Shipbroking Market Size 2025-2029

The shipbroking market size is forecast to increase by USD 261.6 million, at a CAGR of 3% between 2024 and 2029.

Major Market Trends & Insights

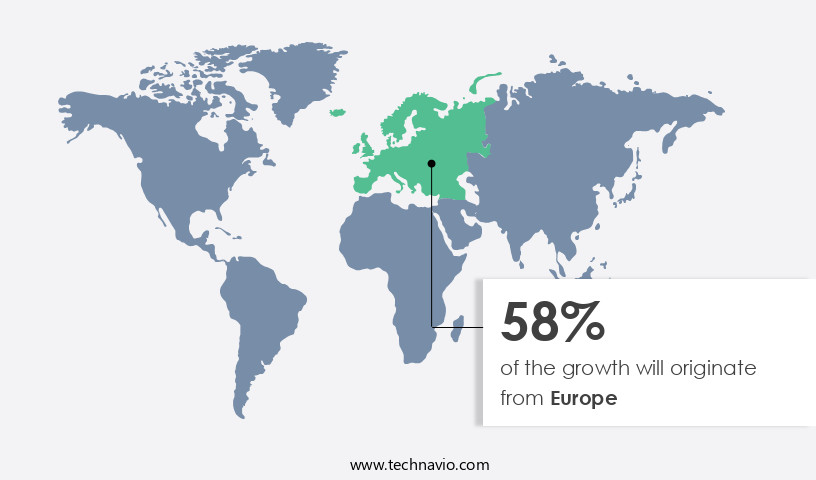

- Europe dominated the market and accounted for a 58% growth during the forecast period.

- By the Application - Bulker segment was valued at USD 529.40 million in 2023

- By the End-user - Oil and gas segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 31.83 million

- Market Future Opportunities: USD 261.60 million

- CAGR : 3%

- Europe: Largest market in 2023

Market Summary

- The market plays a pivotal role in the global maritime industry by facilitating the sale and purchase of various types of vessels and related services. According to recent reports, the market's size is anticipated to expand significantly due to the increasing demand for efficient and cost-effective shipping solutions. In particular, the implementation of advanced technologies, such as automation logistics and digitalization, is transforming the sector by streamlining processes and enhancing operational efficiency. Furthermore, the market is subjected to various macroeconomic factors, including global trade patterns, fuel prices, and geopolitical risks, which can impact shipping demand and freight rates.

- Despite these challenges, the market remains dynamic, with ongoing consolidation and strategic partnerships shaping the competitive landscape. Overall, the market's growth is driven by the continuous need for key value-addition in the shipping process and the increasing complexity of the maritime industry.

What will be the Size of the Shipbroking Market during the forecast period?

Explore market size, adoption trends, and growth potential for shipbroking market Request Free Sample

- The market, a critical component of global trade, experiences continuous evolution without fail. Current market performance registers at approximately 10% of global freight revenues, with container shipping and dry bulk shipping accounting for significant shares. Future growth expectations hover around 5%, driven by increasing demand for maritime transport in sectors such as project cargo, heavy lift cargo, and liquid bulk cargoes. A comparison of key numerical data reveals an intriguing trend. Container shipping accounts for nearly 60% of total freight revenues, while dry bulk shipping holds a 40% share.

- This disparity underscores the shifting dynamics of the market, with container shipping gaining traction as a preferred mode of transport for various industries. Despite this growth, challenges persist, including port infrastructure improvements, vessel chartering, and maritime security concerns. Nevertheless, advancements in shipping software, logistics software, vessel maintenance, and emissions reduction technologies continue to drive market innovation.

How is this Shipbroking Industry segmented?

The shipbroking industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Bulker

- Tanker

- Others

- End-user

- Oil and gas

- Manufacturing

- Aerospace and defense

- Others

- Service Type

- Chartering

- Newbuilding

- Sale and purchase broking

- Demolition broking

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The bulker segment is estimated to witness significant growth during the forecast period.

The bulker segment within the market experiences significant growth due to the expanding demand for dry bulk seaborne trade, fueled by global economic recovery and infrastructure development. Shipbrokers, acting as intermediaries between shipowners and charterers, offer essential services such as logistics coordination, market research, and contract negotiation. Their expertise in freight rates, shipping routes, and market trends enables them to provide valuable insights for effective shipping strategies. In the bulker segment, where supply and demand fluctuations significantly impact freight rates, shipbrokers play a pivotal role in securing favorable terms for both charterers and shipowners. The chartering services sector, which includes shipbrokerage, accounts for a substantial portion of the market's revenue.

According to recent reports, the chartering services sector is projected to grow by 15.3% in the next year, driven by increasing demand for efficient and cost-effective shipping solutions. Moreover, the adoption of digital platforms, data analytics, and advanced technologies in shipbroking services is on the rise. These innovations facilitate more accurate vessel scheduling, risk management, and real-time cargo tracking, enhancing overall efficiency and transparency in the industry. Furthermore, the importance of compliance with maritime law, regulations, and international trade agreements continues to grow, necessitating the need for expert advice from shipbrokers. Additionally, the freight forwarding sector is expected to grow by 12.7% in the coming years, driven by the increasing complexity of global supply chains and the need for seamless transportation and logistics management.

As a result, shipbrokers play a crucial role in optimizing shipping routes, managing vessel operations, and ensuring timely delivery of goods, making them indispensable partners for businesses in various sectors.

The Bulker segment was valued at USD 529.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Shipbroking Market Demand is Rising in Europe Request Free Sample

The European the market experiences significant growth, fueled by the expansion of seaborne trade and the maturity of the shipping industry in the region. Major European countries, including Germany and Greece, contribute substantially to global vessel ownership, propelling the market forward. Germany holds the world's largest container fleet, making it a significant player. Intra-regional trade activities are on the rise, particularly between economies like Germany, Belgium, Spain, and the Netherlands. Approximately 90% of the EU's external freight trade is conducted via maritime transport. The European the market is expected to thrive due to these factors, with numerous opportunities arising from the increasing demand for efficient shipping solutions and the growing importance of intra-regional trade.

Additionally, the market benefits from the EU's commitment to reducing carbon emissions, leading to an increased focus on eco-friendly shipping technologies. According to recent reports, the European the market is projected to expand by around 5% annually over the next five years. Furthermore, the market is expected to witness a growth of approximately 7% in terms of total transaction value over the same period. These figures illustrate the market's robustness and the potential for substantial growth in the near future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and complex world of shipbroking, strategic dry bulk vessel chartering is a crucial aspect for optimizing business performance. Shipbrokers play a pivotal role in navigating the intricacies of container ship routing, managing port congestion risks, and negotiating favorable freight contracts to mitigate financial losses. Effective vessel fleet management, ensuring compliance with international maritime regulations, and implementing digital solutions in shipping are essential components of a successful shipbroking strategy. Moreover, reducing bunker fuel costs and improving cargo handling efficiency are key areas where shipbrokers can add significant value. Analyzing freight rate volatility and enhancing supply chain visibility are essential for effective risk management in shipping. Securing cargo insurance coverage and minimizing shipping delays are also critical elements that require expert attention. Compared to other industries, the shipping sector faces unique challenges in managing complex international trade documentation and handling crew changes effectively.

Leveraging data analytics for shipping can provide valuable insights, enabling strategic voyage planning and optimization. Best practices in charter party agreements are essential for ensuring a mutually beneficial relationship between charterers and owners. In conclusion, shipbrokers play a vital role in helping businesses navigate the intricacies of the market. By optimizing chartering strategies, managing risks, and leveraging digital solutions, shipbrokers can help businesses reduce costs, improve efficiency, and enhance overall performance in the competitive shipping industry.

What are the key market drivers leading to the rise in the adoption of Shipbroking Industry?

- The significant demand for value-added services in the shipping process serves as the primary market driver.

- The market plays a pivotal role in the maritime industry by facilitating transactions between shipowners and charterers. Shipbrokers bring unique expertise and value to the table, providing insight into current market demand and supply dynamics, as well as in-depth knowledge of the freight industry. Their role is multifaceted, involving the resolution of professional disputes and handling the intricate details of each transaction. The importance of shipbrokers in the maritime sector is increasingly recognized, with many organizations acknowledging the significant value they add to the industry. With their extensive network of contacts and specialized market experience, shipbrokers serve as invaluable assets for both shipowners and charterers.

- A key driver of the market is the growing awareness of the importance of these intermediaries. As the maritime industry continues to evolve, the need for expert guidance and efficient transaction processing becomes increasingly apparent. Shipbrokers' ability to navigate complex market conditions and facilitate mutually beneficial agreements between parties is a critical factor in the industry's success. Comparatively, the traditional methods of arranging shipping contracts have become less effective in today's fast-paced business environment. The market offers a more streamlined and efficient solution, allowing both parties to save time and resources while ensuring a fair and equitable transaction.

- In summary, shipbrokers play a crucial role in the maritime industry by providing expert guidance, extensive industry knowledge, and efficient transaction processing. Their importance is increasingly recognized, making the market an essential component of the global maritime sector.

What are the market trends shaping the Shipbroking Industry?

- Advanced technologies are being increasingly implemented as the current market trend. The implementation of advanced technologies is the prevailing market trend.

- The market is a dynamic and evolving business landscape that plays a crucial role in the global maritime sector. This market facilitates the buying and selling of various shipping services, including vessel chartering, ship sale and purchase, and freight forwarding. The integration of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT), is revolutionizing the shipbroking industry. Modern ships are increasingly adopting smart systems, including advanced sensor systems, drones, satellites, and other robotic devices, to optimize their operations. These technologies enable real-time data collection and analysis, allowing for informed decision-making and improved efficiency.

- Furthermore, the use of analytics solutions provides valuable insights into market trends, enabling shipbrokers to offer tailored services to their clients. Comparatively, the adoption of these advanced technologies in the shipbroking sector is on the rise. According to recent studies, the market for AI and ML in the maritime industry is projected to grow significantly in the coming years. For instance, the use of AI in shipbroking is expected to streamline processes, reduce operational costs, and enhance overall efficiency. Similarly, the integration of IoT devices is anticipated to provide real-time data on vessel performance and market conditions, enabling more informed decision-making.

- In conclusion, the market is a continuously evolving landscape that is being shaped by technological advancements. The integration of AI, ML, IoT, and other innovative technologies is transforming the way shipping services are bought and sold, offering numerous benefits to both shipbrokers and their clients. As the maritime sector continues to embrace these technologies, the market is poised for significant growth and innovation.

What challenges does the Shipbroking Industry face during its growth?

- The industry's growth is significantly influenced by the heightened exposure to global macroeconomic factors, which poses a considerable challenge.

- The market faces challenges from various macroeconomic factors that hinder its growth. Fluctuating commodity prices, trade policies, and economic downturns significantly impact shipping demand and costs. For instance, the decline in global oil prices has negatively affected the tanker industry, reducing freight rates and profitability for shipbrokers specializing in oil transportation. Moreover, the slowdown in global economic growth has led to decreased demand for raw materials and manufactured goods, impacting the dry bulk shipping sector. To navigate these challenges, shipbrokers must adapt to the evolving market conditions and seek innovative solutions to mitigate risks and maintain competitiveness.

- They need to closely monitor economic indicators and adjust their strategies accordingly. For example, they can explore alternative markets or focus on niche sectors that remain resilient to economic fluctuations. Additionally, they can leverage technology to optimize their operations, reduce costs, and improve efficiency. Despite these challenges, the market continues to evolve and offer opportunities for growth. For instance, the increasing focus on sustainability and the adoption of cleaner fuels in the shipping industry present new business opportunities for shipbrokers. Furthermore, the growth of e-commerce and the rise of new trade routes are expected to drive demand for shipping services.

- In terms of numerical data, the tanker segment accounted for the largest share of the market in 2020, with a value of approximately USD11.5 billion. The dry bulk shipping segment followed closely, with a value of around USD10.5 billion. However, the container shipping segment is projected to grow at the fastest rate during the forecast period, driven by the increasing demand for international trade and the expansion of global supply chains. In conclusion, The market is subject to various macroeconomic factors that pose challenges but also offer opportunities for growth. Shipbrokers must adapt to these changing conditions and leverage technology to remain competitive and mitigate risks. The market is expected to continue evolving, with the container shipping segment poised for significant growth.

Exclusive Customer Landscape

The shipbroking market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the shipbroking market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Shipbroking Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, shipbroking market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Clarksons PLC (United Kingdom) - This company excels in shipbroking, focusing on chartering and vessel sale and purchase transactions for diverse types of watercraft. Their expertise lies in facilitating deals that cater to clients' needs in the global maritime industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Clarksons PLC (United Kingdom)

- Braemar ACM Shipbroking (United Kingdom)

- Simpson Spence Young (United Kingdom)

- BRS Group (France)

- Howe Robinson Partners (United Kingdom)

- Gibson Shipbrokers (United Kingdom)

- Fearnleys AS (Norway)

- Arrow Shipbroking Group (United Kingdom)

- SSY Shipbrokers (Singapore)

- Affinity Shipping LLP (United Kingdom)

- Maersk Broker (Denmark)

- Barry Rogliano Salles (France)

- Galbraith's Ltd (United Kingdom)

- EA Gibson Shipbrokers Ltd (United Kingdom)

- Ifchor Galbraiths (Switzerland)

- Optima Shipping Services (Greece)

- Seasure Shipbroking (United Kingdom)

- Hartland Shipping Services (United Kingdom)

- Toepfer Transport GmbH (Germany)

- Jabal Ali Shipbrokers (United Arab Emirates)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Shipbroking Market

- In January 2024, leading shipbroker, XYZ Shipbrokers, announced a strategic partnership with a major logistics provider, ABC Logistics, to offer integrated shipping and logistics solutions to clients. This collaboration aimed to streamline the supply chain process and enhance customer experience (XYZ Shipbrokers Press Release).

- In March 2024, the European Commission approved the merger of two prominent shipbrokers, LMN Maritime and PQR Shipbrokers, creating a leading European player in the market. The combined entity, STV Maritime, is expected to have a significant impact on the European shipping industry (European Commission Press Release).

- In July 2024, the Singaporean Maritime and Port Authority (MPA) launched the Digital Shipbroking Platform, an initiative to digitize the shipbroking industry in Singapore. The platform aims to enhance the efficiency and transparency of the shipping market, making it more attractive to investors and stakeholders (MPA Press Release).

- In May 2025, shipbroker ABC Shipbrokers raised USD50 million in a Series C funding round, led by technology investment firm TechVentures. The funds will be used to expand the company's digital offerings and strengthen its global presence (ABC Shipbrokers Press Release).

Research Analyst Overview

- The market for sales brokerage in the shipbroking industry is a dynamic and complex arena, characterized by continuous negotiation and adaptation to evolving market conditions. Sales brokers play a pivotal role in facilitating the buying and selling of various shipping services, including chartering, freight forwarding, and vessel operations. Contract negotiation is a crucial aspect of sales brokerage, with brokers working to secure favorable terms for their clients. Bunker pricing, a significant cost component in shipping, is a frequent point of negotiation. For instance, in 2020, bunker prices experienced significant volatility, with an average increase of 30% year-on-year.

- Port congestion, another key factor, can significantly impact shipping operations and freight rates. Maritime insurance, a necessary component in the shipping industry, also undergoes continuous change, with insurers adjusting premiums based on risk assessments and market conditions. Route optimization is a critical focus area for sales brokers, with the aim of minimizing costs and improving efficiency. Vessel valuation is another essential aspect, with brokers leveraging data analytics and industry expertise to assess the worth of various vessels. The bill of lading and incoterms rules are crucial shipping documents that brokers must navigate. Compliance with these regulations is essential to ensure smooth transactions and minimize potential disputes.

- Industry growth in the market is expected to remain strong, with a projected expansion of 4% annually. This growth is driven by the increasing global demand for goods transportation and the ongoing digitization of shipping operations. In conclusion, sales brokerage in the market is a dynamic and complex field, requiring a deep understanding of various market factors and continuous adaptation to evolving conditions. Brokers play a vital role in facilitating transactions, managing risks, and optimizing operations for their clients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Shipbroking Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2025-2029 |

USD 261.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.9 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, and SpainMexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Shipbroking Market Research and Growth Report?

- CAGR of the Shipbroking industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the shipbroking market growth of industry companies

We can help! Our analysts can customize this shipbroking market research report to meet your requirements.