PMMA Microspheres Market Size 2024-2028

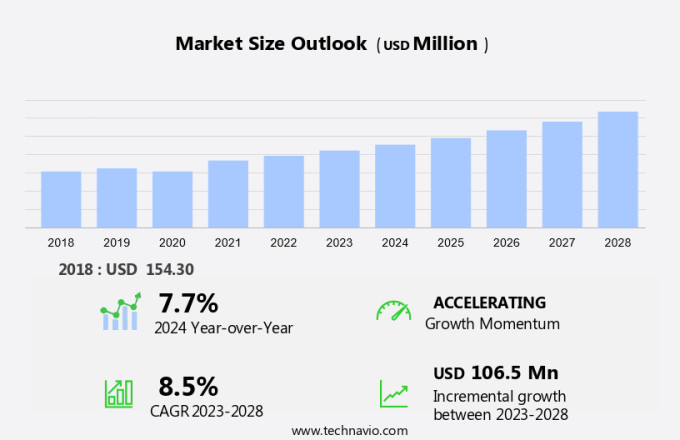

The PMMA microspheres market size is forecast to increase by USD 106.5 million at a CAGR of 8.5% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing research and development activities in various industries such as pharmaceuticals, life sciences, and medical sectors. The adoption of PMMA microspheres is expanding in the cosmetics industry due to their superior properties, including excellent optical clarity, high refractive index, and biocompatibility. Furthermore, the increasing awareness of the toxicity of traditional microspheres is driving the demand for PMMA microspheres as a safer alternative. PMMA, or poly(methyl methacrylate), is a clear thermoplastic polymer that falls under the engineering plastics category. Known by various names such as acrylic, acrylic glass, perspex, plexiglass, Crylux, Plexiglas, Acrylite, Astariglas, Lucite, Perclax, and Perspex, PMMA is widely used as a lightweight and shatter-resistant alternative to glass in sheet form. Additionally, PMMA microspheres are finding applications in printing inks, films, decorative paints, plastic underbody coatings, and architectural coatings, contributing to the market growth. Polymethyl methacrylate (PMMA) microspheres offer numerous advantages, including high stability, excellent dispersibility, and ease of processing, making them a preferred choice for various industries. This trend is expected to continue, with the market exhibiting steady growth in the coming years.

What will be the Size of the Market During the Forecast Period?

- Polymethyl Methacrylate (PMMA) Microspheres Polymethyl methacrylate (PMMA) microspheres, also known as spherical particles of PMMA, are gaining significance in various industries due to their unique properties. These microspheres are made from polymers and function as fillers and additives in numerous applications. PMMA microspheres offer superior optical clarity and mechanical resistance, making them suitable for use in flat display panels, coatings, cosmetics, and optical devices. In the field of electronics, these microspheres contribute to the production of high-performance components. In the realm of polymers and films, PMMA microspheres serve as valuable additives, enhancing the properties of the base material.

- Additionally, the healthcare sector utilizes these microspheres in medical applications, including personal care, pharmaceuticals, and drug delivery systems. PMMA microspheres have found extensive use in the construction industry as a bulking agent in bone cement and as a tissue engineering scaffold. They also play a crucial role in cosmetic surgeries and medical procedures, such as spinal disc defect treatment and collagen production enhancement. Biocompatibility is a significant factor in the growing adoption of PMMA microspheres in the medical and life sciences sectors. These microspheres have proven safe for use in various applications, including bone cement and hyaluronic acid (HA) based products.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Industrial PMMA microspheres

- Medical PMMA microspheres

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Type Insights

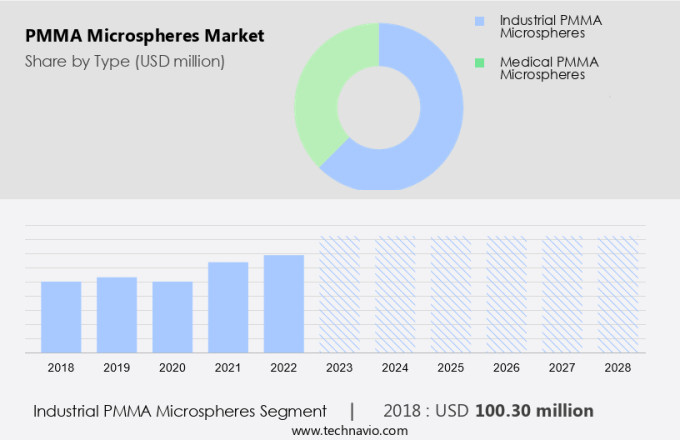

- The industrial PMMA microspheres segment is estimated to witness significant growth during the forecast period.

PMMA, or poly(methyl methacrylate), is a clear thermoplastic polymer that falls under the engineering plastics category. Known by various names such as acrylic, acrylic glass, perspex, plexiglass, Crylux, Plexiglas, Acrylite, Astariglas, Lucite, Perclax, and Perspex, PMMA is widely used as a lightweight and shatter-resistant alternative to glass in sheet form. This versatile material is also utilized in various industries and applications, including cosmetics, automotive, medical, printing inks, decorative paints, plastic underbody coatings, and architectural coatings. In the cosmetics industry, PMMA microspheres are used as pigment carriers and thickening agents. In the medical field, PMMA is employed in bone cement and orthopedic implants due to its biocompatibility and biodegradability.

Moreover, for automotive applications, PMMA is used in car rear lights and instrument clusters due to its transparency and durability. In the field of printing inks, PMMA microspheres are used as extenders and pigment dispersants. In the realm of decorative paints, PMMA is used as a binder and coating material. In the manufacturing of plastic underbody coatings, PMMA is utilized for its excellent chemical resistance and weatherability. Lastly, in architectural coatings, PMMA is used for its high clarity and weather resistance. PMMA's unique properties make it an essential material in various industries and applications. Its transparency, durability, and versatility make it an ideal substitute for glass in sheet form and a valuable addition to various industries and applications.

Get a glance at the market report of share of various segments Request Free Sample

The industrial PMMA microspheres segment was valued at USD 100.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

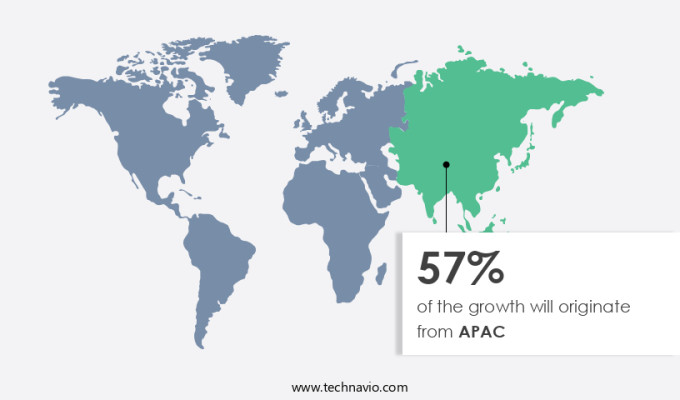

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market holds significant potential, particularly in sectors such as Drug Delivery, Optical Devices, Electronic Displays, Cosmetic surgeries, and Life Sciences, with the US being a major contributor due to its strong economic growth and expanding medical and industrial sectors. In the US, the construction industry is experiencing a notable expansion, with residential and non-residential sectors projected to reach over USD 1.1 trillion and USD 1.4 trillion, respectively, by 2025. This growth is attributed to increased investments in infrastructure development, including office buildings, highways, and street projects. Consequently, the construction sector's expansion is anticipated to boost the market in North America, given their extensive use as fillers in composites. This trend is expected to continue during the forecast period. The US, with its large and thriving building market, offers substantial opportunities for the growth of the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of PMMA Microspheres Market?

Increasing research and development activities in pharmaceutical, life science, and medical industries is the key driver of the market.

- PMMA microspheres, which are translucent spherical particles made of medical-grade acrylic glass, hold significant importance in the biomedical technology sector. The primary application of PMMA microspheres lies in the life sciences and medical industries due to their use as a bulking agent in bone cement and tissue engineering. These microspheres possess superior biocompatibility, enabling their integration into various medical applications. Upon implantation, PMMA microspheres initiate a natural biological response, leading to the growth of new collagenous tissue around each particle. This property is particularly beneficial in addressing spinal disc defects and orthopedic procedures. The small, spherical, and smooth structures of PMMA microspheres ensure minimal absorption by the body, ensuring long-term efficacy.

