Same Day Delivery Market Size and Trends

The same day delivery market size is forecast to increase by USD 40.50 billion at a CAGR of 32.4% between 2023 and 2028. The same day delivery market is experiencing significant growth due to the growth in online shopping and the increasing number of local shops joining the digital platform. Online retailers are leveraging airway and roadway transportation to ensure swift delivery, meeting consumers' demand for quick turnaround times. Automation in the delivery industry is also a major trend, streamlining processes and reducing errors. However, the market's fragmented structure is leading to increased competition among retailers. To stay competitive, companies must optimize their logistics networks and offer flexible delivery options to meet consumers' evolving needs. This market analysis report provides a comprehensive examination of the factors driving growth in the same day delivery market.

Same day delivery has emerged as a critical aspect of the logistics landscape in the United States, revolutionizing the way businesses and consumers receive goods. This delivery model, which ensures items are delivered within 24 hours of order placement, is increasingly popular in e-commerce and various sectors, including business-to-business (B2B), business-to-consumer (B2C), and consumer-to-consumer (C2C) transactions. Logistics infrastructure plays a pivotal role in enabling same-day delivery. Real-time tracking systems, automated warehouses, and advanced transportation methods such as drones and autonomous vehicles have become essential components of this infrastructure. These technologies streamline the process, allowing for quicker order fulfillment and efficient last-mile delivery. Logistics automation is a significant driver of same-day delivery. Automated sorting and packing systems, real-time inventory management, and automated delivery vehicles enable faster processing and delivery times.

Furthermore, intermodal transportation, which combines different modes of transportation like airway, roadway, and rail logistics, optimizes delivery routes and reduces transit times. Same day delivery is not limited to the e-commerce sector. It is also gaining traction in various industries such as healthcare, food delivery, and retail, where quick turnaround times are crucial. Real-time tracking and automated delivery systems ensure that time-sensitive items reach their destinations on the same day, enhancing customer satisfaction and operational efficiency.

Moreover, logistics and transportation companies are continually innovating to meet the growing demand for same-day delivery. They are exploring various solutions, including crowdsourced delivery models, where delivery personnel use their personal vehicles to transport goods. This not only reduces delivery times but also creates opportunities for individuals to earn extra income. In conclusion, same day delivery is transforming the logistics landscape in the United States, enabling faster and more efficient delivery of goods. The integration of advanced technologies, logistics automation, and innovative transportation methods is driving the growth of this market, making it an essential component of e-commerce and various industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- End-user

- B2C

- B2B

- C2C

- Service

- Regular service

- Priority service

- Rush service

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

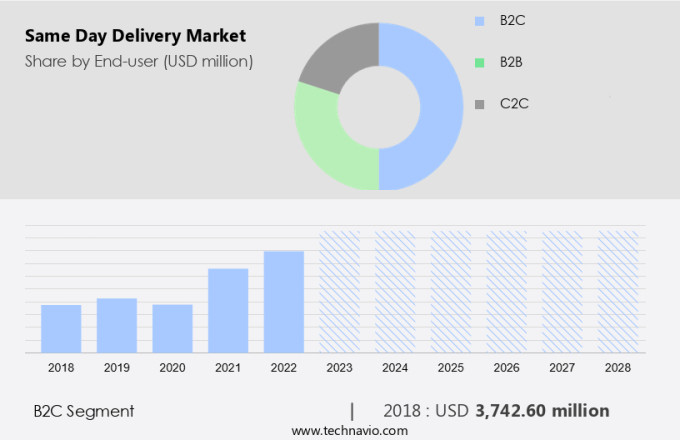

The B2C segment is estimated to witness significant growth during the forecast period. In the business-to-consumer (B2C) sector, e-commerce is driving significant growth. The need for same day delivery services is gaining traction, particularly in the retail grocery industry. The online sale of groceries is projected to expand substantially during the forecast period. Shopping for groceries online offers cost savings and convenience, making it an attractive option for consumers. The COVID-19 pandemic has further accelerated this trend due to social distancing measures. Consequently, e-retailers have been investing heavily in online grocery sales, creating lucrative opportunities for same day delivery providers in the global same day delivery market.

Get a glance at the market share of various segments Download the PDF Sample

The B2C segment was valued at USD 3.74 billion in 2018. Crowdsourced delivery services, such as UberEats and DoorDash, have already made significant strides in the consumer-to-consumer (C2C) and peer-to-peer (P2P) sectors. Autonomous vehicles are also being explored as a potential solution for same day delivery, offering increased efficiency and reduced costs. As the demand for same day delivery continues to rise, market players are expected to leverage these innovations to stay competitive.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

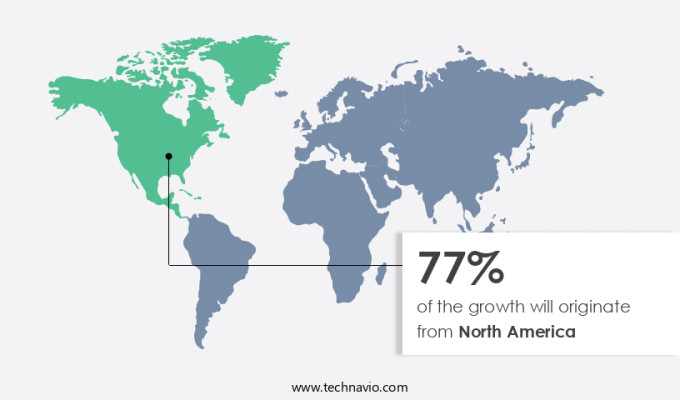

North America is estimated to contribute 77% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The same day delivery market in North America is experiencing significant growth due to the increasing demand for swift delivery services in various sectors, including e-commerce, food and beverages, healthcare, and retail. The region's well-established infrastructure, featuring sophisticated logistics networks and extensive internet coverage, ensures smooth operations and easy accessibility for consumers. Leading e-commerce companies like Amazon, Walmart, and Target are significant market players, utilizing same day delivery as a key competitive advantage to attract and retain customers. These corporations invest heavily in technology and logistics innovations, such as automated warehousing, route optimization, and drone delivery systems, to boost efficiency and decrease delivery durations. Furthermore, the utilization of third-party logistics (3PL) services has become increasingly popular, allowing smaller retailers to provide comparable delivery choices.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Same Day Delivery Market Driver

The growing global B2C e-commerce industry is notably driving market growth. The e-commerce industry has experienced remarkable expansion due to the widespread use of the Internet and the convenience of shopping online. With the proliferation of smartphones and social media, consumers now have easy access to a vast array of products and services from the comfort of their homes. The same day delivery market is poised for significant growth in the coming years, fueled by the trend towards digital dependency and the desire for immediate gratification. Inventory management and trade facilitation have become increasingly important for businesses, particularly those dealing with perishable commodities.

Similarly, delivery services and freight transportation have become essential components of the supply chain, enabling just-in-time production and meeting consumer purchasing power. The convenience of same day delivery has made it an attractive option for businesses and consumers alike, as they seek to streamline their operations and fulfill their needs efficiently. The global same day delivery market is expected to experience substantial growth during the forecast period, as businesses continue to prioritize efficiency and customer satisfaction. Thus, such factors are driving the growth of the market during the forecast period.

Same Day Delivery Market Trends

Automation in same day delivery industry is the key trend in the market. In the dynamic landscape of the same day delivery market, the implementation of autonomous logistics is gaining traction. Traditional logistics players are facing increasing costs related to fuel, maintenance, and labor, which are negatively impacting their profitability. To remain competitive, several companies providing same day delivery services have turned to autonomous logistics. This technology, which gradually replaces manual interaction, offers precise results by minimizing human errors. Furthermore, it significantly reduces the time taken for logistics operations by approximately 80-85%.

An illustrative example of this trend is DHL's Parcelcopter, an unmanned aerial vehicle, which plays a crucial role in delivering emergency parcels. Its capability to cover short distances swiftly makes it an essential component of the modern logistics ecosystem. As the need for efficient and cost-effective same day delivery solutions continues to grow, the adoption of autonomous logistics is poised to expand further. This trend is driven by the increasing popularity of e-commerce platforms and the growing demand for quick and reliable delivery services. Thus, such trends will shape the growth of the market during the forecast period.

Same Day Delivery Market Challenge

Growing competition due to fragmented market structure is the major challenge that affects the growth of the market. The same day delivery market in the United States is experiencing significant growth, leading to increased competition among both new and established players. New entrants are entering the market through various means, such as start-ups and mergers, and are differentiating themselves through advanced technology and competitive pricing. For instance, Uber, a well-known crowdsourcing company, has expanded its offerings with UberEATS and UberRUSH, which cater to online retailers like Amazon and provide express delivery services. The market's fragmented nature has intensified price competition among players.

However, to justify their pricing, both start-ups and established players are investing in innovative technologies, such as airway and roadway delivery systems, to streamline operations and offer faster delivery times. This investment in technology is essential to meet the increasing demand for quick and convenient delivery options from consumers. In conclusion, the same day delivery market in the US is a dynamic and competitive landscape, with new players constantly entering the fray. To succeed, companies must focus on offering competitive pricing and advanced technology to meet the evolving needs of online shoppers and local businesses. By doing so, they can capture market share and thrive in this growing industry. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

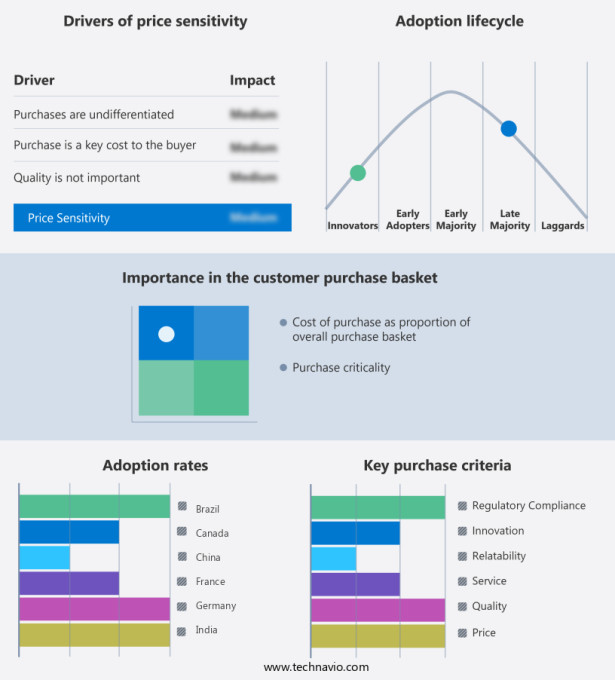

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ArcBest Corp. - The company offers same day delivery services such as ArcBest and Panther premium logistics.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcBest Corp.

- Cargo Express Delivery UK Ltd.

- Courier Express

- Deliv Express Courier LLC

- Deutsche Post AG

- DPEX Worldwide

- FedEx Corp.

- Greenwich Logistics LLC

- Life Science Outsourcing Inc.

- Manston Express Transport

- NAPAREX

- Power Link Expedite Corp.

- Reliable Couriers

- Uber Technologies Inc.

- United Parcel Service Inc.

- United Same Day Delivery Service

- US Cargo

- USA Couriers

- XPO Inc.

- Zipline International Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Same day delivery has revolutionized the way businesses and consumers move goods and documents in the modern world. With the rise of e-commerce and the increasing demand for quick delivery, logistics infrastructure has become a crucial element for businesses looking to stay competitive. Real-time tracking, automated warehouses, drones, and autonomous vehicles are some of the technologies driving the same day delivery market. Peer-to-peer platforms, mobile apps, and digital payment systems have made it easier than ever to arrange same-day delivery services for various mode of transportation, including airways, railways, and intermodal transportation. Time-sensitive communications, legal papers, and other documents are common use cases for same-day delivery in business-to-business (B2B) and business-to-consumer (B2C) transactions.

In summary, the same day delivery market also caters to the needs of consumers, with services like UberEats and DoorDash providing quick delivery of food and other essentials. Last-mile delivery, logistics automation, and supply chain optimization are key areas of focus for retailers looking to offer same-day delivery. Perishable commodities and just-in-time production are industries that particularly benefit from the efficiency and reliability of same-day delivery services. Freight transportation and inventory management are also critical aspects of the same day delivery market. The consumer purchasing power and online shopping trend have fueled the growth of same-day delivery services, making it an essential component of the logistics and transportation landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.4% |

|

Market growth 2024-2028 |

USD 40.50 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.0 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 77% |

|

Key countries |

US, China, Germany, UK, Canada, India, France, UAE, Japan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ArcBest Corp., Cargo Express Delivery UK Ltd., Courier Express, Deliv Express Courier LLC, Deutsche Post AG, DPEX Worldwide, FedEx Corp., Greenwich Logistics LLC, Life Science Outsourcing Inc., Manston Express Transport, NAPAREX, Power Link Expedite Corp., Reliable Couriers, Uber Technologies Inc., United Parcel Service Inc., United Same Day Delivery Service, US Cargo, USA Couriers, XPO Inc., and Zipline International Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch