Subscription Based Gaming Market Size 2024-2028

The subscription based gaming market size is forecast to increase by USD 7.79 billion at a CAGR of 12.17% between 2023 and 2028.

- The market is experiencing significant growth, driven by the enhanced features of next-generation gaming consoles and the emergence of mobile cloud video gaming. The advanced functionalities of new gaming consoles, such as high-definition graphics, seamless connectivity, and great gaming experiences, are compelling gamers to opt for subscription models. Additionally, mobile cloud gaming is gaining popularity, enabling users to access games on-demand without the need for high-end hardware or installation. However, the market faces challenges, including the impact of piracy on subscription-based gaming. Piracy continues to be a major concern, with unauthorized access to games and services posing a significant threat to revenue growth. Despite these challenges, the market is expected to grow at a strong pace, driven by the shifting consumer preferences toward flexible and affordable gaming options.

What will be the Size of the Subscription Based Gaming Market During the Forecast Period?

- Subscription-based gaming services have gained significant traction In the global market, offering consumers a new way to access and engage with their favorite games. These services, which require a monthly fee, provide additional benefits beyond the game itself, such as exclusive content, discounts, and community features. Gaming consoles and PCs are popular platforms for subscription-based gaming, with augmented reality (AR) and virtual reality (VR) emerging as new frontiers. The pandemic has accelerated the shift towards subscription models, as more people seek out leisure activities at home. The subscription economy has expanded beyond traditional gaming platforms, with Twitch and cloud-based gaming solutions offering new avenues for engagement.

- AR, VR, and IoT technologies are also influencing the market, while AI and machine learning are enhancing the gaming experience. Smartphone penetration and internet access have expanded the reach of subscription games to mobile gamers, who can now access high-end gaming experiences on their devices. The action and adventure genres continue to dominate the subscription gaming landscape, with microtransactions and paid downloads complementing the subscription model.

How is this Subscription Based Gaming Industry segmented and which is the largest segment?

The subscription based gaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Genre

- Action

- Adventure

- Shooting

- Sports

- Others

- Device

- Smartphones

- Console

- PC

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Genre Insights

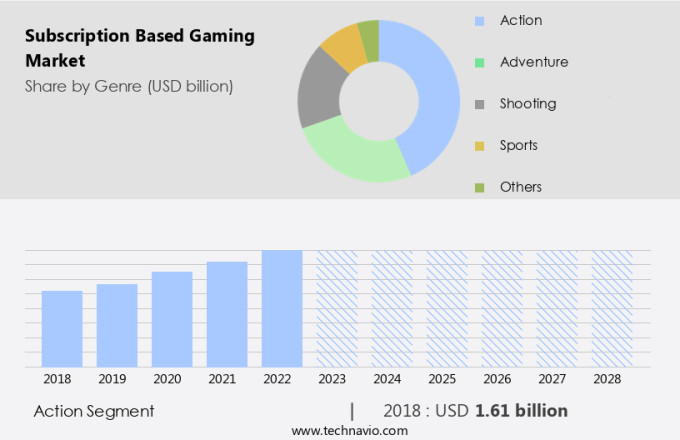

- The action segment is estimated to witness significant growth during the forecast period. The action games are packed with thrills, challenges, and entertaining stories that demand to a wide variety of gamers. The thematic element within the action games is driving the growth of the action games segment. Some players are drawn to action games with military themes, such as Battlefield, while others are drawn to fantasy worlds, like Dark Souls, or sci-fi environments, such as Destiny. These thematic differences let developers and marketers target players based on their interests. Thus, the rising adoption of augmented reality and VR in the action genre is a major factor that will fuel the growth of the action segment in the market during the forecast period.

Get a glance at the Subscription Based Gaming Industry report of share of various segments Request Free Sample

The Action segment was valued at USD 1.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

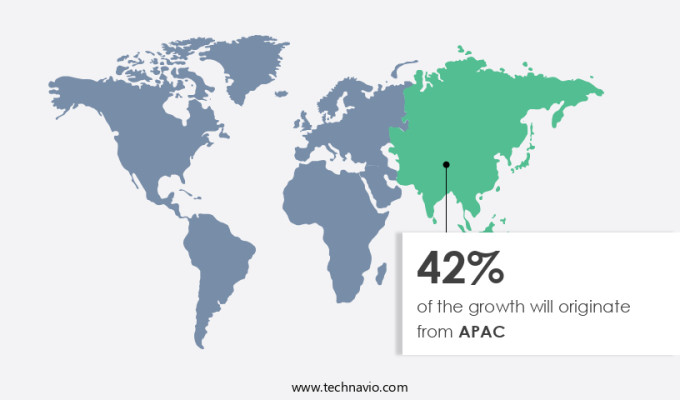

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Subscription-based Gaming Market in APAC is projected to dominate the global landscape due to the region's expanding middle class, increasing smartphone penetration, and thriving gaming industry. Mobile gaming is a significant contributor to this growth, with major players like Tencent, Sony, and Nintendo leading the charge. companies are collaborating with telecom service providers to introduce cloud-based mobile gaming. The APAC region is home to a vast consumer base of mobile gamers. Key gaming genres include Action, Shooting, Sports, Adventure, Fighting, Role-playing, and Racing, with Action and Role-playing being particularly popular. The market's growth is further fueled by advancements in technologies like Augmented Reality (AR), Virtual Reality (VR), and Artificial Intelligence (AI).

The subscription-based business model offers monthly fees, additional benefits, and access to a vast library of games. The competitive landscape is shaped by key companies such as Google for Games, Microsoft, and Activision Blizzard, offering services like Xbox Cloud Gaming and Call of Duty, Warcraft, Overwatch, Crash Bandicoot, and Guitar Hero. The market's profitability is influenced by factors like device type, game type, and availability on various platforms like smartphones, gaming consoles, and PCs. The COVID-19 pandemic and subsequent lockdown regulations have accelerated the adoption of cloud-based subscription games and competitive games, leading to a rise in demand. The market's growth is also driven by the availability of IoT-enabled devices and high-end smartphones, which facilitate seamless gaming experiences.

SMEs and service providers are also capitalizing on the subscription economy to offer innovative gaming platforms and business models.

Market Dynamics

Our subscription based gaming market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Subscription Based Gaming Industry?

Enhanced features of next-generation gaming consoles is the key driver of the market.

- The Subscription-based Gaming Market has witnessed significant growth in recent years, with revenue models shifting from paid downloads to monthly fees and additional benefits provided by subscription-based gaming services. This engaged audience trend is observed across various gaming sectors, including Action, Shooting, Sports, Adventure, Fighting, Role-playing, and Racing, on devices such as smartphones, gaming consoles, and PCs. The availability of augmented reality (AR) and virtual reality (VR) games, as well as cloud-based gaming solutions, IoT, and artificial intelligence (AI), have broadened the competitive space In the gaming industry. The COVID-19 pandemic and lockdown regulations have led to a pandemic-driven rise in cloud-based games, with consumers seeking entertainment In their remote work environment and increased leisure time.

- The subscription economy and gaming platforms have transformed the business models, with companies adopting subscription business models. The competitive market is further fueled by the availability of high-end smartphones, increasing internet access, and the growing popularity of hyper-casual game genres. The prices for subscription-based gaming services vary, with some offering free trials and others charging a monthly fee. SMEs and individual gamers are increasingly adopting these services due to their affordability and convenience.

What are the market trends shaping the Subscription Based Gaming Industry?

The emergence of mobile cloud video gaming is the upcoming market trend.

- The Subscription-based Gaming Market is experiencing significant growth due to the increasing popularity of cloud gaming services. These services allow users to access and play games hosted on remote servers, which can be streamed through Internet-connected devices. The affordability of subscription-based gaming services is attracting non-core gamers, particularly those who play games on social media and mobile devices. Additional benefits, such as exclusive discounts and early access to new releases, further enhance the value proposition for subscribers. Subscription-based gaming services cater to various gaming sectors, including Action, Shooting, Sports, Adventure, Fighting, Role-playing, and Racing.

- The Action segment, in particular, is expected to dominate the market due to the high engagement levels of gamers. The availability of cloud-based games on multiple device types, including smartphones, Gaming consoles, and PCs, broadens the reach of subscription-based gaming services. The COVID-19 pandemic and subsequent lockdown regulations have led to an increase in leisure time, driving the demand for subscription-based gaming services. The pandemic's impact on the gaming industry is further accentuated by the rise in remote work environments. As a result, the competitive market for subscription-based gaming services is expected to grow further. Cloud-based gaming solutions are also gaining traction due to the integration of Artificial Intelligence (AI), Augmented Reality (AR), and Virtual Reality (VR) technologies.

What challenges does the Subscription Based Gaming Industry face during its growth?

Impact of piracy on subscription based gaming is a key challenge affecting the industry growth.

- The Subscription-based Gaming Market is witnessing significant growth, driven by the increasing popularity of monthly fee models and additional benefits offered by subscription-based gaming services. Operators In the gaming sectors are adopting various revenue models, including microtransactions and paid downloads, to cater to the engaged audience. The use of Artificial Intelligence (AI) and the integration of Augmented Reality (AR) and Virtual Reality (VR) technologies are also contributing to the market's growth. Despite the profit potential, the market faces risks, particularly from piracy and the availability of offline games. The COVID-19 pandemic and resulting lockdown regulations have led to a pandemic rise in cloud-based subscription games, as consumers seek new forms of entertainment In their remote work environment.

- The Service providers are competing in a crowded space, with the Action and Role-playing genres being the most popular among gamers. Smartphone penetration and Internet access have led to an increase in mobile gamers, making it a significant market for subscription-based gaming services. Cloud-based gaming solutions, IoT, and Hardware sales are expected to drive the Subscription Economy further, with Gaming platforms and Subscription business models becoming increasingly popular. The market is highly competitive, with Newzoo estimating a CTR of over 50% for subscription games on Streamlabs, Stream Hatchet, Twitch, and other platforms.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the subscription based gaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, subscription based gaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- BLACKNUT

- Blade SAS

- Capcom Co. Ltd.

- Electronic Arts Inc.

- Epic Games Inc.

- Gimzawy

- Microsoft Corp.

- NEOM Co.

- Netflix Inc.

- Nintendo Co. Ltd.

- NVIDIA Corp.

- Roblox Corp.

- Sony Group Corp.

- Take Two Interactive Software Inc.

- Tencent Holdings Ltd.

- Ubisoft Entertainment SA

- Ziff Davis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The subscription-based gaming market has emerged as a significant revenue stream for operators In the gaming industry. This business model allows players to access a library of games for a monthly fee, providing additional benefits beyond the initial purchase price. Subscription-based gaming services have gained traction due to their ability to engage audiences and offer flexibility in game selection. The subscription economy has seen exponential growth, driven by the increasing availability of high-speed internet and the proliferation of smart devices. The gaming sector, in particular, has witnessed a rise in demand for subscription-based services.

Moreover, the adoption of subscription-based gaming services is influenced by several factors. The gamer's perception of value plays a crucial role in decision-making skills. The convenience of having access to a vast library of games without the need for frequent purchases appeals to many consumers. Additionally, the competitive market dynamics have led to intense price competition among service providers, making subscriptions an attractive option for budget-conscious gamers. The pandemic and resulting lockdown regulations have further accelerated the growth of subscription-based gaming. With remote work environments becoming the norm, individuals have been seeking new ways to fill their leisure time.

Furthermore, subscription games have provided a cost-effective and convenient solution for gamers looking to stay entertained. The gaming industry is witnessing a shift towards cloud-based subscription games, which offer the added benefits of reduced hardware requirements and the ability to play games on multiple devices. The Internet of Things (IoT) has also played a role In the growth of subscription-based gaming, enabling players to access games on smartphones, tablets, and PCs. The competitive space In the subscription-based gaming market is crowded, with key companies offering various pricing models and additional benefits to differentiate themselves. Artificial intelligence (AI) has also emerged as a key trend In the market, with companies leveraging AI to enhance gaming experiences and provide personalized recommendations.

|

Subscription Based Gaming Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.17% |

|

Market Growth 2024-2028 |

USD 7.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

11.03 |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Subscription Based Gaming Market Research and Growth Report?

- CAGR of the Subscription Based Gaming industry during the forecast period

- Detailed information on factors that will drive the Subscription Based Gaming market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the subscription based gaming market growth of industry companies

We can help! Our analysts can customize this subscription based gaming market research report to meet your requirements.