- Moreover, PMMA microspheres have gained popularity as a critical component in medical devices, driving innovation in the biomedical technology sector. The use of these microspheres in hyaluronic acid (HA) formulations has further expanded their applications, particularly in the field of tissue engineering and regenerative medicine. In summary, PMMA microspheres, with their unique properties and broad applicability, continue to be a vital component in various medical applications, contributing to the growth and advancement of the biomedical technology industry.

What are the market trends shaping the PMMA Microspheres Market?

Increasing adoption of cosmetic industry is the upcoming trend in the market.

- PMMA microspheres, or polymethylmethacrylate spherical particles, serve as essential components in various industries, including cosmetics and toiletries. These microspheres function as fillers and additives, offering benefits such as optical clarity and mechanical resistance. In the realm of flat display panels, PMMA microspheres are utilized for coating applications due to their unique properties. The cosmetics sector's expansion is anticipated to significantly increase the demand for PMMA microspheres. These microspheres are employed in dermal fillers, permanently minimizing wrinkles and scars while enhancing light-scattering qualities. Consequently, the growing popularity of anti-aging products and skin-enhancing treatments fuels innovation in formulations that incorporate these microspheres.

- Moreover, the increasing consumer awareness of high-quality cosmetic ingredients propels market growth. As a result, The market is poised to thrive during the forecast period, as companies endeavor to cater to evolving consumer preferences and demands for effective cosmetic solutions.

What challenges does PMMA Microspheres Market face during the growth?

Increasing awareness on toxicity of PMMA microspheres is a key challenge affecting market growth.

- PMMA microspheres, a type of plastic microbead, have been commonly used in various industries, including in vitro equipment, diagnostic analysis, and implantable materials, among others. In the realm of healthcare, they are utilized in Point of Care Tests (POCT) and electronic devices. Additionally, they find applications in display technologies and anti-aging products, such as skincare. However, recent regulatory actions have impacted the market.

- For instance, the European Chemical Agency (ECHA) has imposed restrictions on certain chemicals, including D4 (octamethylcyclotetrasiloxane) and D5 (dodecamethylcyclohexasiloxane), which are commonly found in PMMA microspheres. These chemicals have been limited in rinse-off cosmetic products with a concentration of 0.1% or more by weight, effective January 31, 2020. This regulation will further reduce the usage of PMMA microspheres in the cosmetic industry. It is essential for manufacturers to stay updated with such regulatory changes to ensure compliance and maintain the quality of their products.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bangs Laboratories Inc.

- Comindex SA

- Cospheric LLC

- EPRUI Biotech Co. Ltd.

- Goodfellow Cambridge Ltd.

- Gujarat State Fertilizers and Chemicals Ltd.

- HEYO ENTERPRISES Co. Ltd.

- Imperial Microspheres

- Lab 261

- Lucite International Alpha BV

- Magsphere Inc.

- Makevale Group

- Matsumoto Yushi Seiyaku Co. Ltd.

- Microbeads AS

- Microchem

- Phosphorex Inc.

- Polysciences Inc.

- Sekisui Kasei Co., Ltd.

- Sparsh Polychem Pvt Ltd.

- Trinseo PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polymethyl methacrylate (PMMA) microspheres, also known as spherical particles, play a significant role in various industries due to their unique properties. These microspheres are widely used as fillers and additives in various applications. In the field of flat display panels, PMMA microspheres contribute to improving optical clarity and mechanical resistance. In coatings, they enhance the performance of films, printing inks, and decorative paints. PMMA microspheres find extensive use in the cosmetics industry, particularly in anti-aging products and skincare. They act as bulking agents in bone cement and tissue engineering, aiding in collagen production and biocompatibility. In the medical field, they are used as implantable materials in orthopedics, spinal disc defect treatments, and cosmetic surgeries.

PMMA microspheres are also essential in the life sciences sector, contributing to drug delivery systems, optical devices, and electronic displays. Their biocompatibility makes them suitable for use in in vitro equipment and diagnostic analysis. In the electronics industry, they are utilized in the manufacturing of electronic devices and display technologies. Overall, PMMA microspheres offer versatility and functionality in numerous applications, from construction to healthcare.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2024-2028 |

USD 106.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.7 |

|

Key countries |

US, China, Japan, Canada, and Austria |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch