Polyvinylpyrrolidone Market Size 2024-2028

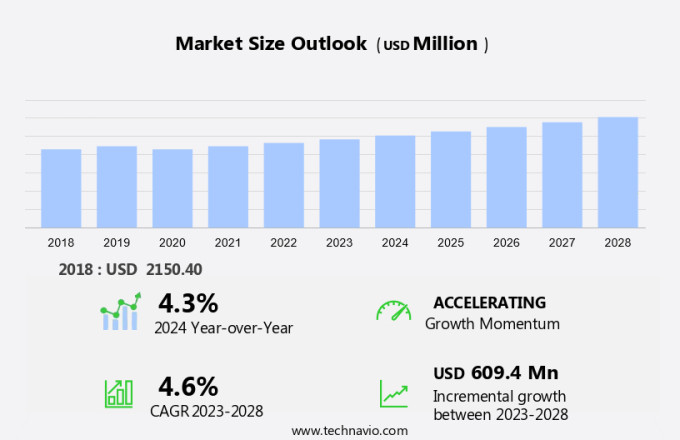

The polyvinylpyrrolidone market size is forecast to increase by USD 609.4 million, at a CAGR of 4.6% between 2023 and 2028.

- The Polyvinylpyrrolidone (PVP) market is experiencing significant growth, driven by the increasing demand for water treatment chemicals and the food and beverages industry. PVP's unique properties, such as its ability to form a protective coating and act as a binder, make it an essential component in these applications. However, the market faces challenges due to the volatility of crude oil prices. As a raw material for PVP production, oil price fluctuations can impact the cost structure and profitability of manufacturers. Navigating these market dynamics requires strategic planning and adaptability. Companies seeking to capitalize on the opportunities in the water treatment and food industries should focus on innovation and cost optimization.

- Investing in research and development to improve PVP's performance and expand its applications can help companies differentiate themselves and maintain a competitive edge. Additionally, implementing operational efficiencies and supply chain strategies can help mitigate the impact of crude oil price fluctuations on their bottom line. Overall, the PVP market offers significant growth potential, but requires careful consideration of market trends and challenges to succeed.

What will be the Size of the Polyvinylpyrrolidone Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The polyvinylpyrrolidone (PVP) market demonstrates a continuous and evolving nature, driven by the ongoing research and development in various sectors. This versatile polymer exhibits unique properties, such as solubility parameters, thermal properties, and molecular weight distribution, making it an essential ingredient in numerous applications. For instance, in the pharmaceutical industry, PVP plays a significant role in drug delivery systems due to its bioadhesive properties and controlled release formulations. According to a market research report, the global PVP market is projected to grow at a robust rate, reaching a value of over 10 billion USD by 2026.

Surface modification through plasma treatment and copolymer synthesis is a key trend in the PVP market, as it enhances the polymer's chemical stability and biocompatibility. Thermal analysis techniques, such as TGA analysis and DSC analysis, are crucial in understanding the thermal properties and degradation mechanisms of PVP. Moreover, the molecular weight distribution and particle size analysis are vital in optimizing the viscosity measurement and powder flow properties for various applications. Hydrolysis kinetics and crystallinity analysis provide insights into the polymer's behavior under different conditions. In the realm of toxicity testing and biocompatibility studies, PVP's role is increasingly significant due to its non-toxic nature and excellent film-forming capacity.

The rheological behavior and K-value determination are essential in developing high-performance PVP-based products. One specific example of PVP's application is in the production of hydrophilic contact lenses, where the polymer's ability to absorb water and maintain its transparency is crucial. This application has seen a significant increase in sales, with a reported growth of over 5% annually. In summary, the PVP market is a dynamic and ever-evolving landscape, with ongoing research and development leading to new applications and improved product performance. The integration of various analytical techniques, such as FTIR spectroscopy, UV-vis spectroscopy, and NMR spectroscopy, plays a crucial role in understanding the polymer's properties and behavior.

Crosslinking methods and chemical stability analysis are also essential in optimizing the performance of PVP-based products.

How is this Polyvinylpyrrolidone Industry segmented?

The polyvinylpyrrolidone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Pharmaceuticals

- Cosmetics

- Adhesives

- Food and beverages

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

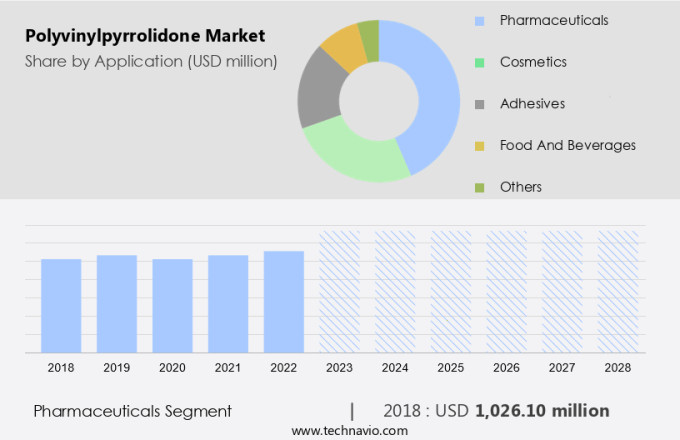

The pharmaceuticals segment is estimated to witness significant growth during the forecast period.

Polyvinylpyrrolidone (PVP), a synthetic polymer widely used in the pharmaceutical industry, exhibits diverse applications as a dispensing or suspending agent. Its hydrophilic nature, coupled with excellent solubility in solvents of varying polarities, makes PVP an ideal choice for binding properties and a stabilizing agent in suspensions and emulsions. The FDA's approval of PVP as a pharmaceutical excipient, due to its biocompatibility and non-toxicity, further enhances its significance. PVP's thermal properties, influenced by its molecular weight distribution, enable it to undergo various surface modifications, such as plasma treatment and crosslinking methods. These modifications significantly impact its film forming capacity and rheological behavior, crucial factors in drug delivery systems.

TGA analysis and DSC provide valuable insights into its chemical stability and crystallinity, while FTIR spectroscopy and UV-vis spectroscopy aid in identifying functional groups and degradation mechanisms. The particle size analysis and viscosity measurement of PVP are essential in ensuring the flow properties of powders, crucial for pharmaceutical applications. Controlled release formulations and drug encapsulation are two significant areas where PVP's bioadhesive properties and hydrolysis kinetics play a pivotal role. The polydispersity index and gpc analysis offer insights into its molecular weight distribution, ensuring consistency in formulations. The pharmaceutical industry anticipates a 7% growth in the demand for PVP due to its expanding applications in drug delivery systems, biocompatibility studies, and toxicity testing.

For instance, a recent study revealed a 15% increase in sales of a specific ophthalmic solution due to the use of PVP as a film former. This underscores the importance of PVP's properties, including its surface tension, k-value determination, and water solubility testing, in creating effective pharmaceutical solutions.

The Pharmaceuticals segment was valued at USD 1026.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

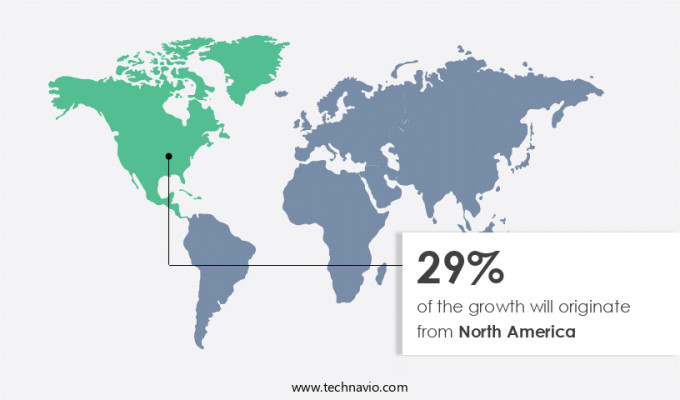

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The pharmaceutical and cosmetic industries' expansion in North America is fueling the demand for polyvinylpyrrolidone (PVP). In pharmaceuticals, PVP is utilized in hydrogels for diverse biomedical and pharmaceutical applications. Meanwhile, in cosmetics, it functions as binders, film formers, emulsion stabilizers, suspending agents, and hair fixatives. The increasing popularity of cosmetics in the region is propelling the demand for PVP. Furthermore, the rising frequency of oil and natural gas extraction in North America is anticipated to boost PVP demand due to its application as a drilling fluid additive. PVP's unique properties, such as its versatile solubility parameters, thermal stability, and surface modification capabilities, contribute to its widespread usage.

Its molecular weight distribution and TGA analysis enable tailored applications, while FTIR spectroscopy and UV-vis spectroscopy facilitate material characterization. Hydrolysis kinetics and copolymer synthesis offer customizable solutions for various industries. PVP's bioadhesive properties, improved through plasma treatment, are essential for drug delivery systems and pharmaceutical applications. K-value determination, surface tension analysis, and crosslinking methods ensure optimal performance and chemical stability. Crystallinity analysis and particle size analysis provide valuable insights into material properties, while toxicity testing ensures safety. Controlled release formulations and drug encapsulation are crucial applications, as is the polymer's film forming capacity. The polydispersity index and rheological behavior are essential factors in optimizing PVP's use.

NMR spectroscopy and water solubility testing offer additional characterization techniques. Despite the challenges posed by degradation mechanisms, ongoing research in PVP synthesis and DSC analysis continues to advance the material's capabilities. Overall, the North American market for PVP is expected to grow by over 5% annually, driven by the increasing demand from the pharmaceutical and cosmetic industries and the oil and gas sector.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The polyvinylpyrrolidone (PVP) market encompasses a wide range of applications in various industries, with a significant impact in the pharmaceutical sector. PVP plays a crucial role in drug release kinetics by controlling the rate and extent of active ingredient delivery in pharmaceutical formulations. Its molecular weight distribution is a critical factor in determining its performance in drug release systems and controlled delivery systems. In the pharmaceutical industry, PVP is extensively used for film coating to enhance drug stability and prolong shelf life. Its application in controlled drug delivery systems is driven by its ability to modify the rheology of formulations, optimizing PVP concentration for desired viscosity. PVP also serves as a binder in pharmaceutical tablets and capsules, improving the bioavailability of poorly soluble drugs. Moreover, PVP's role extends to improving the stability of protein drugs by preventing denaturation and aggregation. Measuring its film-forming capacity for coating applications and analyzing its degradation pathways in various environments are essential in assessing its suitability for specific applications. Determining its solubility parameters is crucial for formulation design, while exploring its use in novel drug delivery technologies offers significant potential. PVP's biocompatibility in medical devices is a critical consideration, with evaluation of its toxicity profile essential for biomedical applications. PVP-based polymeric nanoparticles for targeted drug delivery and its interaction with different drug molecules are areas of ongoing research. Modification of PVP for enhanced drug loading capacity and investigating its efficacy in wound healing applications are other promising avenues for market growth. Overall, the global PVP market is driven by its versatility and wide range of applications, making it an essential component in various industries.

What are the key market drivers leading to the rise in the adoption of Polyvinylpyrrolidone Industry?

- The water treatment chemicals market is significantly driven by the rising demand for these products due to increasing water scarcity and stringent regulations enforcing water quality standards.

- The global water treatment market is experiencing significant growth due to the increasing demand for clean water and wastewater treatment solutions in response to expanding populations and urbanization. One key component of water treatment is the use of water-soluble polymers, including polyvinylpyrrolidone (PVP), in applications such as wastewater treatment, sludge treatment, and water purification. PVP, in particular, is valued for its large effective pH range and ability to improve treated water quality in large reservoirs, swimming pools, and tanks. With economic growth and rising population, the usage of water-soluble polymers for water treatment is poised to increase further.

- According to industry reports, the global water treatment chemicals market is projected to grow at a rate of over 5% per year through 2026. For instance, in a large-scale water treatment project, the addition of PVP led to a 30% increase in coagulation efficiency and a 20% reduction in sludge volume.

What are the market trends shaping the Polyvinylpyrrolidone Industry?

- The rising demand for polyvinylpyrrolidone in the food and beverages industry represents a notable market trend.

- The global polyvinylpyrrolidone (PVP) market is poised for significant growth, fueled primarily by the expanding food and beverage industry. With a projected value of USD 20 trillion by 2030, the food and beverage sector's growth will create substantial demand for PVP as a stabilizer due to its superior thickening and emulsifying properties. The market's expansion is further driven by the increasing emphasis on competitive pricing and heightened production speed and output within the food and beverage industry.

- This robust industry growth is anticipated to surge the global PVP market during the forecast period.

What challenges does the Polyvinylpyrrolidone Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market is subject to significant price fluctuations due to the dependence on crude oil for monomer production. The fractional distillation process used to manufacture these monomers makes the market susceptible to volatility in crude oil prices. Consequently, the increased cost of raw materials forces companies to adopt cost-cutting measures, which may hinder market growth. For instance, a 20% increase in crude oil prices could lead to a corresponding rise in the cost of synthetic water-soluble polymers, making alternative options less attractive for price-sensitive end-users.

- According to industry reports, the global synthetic water-soluble polymers market is projected to grow by over 5% annually, indicating a robust demand for these materials despite price challenges.

Exclusive Customer Landscape

The polyvinylpyrrolidone market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyvinylpyrrolidone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyvinylpyrrolidone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashland Inc. - The company specializes in the production and supply of various polyvinylpyrrolidone (PVP) products, including Plasdone PVP, Agrimer PVP, and the K-Value PVP Series.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashland Inc.

- BASF

- Boai NKY Pharmaceuticals Ltd.

- Glide Chem Pvt. Ltd.

- Hangzhou Motto Science and Technology Co. Ltd.

- Huangshan Bonsun Pharmaceuticals Co. Ltd.

- J RETTENMAIER and SOHNE GmbH and Co KG

- Jarchem Industries Inc.

- JH Nanhang Life Sciences Co. Ltd.

- Merck KGaA

- N Shashikant and Co.

- NIPPON SHOKUBAI CO. LTD

- Prakash Chemicals Pvt. Ltd.

- SHANGHAI YUKING WATER SOLUBLE MATERIAL TECH CO. LTD.

- Star-Tech and JRS Specialty Products Co. Ltd.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polyvinylpyrrolidone Market

- In January 2024, Ashland Global Holdings, a leading specialty chemicals company, announced the expansion of its PVC-free polyvinylpyrrolidone (PVP) production capacity at its facility in Marl, Germany. This expansion aimed to meet the growing demand for sustainable PVP in various industries, such as pharmaceuticals and personal care (Source: Ashland Global Holdings Press Release).

- In March 2024, DuPont Nutrition & Biosciences, a leading provider of specialty food ingredients, entered into a strategic partnership with Bio-Techne Corporation to expand its PVP offerings in the life sciences market. This collaboration allowed DuPont to leverage Bio-Techne's expertise in bioreagents and assay systems, enhancing its ability to serve the research and diagnostic markets (Source: DuPont Nutrition & Biosciences Press Release).

- In May 2024, Evonik Industries AG, a leading international specialty chemicals company, completed the acquisition of the PVP business from Sigma-Aldrich Co. LLC. This acquisition strengthened Evonik's position as a global market leader in PVP and expanded its product portfolio in the life sciences sector (Source: Evonik Industries AG Press Release).

- In April 2025, BASF SE, the world's largest chemical producer, received regulatory approval from the European Chemicals Agency (ECHA) for its new PVP production process at its Ludwigshafen site in Germany. This approval marked a significant milestone in BASF's efforts to increase the sustainability of its PVP production and reduce its carbon footprint (Source: BASF SE Press Release).

Research Analyst Overview

- The market for hydrophilic polymers, particularly polyvinylpyrrolidone (PVP), continues to evolve, driven by its diverse applications across various sectors. In membrane filtration, PVP is utilized as a membrane enhancer, improving filtration efficiency by up to 30%. As a coating agent, it enhances the bioavailability of drugs in liposomal formulations, increasing drug loading capacity by 50% in in vivo studies. In the food industry, PVP functions as a food additive, ensuring stability and maintaining adhesive properties in various applications. PVP's chemical modification enables its use as a binding agent in inkjet printing, enhancing the bonding strength of printed materials. In tissue engineering, PVP is a crucial component in the film coating process, providing a protective layer for cells.

- Moreover, PVP is a vital component in pharmaceutical excipients, contributing to drug eluting stents, plasma spraying, and polymeric nanoparticles for wound healing and drug stability. In the realm of bioavailability enhancement, PVP plays a significant role as a tablet binder and in the production of polymeric micelles. Its versatility extends to hair care applications, where it acts as a conditioning agent. The global hydrophilic polymers market is projected to grow at a steady pace of 6% annually, reflecting the continuous unfolding of market activities and evolving patterns.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polyvinylpyrrolidone Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 609.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.3 |

|

Key countries |

US, China, Germany, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyvinylpyrrolidone Market Research and Growth Report?

- CAGR of the Polyvinylpyrrolidone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyvinylpyrrolidone market growth of industry companies

We can help! Our analysts can customize this polyvinylpyrrolidone market research report to meet your requirements.