Plasma Cutting Machine Market Size 2025-2029

The plasma cutting machine market size is forecast to increase by USD 598.6 million, at a CAGR of 5.9% between 2024 and 2029.

- The market is characterized by the continuous enhancement of cutting machines' accuracy in various applications, providing significant improvements in operational efficiency and product quality. This trend is driven by the increasing demand for machine serving precision and customization in manufacturing industries. Additionally, the market is witnessing an uptick in mergers and acquisitions activities and strategic alliances among companies, aiming to expand their product portfolios and strengthen their market positions. However, the high installation cost of plasma cutting machines poses a significant challenge for small and medium-sized enterprises, limiting their adoption and potentially hindering market growth.

- Companies seeking to capitalize on market opportunities should focus on offering cost-effective solutions while maintaining high precision and quality standards. Furthermore, strategic collaborations and partnerships can help companies overcome the high investment barrier and expand their customer base.

What will be the Size of the Plasma Cutting Machine Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, driven by advancements in power supply technology, service contracts, and the integration of waterjet cutting equipments technology. he ongoing unfolding of market activities is evident in the development of thin-sheet cutting, abrasive delivery systems, and kerf width reduction. Automated plasma cutting and stainless steel cutting have gained significant traction, with machine calibration and heavy-duty cutting solutions catering to the industry's demands. Power supply systems have evolved to provide greater efficiency and reliability, enabling improved cutting speeds and precision. Service contracts have become essential for maintaining optimal machine performance, ensuring preventive maintenance and timely replacement of consumable parts, such as plasma gases, cutting heads, and high-frequency starters.

Waterjet cutting technology has emerged as a viable alternative for certain applications, offering advantages in material handling, cutting path optimization, and productivity enhancement. Industrial automation and auxiliary gas systems have also become increasingly important, contributing to cost reduction and enhanced cutting quality. Plasma gas optimization, cutting parameters, and pilot arc control are critical aspects of plasma cutting technology, ensuring consistent cut quality and reducing material waste. The integration of laser beam sources and laser cutting technology has expanded the capabilities of plasma cutting machines, enabling precise cutting of various materials, including non-ferrous metals and aluminum. The market's dynamism is further reflected in the development of safety systems, CAD/CAM software, nesting software, and gas flow rate control systems.

These advancements aim to improve the overall efficiency and effectiveness of plasma cutting machines in various sectors, including metal fabrication and sheet metal processing.

How is this Plasma Cutting Machine Industry segmented?

The plasma cutting machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Aerospace and defense

- Industrial construction

- Electrical equipment

- Others

- Product Type

- Portable

- Stationary

- Type

- Semi-automated systems

- Manual plasma cutting systems

- Fully automated robotic plasma systems

- Technology

- Conventional plasma cutting

- CNC-based plasma cutting systems

- Precision plasma cutting

- High-definition plasma cutting

- Hybrid technologies

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

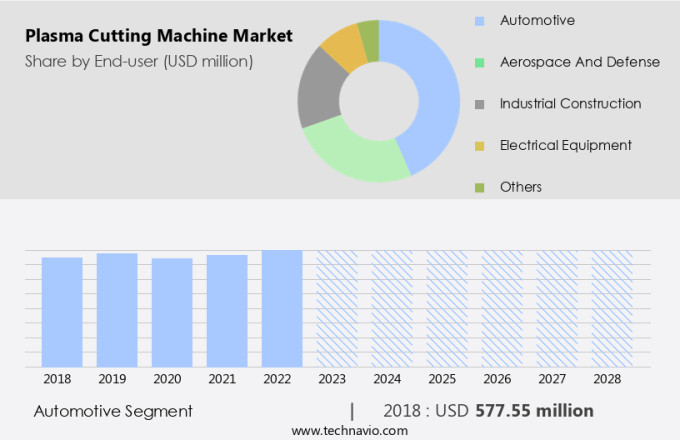

The automotive segment is estimated to witness significant growth during the forecast period.

Plasma cutting machines play a pivotal role in the manufacturing processes of various industries, particularly in metal fabrication and sheet metal processing. The automotive industry is a significant consumer, utilizing these machines for cutting metal parts essential to the production of fuel delivery systems, airbag components, headliners, carpets, trunk liners, metal gaskets, decorative brackets, fittings, and fuel systems. The shift towards lightweight metals, such as aluminum and titanium, due to stringent emission norms like BS VI, and the demand for fuel efficiency have intensified the use of plasma cutting technology in automotive manufacturing. Preventive maintenance is crucial in ensuring the longevity and optimal performance of plasma cutting machines.

Focus length and spare parts are essential components requiring regular attention. Waterjet cutting, an alternative to plasma cutting, offers advantages in cutting non-ferrous metals and thin sheets. Material handling and cutting path optimization enhance productivity, while compressed air, edge finish, and safety systems ensure quality. Plasma cutting technology employs a high-frequency starter, plasma gas, and a motion control system to generate an electric arc between the torch and the workpiece, melting the metal. Consumable parts like cutting heads, laser power, and pilot arc are continually replaced. Laser cutting technology, an alternative, uses a high-pressure pump, laser beam source, and auxiliary gas for cutting.

Process optimization and machine calibration are essential for heavy-duty cutting applications, while industrial automation and machine efficiency contribute to cost reduction. The market is witnessing the integration of CAD/CAM software, nesting software, and beam delivery systems for automated plasma cutting, enabling precision cutting and improved cutting parameters. Additionally, water recycling systems and material efficiency measures are gaining traction for environmental sustainability.

The Automotive segment was valued at USD 598.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experienced notable growth in APAC in 2024, with China and India leading the charge. China, as the largest producer, and India, driven by automotive production in countries like China, India, and Japan, are projected to expand at a substantial rate during the forecast period. The APAC the market's expansion is further bolstered by increased government funding for end-user industries across the region. In 2024, the APAC segment of the market was characterized by diverse industrial frameworks, operational models, and regulatory conditions. Preventive maintenance, focus length, and spare parts were essential considerations for market participants. Plasma gas and water recycling systems were integral to the technology's efficiency and cost reduction.

Metal fabrication and sheet metal processing industries relied on plasma cutting machines for precision cutting, including mild steel, non-ferrous metals, and aluminum. Operator training, cutting speed, and motion control systems were crucial for productivity enhancement. Plasma cutting technology's evolution included advancements in cutting head design, laser power, and machine calibration. Safety systems, CAD/CAM software, and nesting software were essential for industrial automation and process optimization. The market dynamics were influenced by factors such as gas flow rate, plasma torch, cutting table, optical system, and assist gas. Thin-sheet cutting and heavy-duty cutting applications were addressed through waterjet cutting technology and automated plasma cutting systems.

Laser cutting technology, oxy-fuel cutting, and thermal cutting were alternative cutting methods, each with its unique advantages and applications. The market's growth was underpinned by the continuous development of plasma cutting technology, consumable parts, and high-frequency starters.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global plasma cutting machine market size and forecast projects growth, driven by plasma cutting machine market trends 2025-2029. B2B plasma cutting solutions leverage advanced cutting technologies for precision. Plasma cutting machine market growth opportunities 2025 include plasma cutters for manufacturing and portable plasma cutting systems, meeting demand. Plasma cutting management software optimizes operations, while plasma cutting machine market competitive analysis highlights key manufacturers. Sustainable plasma cutting practices align with eco-friendly manufacturing trends. Plasma cutting regulations 2025-2029 shapes plasma cutter demand in Asia 2025. High-precision plasma cutters and premium plasma cutting insights boost adoption. Plasma cutters for construction and customized cutting designs target niches. Plasma cutting machine market challenges and solutions address safety, with direct procurement strategies for plasma cutters and plasma cutter pricing optimization enhancing profitability. Data-driven plasma cutting analytics and smart cutting technology trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Plasma Cutting Machine Industry?

- The enhanced accuracy of cutting machines significantly drives the market by optimizing cutting operations.

- Plasma cutting machines are specialized machines used for profiling various materials, including metals, with high precision and accuracy. The plasma cutting process, a thermal cutting method, utilizes a plasma torch that generates a high-temperature jet of ionized gas to melt and remove metal. The cutting table and optical system ensure consistent and precise cuts. To optimize the cutting process and reduce costs, plasma cutting machines employ different gases, such as nitrogen, oxygen, or a mix of hydrogen, nitrogen, and argon, as assist gases. The choice of gas flow rate depends on the material thickness and the desired cut quality.

- Laser cutting technology, another profiling method, is gaining popularity due to its high cutting speed and superior edge quality. However, plasma cutting remains a preferred choice for certain applications due to its versatility and cost-effectiveness. High-pressure pumps and beam delivery systems are essential components of plasma cutting machines, ensuring efficient gas delivery and stable plasma arc performance. Process optimization is crucial for maximizing productivity and minimizing energy consumption. In summary, plasma cutting machines offer a cost-effective and versatile solution for profiling various materials with high precision and accuracy. The plasma torch, cutting table, optical system, and gas flow rate are essential factors that contribute to the optimal performance of these machines.

What are the market trends shaping the Plasma Cutting Machine Industry?

- Market trends indicate an uptick in mergers and acquisitions among companies, as well as the formation of strategic alliances. This trend signifies a growing emphasis on collaboration and consolidation within the industry.

- The market is experiencing significant growth due to strategic partnerships and acquisitions among key players. These collaborations enable companies to expand their product offerings, enhance product features, and broaden their geographic reach. For instance, ESAB's acquisition of Swift-Cut, a global provider of CNC plasma cutting systems, on March 7, 2023, is an example of such strategic moves. This trend is leading to increased investments and innovations in the market. Other factors driving market growth include advancements in power supplies, waterjet cutting technology, and automated plasma cutting for thin-sheet cutting.

- Machine calibration, kerf width, industrial automation, auxiliary gas, material efficiency, and cutting parameters are crucial considerations for plasma cutting machines, with companies continually striving to optimize these aspects for improved performance and productivity.

What challenges does the Plasma Cutting Machine Industry face during its growth?

- The high installation cost of plasma cutting machines poses a significant challenge to the growth of the industry. This expense is a critical consideration for businesses looking to invest in plasma cutting technology, potentially limiting the adoption rate and expansion of the industry.

- Plasma cutting machines offer distinct advantages over gas cutting technology, but the significant initial investment is a critical consideration for manufacturers when deciding on the appropriate equipment. The cost of installing a plasma cutting machine is roughly six times greater than that of a gas cutting machine, and retrofitting plasma cutting machines incurs an additional cost of 1.5 times that of gas cutting machines. Consequently, this high financial barrier may deter numerous industries from adopting plasma cutting machines and instead opt for alternative metal-cutting technologies. Preventive maintenance, such as focus length adjustment, spare parts replacement, and maintenance procedures, is essential for optimizing productivity and ensuring the longevity of plasma cutting machines.

- Furthermore, advancements in plasma cutting technology include cutting path optimization, productivity enhancement through CNC controllers, edge finish improvements, and water recycling systems. These innovations contribute to the efficiency and versatility of plasma cutting machines, particularly in the processing of non-ferrous metals and sheet metal fabrication. Compressed air and water are the primary consumables required for plasma cutting, and their efficient management is crucial for reducing operational costs. In summary, while the high initial investment remains a challenge, the benefits of plasma cutting machines, including improved cutting precision, material handling, and edge finish, make them an attractive option for various industries.

Exclusive Customer Landscape

The plasma cutting machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plasma cutting machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, plasma cutting machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AJAN ELEKTRONIK - The company specializes in providing advanced plasma cutting solutions, including standard CNC plasma cutting machines and pipe CNC plasma cutting systems, catering to various industries with precision, efficiency, and innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AJAN ELEKTRONIK

- Automated Cutting Machinery Inc.

- C and G Systems Corp.

- ESAB Corp.

- Esprit Automation Ltd.

- Haco NV

- Hornet Cutting Systems

- Hypertherm Inc.

- Illinois Tool Works Inc.

- Kjellberg Holding GmbH

- Koike Aronson Inc.

- Komatsu Ltd.

- Kongsberg PCS

- Messer Cutting Systems Inc.

- NISSAN TANAKA Corp.

- SICK AG

- Spiro International SA

- The Lincoln Electric Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plasma Cutting Machine Market

- In January 2024, Hypertherm, a leading plasma cutting systems manufacturer, launched its new MAXPRO160 XP plasma system, featuring advanced Inverter technology for improved cutting performance and energy efficiency (Hypertherm Press Release).

- In March 2024, OMAX Corporation, another major plasma cutting equipment provider, announced a strategic partnership with ESAB, a global manufacturer of welding and cutting equipment, to expand their market reach and enhance their product offerings (ESAB Press Release).

- In May 2025, Prima Power, a European plasma cutting systems manufacturer, completed a â¬20 million investment in its production facilities to increase its production capacity and meet the growing demand for plasma cutting machines in various industries (Prima Power Press Release).

- In the same month, the European Union introduced new regulations on the use of plasma cutting machines in the metalworking industry, focusing on improved safety measures and reduced emissions (European Commission Press Release).

Research Analyst Overview

- The market encompasses advanced technologies such as laser welding, digital twins, and visual inspection, which are transforming manufacturing processes. Remote monitoring and quality control are key trends, enabling real-time thermal dynamics assessment and surface treatments like ultrasonic welding and friction stir welding. Material science innovations, including non-destructive testing (NDT) and heat treatment, ensure optimal welding metallurgy. Precision plasma systems facilitate automated nesting, while electron beam welding, autogenous cutting, adhesive bonding, and plasma arc welding expand application possibilities.

- IOT integration enhances operational efficiency, enabling dimensional inspection and cutting software optimization. Resistance spot welding and powder coating further broaden the market scope. These advancements are revolutionizing manufacturing processes for US businesses, driving growth and innovation in the plasma cutting machine industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plasma Cutting Machine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 598.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, India, Germany, Japan, France, Canada, UK, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Plasma Cutting Machine Market Research and Growth Report?

- CAGR of the Plasma Cutting Machine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the plasma cutting machine market growth of industry companies

We can help! Our analysts can customize this plasma cutting machine market research report to meet your requirements.