PolyDADMAC Market Size 2025-2029

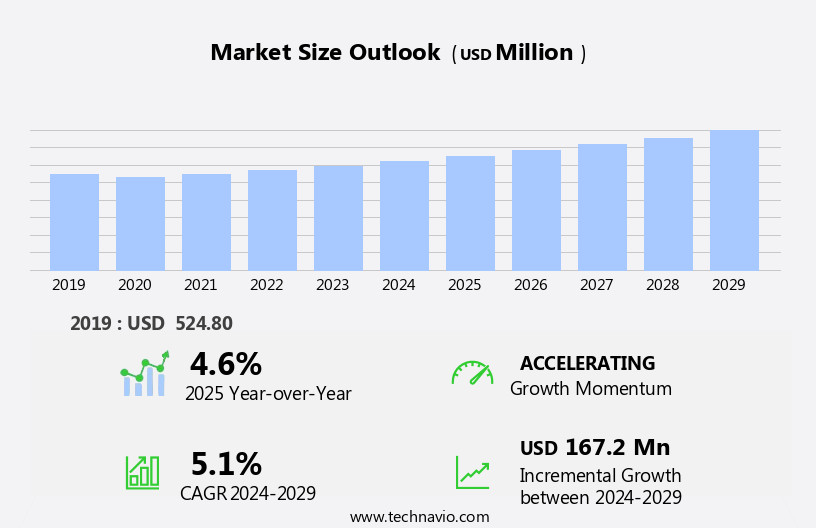

The polydadmac market size is forecast to increase by USD 167.2 million, at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for freshwater to cater to the expanding global population. This trend is particularly prominent in the Asia Pacific region, where the water treatment industry is witnessing a surge in demand for polyDADMAC as a crucial coagulant and flocculant in water treatment processes. However, the market faces a notable challenge: the shortage of skilled workforce in water treatment plants. This labor scarcity may hinder the market's growth potential, as the efficient operation of water treatment facilities relies heavily on the expertise of skilled personnel. Companies seeking to capitalize on the market's opportunities must focus on addressing this challenge by investing in workforce development and training programs.

- Additionally, collaborating with educational institutions and industry associations could help attract and prepare the next generation of water treatment professionals. Overall, the market presents a strategic landscape filled with growth potential, but also requires careful attention to workforce development to ensure sustainable and effective industry growth.

What will be the Size of the PolyDADMAC Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its applications across various sectors. In the realm of water treatment, polydadmac corrosion inhibitors play a crucial role in protecting infrastructure from the damaging effects of water. Simultaneously, in the production process, polydadmac effluent discharge solutions ensure regulatory compliance and cost optimization. Moreover, membrane filtration systems employ polydadmac antimicrobial agents for biofouling control and algae reduction, while cationic polymers optimize dosage in municipal wastewater treatment. In the oil and gas industry, polydadmac scale inhibitors mitigate the buildup of mineral scales in production processes. Water treatment for surface water and industrial wastewater also benefits from polydadmac's ability to reduce turbidity and enhance quality control.

Environmental impact assessments consider the environmental benefits of polydadmac in groundwater treatment and sludge dewatering. In textile dyeing, polydadmac aids in particle removal and color retention, while antimicrobial agents ensure hygiene in swimming pools and drinking water treatment. The ongoing unfolding of market activities necessitates continuous performance evaluation and optimization of polymer dosage and antimicrobial agent applications.

How is this PolyDADMAC Industry segmented?

The polydadmac industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Liquid

- Powder

- Bead

- Application

- Water purification

- Pulp and paper industry

- Cosmetics

- Oilfields

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

. By Type Insights

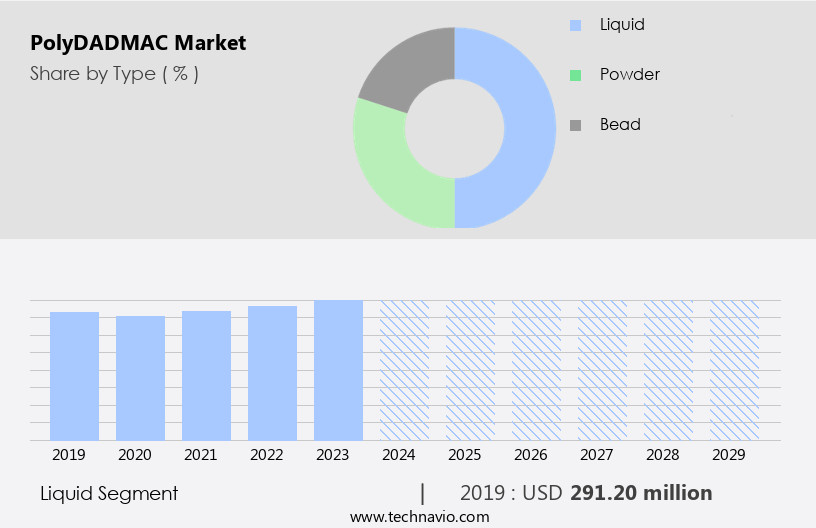

The liquid segment is estimated to witness significant growth during the forecast period.

The market encompasses the use of this cationic polymer in various industries for water treatment applications. In 2024, the liquid form of polyDADMAC held a significant market share due to its high charge density, making it an effective flocculant and coagulant in liquid-solid separation processes. This polymer is majorly used in paper production, textile dyeing and finishing, and other industries for effluent discharge management. Its application in water treatment processes, including membrane filtration and surface water treatment, is crucial for turbidity reduction, particle removal, and environmental impact mitigation. The production process relies on the polymer dosage, which is optimized for cost efficiency and performance evaluation.

Antimicrobial agents and biofouling control are integral to maintaining water quality, while cationic polymers like polyDADMAC are essential in controlling algae and scale inhibitors. Industries such as oil and gas, leather tanning, and municipal wastewater treatment also utilize polyDADMAC for sludge dewatering and industrial wastewater treatment. The global market for polyDADMAC is dynamic, with ongoing research and development focusing on dosage optimization and application expansion in areas like drinking water treatment and swimming pools.

The Liquid segment was valued at USD 291.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

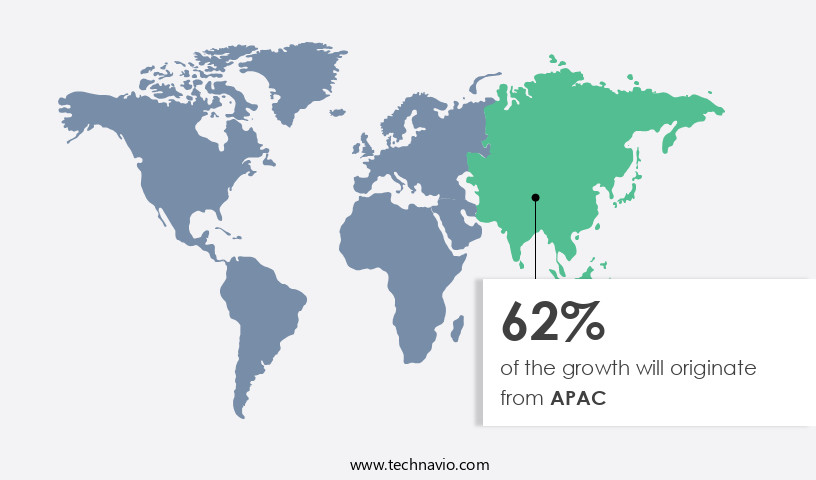

APAC is estimated to contribute 62% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, the APAC region holds a significant position due to the increasing demand for clean water resources in response to industrialization, urbanization, and population growth. The food and beverage, pharmaceuticals, pulp and paper, and power generation industries in APAC are major contributors to the market's expansion, driven by the need for efficient water treatment solutions. Stringent regulations on water pollution further fuel market growth. China, being the world's largest consumer of polyDADMAC, is a key player in the APAC market. Other industries, such as oil and gas, municipal wastewater treatment, and textile dyeing, also utilize polyDADMAC for various applications, including corrosion inhibition, biofouling control, algae control, scale inhibition, and turbidity reduction.

The market's evolution includes the integration of membrane filtration and dosage optimization technologies for enhanced water treatment efficiency. Additionally, antimicrobial agents and cationic polymers are essential components in the production process for improved performance evaluation and quality control. The environmental impact of polyDADMAC use is a critical consideration, with focus on sludge dewatering and particle removal in industrial wastewater treatment and groundwater treatment. In surface water treatment and swimming pool applications, the market offers cost optimization opportunities for water treatment and drinking water treatment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of PolyDADMAC Industry?

- The escalating population growth is the primary cause for the surging market demand for freshwater resources. The market is experiencing significant growth due to the increasing demand for groundwater treatment and water resource management. This demand is driven by various factors, including urbanization, population growth, and economic expansion. In particular, the rising usage of water in industries such as textile dyeing, swimming pools, and wastewater treatment has created substantial opportunities for market participants. The need for efficient dosage optimization in water treatment processes is also fueling the market's growth. As cities expand and populations grow, the strain on water supply systems intensifies, making the efficient use of water resources a top priority.

- The market is poised to continue its growth trajectory as the global community seeks innovative solutions to address the challenges of water scarcity and quality.

What are the market trends shaping the PolyDADMAC Industry?

- The increasing demand for polyDADMAC is a notable trend in the APAC market. This growth can be attributed to the product's superior properties and wide-ranging applications in various industries.

- The market is experiencing growth in various industries, particularly in water purification, pulp and paper, cosmetics, and healthcare sectors, primarily in the Asia Pacific (APAC) region. Indonesia plays a significant role as a supplier of raw materials for PolyDADMAC production, exporting a substantial quantity to European manufacturers. The APAC market for PolyDADMAC is projected to expand due to the escalating demand for water treatment from diverse end-user industries. Increased investments from international corporations contribute to the potential for increased PolyDADMAC production in the region.

- In emerging economies like India and China, industrialization and expansion in the paper and pulp industry are essential factors driving the growth of the market. Overall, the market dynamics in APAC are favorable for the expansion of the PolyDADMAC industry.

What challenges does the PolyDADMAC Industry face during its growth?

- The water treatment industry faces significant growth impediments due to the scarcity of adequately skilled labor force in managing and maintaining water treatment plants.

- The market plays a crucial role in the municipal wastewater treatment sector, as this cationic polymer is an essential component in various applications such as biofouling control and algae control. The market's growth is driven by the increasing demand for cost optimization in industries like leather tanning, oil and gas, and water and wastewater treatment. In the water and wastewater treatment industry, which is a significant end-user, the skilled workforce is responsible for maintaining water quality and optimizing treatment processes. However, the current shortage of adequately trained and certified workers poses a challenge to the industry's operations and, consequently, to the market.

- Performance evaluation of polyDADMAC in water treatment processes is essential to ensure efficient and effective use, leading to cost savings and improved water quality. The market's growth is further propelled by the increasing focus on water reuse and recycling, which necessitates the use of advanced water treatment technologies, including those that utilize polyDADMAC.

Exclusive Customer Landscape

The polydadmac market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polydadmac market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polydadmac market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accepta Ltd - This company provides the advanced cationic coagulant, PolyDADMAC, including Accepta 4351. Formulated for diverse wastewater and effluent treatment applications, this high-performance solution effectively enhances water clarification processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accepta Ltd

- Ashland Inc.

- ATAMAN Kimya AS

- Atish Chemicals

- BASF SE

- Envichem Speciality Chemicals and Polymers Pvt. Ltd.

- GEO Specialty Chemicals Inc.

- Kemira Oyj

- MERU CHEM PVT. LTD.

- NR Chemicals Corp.

- Ocean Chemicals

- Raybon Chemicals and Allied Products

- Shandong Luyue Chemical Industry Co. Ltd.

- SNF Group

- TRIGON Chemie GmbH

- Vertex Chem Pvt. Ltd.

- YIXING BLUWAT CHEMICALS CO. LTD.

- Zhangjiagang Kaibaolai Environmental Protection Technology Co.

- Zhejiang Xinhaitian Bio Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in PolyDADMAC Market

- In February 2024, DuPont Water & Protection announced the commercial launch of Sorona® Renewably-Sourced PolyDADMAC, a new water treatment polymer with enhanced performance and sustainability. This innovative product, derived from renewable feedstocks, offers improved flocculation capabilities and reduced environmental impact (DuPont Press Release, 2024).

- In October 2024, Evonik Industries AG and Lanxess AG, two leading specialty chemicals companies, entered into a strategic collaboration to jointly develop and commercialize PolyDADMAC-based water treatment solutions. This partnership combines Evonik's expertise in PolyDADMAC production with Lanxess' market knowledge and distribution network (Evonik Press Release, 2024).

- In January 2025, Ashland Global Holdings Inc. Completed the acquisition of BASF's water treatment business, including its PolyDADMAC product line. This acquisition significantly expanded Ashland's water treatment portfolio and strengthened its position in the global market (Ashland Press Release, 2025).

- In March 2025, the European Union's REACH regulation approved the renewable feedstock-based PolyDADMAC from DuPont under the registration number 01-244635. This approval paves the way for the increased adoption of more sustainable PolyDADMAC products in Europe (European Chemicals Agency, 2025).

Research Analyst Overview

- In the dynamic water treatment market, polymeric flocculants play a pivotal role in enhancing water conservation efforts. These nonionic and anionic polymers facilitate waste minimization by improving particle size distribution and optimizing zeta potential in water treatment plants. Data analytics and pilot plants are essential tools for testing and evaluating the performance of these polymers under various conditions. Sustainable water management practices, including water reuse and resource recovery, are increasingly adopting polymeric flocculants to address water scarcity issues. Alternative technologies, such as natural polymers and polymer blends, are also gaining traction due to their eco-friendly properties and lower carbon footprint.

- The circular economy approach is driving the full-scale implementation of these solutions, with a focus on process optimization and life cycle assessment. Quaternary ammonium compounds and jar tests are crucial in evaluating the efficiency and effectiveness of these polymers in water treatment applications. Green chemistry principles guide the development of new polymeric flocculants, ensuring a sustainable and efficient approach to water treatment.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled PolyDADMAC Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 167.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

China, US, India, Japan, South Korea, UK, Germany, France, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this PolyDADMAC Market Research and Growth Report?

- CAGR of the PolyDADMAC industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polydadmac market growth of industry companies

We can help! Our analysts can customize this polydadmac market research report to meet your requirements.