Ultra-Thin Glass Market Size 2024-2028

The ultra-thin glass market size is forecast to increase by USD 11.43 billion at a CAGR of 12.13% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for advanced technologies such as nano-coatings and smart glass technologies. The market is driven by rapid advancements in technology, particularly in the areas of flexible and foldable electronics, smart home devices, and medical technology. Ultra-thin glass is essential for these applications due to its lightweight and robust properties. The adoption of these technologies is expected to increase, leading to a surge in demand for ultra-thin glass. Additionally, the integration of ultra-thin glass in nano-coatings is expected to further boost market growth. Overall, the market is poised for continued expansion, offering significant opportunities for businesses and innovators in the technology sector.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to its increasing adoption in various industries. Ultra-thin glass, also known as thin glass, is a type of glass that is thinner than traditional glass, with a thickness ranging from 0.1 to 3.2 mm. This glass offers several advantages over conventional glass, including lightweight, strength, and flexibility. In the consumer electronics sector, ultra-thin glass is gaining popularity due to its use in touch panel displays. The demand for larger and thinner displays in smartphones, tablets, and laptops is driving the adoption of ultra-thin glass.

Additionally, the integration of ultra-thin glass in foldable and flexible electronics is expected to further fuel market growth. The solar energy industry is another significant end-user of ultra-thin glass. Thin glass is used in solar panels to increase their efficiency and durability. The growing demand for renewable energy sources and the need to reduce carbon emissions are expected to boost the market growth in this sector. Ultra-thin glass also finds applications in the healthcare industry, particularly in medical technology. Thin glass is used in the production of medical devices, such as sensors and diagnostic equipment, due to its strength and transparency.

Also, the increasing prevalence of chronic diseases and the growing aging population are expected to drive the demand for medical technology, thereby fueling the growth of the market. Furthermore, the Internet of Things (IoT) is another emerging area where ultra-thin glass is finding applications. Thin glass is used in IoT applications, such as smart home devices and data bridges, due to its ability to conduct electricity and its transparency. The increasing adoption of smart homes and the growing number of connected devices are expected to drive the demand for ultra-thin glass in this sector. In the optics industry, ultra-thin glass is used in the production of lenses and mirrors due to its high refractive index and low weight.

Moreover, the increasing demand for high-quality optics in various industries, such as telecommunications and defense, is expected to fuel the growth of the market. Microelectro mechanical systems (MEMS) are another area where ultra-thin glass is finding applications. Thin glass is used in the production of MEMS sensors, such as accelerometers and gyroscopes, due to its high precision and sensitivity. The increasing demand for MEMS sensors in various industries, such as automotive and aerospace, is expected to drive the growth of the market. In conclusion, the market is witnessing significant growth due to its increasing adoption in various industries, including consumer electronics, solar energy, healthcare, optics, and IoT. The advantages of ultra-thin glass, such as its lightweight, strength, and flexibility, make it an ideal choice for various applications. The growing demand for renewable energy sources, medical technology, and smart homes is expected to further fuel the growth of the market.

Market Segmentation

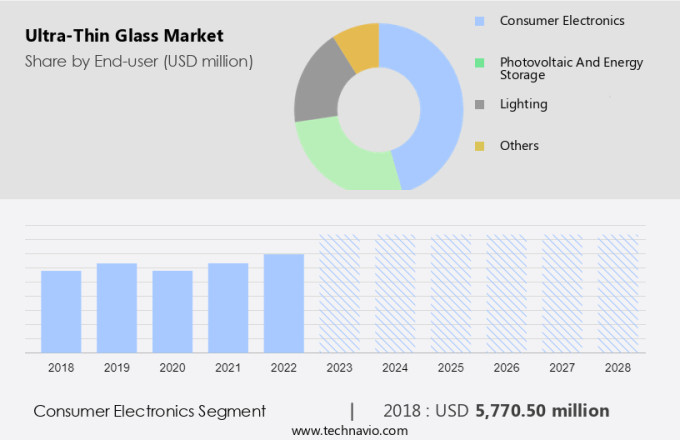

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Consumer electronics

- Photovoltaic and energy storage

- Lighting

- Others

- Geography

- APAC

- China

- India

- South Korea

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By End-user Insights

The consumer electronics segment is estimated to witness significant growth during the forecast period. Ultra-thin glass, a lightweight and smooth material, is gaining significant traction in various industries, particularly in consumer electronics. The primary end-users of ultra-thin glass are smartphone manufacturers, television companies, and creators of wearable devices. This glass type offers numerous advantages, including transparency, flexibility, and enhanced electrical resistance, making it an ideal choice for manufacturing light-emitting diode (LED) and organic LED (OLED) display panels. In the realm of smartphones, ultra-thin glass is utilized for producing touch panel displays. The advent of foldable display smartphones has led to a notable increase in the demand for ultra-thin glasses. These glasses offer scratch-resistant and flexible display panels, which are replacing traditional plastic-based screens in high-end smartphones.

Moreover, ultra-thin glass finds extensive applications in the production of nano-coatings and smart glass technologies. In the field of flexible and foldable electronics, ultra-thin glass plays a crucial role in enhancing the durability and functionality of these devices. Additionally, it is increasingly being adopted in smart home devices and medical technology to provide enhanced user experiences and improved performance. In conclusion, the market is expected to grow significantly due to its extensive applications in various industries, particularly in consumer electronics. The properties of ultra-thin glass, such as lightweight, transparency, flexibility, and enhanced electrical resistance, make it an indispensable component in the manufacturing of advanced display panels and other high-tech devices.

Get a glance at the market share of various segments Request Free Sample

The consumer electronics segment was valued at USD 5.77 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 65% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) holds a significant share of the global industry, with key contributors being China, Japan, South Korea, Taiwan, and India. The surge in the manufacturing of consumer electronics, particularly in the production of smartphones, laptops, flat-panel televisions, and wearable devices, is fueling the demand for ultra-thin glasses in this region. Moreover, the availability of a vast pool of ultra-thin glass companies in APAC ensures a wide selection for various applications, such as MicroElectro Mechanical Systems (MEMS), IoT applications, touch panel displays, and semiconductors. The production of ultra-thin solar cover glasses and automotive head-up displays further boosts the market growth in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

An increase in demand for flat panel displays is the key driver of the market. The market is experiencing significant growth due to the increasing demand for lightweight, flexible, and highly responsive displays in various sectors. Ultra-thin glass is a valuable component in the production of flat panel displays, including televisions, laptops, monitors, smartphones, and wearables.

Consumers' preference for larger displays, particularly in LCD televisions and smartphones, is driving market growth. In the automotive industry, the trend towards larger central information displays (CIDs) and the rise of smart cars with advanced driver assistance systems (ADAS) is fueling demand for ultra-thin glass. This market is also impacted by the economic slowdown, which may affect the availability and pricing of ultra-thin glass.

Market Trends

Ultra-thin glass in roll form is the upcoming trend in the market. Ultra-thin glass, previously limited to cut-sheet forms, is experiencing a shift towards roll forms, broadening its application scope. This adaptable glass offers both flexibility and durability, making it suitable for various industries. In consumer electronics, ultra-thin glass enhances the protection of sensitive components by addressing the gas-tightness issue faced by plastic covers. In the realm of solar energy, it plays a crucial role in solar panels by providing the necessary transparency and durability.

Furthermore, ultra-thin glass is indispensable in healthcare for medical devices and diagnostic tools due to its exceptional chemical and physical properties. In the burgeoning Internet of Things (IoT) sector, ultra-thin glass is utilized in optics and artificial intelligence applications. By employing roll-to-roll manufacturing processes, the production of electric switches becomes more efficient, eliminating the need for labor-intensive vapor deposition methods. This advancement significantly reduces production costs and increases overall productivity.

Market Challenge

Rapid changes in technology is a key challenge affecting the market growth. The market is experiencing significant challenges due to the dynamic nature of technology and innovation. As technology advances, manufacturers must keep pace to meet evolving consumer demands. One of the major hurdles in this regard is the potential raw material shortages and shipping delays that may arise from the adoption of new technologies. Procurement levels must be carefully managed to mitigate these risks and ensure a steady supply of ultra-thin glass. Moreover, staying abreast of technological trends is crucial for manufacturers to remain competitive in the market. With the introduction of foldable smartphones, the market is poised for disruption.

To adapt, manufacturers must be agile and able to incorporate new technologies into their production processes. By doing so, they can bring innovative products to market that meet the evolving needs of consumers and the industry. In conclusion, the market is subject to various challenges, including raw material shortages, shipping delays, and the need to keep up with technological trends. Manufacturers must remain proactive and flexible to navigate these challenges and deliver high-quality, innovative products to their customers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AGC Inc. - The company offers ultra-thin glass for analysis and microscopic observation.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aviation Glass

- Blue Star Glass Co. Ltd.

- Central Glass Co. Ltd.

- Changzhou Almaden Co. Ltd

- China Luoyang Float Glass Group Co. Ltd.

- Corning Inc.

- CSG Holding Co. Ltd.

- Emerge Glass India Pvt. Ltd.

- Gentex Corp.

- Huihua Glass Co. Ltd.

- Nippon Electric Glass Co. Ltd.

- Nippon Sheet Glass Co. Ltd.

- Noval Glass Group Ltd.

- Prazisions Glas & Optik GmbH

- RUNTAI INDUSTRY Co. Ltd.

- SCHOTT AG

- SGC International

- Taiwan Glass Ind. Corp.

- Xinyi Glass Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ultra-thin glass is a key component in various industries, including consumer electronics, solar energy, healthcare, optics, and the Internet of Things (IoT). Its thinness and strength make it an ideal material for applications in smart glass technologies, such as flexible and foldable electronics, smart home devices, and medical technology. In the automotive industry, ultra-thin glass is used in display panels, while in renewable energy, it is used in solar panels and photovoltaic cells. The thickness of ultra-thin glass ranges from 0.1 to 2.5 mm, making it lighter and more durable than traditional glass. It is also used in acoustic applications, such as microelectro mechanical systems (MEMS) and touch panel displays.

In the semiconductor industry, ultra-thin glass is used in the production of sensors, including fingerprint sensors and electrical components. However, the economic slowdown and raw material shortages have impacted the availability and procurement level of ultra-thin glass. This has resulted in shipping delays and increased negotiation coverage in the sourcing process. Despite these challenges, the demand for ultra-thin glass continues to grow due to its versatility and applications in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.13% |

|

Market growth 2024-2028 |

USD 11.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.94 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 65% |

|

Key countries |

China, India, US, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGC Inc., Aviation Glass, Blue Star Glass Co. Ltd., Central Glass Co. Ltd., Changzhou Almaden Co. Ltd, China Luoyang Float Glass Group Co. Ltd., Corning Inc., CSG Holding Co. Ltd., Emerge Glass India Pvt. Ltd., Gentex Corp., Huihua Glass Co. Ltd., Nippon Electric Glass Co. Ltd., Nippon Sheet Glass Co. Ltd., Noval Glass Group Ltd., Prazisions Glas & Optik GmbH, RUNTAI INDUSTRY Co. Ltd., SCHOTT AG, SGC International, Taiwan Glass Ind. Corp., and Xinyi Glass Holdings Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch