Singapore Fresh Mushroom Market Size 2025-2029

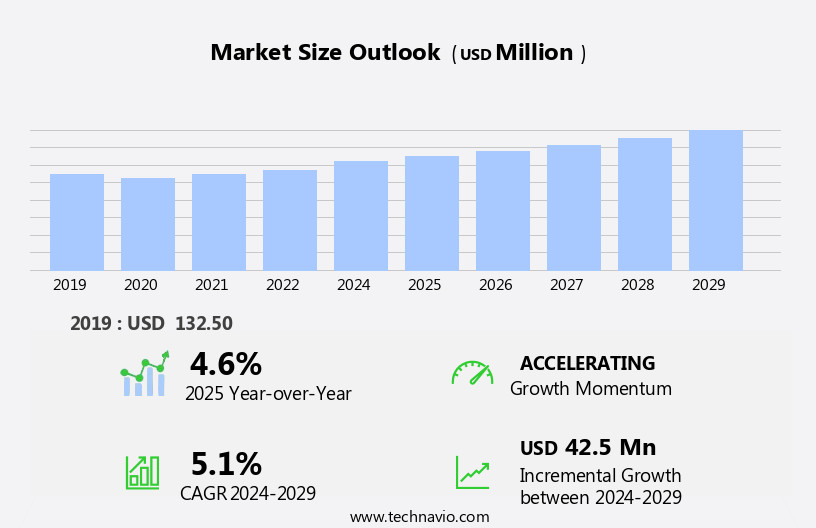

The singapore fresh mushroom market size is forecast to increase by USD 42.5 million million at a CAGR of 5.1% between 2024 and 2029.

- The market presents a compelling growth opportunity for businesses, driven by the increasing recognition of mushrooms' medicinal values and the rising adoption of vegan and vegetarian diets. Mushrooms are rich in essential nutrients, including protein, fiber, and various vitamins and minerals. Moreover, they are known for their medicinal properties, such as boosting immunity, aiding digestion, and reducing inflammation. However, this market also faces challenges, primarily from external factors. The risks associated with diseases, abnormal temperature changes, and extreme weather events can significantly impact mushroom cultivation and supply. For instance, diseases like white rot and verticillium wilt can decimate mushroom crops, leading to price volatility and supply shortages.

- Additionally, extreme weather conditions, such as heavy rainfall or drought, can negatively affect the growth and yield of mushrooms. Companies seeking to capitalize on this market's opportunities must navigate these challenges effectively by implementing risk management strategies, investing in research and development, and adopting sustainable farming practices to ensure a consistent supply of high-quality fresh mushrooms.

What will be the size of the Singapore Fresh Mushroom Market during the forecast period?

- The market is a significant component of the global mushroom industry, encompassing various edible macromonial groups such as button, shiitake, oyster, and others. Demand for these fungi is driven by their desirable flavors, aromas, and nutritional benefits, making them essential ingredients in local and international dishes. Home gardeners and health-conscious consumers alike appreciate mushrooms for their rich protein content and various health benefits, including the antioxidants glutathione and ergothioneine. Fresh mushrooms are popular in their natural state, but processed forms like frozen, dried, and canned also hold a strong presence in the market. Import duties and consumer preferences influence the distribution and consumption of different mushroom types.

- For instance, button mushrooms are widely consumed in processed forms, while shiitake and oyster mushrooms are often preferred fresh. Label-conscious consumers increasingly seek out plant extracts and mushroom-derived products, expanding the market's scope beyond traditional applications. The versatility of mushrooms, coupled with their growing popularity as a protein-rich, vegan alternative, ensures the market's continued growth and relevance.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Button mushroom

- Shiitake mushroom

- Oyster mushroom

- Others

- Distribution Channel

- Offline

- Online

- Application

- Food

- Pharmaceuticals

- Geography

- Singapore

By Product Insights

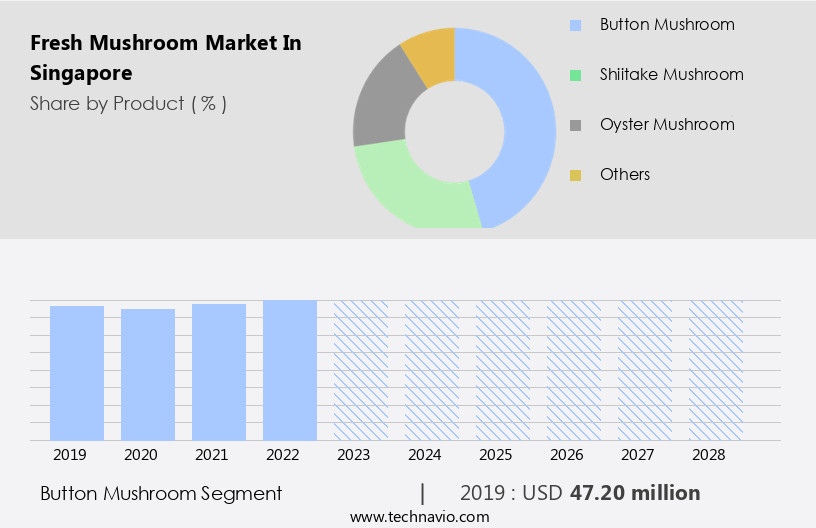

The button mushroom segment is estimated to witness significant growth during the forecast period.

Button mushrooms, scientifically known as Agaricus bisporus, are a popular and versatile edible fungi widely used in various culinary applications due to their mild flavor and meaty texture. These mushrooms are the least expensive type and are commonly consumed in dishes such as cakes, omelets, pasta, risotto, and pizza. Button mushrooms are rich in proteins and essential amino acids, making them an excellent option for individuals following protein-rich vegan diets. They have a low cholesterol and fat content, making them a healthier choice for those with chronic conditions. Button mushrooms are a natural source of essential nutrients such as selenium, vitamin D, glutathione, ergothioneine, and bioactive compounds.

These nutrients have been linked to various health benefits, including immunity boosting, improved cognitive function, and antioxidant properties. The mushroom market in Singapore has seen increasing demand due to label-conscious consumers seeking out plant-based alternatives for their nutritional needs. The mushroom market in Singapore includes various forms such as fresh, frozen, dried, and canned. The fresh form is highly preferred due to its savory flavors and health advantages, including the umami quality that enhances the taste of food. Processed forms, such as those containing plant extracts, are also popular as they offer convenience and longer shelf life. Mushrooms belong to the macrofungal groups and have gained popularity as gourmet products, meat replacers, and dietary supplements.

The global mushroom market is expected to grow significantly due to increasing health awareness and the availability of new and innovative products. Home gardeners and health enthusiasts can also grow their button, shiitake, oyster, and other types of mushrooms for personal use.

Get a glance at the market share of various segments Request Free Sample

The Button mushroom segment was valued at USD 47.20 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Singapore Fresh Mushroom Market?

- Medicinal values associated with mushrooms is the key driver of the market.

- Mushrooms have gained recognition as a superfood due to their rich nutritional profile. These fungi are high in antioxidants and contain selenium, a mineral essential for liver enzyme function and cancer prevention. Selenium aids in detoxifying cancer-triggering compounds in the body, decreases tumor growth, and prevents inflammation. Additionally, mushrooms provide vitamin C, fiber, and potassium, all contributing to cardiovascular health.

- Mushrooms are also low in sodium and high in potassium, reducing the risk of cardiovascular diseases and high blood pressure. Medicinal mushrooms, such as Shitake, possess medicinal, functional, and nutritional properties and are used to prevent, alleviate, or heal diseases like Parkinson's and Alzheimer's. Mushrooms offer significant health benefits and are a valuable addition to any diet.

What are the market trends shaping the Singapore Fresh Mushroom Market?

- Rising adoption of vegan and vegetarian diets is the upcoming trend in the market.

- The market experiences significant growth due to the expanding food and beverage industry and the increasing number of health-conscious consumers worldwide. Mushrooms, recognized as a nutritious superfood, are gaining popularity due to their rich vitamin, protein, and mineral content. These nutrients contribute to alleviating oxidative stress and reducing the risk of chronic conditions, including cancer, dementia, and heart disease. The growing preference for vegan food items, driven by a rising vegan population seeking protein-rich alternatives, is a major factor fueling market growth.

- Mushrooms' versatility as a meat substitute makes them an attractive choice for health-conscious consumers. With their nutritional benefits and increasing demand, the market is poised for steady expansion during the forecast period.

What challenges does Singapore Fresh Mushroom Market face during the growth?

- Risks related to diseases, abnormal temperature change, and extreme weather events is a key challenge affecting the market growth.

- Mushrooms face challenges from various threats, including pests and diseases. Midge species, flies, and certain mite varieties can harm mushroom crops. Fungal pathogens, such as Trichoderma, Mycogone, Dactylium, Fusarium, Verticillium, Scopulariopsis, Papulaspora, and Diehlomyces, can significantly impact mushroom growth. Temperature plays a crucial role in mushroom cultivation. Mushrooms thrive under specific temperature conditions. If temperatures are too low, growth may be slow or non-existent.

- Conversely, high temperatures can lead to rapid growth and inferior texture. Ensuring optimal temperature and managing pests and diseases are essential for a successful mushroom market.

Exclusive Singapore Fresh Mushroom Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aries Fresh Pte Ltd.

- Champ Fungi Sdn. Bhd.

- Cold Storage Singapore 1983 Pte Ltd.

- Fresh Direct LLC

- Kin Yan Agrotech Pte Ltd.

- Mycofarm Pte Ltd.

- The Mushroom Farm

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by various factors. One key trend is the increasing preference for plant-based diets among the population, with vegans and individuals following protein-rich dietary regimens seeking out mushrooms as a source of essential nutrients. Mushrooms are known for their nutritional contents, including selenium, vitamin D, and various bioactive compounds such as glutathione and ergothioneine. These compounds have been linked to chronic condition prevention and overall health benefits. As a result, label-conscious consumers in Singapore are increasingly turning to fresh mushrooms as a healthier alternative to meat.

The market can be segmented into several categories based on product type. These include button mushrooms, shiitake mushrooms, oyster mushrooms, and others. Button mushrooms are the most commonly consumed fresh mushroom variety, while shiitake and oyster mushrooms are popular due to their savory flavors and umami quality. Fresh mushrooms are available in various forms, including fresh, frozen, dried, and canned. The fresh form is preferred by consumers for its superior taste and texture, while processed forms offer longer shelf life and convenience. The demand for fresh mushrooms is particularly high in the gourmet food sector, where they are used as meat replacers and in the production of dietary supplements.

The macrofungal groups that produce these mushrooms have also gained attention due to their potential in the biotechnology industry. Mycelium-based materials have been developed for use in various applications, including food, medicine, and construction materials. The use of artificial intelligence and biotechnology in mushroom cultivation has further increased efficiency and productivity. Despite the growing demand for fresh mushrooms, import duties and other regulatory factors can impact market dynamics. Home gardeners and small-scale farmers are exploring alternative methods of cultivation to reduce reliance on imported mushrooms and support local production. In , the market is driven by various factors, including health benefits, savory flavors, and the growing preference for plant-based diets.

The market is diverse, with various product types and forms catering to different consumer needs and preferences. The use of biotechnology and artificial intelligence in mushroom cultivation is expected to further drive innovation and growth in the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 42.5 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.6 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Singapore

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch