Treasury And Risk Management Software Market Size 2025-2029

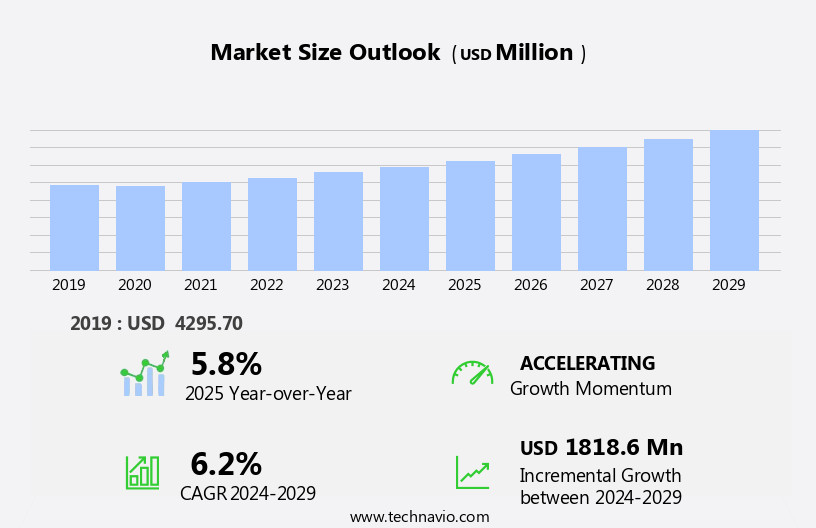

The treasury and risk management software market size is forecast to increase by USD 1.82 billion, at a CAGR of 6.2% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing adoption of intelligent treasury management solutions. These advanced software solutions enable organizations to automate financial processes, optimize cash flow, and mitigate financial risks more effectively. However, the market faces challenges as data security and cybersecurity concerns persist, with the potential for breaches posing a significant threat to financial data. Organizations must prioritize robust security measures to protect sensitive financial information and maintain trust with stakeholders.

- Navigating these challenges requires a strategic approach, with companies investing in advanced security technologies and adhering to regulatory compliance frameworks. By addressing these challenges and leveraging the benefits of intelligent treasury management software, organizations can streamline operations, reduce risk, and enhance overall financial performance.

What will be the Size of the Treasury And Risk Management Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic needs of businesses across various sectors. Mobile access to real-time data is a crucial requirement, enabling users to make informed decisions on the go. Machine learning algorithms and data integration are essential components, providing valuable insights through predictive analytics and performance measurement. Data encryption and security features ensure data privacy and regulatory compliance, while foreign exchange management and debt management solutions facilitate efficient financial operations. Fintech innovations, such as digital assets and non-fungible tokens (NFTs), are reshaping the financial landscape. Artificial intelligence (AI) and business continuity solutions enhance operational efficiency and risk modeling, allowing organizations to mitigate operational and financial risks.

Carbon emissions reporting and social impact analysis are increasingly important, as businesses strive to meet sustainability goals. Risk management solutions encompass a wide range of applications, including market risk, credit risk, counterparty risk, and regulatory reporting. Cash management, user interface (UI), and data analytics tools streamline financial operations and improve financial modeling. Cloud computing and data governance ensure seamless data access and management, while scenario planning and stress testing enable organizations to prepare for various eventualities. Security features and access control safeguard against potential threats, ensuring business continuity and maintaining audit trails. Investment management, liquidity risk management, and investment analysis tools provide valuable insights for hedge funds and other investment vehicles.

Performance measurement and capital budgeting solutions enable strategic planning and effective financial resource allocation. The ongoing unfolding of market activities and evolving patterns necessitate continuous innovation and adaptation in the market.

How is this Treasury And Risk Management Software Industry segmented?

The treasury and risk management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Type

- Treasury

- Investment management

- Risk and compliance

- End-User

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Government

- Manufacturing

- Others

- Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Component

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

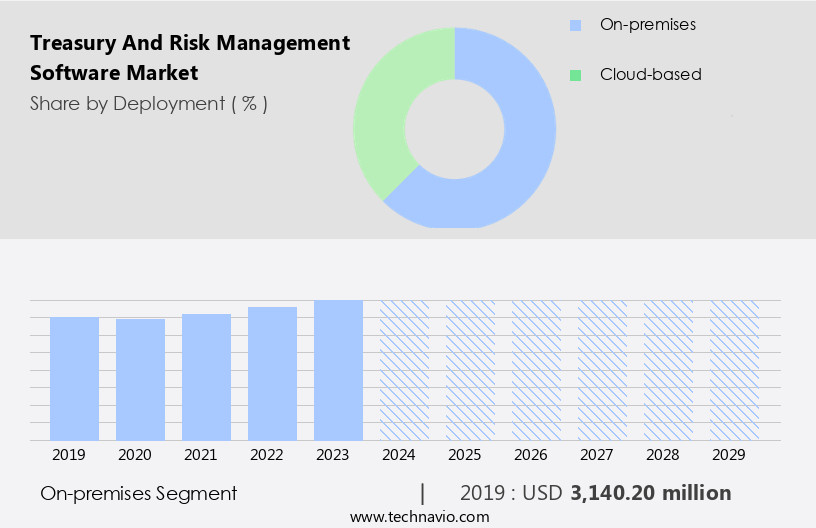

The on-premises segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, driven by the integration of advanced technologies such as machine learning, artificial intelligence, and data analytics. Mobile access to these solutions is becoming increasingly important for businesses seeking flexibility and convenience. On-premises remains the largest segment due to the heightened security it provides, requiring a robust IT infrastructure for deployment. companies like Fidelity National Information Services, Bottomline Technologies, and SAP cater to this segment. Financial technology (fintech) innovations, including digital assets and non-fungible tokens, are disrupting traditional treasury and risk management practices. Data integration and encryption are essential for secure data handling, while regulatory compliance and access control ensure business continuity and data privacy.

Risk modeling and management are crucial for operational risk assessment, financial risk mitigation, and strategic planning. Carbon emissions reporting and social impact analysis are gaining traction in the market, as businesses focus on their environmental and social responsibilities. Cash management and performance measurement are essential components of investment management, with real-time data and predictive analytics enabling more informed decision-making. Cloud computing and business intelligence facilitate data-driven insights for capital budgeting, liquidity risk management, and portfolio optimization. Disaster recovery and stress testing are essential for business continuity planning. Compliance reporting, financial reporting, and regulatory reporting are vital for maintaining transparency and adhering to regulatory requirements.

Treasury management solutions include features like interest rate swaps, forward contracts, and quantitative analysis, enabling effective financial risk management. Market risk management and scenario planning are crucial for hedge funds and other financial institutions, while counterparty risk assessment is essential for managing external relationships. Security features, such as data encryption and access control, are critical for maintaining data security. User interface design and user experience are increasingly important for user adoption and efficiency. Overall, the market is evolving to meet the complex needs of modern businesses, with a focus on data integration, security, and advanced analytics.

The On-premises segment was valued at USD 3.14 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

