Europe Vacuum Packaging Market Size 2025-2029

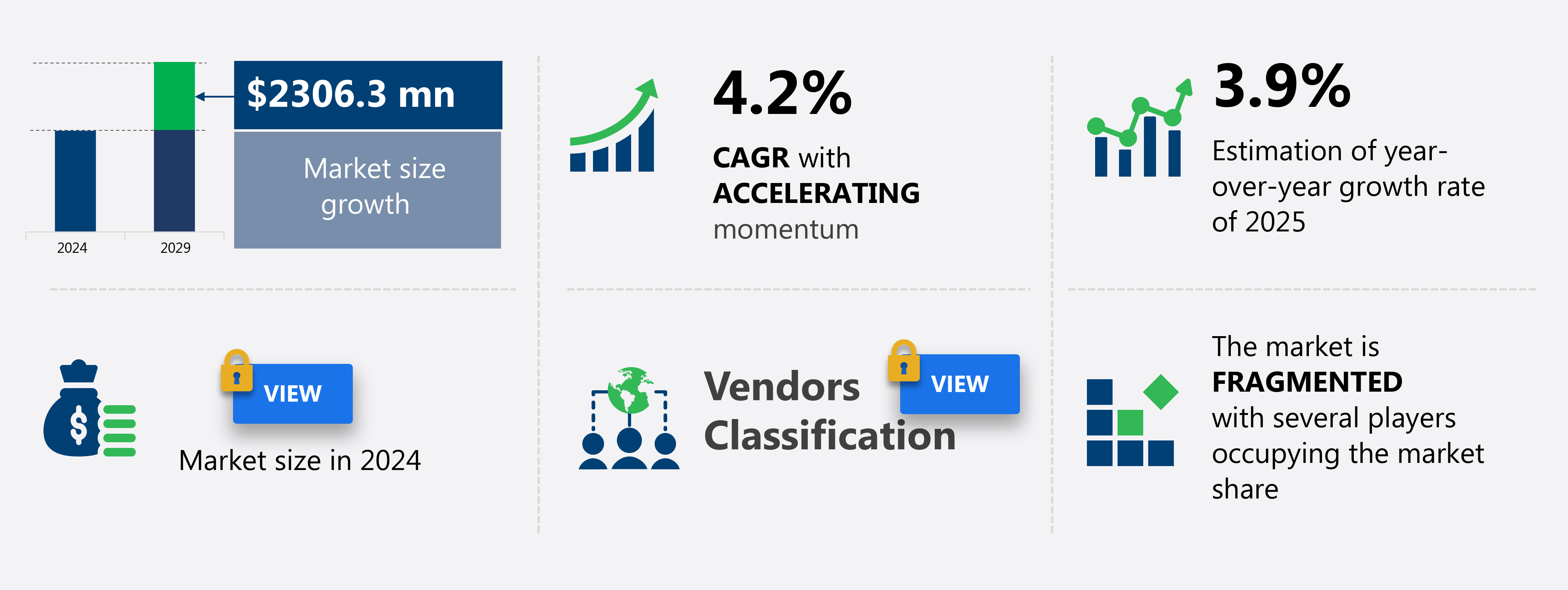

The vacuum packaging market in Europe size is forecast to increase by USD 2.31 billion at a CAGR of 4.2% between 2024 and 2029.

-

Vacuum packaging, a form of modified atmosphere packaging, has gained significant traction in various industries due to its ability to extend the shelf life of perishable goods. Plastic containers and pouches, two popular forms of vacuum packaging, are widely used for fresh food, particularly in the food service industry and for dining out. Key materials used include polypropylene, carbon dioxide, and flexible packaging with barrier materials such as polyethylene, polyethylene terephthalate, polyamide, and adhesives. Trends in the market include the increasing use of LED lights to maintain the freshness of food, the growing popularity of green packaging, and the expansion of applications in the cosmetics, frozen food, and cheese industries.

Vacuum pumps and packaging machinery are essential components of the process. Challenges in the market include the need for efficient logistics and e-commerce solutions to ensure the timely delivery of vacuum-packed products. Contamination during packaging remains a concern, necessitating the use of stringent hygiene practices and high-quality materials. The rise of food service and the convenience for individual portions have contributed to its increasing popularity. Additionally, it has found applications in the spa industry for storing and transporting various products.

What will be the Size of the market During the Forecast Period?

-

In the dynamic packaging market, cost reduction and sustainability are key drivers. Compostable packaging and waste reduction are gaining traction as businesses seek eco-friendly solutions. Barrier properties, such as oxygen and moisture, are essential for preserving product freshness and extending shelf life. Sustainable packaging materials, like biodegradable plastics, are increasingly popular due to their environmental benefits. Advancements in technology include shrink wrapping, RFID tags, and labeling technology, enhancing packaging functionality and safety. Packaging trends lean towards sustainability, with an emphasis on recyclable and circular economy packaging. Durability and convenience are also important considerations, with vacuum sealing and pulse vacuum technologies offering extended shelf life and microbial growth inhibition.

Packaging line integration and automation streamline production processes, while gas flushing and gas permeability ensure product quality and safety. Packaging aesthetics remain important for brand loyalty and consumer appeal. Ongoing research focuses on developing new materials and technologies to improve packaging functionality, safety, and sustainability.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food

- Non-food

- Material

- Polyethylene

- Polyamide

- EVOH

- Others

- Packaging

- Flexible packaging

- Rigid packaging

- Technology

- Skin vacuum packaging

- Shrink vacuum packaging

- Geography

- Europe

- France

- Germany

- Italy

- UK

- Europe

By End-user Insights

- The food segment is estimated to witness significant growth during the forecast period. In the realm of packaging, vacuum packaging holds significant importance, particularly within the food industry in Europe. As food products traverse the intricate web of the supply chain, from manufacturers to distributors, retailers, and ultimately, consumers, the necessity of effective packaging solutions becomes paramount. Vacuum packaging, with its ability to extend shelf life, enhance brand image, and ensure food safety, is a preferred choice for various food segments. The integration of technology in food processing offers numerous benefits. For instance, it aids in preserving food freshness, preventing contamination, and maintaining product quality throughout the distribution process.

- Moreover, vacuum packaging's role in meat, seafood, and dairy packaging is noteworthy, as these perishable items require specialized packaging solutions to maintain their integrity. Packaging innovation continues to thrive, with advancements in technology. Automated packaging lines, smart packaging, and chamber vacuum sealers are some of the recent developments that streamline production processes and improve packaging performance. Furthermore, the emergence of e-commerce as a dominant sales channel has led to the development of solutions tailored to this sector. The regulatory landscape plays a crucial role in the market. Packaging regulations ensure that food safety standards are met, while adherence to packaging standards is essential for maintaining product quality and consumer trust.

- Additionally, sustainability in packaging is a growing concern, with the adoption of biodegradable packaging and reusable packaging gaining traction. In the pharmaceutical and industrial sectors, it is employed for its ability to protect sensitive products from environmental factors and maintain their potency. Modified atmosphere packaging and active packaging are some of the advanced techniques used in these applications. Logistics and distribution companies leverage to ensure the safe and efficient transport of various goods, including food, pharmaceuticals, and industrial components. The integration of technology in the supply chain management process helps minimize product damage and optimize inventory levels.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Europe vacuum packaging market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Europe Vacuum Packaging Market?

- Rising focus on improving shelf life of products is the key driver of the market. Vacuum packaging is a critical aspect of preserving product freshness and extending shelf life. This packaging technique involves creating a vacuum in a pouch or container to prevent air from entering and degrading the product. High-performance packaging materials, such as EVOH, polyethylene, and polyamide, are utilized to create modified atmospheres filled with carbon dioxide, oxygen, nitrogen, and other environmental gases. These advanced packaging solutions are widely used in various industries, including food processing, pharmaceuticals, and industrial components. Sustainability in packaging is a growing concern, leading to the development of biodegradable and reusable packaging options. Automated packaging lines and smart packaging technologies, such as active and electronic packaging, are enhancing brand image, improving consumer convenience, and ensuring food safety.

-

Vacuum packaging is also used in sectors like meat, produce, seafood, and dairy, where freshness retention is essential. Packaging regulations play a crucial role in ensuring product quality and safety. Packaging testing and adherence to packaging standards are essential to maintain product performance and meet consumer expectations. In the context of e-commerce, systems are vital for efficient logistics and distribution. Overall, it is a vital component of the packaging industry, contributing to product innovation, supply chain management, and food preservation. Vacuum packaging trends include the increasing use of sustainable materials and the integration of automation and IoT technologies.

What are the market trends shaping the Europe Vacuum Packaging Market?

- Use of high-barrier plastic is the upcoming trend in the market. Vacuum packaging, a type of modified atmosphere packaging, is gaining popularity due to its ability to extend shelf life and ensure food safety. The use of high-barrier plastic resins, such as biaxially oriented polyethylene terephthalate (BOPET) and ethylene vinyl alcohol (EVOH), is a significant trend in the market. These resins improve the barrier properties of packaging, preventing the entry of oxygen, light, and water. BOPET films, in particular, are favored for their superior barrier properties, while EVOH films offer high impermeability to gases, preserving the aroma, texture, and flavor of packaged items. Sustainability in packaging is also a major concern, leading to the development of biodegradable and reusable packaging solutions.

-

Automated packaging lines, smart packaging, and active packaging are other areas of innovation in the market. Packaging regulations, logistics and distribution, and supply chain management are key factors influencing the market dynamics. It is used extensively in various industries, including food processing, pharmaceuticals, and medical devices, for product quality, brand enhancement, and consumer convenience. Packaging testing and performance are crucial aspects of systems, ensuring freshness retention and product preservation. The solutions are also used in e-commerce and retail applications, as well as in industrial components packaging and seafood packaging. Packaging materials, such as barrier films and machines, play a vital role in the efficiency and effectiveness of systems.

What challenges doesEurope Vacuum Packaging Market face during the growth?

- Contamination of food during packaging is a key challenge affecting the market growth. Vacuum packaging, a type of modified atmosphere packaging, plays a significant role in the food processing industry by preserving food freshness and enhancing product quality. This packaging technique removes air from the packaging chamber, creating a vacuum, and seals the bag or container. The resulting modified atmosphere inside the package inhibits the growth of microorganisms, extending the shelf life of perishable items. Sustainability in packaging is a growing concern, leading to innovations such as biodegradable bags and reusable systems. Food safety is paramount, and ensures that by maintaining an airtight seal and minimizing the presence of oxygen, which can cause spoilage.

-

Packaging regulations, such as those related to food labeling and food preservation, play a crucial role in ensuring consumer safety and trust. Automated packaging lines and chamber vacuum sealers increase packaging efficiency and reduce labor costs. Vacuum packaging is also used extensively in industries such as pharmaceuticals, industrial components, and medical devices for product protection and preservation. Freshness retention is a key benefit of vacuum packaging, making it ideal for seafood, meat, dairy, and produce. The systems also offer brand enhancement and consumer convenience, as products remain fresh for extended periods. The technology continues to evolve, with advancements in smart packaging, active packaging, and barrier films.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amcor Plc - Vacuum packaging is a critical solution for preserving various perishable goods, including meat and cheese, through the removal of air and contaminants. T

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- ANL Packaging

- Bernhardt SAS

- Berry Global Inc.

- Coveris Management GmbH

- Filtration Group

- G.MONDINI Spa

- Green Packaging Material Jiangyin Co. Ltd.

- GRUPO ULMA S. COOP

- Henkelman BV

- JAW FENG MACHINERY Co. Ltd.

- Kopack Enterprises

- Mondi Plc

- ORICS Industries Inc.

- Plastopil Hazorea Co. Ltd.

- Sealed Air Corp.

- SIA SCANDIVAC

- Swiss Pack

- The Middleby Corp.

- Wihuri International Oy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vacuum packaging, a form of modified atmosphere packaging (MAP), has gained significant traction in various industries due to its ability to extend shelf life, ensure food safety, and enhance brand image. This packaging technique involves removing air from the package, creating an airtight seal, and replacing it with a controlled atmosphere. The sustainability movement has influenced the packaging industry, leading to an increased focus on eco-friendly solutions. It contributes to this trend by reducing food waste through extended shelf life and minimizing the need for preservatives. Moreover, the use of reusable bags and biodegradable materials further enhances the sustainability aspect. As concerns about plastic waste and environmental impact continue to rise, vacuum packaging companies are responding by offering eco-friendly alternatives

Regulations play a crucial role in the market. Compliance with food safety and pharmaceutical packaging standards is essential to ensure consumer safety and product efficacy. Vacuum packaging systems adhere to these regulations by maintaining the required atmosphere and temperature conditions. Logistics and distribution are critical aspects of the market. Automated packaging lines and efficient machines enable quick processing and shipping, reducing the time from production to delivery. This is particularly important for perishable goods such as seafood and meat, which require proper temperature control and short transit times. The market is not limited to food and pharmaceutical applications.

Industrial components, dairy products, and produce also benefit from this packaging technology. Vacuum packaging solutions offer improved product quality by protecting against contamination and maintaining freshness. Innovation is a key driver in the vacuum packaging market. Advancements in technology include smart packaging, which monitors temperature, humidity, and other conditions to ensure optimal product preservation. Additionally, the integration of systems into e-commerce and retail environments enhances consumer convenience. Packaging materials, such as barrier films, play a vital role in vacuum packaging. These materials protect against oxygen, moisture, and other contaminants, ensuring product freshness and longevity. The development of advanced barrier films continues to push the boundaries of capabilities. Vacuum-sealed PE bags maintain the freshness of fruits and vegetables, thereby reducing food waste and improving product quality and safety.

Food processing and food preservation are essential industries for vacuum packaging. By maintaining the desired atmosphere and temperature conditions, systems help preserve the quality and extend the shelf life of various food products. This is particularly important for sous vide cooking, where precise temperature control is essential. Systems offer numerous benefits, including improved product quality, extended shelf life, and enhanced brand image. As the market continues to evolve, we can expect to see further innovations and advancements in technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2025-2029 |

USD 2.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

Germany, UK, France, Italy, and Rest of Europe |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch