnessing significant growth due to increasing consumer preference for meat alternatives. Vegetarian and vegan options, such as black-bean burgers, are gaining popularity as they offer a diner burger experience without the use of animal-derived products like dairy and eggs. These patties are made from various plant sources including peas, soybeans, black beans, lentils, grains, tofu, vegetables, nuts, and seeds. The production process involves blending these ingredients, forming them into patties, and cooking them to replicate a meaty flavor and texture. Some plant-based burger patties are made using 3D printing technology and robot chefs, adding a personalized touch to the product. The ingredients are carefully selected to ensure a rich and moist texture, often using binders like breadcrumbs, flax eggs, and tomato paste. Spices such as smoked paprika, chili powder, salt, and pepper are added to enhance the flavor. Despite the meaty flavor and texture, these patties are free from the negative aspects of meat consumption. They do not require fresh water for production, reducing the impact on biodiversity and minimizing greenhouse gas emissions.

- Additionally, they are free from fat residues and gluten, making them a healthier option for those conscious about fitness. The market for plant-based burger patties is expected to continue growing as more consumers seek sustainable and healthier alternatives to traditional meat burgers. Plant-based burger patties are made using a variety of ingredients such as peas, soybeans, black beans, lentils, grains, tofu, vegetables, nuts, and seeds. The production process involves blending these ingredients, forming them into patties, and cooking them to replicate a meaty flavor and texture. Some plant-based burger patties are made using 3D printing technology and robot chefs, adding a personalized touch to the product. The ingredients are carefully selected to ensure a rich and moist texture, often using binders like breadcrumbs, flax eggs, and tomato paste. Spices such as smoked paprika, chili powder, salt, and pepper are added to enhance the flavor. These patties offer a diner burger experience without the use of animal-derived products like dairy and eggs, making them a popular choice for vegetarians and vegans. They do not require fresh water for production, reducing the impact on biodiversity and minimizing greenhouse gas emissions.

- However, they are free from fat residues and gluten, making them a healthier option for those conscious about fitness. The market for plant-based burger patties is expected to continue growing as more consumers seek sustainable and healthier alternatives to traditional meat burgers. Ingredients like mushrooms, carrots, broccoli, onion, garlic, spinach, walnuts, and various spices are used to create a diverse range of flavors and textures. The patties can be cooked using various methods, including a skillet, oven, or grill, to achieve a golden crust and desired moisture level. The market for plant-based burger patties is expected to continue growing as more consumers seek sustainable and healthier alternatives to traditional meat burgers.

What are the market trends shaping the Plant-Based Burger Patties Industry?

Partnership with global food service chains is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for vegetarian and vegan options In the foodservice industry. Foodservice chains, such as Burger King, KFC, and McDonald's, are responding to this trend by partnering with companies to offer plant-based burger patties on their menus. These patties are made from various plant sources, including black beans, peas, soybeans, lentils, grains, tofu, vegetables, nuts, and seeds, and are often textured to replicate the taste and texture of meat burgers. The production process for these patties can involve a range of techniques, including 3D printing technology and robot chefs. Ingredients are carefully selected to ensure a meaty flavor and richness, with the addition of spices like smoked paprika, chili powder, salt, and pepper, and binders like tomato paste, flax eggs, and breadcrumbs.

- Additionally, the patties can be cooked using various methods, such as grilling, roasting, or baking, to achieve a golden crust and moist interior. The popularity of plant-based burger patties is driven by several factors, including health concerns, ethical considerations, and the desire for personalized dining experiences. As more foodservice chains enter the market, competition is increasing, leading companies to innovate and differentiate their offerings. For example, some companies are experimenting with juices and flame-broiled tastes to enhance the diner burger experience. Overall, the market is expected to continue growing as more consumers seek out meatless alternatives to traditional burgers.

What challenges does the Plant-Based Burger Patties Industry face during its growth?

Rising consumption of meat products is a key challenge affecting the industry growth.

- The market in North America is experiencing significant growth due to increasing health consciousness and the trend towards sustainable eating. Consumers are seeking alternatives to animal-derived products, leading to a growth in demand for vegetarian and vegan options. Companies such as Beyond Meat and Impossible Foods are leading the charge, expanding production and focusing on innovation to replicate the taste and texture of meat burgers using plant sources like peas, soybeans, black beans, lentils, grains, tofu, vegetables, nuts, and seeds. Ingredients like tomato paste, smoked paprika, chili powder, salt, and pepper are used to enhance flavor, while binders like flax eggs and breadcrumbs ensure sticking power and richness.

- Additionally, production methods include freezing, roasting, baking, and grilling to achieve a golden crust and meaty flavor. Ingredients like mushrooms, carrots, broccoli, onion, and garlic add to the overall taste profile. The competitive landscape is evolving as more brands enter the market, offering personalized options and catering to the preferences of flexitarian and vegan consumers. The use of robot chefs and 3D printing technology is also revolutionizing the production process, making veggie burgers more accessible and convenient for consumers.

Exclusive Customer Landscape

The plant-based burger patties market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plant-based burger patties market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plant-based burger patties market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALPHA FOODS

- Amazon.com Inc.

- Atlantic Natural Foods Inc.

- Beyond Meat Inc.

- Conagra Brands Inc.

- Hilarys Drink Eat Well LLC

- Hungry Planet Inc.

- Impossible Foods Inc.

- Kellogg Co.

- Laura s Lean

- Life Health Foods NZ Ltd.

- Maple Leaf Foods Inc.

- Nestle SA

- Tesco Plc

- The Kraft Heinz Co.

- The Kroger Co.

- The Meatless Farm Co.

- The Tofurky Co. Inc.

- Transcend Information Inc.

- Tyson Foods Inc.

- Unilever PLC

- Upton Naturals

- V2 Food Pty Ltd.

- WH Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The plant-based burger patties market has witnessed significant growth in recent years, driven by the increasing demand for sustainable and ethical food options. This trend is fueled by various factors, including health consciousness, animal welfare concerns, and environmental sustainability. Plant-based burger patties offer a diverse range of protein sources, including peas, soybeans, black beans, lentils, grains, tofu, vegetables, nuts, and seeds. These ingredients provide not only nutritional benefits but also allow for the creation of textures and flavors that replicate the meaty taste and juicy experience of traditional meat burgers. The production process of plant-based burger patties varies, with some using 3D printing technology or robot chefs to create uniform shapes and textures.

Further, others employ traditional methods, such as baking sheets or skillets, to roast and brown the patties, enhancing their golden crust and richness. The market for plant-based burger patties is diverse, catering to both vegetarian and vegan consumers. Ingredients such as flax eggs, tomato paste, smoked paprika, chili powder, salt, and pepper are commonly used to add flavor and binding properties to the patties. Some recipes call for the inclusion of breadcrumbs, while others opt for moisture-retaining ingredients like cooked rice or quinoa. Despite the advances in plant-based burger patties technology, some challenges remain. For example, achieving the desired sticking power and texture can be difficult, particularly when using wetter ingredients like mushrooms, carrots, broccoli, onion, and garlic.

Additionally, replicating the meaty flavor and juiciness of meat burgers can be a challenge, requiring careful consideration of seasoning and cooking methods. The history of veggie burgers dates back to the 19th century, with early iterations made from ingredients like onions, beans, and nuts. However, it was not until the mid-20th century that veggie burgers began to gain popularity, with the introduction of mass-produced, frozen options. Today, the market for plant-based burger patties continues to evolve, with new innovations and offerings emerging regularly. In summary, the plant-based burger patties market is a dynamic and growing industry, driven by consumer demand for sustainable, ethical, and health-conscious food options. The use of a diverse range of plant-based protein sources and innovative production methods allows for the creation of textures and flavors that replicate the meat burger experience while catering to a wide range of dietary preferences and ethical considerations. The future of this market is bright, with continued innovation and growth expected In the years to come.

|

Plant-Based Burger Patties Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 70.7% |

|

Market growth 2024-2028 |

USD 7.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

47.9 |

|

Key countries |

US, UK, Germany, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plant-Based Burger Patties Market Research and Growth Report?

- CAGR of the Plant-Based Burger Patties industry during the forecast period

- Detailed information on factors that will drive the Plant-Based Burger Patties growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plant-based burger patties market growth of industry companies

We can help! Our analysts can customize this plant-based burger patties market research report to meet your requirements.