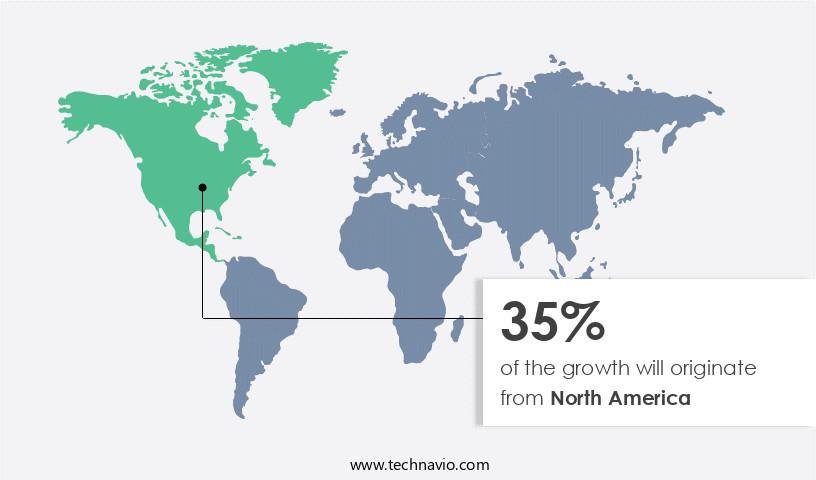

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth due to the increasing need for regulatory compliance. The European Markets Infrastructure Regulation (EMIR) mandates enterprises to validate risk management procedures for European derivative markets, central counterparties (CCPs), and trade repositories (TRs). This regulation aims to improve transparency in over-the-counter (OTC) derivatives markets and reduce associated risks. OTC derivatives are contracts traded between two parties without an exchange or intermediaries. To comply with these regulations, organizations must manage vast amounts of financial data securely and efficiently. Financial technology (fintech) solutions are increasingly being adopted to address these challenges. Mobile access, data integration, and user interface (UI) enhancements facilitate seamless data management.

Machine learning and artificial intelligence (AI) enable predictive analytics and risk modeling, while data encryption and access control ensure data security. Cash management, debt management, and liquidity risk are critical areas of focus. Foreign exchange management and hedge funds require sophisticated financial modeling and regulatory reporting. Scenario planning and stress testing help organizations prepare for market volatility and regulatory changes. Compliance risk, counterparty risk, and operational risk are managed through risk management software. Business continuity, disaster recovery, and audit trails ensure regulatory compliance and data privacy. Cloud computing and real-time data enable organizations to make informed decisions, while capital budgeting and performance measurement provide insights into financial health.

Data governance and regulatory compliance are essential for maintaining trust and transparency. Digital assets, including non-fungible tokens (NFTs), are gaining popularity, requiring specialized risk management solutions. Climate change and social impact are increasingly influencing financial decision-making, necessitating carbon emissions reporting and social impact analysis. Market risk, investment management, and portfolio optimization are crucial for managing financial risk. Security features, such as data encryption and access control, protect against cyber threats. In conclusion, the European the market is evolving to address the complexities of financial data management and regulatory compliance. Solutions encompass data integration, risk modeling, performance measurement, access control, and regulatory reporting.

The use of fintech, AI, and machine learning enhances efficiency and accuracy, enabling organizations to make informed decisions and manage risk effectively.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Treasury And Risk Management Software Industry?

- The significant benefits derived from the utilization of treasury and risk management software serve as the primary catalyst for market growth.

- Treasury and risk management software has become an essential tool for organizations to mitigate liquidity and capital risks. Liquidity risk refers to the potential loss resulting from the inability to convert assets into cash or utilize cash efficiently. Capital risk, on the other hand, relates to the potential loss from holding inadequate or poorly managed capital. Proper management of these risks is crucial for organizations to maintain financial stability and drive growth. Treasury and risk management software offers various features to help organizations optimize their financial performance. It provides integration, automation, visibility, and collaboration capabilities that enable treasurers to manage risk, maximize liquidity, and make informed investment decisions.

- The software employs advanced techniques such as data analytics, predictive analytics, and stress testing to identify potential risks and opportunities. Data governance is another critical aspect of treasury and risk management software. It ensures that data is accurate, consistent, and secure, enabling organizations to make informed decisions. Additionally, cloud computing provides accessibility and scalability, allowing organizations to manage their treasury operations from anywhere, at any time. Portfolio optimization is another essential function of treasury and risk management software. It helps organizations to allocate their resources efficiently and effectively, minimizing risk and maximizing returns.

- Interest rate swaps and other quantitative analysis tools are available to help organizations manage their interest rate risk. In conclusion, treasury and risk management software is a valuable investment for organizations looking to manage their liquidity and capital risks effectively. It offers advanced features, such as data analytics, predictive analytics, and portfolio optimization, to help organizations make informed decisions, maximize liquidity, and drive growth. By adopting this software, organizations can gain a competitive edge and maintain financial stability in an increasingly complex business environment.

What are the market trends shaping the Treasury And Risk Management Software Industry?

- Intelligent treasury management software is gaining prominence as the latest market trend. This advanced technology is essential for businesses seeking to streamline financial operations and enhance financial management capabilities.

- Treasury and risk management software plays a crucial role in automating cash management processes and ensuring regulatory compliance for businesses. With the increasing threat of data leakage and Internet fraud, there is a growing demand for advanced analytics solutions. Banks and organizations are adopting technologies such as artificial intelligence (AI), machine learning (ML), and data encryption to mitigate risks and enhance operational efficiency. These solutions enable treasury tasks automation, exception identification, and policy recommendation. Furthermore, data integration and workflow automation streamline business procedures, while risk modeling and business continuity planning ensure business resilience. Carbon emissions reporting and debt management are also essential features for environmentally conscious and financially responsible businesses.

- Digital assets management and foreign exchange management are additional functionalities that cater to the evolving financial landscape. Overall, these advanced solutions offer a harmonious blend of security, efficiency, and innovation for businesses seeking to optimize their treasury and risk management operations.

What challenges does the Treasury And Risk Management Software Industry face during its growth?

- The growth of the industry is significantly impacted by data security and cybersecurity challenges, particularly those concerning the financial data of organizations. Ensuring the confidentiality, integrity, and availability of financial data is a critical priority for businesses to maintain trust with their clients and regulators.

- In today's business landscape, data security and regulatory compliance are paramount, particularly in industries dealing with sensitive financial information, such as banking, finance, and healthcare. As organizations increasingly rely on digital platforms for managing financial risks and cash flow, the demand for advanced treasury and risk management software solutions has grown. These solutions offer features like performance measurement, access control, user interface optimization, and scenario planning to help businesses make informed decisions and mitigate financial risks. Moreover, the advent of technology trends like non-fungible tokens (NFTs) has added a new dimension to risk management, necessitating solutions that can accommodate these digital assets.

- Cloud-based software services have gained popularity due to their cost-effectiveness and ease of use. In a public cloud architecture, third-party providers ensure data security and regulatory compliance, allowing businesses to focus on strategic planning and risk mitigation. Counterparty risk, credit risk, and data privacy are some of the key areas addressed by these solutions. Hedge funds and other financial institutions also benefit from these advanced tools to manage their financial risks effectively.

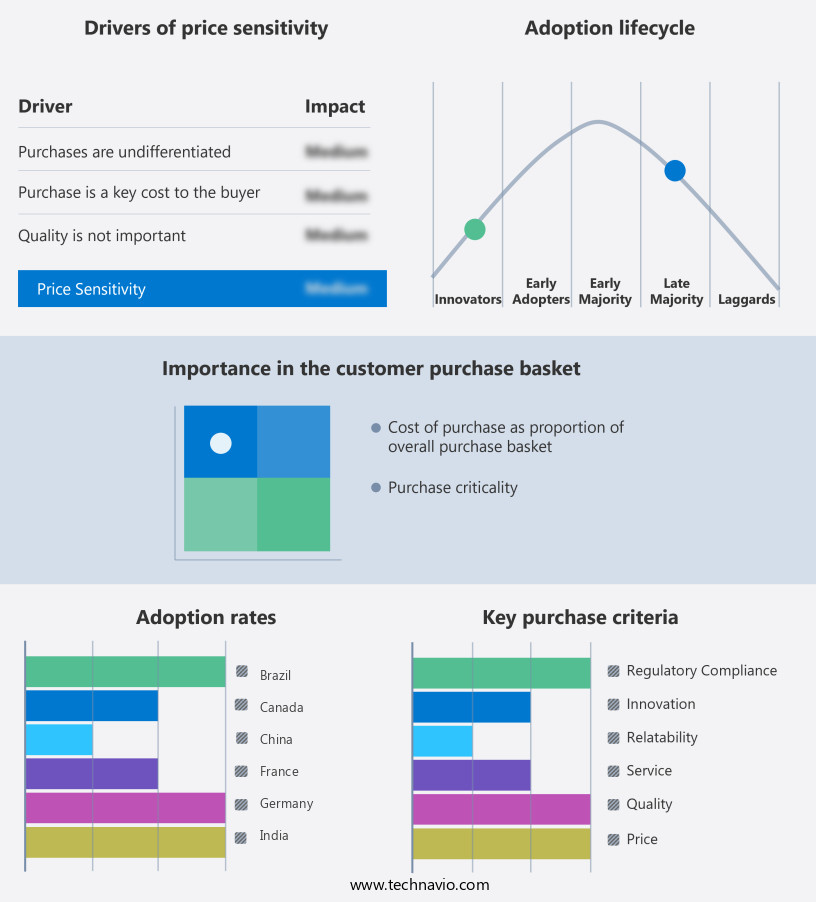

Exclusive Customer Landscape

The treasury and risk management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the treasury and risk management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, treasury and risk management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adenza Group Inc. - This company specializes in treasury and risk management solutions, featuring Calypso - an integrated platform encompassing treasury management, risk analytics, and regulatory compliance. By utilizing Calypso, organizations can optimize their financial operations, enhancing efficiency and ensuring regulatory compliance. The software's advanced analytics capabilities enable businesses to effectively manage risk and make informed decisions, ultimately contributing to improved financial performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adenza Group Inc.

- Alpha Group International plc

- Bottomline Technologies Inc.

- CAPIX Treasury Software

- Coupa Software Inc.

- DataLog Finance

- Eurobase Systems Ltd.

- Fidelity National Information Services Inc.

- Financial Sciences Corp.

- Finastra

- GTreasury

- Infosys Ltd.

- ION Group

- Kyriba Corp.

- Murex SAS

- Oracle Corp

- Salmon Software Ltd.

- SAP SE

- Sphera Solutions Inc.

- Wolters Kluwer NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Treasury And Risk Management Software Market

- In March 2024, Oracle announced the launch of its updated Treasury and Risk Management Cloud, offering enhanced features such as real-time analytics and machine learning capabilities to help businesses manage their financial risks more effectively (Oracle Press Release, 2024).

- In July 2024, IBM and SAP signed a strategic partnership to integrate IBM's Watson AI capabilities with SAP's Treasury and Risk Management solutions, enabling advanced predictive analytics and automated risk identification for clients (IBM Press Release, 2024).

- In October 2024, SAS, a leading analytics software company, completed the acquisition of KX, a provider of real-time data analytics and streaming analytics technology. This acquisition is expected to strengthen SAS's Treasury and Risk Management offerings by enhancing its real-time data processing capabilities (SAS Press Release, 2024).

- In February 2025, the European Central Bank (ECB) introduced a new regulatory framework for large financial institutions, requiring them to adopt advanced Treasury and Risk Management systems to ensure regulatory compliance and improve risk management practices (ECB Press Release, 2025). This initiative is expected to drive significant demand for advanced Treasury and Risk Management solutions in the European market.

Research Analyst Overview

- The market is witnessing significant transformation, driven by the need for enhanced risk management capabilities and digital transformation. Risk management dashboards are becoming increasingly popular, providing real-time visualization of risks and enabling quicker response to emerging threats. Training and support are essential for successful implementation, with industry best practices emphasizing the importance of a strong risk culture. Automated reporting and data validation are key features, ensuring regulatory compliance and data quality. Internal controls and fraud detection are also critical components, with data enrichment and data leakage prevention essential for safeguarding sensitive information. Consulting services and implementation partners offer valuable expertise during the transition to cloud-based solutions.

- The regulatory landscape continues to evolve, requiring treasury workstations to adapt and offer global compliance capabilities. User adoption is a top priority, with agile development and integration partners facilitating seamless implementation. Real-time risk monitoring and data management are essential for effective risk governance, while data visualization tools enable better decision-making. Treasury and risk management software is undergoing a digital transformation, with a focus on automation, integration, and user-friendly interfaces. Industry best practices emphasize the importance of a risk appetite framework and robust internal controls, ensuring effective risk management and mitigation strategies. Customer support remains a crucial factor, with providers offering various levels of assistance to meet diverse client needs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Treasury And Risk Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 1818.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, UK, India, Germany, Canada, France, Japan, Brazil, Italy, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Treasury And Risk Management Software Market Research and Growth Report?

- CAGR of the Treasury And Risk Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the treasury and risk management software market growth of industry companies

We can help! Our analysts can customize this treasury and risk management software market research report to meet your requirements.