Solar PV Mounting Systems Market Size 2025-2029

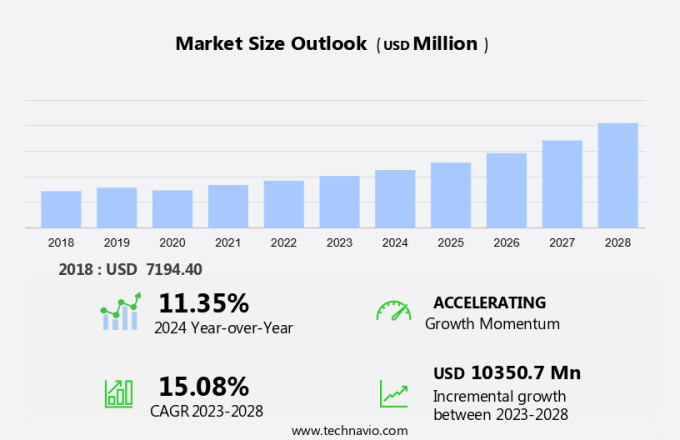

The solar PV mounting systems market size is forecast to increase by USD 11.53 billion at a CAGR of 15.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by supportive government policies and the emergence of zero-energy buildings. These factors are creating a favorable environment for the adoption of solar PV systems, thereby increasing the demand for robust and efficient mounting systems. Additionally, the increasing number of alternative energy sources is expanding the market's scope, offering new opportunities for growth. These include the increasing adoption of renewable energy sources in the utility industry and industrial applications.

- By addressing these key drivers and obstacles, players in the market can position themselves for long-term success. However, challenges persist, including the need for cost reduction and the development of mounting systems that can effectively accommodate larger solar panels and more complex installations. To capitalize on market opportunities and navigate these challenges, companies must focus on innovation, efficiency, and cost competitiveness. Green hydrogen, produced through renewable energy sources, is also gaining traction as a clean fuel alternative, further boosting the demand for solar PV mounting systems.

What will be the Size of the Solar PV Mounting Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is experiencing significant growth as renewable energy sources, such as solar power, gain prominence in the global energy landscape. Feed-in tariffs and subsidies continue to drive demand for photovoltaic mounting systems, particularly for rooftop mounted solar PV panels. Iron and steel, including aluminum and stainless steel, are key materials in the production of solar PV mounting systems. Fossil fuel-reliant industries are increasingly turning to solar PV panels and batteries for low carbon electricity generation.

Carbon emissions reduction targets are pushing businesses to adopt solar power and related technologies. The market for solar PV mounting systems is expected to grow as the world transitions to a more sustainable energy future. Tax breaks and incentives continue to support the adoption of solar PV systems, making them a cost-effective solution for businesses seeking to reduce their carbon footprint. Supportive government policies and the emergence of zero-energy buildings are also contributing to market growth. Iron is increasingly being used in the manufacturing of solar mounting systems due to its strength and durability.

How is this Solar PV Mounting Systems Industry segmented?

The solar PV mounting systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Fixed

- Tracking

- Type

- Ground-mounted systems

- Rooftop mounting systems

- Floating solar mounting systems

- Carport systems

- Deployment

- Large-scale

- Medium-scale

- Small-scale

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Technology Insights

The Fixed segment is estimated to witness significant growth during the forecast period. Fixed solar mounting systems, which are installed at a predetermined tilt on roofs or other surfaces, have gained popularity due to their affordability and ease of installation and maintenance. These systems, commonly used in residential and small commercial applications with non-concentrating solar technologies, are a significant component of the renewable energy sector's growth. The global expansion of solar power, particularly solar PV technology, in major markets such as China, the United States, Japan, Germany, and France, fuels the demand for fixed solar mounting solutions. Materials like aluminum, steel, and stainless steel are used in the manufacturing of these mounting systems.

Design and testing play a crucial role in ensuring the durability and efficiency of these systems. Renewable portfolio standards and net metering policies encourage the adoption of solar power, further increasing demand. In the utility industry, ground-mounted solar installations are prevalent for industrial applications, while rooftop mounting is popular for commercial and residential use. Greenhouse gas emissions from fossil fuels continue to be a concern, making low carbon electricity from solar power increasingly attractive. Feed-in tariffs, subsidies, and tax breaks further incentivize the use of solar power. The integration of solar power with batteries and green hydrogen storage systems is a growing trend, with tilted installations providing an optimal angle for solar panels to maximize energy production.

The Fixed segment was valued at USD 4.94 billion in 2019 and showed a gradual increase during the forecast period.

The Solar PV Mounting Systems Market is rapidly expanding as industries transition from fossil fuel dependency to cleaner energy alternatives. Rising concerns over carbon emission levels have accelerated investments in solar infrastructure across multiple sectors. Industrial application of solar PV systems is growing, with companies adopting advanced mounting solutions for efficient, scalable, and secure installations. The demand for durable and adaptable PV modules continues to rise, driving innovation in mounting system designs suitable for various terrains.

Inverter technology plays a vital role in converting DC power from solar panels into AC power for use in homes and businesses. PV manufacturing companies produce solar modules, which are mounted using photovoltaic mounting systems. These systems are essential for the successful installation and operation of solar power systems. Flat roofs and ground-mounted production sites are common locations for solar installations, with carports and luggage racks providing additional space for solar panels. The increasing demand for renewable energy sources and the need to reduce carbon emissions are driving the growth of the fixed solar mounting systems market.

Regional Analysis

APAC is estimated to contribute 67% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The solar photovoltaic (PV) mounting systems market in the Asia-Pacific (APAC) region is experiencing notable growth due to the increasing adoption of renewable energy sources, particularly solar PV panels. Key countries in this market, including China, Japan, India, Australia, and South Korea, are driving the regional growth. In China, for instance, the substantial share of the solar PV landscape is attributed to supportive government policies such as feed-in tariffs (FiTs), which have significantly boosted investments in renewable energy, especially solar projects. However, some countries are shifting towards competitive bidding and auction models for renewable energy projects. In Japan, the solar PV market is witnessing growth due to net metering policies, which enable solar energy producers to sell excess electricity back to the grid. Tandem solar cells, bifacial solar panels, and transparent solar cells are emerging technologies.

Additionally, the utility industry's increasing focus on low carbon electricity production is propelling the demand for solar PV mounting systems. In India, the government's renewable portfolio standards and tax incentives are fueling the market's expansion. Rooftop installations are a popular choice for residential and commercial applications due to their cost-effectiveness and ease of installation. Aluminum and stainless steel are commonly used materials for racking systems due to their durability and resistance to corrosion. Ground-mounted installations, including carports and production sites, are popular in industrial applications. The integration of batteries and green hydrogen in solar PV systems is a developing trend, as these technologies enable energy storage and the production of low-carbon electricity.

The utility industry's increasing focus on reducing carbon emissions is further driving the demand for solar PV mounting systems. Despite the growth, challenges remain, such as the high initial investment costs and the need for efficient design and testing to ensure optimal system performance. The solar PV manufacturing industry is continuously innovating to address these challenges and improve system efficiency and affordability. To stay competitive, market players are exploring advanced technologies like artificial intelligence to optimize the performance of solar panels and inverters.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Solar PV Mounting Systems market drivers leading to the rise in the adoption of Industry?

- Government policies that support businesses are a crucial driving force for market growth. The market: Dynamics and Policies The global shift towards renewable energy sources, driven by the need to reduce greenhouse gas (GHG) emissions, has led to significant growth in the solar photovoltaic (PV) industry. In the US, the Investment Tax Credit (ITC) is a key federal policy that supports the adoption of solar PV energy. This incentive encourages producers and consumers to invest in solar energy systems. Globally, various governments are implementing policies to promote the development and adoption of solar power technologies. One such policy is the Feed-in Tariff (FiT), which provides incentives for renewable energy producers by guaranteeing a fixed price for the electricity generated and sold back to the utility grid.

- This policy covers eligibility criteria, bonuses, and various other grants, encouraging investments in solar PV systems. Solar PV mounting systems play a crucial role in the successful installation and operation of solar power systems. These systems securely attach solar panels to structures, allowing them to be tilted for optimal energy production. Racking systems, available in materials such as steel and stainless steel, are commonly used for residential and industrial applications. Tilted installations ensure that solar panels face the sun directly, maximizing energy production. The utility industry is a significant consumer of solar power, as it can purchase excess energy generated by solar PV systems under net metering agreements.

What are the Solar PV Mounting Systems market trends shaping the Industry?

- Zero-energy buildings, which refer to structures that produce as much energy as they consume, are becoming the new market trend. The emergence of this sustainable building concept is mandatory for reducing carbon emissions and promoting energy efficiency. The market is experiencing significant growth due to the increasing adoption of zero-energy buildings (ZEBs). ZEBs, which produce as much energy as they consume annually, are a sustainable response to climate change and rising energy costs. Solar PV systems are a crucial component in achieving ZEB status, leading to a heightened demand for advanced mounting solutions that maximize energy capture and system efficiency.

- In the PV manufacturing sector, there is a focus on producing robust and engaging mounting systems that harmonize with various roof types, including flat roofs and ground-mounted production sites. Iron-based mounting systems are increasingly being adopted due to their durability and cost-effectiveness. Overall, the market is poised for continued growth as the world transitions towards a more sustainable energy future. Innovative technologies, such as solar trackers and integrated building-mounted systems, are gaining popularity. The market's growth is further driven by regulatory initiatives, including feed-in tariffs and subsidies, which incentivize renewable energy adoption. Additionally, the shift towards greenhouse gas emissions reduction is fueling the demand for clean energy solutions.

How does Solar PV Mounting Systems market face challenges during its growth?

- The expansion of alternative energy sources poses a significant challenge to the industry's growth trajectory. With an increasing number of viable options emerging in the renewable energy sector, traditional energy companies must adapt to remain competitive. This shift presents both opportunities and challenges, requiring strategic planning and innovation to navigate the evolving energy landscape. The solar photovoltaic (PV) mounting systems market faces challenges from the growing adoption of various renewable energy sources. As alternative energy technologies, such as wind, geothermal, biomass, and advanced nuclear energy, gain traction due to technological advancements and regional suitability, they compete for investment, land use, and policy support.

- Tax breaks and other incentives play a crucial role in the solar PV market's growth. For instance, carports and luggage racks integrated with solar PV systems can provide additional benefits, such as generating low carbon electricity while offering parking solutions. Inverter technology also plays a vital role in optimizing solar PV system performance and ensuring grid compatibility. Despite these challenges, the market continues to grow, driven by the increasing demand for clean, renewable energy sources and advancements in PV module technology. This arrangement allows consumers to sell their excess solar energy back to the utility company, offsetting their energy consumption and reducing their overall electricity bills.

Exclusive Customer Landscape

The solar PV mounting systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the solar PV mounting systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, solar PV mounting systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arctech Solar Holding Co. Ltd. - The company specializes in delivering solar PV mounting systems, offering diverse solutions tailored for residential, industrial, commercial, and utility-scale installations across a wide range of project requirements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arctech Solar Holding Co. Ltd.

- Clenergy (Xiamen) Technology Co. Ltd.

- GameChange Solar

- IronRidge Inc.

- K2 Systems GmbH

- Land Power Solar Technology Co. Ltd.

- Mounting System GmbH

- Nuevosol Energy PVt. Ltd.

- Pennar Industries Ltd.

- PV Racking

- RBI Solar Inc.

- Schletter Solar GmbH

- Soltech Industries PVt. Ltd.

- Tata International Ltd.

- Unirac Inc.

- Van der Valk Solar Systems BV

- Versolsolar

- Xiamen Corigy New Energy Technology Co. Ltd.

- Xiamen Grace Solar Technology Co. Ltd.

- Xiamen Universe Solar Tech. Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Solar PV Mounting Systems Market

- In January 2024, Trina Solar, a leading solar module manufacturer, announced the launch of its innovative Duomax Twin solar mounting system. This new product offers a 30% reduction in installation time and 10% increase in system efficiency compared to traditional mounting systems (Trina Solar Press Release, 2024).

- In March 2024, First Solar and SunPower, two major solar energy companies, formed a strategic partnership to co-develop and manufacture solar mounting systems. This collaboration aims to enhance their product offerings and improve their competitive positions in the market (First Solar Press Release, 2024).

- In May 2024, Hanwha Q CELLS, a global solar cell and module manufacturer, completed the acquisition of SolarMount, a leading provider of solar mounting systems. This acquisition strengthens Hanwha Q CELLS' position in the solar value chain and expands its product portfolio (Hanwha Q CELLS Press Release, 2024).

- In April 2025, the European Union passed the Solar Rooftop Initiative, a policy aimed at increasing the deployment of solar PV mounting systems on rooftops across Europe. The initiative includes funding for research, development, and implementation of advanced mounting systems and is expected to create significant market opportunities for solar mounting system providers (European Commission Press Release, 2025).

Research Analyst Overview

The solar photovolvoltaic (PV) mounting systems market continues to evolve, driven by the ongoing shift towards renewable energy sources and the increasing demand for low carbon electricity. This market encompasses a range of applications, from residential and commercial rooftop installations to industrial and utility-scale ground-mounted systems. Ground mounts and handrails play a crucial role in the design and testing of PV systems, ensuring optimal energy production and safety. The use of materials such as iron, steel, and stainless steel in PV mounting systems contributes to their durability and ability to withstand various weather conditions. The solar PV manufacturing sector also influences market dynamics, with advancements in technology leading to the production of more efficient and cost-effective solar modules.

The implementation of renewable portfolio standards, net metering, feed-in tariffs, and subsidies further bolsters the market's growth. The solar PV market's continuous evolution is also reflected in the emergence of new applications, such as ground-mounted production sites and solar carports. These innovations expand the market's reach and provide opportunities for growth in various sectors, including the industrial and utility industries. The market is expanding as photovoltaic inverters, electric generators, and grid-connected PV systems play a crucial role in enhancing the efficiency and reliability of solar energy generation and distribution.

The market is driven by government policies and the increasing adoption of solar power in various industries, including residential, industrial, and utility applications. The use of robust and efficient mounting systems, such as those made of steel and stainless steel, is essential for the successful installation and operation of solar PV systems. This competition complicates market dynamics for mounting system manufacturers, requiring them to adapt to fluctuating demand and evolving installation requirements. Furthermore, governments and investors may prioritize energy sources that offer higher efficiency, lower intermittency, or better integration with existing grids, potentially reducing incentives for solar PV expansion.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Solar PV Mounting Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.1% |

|

Market growth 2025-2029 |

USD 11.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.3 |

|

Key countries |

China, US, India, Japan, South Korea, Australia, Germany, Spain, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Solar PV Mounting Systems Market Research and Growth Report?

- CAGR of the Solar PV Mounting Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the solar PV mounting systems market growth of industry companies

We can help! Our analysts can customize this solar PV mounting systems market research report to meet your requirements.