Sodium Naphthalene Sulphonate Formaldehyde Market Size 2024-2028

The sodium naphthalene sulphonate formaldehyde market size is forecast to increase by USD 313.6 million at a CAGR of 4% between 2023 and 2028.

- The market is experiencing significant growth due to the high efficacy of this chemical in various applications. One of the primary industries driving this market's expansion is the plastics and rubber manufacturing sector. Sodium naphthalene sulphonate formaldehyde's unique properties make it an ideal choice for producing high-quality products In these industries. However, stringent regulations on formaldehyde emissions pose a challenge to market growth. Producers must adhere to these regulations to ensure the safety and health of consumers and the environment. Despite this challenge, the market is expected to continue its upward trajectory due to the increasing demand for sodium naphthalene sulphonate formaldehyde in various industries.

- Additionally, another trend influencing the market is the growing awareness of the benefits of using sodium naphthalene sulphonate formaldehyde over other formaldehyde-based chemicals. Its superior performance and lower toxicity make it a preferred choice for many applications, further fueling market growth. Overall, the market is poised for continued expansion, driven by its efficacy, increasing use in various industries, and the growing preference for this chemical over traditional formaldehyde-based alternatives.

What will be the Size of the Sodium Naphthalene Sulphonate Formaldehyde Market During the Forecast Period?

- The naphthalene sulfonate formaldehyde market is a significant segment within the concrete industry, primarily utilized as a high-performance concrete admixture. These naphthalene sulfonate salts, also known as naphthalene sulfonate surfactants, play a crucial role in enhancing concrete properties such as flowability, workability, and slump retention. The naphthalene sulfonate industry caters to various concrete applications, including self-consolidating concrete, concrete superplasticizers, and concrete design. The demand for naphthalene sulfonate formaldehyde is driven by the increasing construction industry's focus on producing high-performance, durable concrete. Concrete technology and engineering continue to evolve, necessitating the use of advanced concrete additives like naphthalene sulfonate salts.

- Additionally, these materials contribute to the concrete's improved rheology, allowing for better concrete workability and enhanced concrete strength. Naphthalene sulfonate synthesis and production have seen significant advancements, ensuring a steady supply for the concrete industry. As the demand for free-flowing, self-consolidating concrete continues to grow, the role of naphthalene sulfonate formaldehyde In the concrete market is expected to remain strong. It is important to note that 1-naphthyl-n-methylcarbamate (carbaryl) is a separate chemical compound and is not directly related to naphthalene sulfonate formaldehyde.

How is this Sodium Naphthalene Sulphonate Formaldehyde Industry segmented and which is the largest segment?

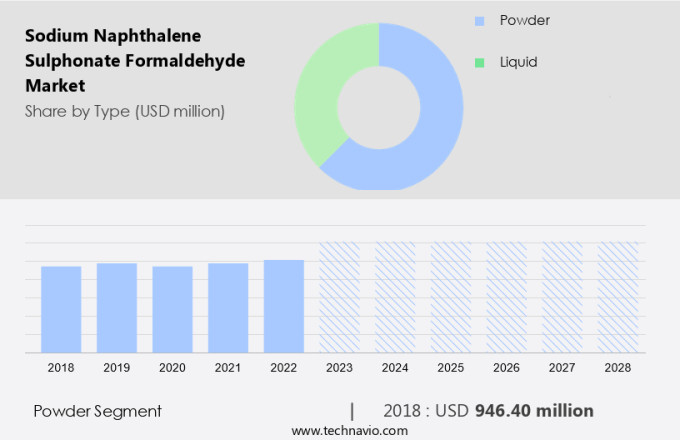

The sodium naphthalene sulphonate formaldehyde industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Powder

- Liquid

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

- The powder segment is estimated to witness significant growth during the forecast period.

The market's powder segment is expected to experience notable growth due to its cost-effective advantages over liquid forms. In various applications, particularly In the construction industry, the powder form is preferred for its superior performance. As a superplasticizer, it enhances concrete's workability and strength while reducing water consumption by 12-25%. This attribute is essential for producing high-strength concrete with lower permeability, a demand that increases alongside the rising global construction output.

Additionally, the construction sector's growth is the primary driver for the market, with the increasing need for efficient concrete mixtures. The powder form's versatility extends to other industries, including bleaching, rubber synthesis, leather tanning, pesticides, detergent, and agrochemicals. Its usage In these sectors is expected to contribute to the market's expansion during the forecast period.

Get a glance at the Sodium Naphthalene Sulphonate Formaldehyde Industry report of share of various segments Request Free Sample

The powder segment was valued at USD 946.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 63% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC region leads the market due to its extensive usage In the construction industry. This trend is expected to continue as demand increases in agriculture, plastics, building compounds, and other sectors. The primary application of sodium naphthalene sulphonate formaldehyde is as a water-reducing agent in high-flowing concrete, improving workability and reducing water consumption by up to 25%. The powder form of this compound is prevalent due to its cost-effectiveness and ease of transportation, while the liquid form is gaining popularity in textiles and construction applications. The market is poised for growth, driven by the construction industry's increasing need for high-strength concrete and the expanding use of this compound in various industries.

Market Dynamics

Our sodium naphthalene sulphonate formaldehyde market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Sodium Naphthalene Sulphonate Formaldehyde Industry?

The high efficacy of sodium naphthalene sulphonate formaldehyde is the key driver of the market.

- Sodium Naphthalene Sulphonate Formaldehyde (SNSF) is a valuable additive in various industries, particularly in concrete production as a superplasticizer. This compound's primary role is to decrease water content in concrete mixtures, thereby improving fluidity and workability without sacrificing strength. By reducing water usage by up to 25%, SNSF enhances the rheological properties of concrete, enabling easier placement and compaction. SNSF functions by dispersing cement particles, preventing clumping and segregation, leading to a more uniform particle distribution withIn the mix. This results in enhanced compressive strength and durability of the final product. Research suggests that SNSF-treated concrete can exhibit strength increases of 20-110% at different curing stages compared to untreated mixtures.

- Additionally, SNSF finds applications in textiles, insecticides, bleaching, rubber synthesis, leather tanning, pesticides, detergents, agrochemicals, and pharmaceuticals, among others. In textiles, it serves as a wetting agent and dispersing agent, improving the dispersion of pigments and dyes. In the production of plastics, building compounds, and compound accelerators, SNSF acts as a water-reducer and dispersant, ensuring high-flowing concrete and prefabricated concrete's optimal performance. SNSF is also used In the oil industry as an anti-freezing agent, in solid concrete as a retarder, and in energy prices as a pumpable concrete additive. In agriculture, it functions as a water-reducer and dispersant for enhancing the workability and strength of concrete used in irrigation systems.

- In summary, SNSF's versatility and effectiveness make it an essential ingredient in various industries, contributing significantly to their growth and efficiency. Despite the potential energy prices' impact on the production and distribution of SNSF, its benefits outweigh the costs, making it a valuable investment for businesses In the US and beyond.

What are the market trends shaping the Sodium Naphthalene Sulphonate Formaldehyde Industry?

Increasing use of sodium naphthalene sulphonate formaldehyde in plastics and rubber manufacturing is the upcoming market trend.

- Sodium Naphthalene Sulphonate Formaldehyde (SNSF) is a valuable additive in various industries, including textiles, rubber synthesis, leather tanning, pesticides, and building materials. This compound, derived from naphthalene sulfonic acids and formaldehyde, functions as a wetting agent, dispersing agent, and water-reducer. In textiles, SNSF enhances the dispersion of dyes and pigments, improving the quality of fabrics. In the production of insecticides and pesticides, it acts as a dispersant, ensuring uniform distribution of active ingredients. For rubber and leather industries, SNSF serves as a compound accelerator, enhancing the curing process and improving the final product's mechanical strength. In the agrochemicals sector, it is used as a dispersing agent for solid fertilizers and pigments in cereals.

- In the manufacturing of paints and coatings, SNSF improves the flow properties and reduces the water requirement, leading to better coverage and durability. Additionally, it is used In the production of high-flowing concrete, prefabricated concrete, and pumpable concrete as a water-reducer and retarder. SNSF is also employed In the synthesis of synthetic dyes, pigments, and naphthalene acetic acid. Its compatibility with various polymers makes it an essential additive for achieving desired rheological properties in plastics and oil industries.

- Furthermore, SNSF is used as an anti-freezing agent in solid concrete and as a dispersant in energy prices and agrochemicals. Overall, Sodium Naphthalene Sulphonate Formaldehyde is a versatile additive that plays a crucial role in various industries, improving product quality and enhancing manufacturing processes.

What challenges does the Sodium Naphthalene Sulphonate Formaldehyde Industry face during its growth?

Stringent regulations on formaldehyde emissions are a key challenge affecting the industry's growth.

- Sodium Naphthalene Sulphonate Formaldehyde, a derivative of naphthalene sulfonic acids and formaldehyde, serves multiple functions in various industries. As a wetting agent, it enhances the spreading and penetration of liquids in textiles, leather tanning, rubber synthesis, and agriculture. In insecticides and pesticides, it acts as a dispersing agent, improving the uniform distribution of active ingredients. In bleaching applications, it functions as a compound accelerator, enhancing the effectiveness of bleaching agents. In the detergent industry, Sodium Naphthalene Sulphonate Formaldehyde acts as an anionic surfactant, reducing surface tension and improving the cleaning power. In the agrochemicals sector, it is used as a water-reducer and dispersant, enabling the production of high-flowing concrete and pumpable concrete in construction.

- In the pharmaceuticals industry, it is used In the synthesis of 1-naphthol and naphthalene acetic acid. In the energy sector, Sodium Naphthalene Sulphonate Formaldehyde is used as an anti-freezing agent in oil production. In the paints and coating industry, it is used as a dispersant, improving the flow properties and color stability of the paints. In the paper industry, it is used as a retarder, enhancing the paper-making process. Despite its widespread use, the production and application of Sodium Naphthalene Sulphonate Formaldehyde involve the use of formaldehyde, which is classified as a Group 1 known human carcinogen by the International Agency for Research on Cancer.

- Additionally, governments and regulatory bodies have implemented stringent regulations and limitations on formaldehyde emissions to mitigate potential health risks. The US Department of Housing and Urban Development (HUD) has placed limits on formaldehyde emissions from non-structural plywood and particleboards used in manufactured housing applications. It is essential to adhere to these regulations to ensure the safety and health of workers and end-users.

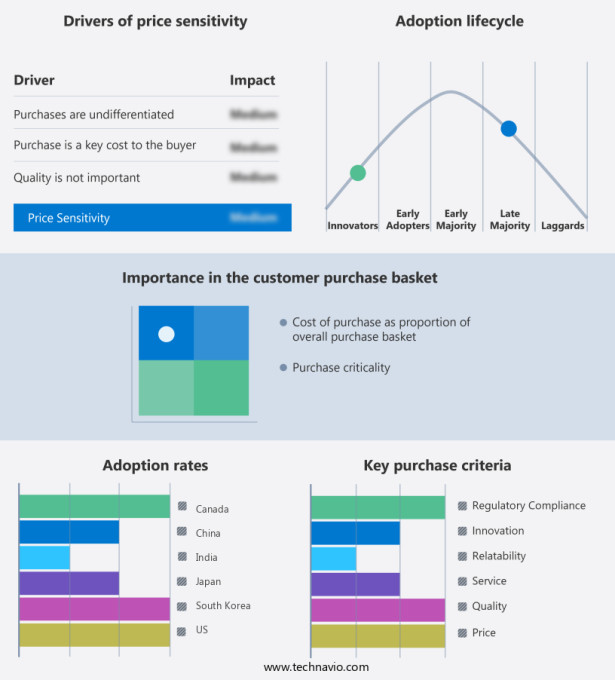

Exclusive Customer Landscape

The sodium naphthalene sulphonate formaldehyde market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sodium naphthalene sulphonate formaldehyde market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sodium naphthalene sulphonate formaldehyde market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agrosyn

- Anhui Elite Industrial

- Carbosynth

- Filtron Envirotech

- Himadri Speciality Chemical Ltd.

