North America Tubes And Cores Market Size 2024-2028

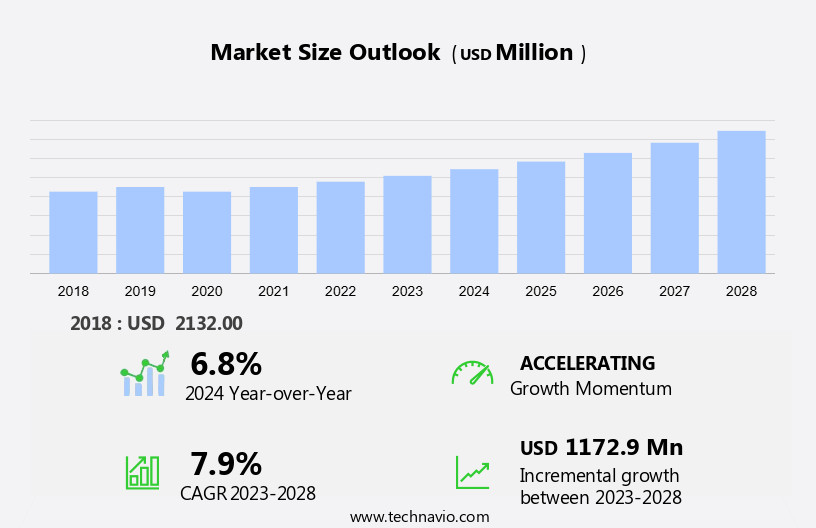

The North America tubes and cores market size is forecast to increase by USD 1.17 billion at a CAGR of 7.9% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the primary drivers is the increasing demand for transparent barrier films, which are widely used in various industries such as food and beverage, pharmaceuticals, and cosmetics. Another trend influencing the market is the expansion of the e-commerce sector, leading to a growth in demand for packaging solutions, including tubes and cores. However, the market is also facing challenges such as the volatility in raw material prices, which can impact the profitability of manufacturers. Overall, the market is expected to experience steady growth In the coming years, driven by these trends and challenges.

What will be the size of the North America Tubes And Cores Market during the forecast period?

- The North American tubes and cores market is experiencing dynamic growth, driven by various factors. In the textile industry, there is a rising demand for tubes and cores due to resistance to crushing during winding processes. In the construction sector, waste reduction strategies are driving the adoption of tubes and cores made from recyclable materials, such as paperboard, in place of virgin materials. The paper industry is also witnessing a shift towards eco-friendly products and sustainable packaging, with tubes and cores made from recycled paper becoming increasingly popular.

- Alternative packaging formats, including biodegradable alternatives, are gaining traction In the food and beverages, cosmetics, and e-commerce sectors. Inflation and automation are also influencing the market, leading to the production of lightweight and cost-effective tubes and cores. The use of recyclable materials, such as paper tubes and cores, is a key trend In the paper and printing industry, as companies seek to reduce their carbon footprint and meet evolving consumer demands.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Paper industry

- Textile industry

- Others

- Geography

- North America

- Canada

- Mexico

- US

- North America

By End-user Insights

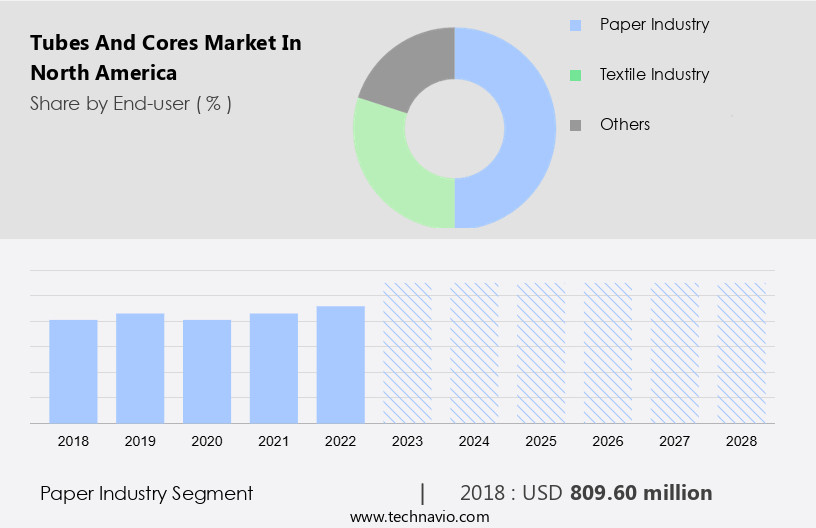

- The paper industry segment is estimated to witness significant growth during the forecast period.

In the North American paper industry, tubes and cores play a crucial role In the production and packaging of various paper materials, including tissue papers, printing and writing papers, label materials, and more. Among these, toilet paper, a type of tissue paper, holds a significant market share due to increasing demand in developed economies. Economic expansion, driven by high foreign investment, is leading to an increase in office space and subsequent demand for office supplies, including toilet paper. Furthermore, the rise of e-commerce platforms for purchasing household essentials and the growing preference for sustainable packaging solutions are additional factors fueling the market growth.

Key applications of tubes and cores in North America include textiles, waste reduction strategies, construction, paper, eco-friendly products, sustainable packaging, alternative packaging formats, biodegradable alternatives, and more. The use of materials such as sodium silicate and modified starch in manufacturing paper tubes and cores contributes to their durability, versatility, and resistance to crushing. Additionally, the recycling of paperboard and the adoption of rapid delivery and specialized packaging solutions cater to the evolving needs of industries and consumers.

Get a glance at the market share of various segments Request Free Sample

The paper industry segment was valued at USD 809.60 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of North America Tubes And Cores Market?

Growing demand for transparent barrier film is the key driver of the market.

- Tubes and cores play a crucial role In the packaging industry, particularly in winding and unwinding films. Sonoco is among the key companies providing tubes and cores for various applications. The demand for tubes and cores is significant in sectors like food and beverages, cosmetics, and textiles, where protective packaging is essential. In the food industry, for instance, barrier film packaging is employed to preserve product quality by preventing the infusion of water, light, moisture, oil, aroma, and flavor. This type of packaging is increasingly preferred In the form of flexible plastic films due to its versatility and sustainability. Moreover, the trend towards eco-friendly and sustainable packaging solutions is driving the market for tubes and cores made from recyclable materials such as paperboard. Waste reduction strategies, including recycling and the use of biodegradable alternatives, are also gaining traction.

- In addition, inflation and rapid delivery requirements are other factors influencing the market dynamics. Specialized packaging solutions, such as spiral winding, parallel winding, and convolute winding, cater to diverse industry needs. Flexible packaging options, including paper tubes and cores, are increasingly popular due to their lightweight nature and ability to accommodate various packaging formats. The construction, paper, and textile industries also rely on tubes and cores for their manufacturing processes. Sodium silicate and modified starch are commonly used In the production of paper tubes and cores, ensuring durability and versatility. E-commerce growth is another factor fueling the demand for tubes and cores, as they facilitate rapid delivery and efficient handling of products. Overall, the market is expected to continue growing due to the increasing demand for sustainable packaging, waste management, and automation in various industries.

What are the market trends shaping the North America Tubes And Cores Market?

Rise of e-commerce sector is the upcoming trend In the market.

- The North American tubes and cores market is experiencing significant growth due to the growth in e-commerce and the increasing demand for sustainable packaging solutions. E-commerce businesses require packaging that is both durable and customizable to ensure the safe delivery of goods. Tubes and cores, particularly those made from recycled paperboard, offer these benefits and are increasingly popular in this sector. Moreover, consumers are increasingly conscious of the environmental impact of their purchases, leading manufacturers to innovate and produce eco-friendly alternatives. These include tubes and cores made from biodegradable materials such as sodium silicate and modified starch. Additionally, the use of textiles in packaging, such as spiral-wound paper tubes and cores, is gaining popularity due to their versatility and lightweight nature.

- The market is further driven by waste reduction strategies in construction, food and beverages, cosmetics, and textile manufacturing industries, which rely on tubes and cores for sustainable packaging and waste management. The trend towards automation and rapid delivery in manufacturing and paper and printing industries is also fueling demand for specialized packaging solutions, including tubes and cores. Overall, the North American tubes and cores market is expected to continue growing as businesses seek durable, versatile, and eco-friendly packaging solutions.

What challenges does North America Tubes And Cores Market face during the growth?

Fluctuation in raw material prices of tubes and cores is a key challenge affecting the market growth.

- The market is experiencing significant changes due to various market dynamics. Kraft paper, the primary raw material for manufacturing tubes and cores, has seen a consistent price increase since 2015. This trend is driven by the growing demand for paper-based packaging, particularly In the e-commerce sector. The high cost of kraft paper is putting pressure on tube and core manufacturers' profit margins. As a result, end-users are facing increased prices, leading to a potential shift towards alternative packaging formats such as plastic tubes and cores. However, this trend may not be sustainable In the long term, as eco-friendly and sustainable packaging solutions continue to gain popularity. Textile manufacturing, food and beverages, cosmetics, and construction industries are major consumers of tubes and cores. These industries are adopting waste reduction strategies and seeking eco-friendly and recyclable materials for their packaging needs. Fiber-based packaging, such as paper tubes and cores, is an attractive option due to its biodegradable and sustainable properties.

- Moreover, the trend toward rapid delivery and specialized packaging solutions is driving innovation In the tubes and cores market. Lightweight and protective packaging options, such as spiral winding, parallel winding, and convolute winding, are gaining traction. The use of eco-friendly materials, such as sodium silicate and modified starch, is also on the rise. Inflation and waste management are critical factors influencing the market. The market is expected to remain competitive, with manufacturers focusing on automation and sustainable production methods to reduce costs and meet the growing demand for eco-friendly packaging solutions. Thus, the market is undergoing significant changes, driven by the increasing demand for eco-friendly and sustainable packaging solutions, inflation, and waste reduction strategies. The market is expected to remain competitive, with manufacturers focusing on innovation and cost reduction to meet the evolving needs of industries such as textiles, food and beverages, cosmetics, and construction.

Exclusive North America Tubes And Cores Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ace Paper Tube

- Callenor Co.

- Cellmark AB

- Chicago Mailing Tube Co.

- Greif Inc.

- LCH Paper Tube and Core Co.

- OX Industries Inc.

- Pacific Paper Tube, Inc.

- PTS Manufacturing Co.

- Rae Products and Chemicals corp

- Sonoco Products Co.

- Transpaco Ltd.

- Valk Industries Inc.

- Wes Pac Inc.

- Western Container Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is characterized by a growing demand for sustainable and eco-friendly solutions. This trend is driven by various factors, including consumer preferences for reduced waste and the increasing popularity of online shopping. Textile manufacturing is a significant end-use industry for tubes and cores. In this sector, tubes are used as cores for winding textiles during the manufacturing process. The textile industry is continually seeking ways to reduce waste and improve efficiency. One strategy is the use of recyclable materials for tubes and cores. Sodium silicate and modified starch are commonly used as binders for paper tubes and cores, making them recyclable and suitable for use in textile manufacturing. Another industry that relies heavily on tubes and cores is construction. In this sector, paper tubes and cores are used for various applications, such as formwork and insulation. The construction industry's focus on sustainability and waste reduction has led to an increased demand for eco-friendly tubes and cores made from virgin paperboard. The paper industry is another major consumer of tubes and cores. Paperboard tubes and cores are used extensively In the production of paper products, such as packaging and paper rolls. The paper industry is undergoing significant changes due to inflation and the need for rapid delivery.

As a result, there is a growing demand for specialized packaging solutions that can meet the industry's unique requirements. Flexible packaging options are gaining popularity in various industries, including food and beverages and cosmetics. Paper tubes and cores are used as the base material for these packaging formats. The use of biodegradable alternatives, such as plant-based materials, is becoming increasingly common in this sector. These eco-friendly solutions offer several advantages, including reduced waste, improved sustainability, and enhanced brand image. The e-commerce sector's growth has led to an increased demand for protective packaging solutions. Paper tubes and cores are used extensively In the production of protective packaging for various applications, such as cushioning and void-filling. The use of recyclable materials in protective packaging is becoming increasingly important, as consumers are becoming more conscious of the environmental impact of their purchases. Automation is another trend that is driving the market. The use of automated manufacturing processes is becoming increasingly common in various industries, including textiles, construction, and paper. Paper tubes and cores are used extensively In these processes, and the demand for lightweight and durable solutions is growing.

Thus, the market is undergoing significant changes due to various factors, including consumer preferences for sustainable and eco-friendly solutions, the increasing popularity of online shopping, and the need for automation and rapid delivery. The use of recyclable materials, such as paperboard, is becoming increasingly common in various industries, including textiles, construction, and paper. The demand for specialized packaging solutions, biodegradable alternatives, and protective packaging is also growing. The market for tubes and cores is expected to continue growing In the coming years, driven by these trends and the need for innovative and sustainable solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

124 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2024-2028 |

USD 1.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch