Track And Trace Solutions Market Size 2024-2028

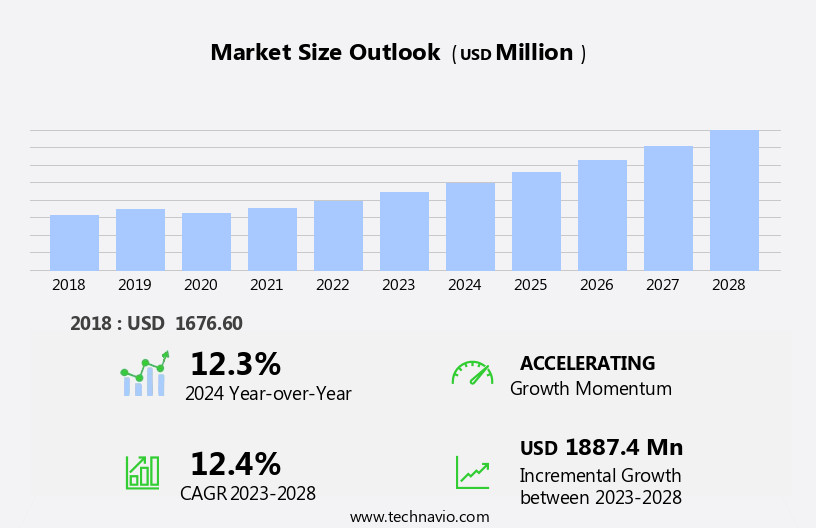

The track and trace solutions market size is forecast to increase by USD 1.89 billion at a CAGR of 12.4% between 2023 and 2028.

What will be the Size of the Track And Trace Solutions Market During the Forecast Period?

How is this Track And Trace Solutions Industry segmented and which is the largest segment?

The track and trace solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Software

- Services

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Component Insights

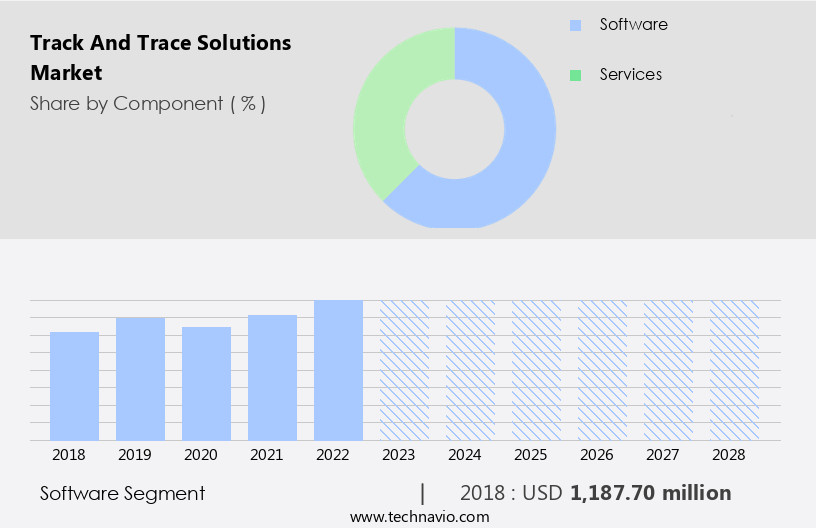

- The software segment is estimated to witness significant growth during the forecast period.

The market encompasses software applications that manage and analyze data to ensure product integrity and regulatory compliance throughout the supply chain. The software segment is a crucial component, offering solutions for monitoring product journeys, managing recalls, and maintaining regulatory standards. Key offerings within this segment include track and trace software, data analytics tools, and compliance management software. These solutions facilitate real-time tracking, enhance visibility, and improve efficiency by integrating data from various sources. Track and trace software is essential for managing product recalls and ensuring the authenticity of medical devices, pharmaceuticals, and consumer packaged goods. Data analytics tools enable advanced analytics and reporting, while compliance management software ensures adherence to regulations such as the Falsified Medicines Directive and Serialization Mandates.

The Internet of Things (IoT) and RFID technologies are increasingly integrated into these solutions, providing continuous data flow and unique identifying barcodes for real-time tracking and monitoring. Additionally, software solutions offer advanced analytics and serialization programs to combat counterfeit drugs, substandard medications, and product recalls in various industries, including medical devices, biopharmaceuticals, and food & beverages.

Get a glance at the Track And Trace Solutions Industry report of share of various segments Request Free Sample

The Software segment was valued at USD 1.19 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

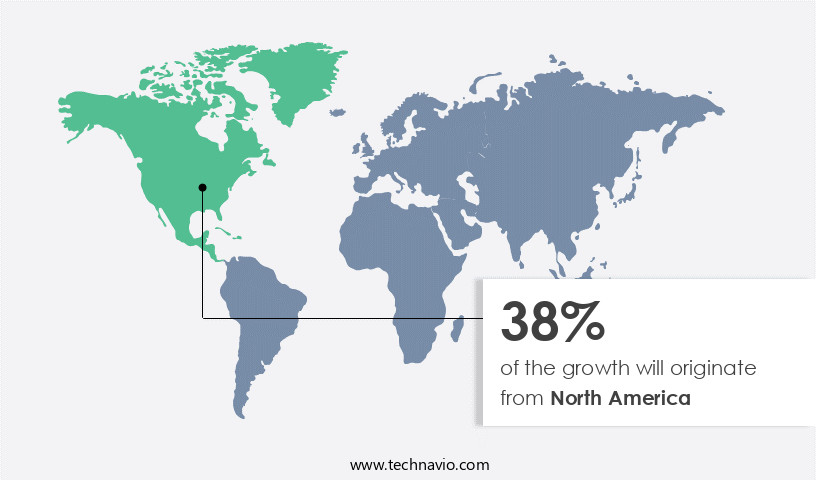

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is propelled by technological advancements and stringent regulatory requirements, primarily In the pharmaceutical, healthcare, and logistics sectors. In the pharmaceutical industry, companies are mandated to implement comprehensive track and trace systems to ensure drug safety and prevent counterfeit products. The U.S. Drug Supply Chain Security Act (DSCSA) enforces detailed tracking information for prescription drugs among manufacturers, repackagers, and wholesale distributors. This regulatory landscape has catalyzed the adoption of advanced technologies, including RFID, barcoding, and IoT devices, which offer real-time visibility and traceability throughout the supply chain. In addition, the Falsified Medicines Directive in Europe and serialization practices In the biopharmaceutical sector further fuel the market's growth.

Serialization solutions, aggregation solutions, and software and hardware systems are integral components of these advanced tracking systems. The market also caters to consumer packaged goods, e-commerce, medical devices, food & beverages, and product recalls.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Track And Trace Solutions Industry?

Stringent laws to ensure product safety, traceability, and authenticity is the key driver of the market.

What are the market trends shaping the Track And Trace Solutions Industry?

New product launches by vendors is the upcoming market trend.

What challenges does the Track And Trace Solutions Industry face during its growth?

Data security and privacy concerns with software solutions is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The track and trace solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the track and trace solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, track and trace solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ACG - The company offers sophisticated track and trace solutions, encompassing advanced serialization, aggregation, and anti-counterfeiting technologies. These solutions safeguard pharmaceutical products throughout the entire supply chain, ensuring transparency and security. By employing cutting-edge technologies, these offerings facilitate comprehensive monitoring and protection against counterfeit goods.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACG

- Accenture PLC

- Antares Vision S.p.A

- Avery Dennison Corp.

- Axway Software SA

- Honeywell International Inc.

- Jekson Vision

- Laetus GmbH

- Marchesini Group Spa

- Mettler Toledo International Inc.

- Optel Group

- Oracle Corp.

- Robert Bosch GmbH

- SAP SE

- SATO Holdings Corp.

- Sea Vision

- Siemens AG

- Syntegon Technology GmbH

- TraceLink Inc.

- Uhlmann Pac Systeme GmbH and Co. KGA

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies and applications designed to enhance supply chain visibility and product authentication in various industries. These solutions enable real-time monitoring of products, ensuring the integrity and authenticity of goods as they move through the supply chain. Serialization practices play a crucial role In the implementation of track and trace systems. By assigning unique identifiers to individual units or batches of products, these practices facilitate accurate tracking and enable effective recall processes in case of product issues. Packaging-related product recalls can significantly impact businesses and consumers alike. Track and trace solutions help mitigate the risks associated with these events by enabling swift identification and isolation of affected products.

Counterfeit drugs pose a serious threat to public health, and the implementation of track and trace systems is essential for combating this issue. Supply chain management has evolved significantly with the advent of advanced hardware and software solutions. Technologies such as radiofrequency identification (RFID) and the Internet of Things (IoT) enable continuous data flow, allowing businesses to monitor their supply chains in real-time and respond quickly to any disruptions. Unique identifying barcodes, such as 2D barcode technology, are a key component of track and trace solutions. These barcodes provide a quick and efficient method for capturing and transmitting product information, ensuring that accurate data is available at every stage of the supply chain.

Serialization solutions and aggregation solutions are two essential components of track and trace systems. Serialization solutions assign unique identifiers to individual units, while aggregation solutions group these units into larger batches or pallets for easier tracking and management. The Falsified Medicines Directive (FMD) is an EU regulation aimed at enhancing the security of the pharmaceutical supply chain. It mandates the implementation of track and trace systems for all prescription medicines, ensuring that each unit can be verified at the point of dispensing. Track and trace solutions are not limited to the pharmaceutical industry. They are increasingly being adopted by consumer packaged goods, e-commerce, and other sectors to improve supply chain efficiency, reduce costs, and enhance product safety.

Product coding is another critical aspect of track and trace systems. Effective coding ensures that products can be easily identified and tracked throughout the supply chain, enabling businesses to maintain accurate inventory levels and respond quickly to any issues. Software solutions and hardware systems are the two primary components of track and trace systems. Software solutions provide the intelligence and analytics capabilities needed to manage and interpret the data generated by the system, while hardware systems, such as RFID readers and scanners, enable the capture and transmission of product information. The adoption of track and trace solutions is driven by a range of factors, including increasing regulatory requirements, growing consumer demand for product safety and authenticity, and the need to improve supply chain efficiency and reduce costs.

As the market continues to evolve, we can expect to see further innovation and the integration of advanced analytics and artificial intelligence to enhance the capabilities of these systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.4% |

|

Market growth 2024-2028 |

USD 1887.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.3 |

|

Key countries |

US, UK, China, Germany, France, Japan, The Netherlands, Italy, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Track And Trace Solutions Market Research and Growth Report?

- CAGR of the Track And Trace Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the track and trace solutions market growth of industry companies

We can help! Our analysts can customize this track and trace solutions market research report to meet your requirements.