- JFE Chemical

- Kao Corp.

- Kashyap Industries

- MUHU China Construction Materials Co. Ltd.

- Nease Performance Chemicals

- Palmer Holland

- Paras Enterprises

- Qingdao Lambert Holdings

- Shandong Jufu Chemical Technology Co. Ltd.

- Sure Chemical

- Trisha Speciality Chemicals Pvt. Ltd.

- Venki Chem

- Wuhan Xinyingda Chemicals Co. Ltd.

- Yahska Polymers Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Sodium Naphthalene Sulfonate Formaldehyde (SNSF) is a chemical compound that has gained significant attention due to its versatile applications across various industries. This compound, derived from naphthalene sulfonic acids and formaldehyde, functions as a wetting agent and dispersing agent, enhancing the performance of various products. Sodium Naphthalene Sulfonate Formaldehyde plays a pivotal role in textile manufacturing, where it is employed as a finishing agent to improve the wettability and dispersion of dyes and pigments. In the textile industry, SNSF aids In the uniform distribution of colorants, ensuring better color fastness and improved overall quality of the textile products.

Additionally, the agrochemical sector also benefits from the use of Sodium Naphthalene Sulfonate Formaldehyde. As a dispersing agent, it enhances the solubility and stability of pesticides, making them more effective in controlling pests and diseases in crops. This results in increased agricultural productivity and improved crop yields. In the realm of rubber synthesis and leather tanning, SNSF serves as a compound accelerator and water-reducer. It facilitates the curing process of rubber, enhancing its properties and making it suitable for various applications. In leather tanning, SNSF improves the penetration of tanning agents into the leather, resulting in better quality and durability. The paint and coating industry utilizes Sodium Naphthalene Sulfonate Formaldehyde as a dispersant. It aids In the dispersion of pigments and other additives In the paint, ensuring a uniform and smooth finish. This results in improved product quality and customer satisfaction. SNSF also finds applications In the production of high-flowing concrete and prefabricated concrete. As a retarder, it helps in controlling the setting time of concrete, allowing for better workability and easier handling.

Furthermore, this is particularly beneficial in large construction projects where precise control over concrete properties is essential. The pharmaceutical industry employs Sodium Naphthalene Sulfonate Formaldehyde as an anionic surfactant In the production of certain drugs. Its ability to improve the solubility and stability of active ingredients makes it an essential component In the pharmaceutical manufacturing process. The energy prices have a significant impact on the production and consumption of Sodium Naphthalene Sulfonate Formaldehyde. The volatility of energy prices can influence the cost of raw materials and the overall production costs, affecting the competitiveness of the market. In the realm of pesticides, the increasing demand for eco-friendly and sustainable agrochemicals is driving the research and development of Sodium Naphthalene Sulfonate Formaldehyde-based products. This trend is expected to continue, as there is a growing focus on reducing the environmental impact of agricultural practices.

Overall, Sodium Naphthalene Sulfonate Formaldehyde is a versatile chemical compound that plays a crucial role in various industries, including textiles, agrochemicals, rubber synthesis, leather tanning, paints and coatings, and pharmaceuticals. Its unique properties as a wetting agent, dispersing agent, and compound accelerator make it an essential component In the production process of these industries. The market for Sodium Naphthalene Sulfonate Formaldehyde is expected to grow, driven by the increasing demand for improved product quality, sustainability, and eco-friendliness.

|

Sodium Naphthalene Sulphonate Formaldehyde Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2024-2028 |

USD 313.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

US, China, Japan, India, South Korea, Canada, UK, Germany, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sodium Naphthalene Sulphonate Formaldehyde Market Research and Growth Report?

- CAGR of the Sodium Naphthalene Sulphonate Formaldehyde industry during the forecast period

- Detailed information on factors that will drive the Sodium Naphthalene Sulphonate Formaldehyde growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sodium naphthalene sulphonate formaldehyde market growth of industry companies

We can help! Our analysts can customize this sodium naphthalene sulphonate formaldehyde market research report to meet your requirements.